Imgorthand

Co-produced with “Hidden Opportunities”

“When the dust settles” – appears to be the mantra of the year.

In my professional and social circles, I hear everyone talking about rising interest rates and how they are waiting for the Fed to stop the quantitative tightening and for inflation to be under control before they deploy their capital into the financial markets. There is one small problem with this approach. When the economic headwinds are gone and the skies are clear, prices and valuations will be far above today’s lows.

During a sale at the supermarket, consumers are excited about the bargain they score with their purchases. In several cases, they buy more than they need because of the deals. But this sentiment is not carried over to the stock market. When prices fall, consumers are afraid and cling on to their cash.

Every economic phenomenon has a bright side, and there are ways to invest to take advantage of the climate. Today, we will visit two CEFs (Closed-End Funds) from PIMCO – PIMCO Dynamic Income Opportunities Fund (NYSE:PDO) and PIMCO Access Income Fund (NYSE:PAXS). These CEFs are knocking it out of the park in the current environment and are well-positioned to get even better as the Fed continues its hawkish moves to tame inflation. Moreover, these 11% yielding CEFs are significantly out-earning their payouts, and investors can expect special distributions around the end of the year.

Rethinking fixed-income investing with PIMCO

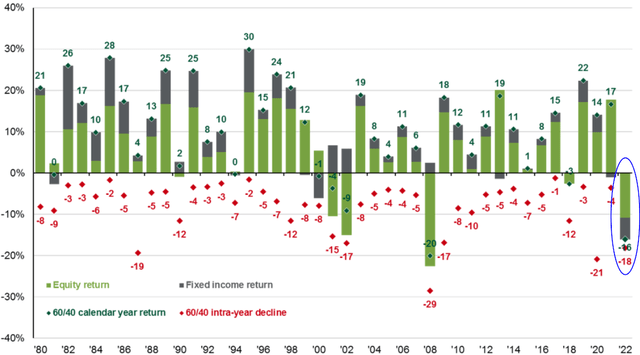

Historically, during stock market selloffs, investors tend to move to bonds as a perceived safe-haven asset. This typically drives bond prices higher and yields lower. But this trend broke during the current bear market. The decline in bond prices and rising yields can be due to elevated inflation levels, aggressive quantitative tightening by the Fed, and shrinking investor appetite to lock themselves into fixed income in a rising-rate environment. (Source: JP Morgan Asset Management)

But there is a strategic way to take advantage of the bond market selloff and stay well-positioned for rising rates. Bonds with short-term maturity dates imply regular principal repayments, which can be reinvested at higher yields upon maturity. Moreover, short-term bonds (particularly those with around 12 months to maturity) experience a ‘pull-to-par’ phenomenon. Pull-to-par reflects the reality that as a bond approaches its maturity date, it will begin to ‘pull’ to its par value as default risk becomes increasingly negligible and the cash price of the bond amortizes to the par value.

In such an environment, long-term bonds will suffer losses, while funds focused on short-term bonds will generate growing income. With over 50 years of actively managing fixed income instruments, PIMCO is one of the best-rated firms for sustainable income production and delivering value to their investors. PIMCO is to CEFs what Apple (AAPL) is to Technology. PDO and PAXS, two of PIMCO’s newest CEFs, are, in fact, star performers when it comes to income production. Both these CEFs have recently raised their distributions and maintain substantial undistributed net investment income (‘UNII’), which are strongly indicative of special distributions at the end of the year.

Pick #1: PDO, Yield 11.1%

PIMCO Dynamic Income Opportunities Fund was born in a yield-less market in January 2021. This CEF comprises securities from multiple fixed income sectors with a total leverage-adjusted effective duration of 2.88 years.

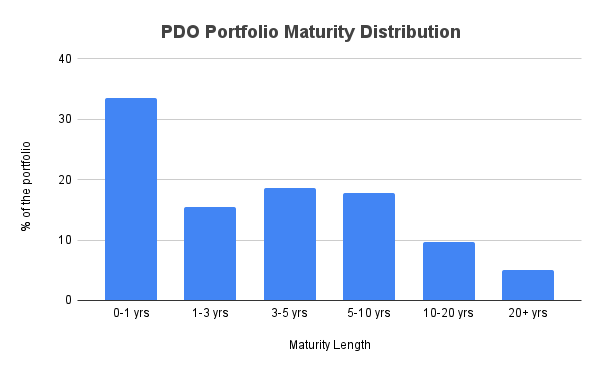

Created by Author (data source: PIMCO website)

Short-term fixed income instruments are valuable in a rising rate environment due to the ability to quickly rotate capital into higher yielding securities upon maturity, and ~33% of PDO’s portfolio matures within the next 12 months.

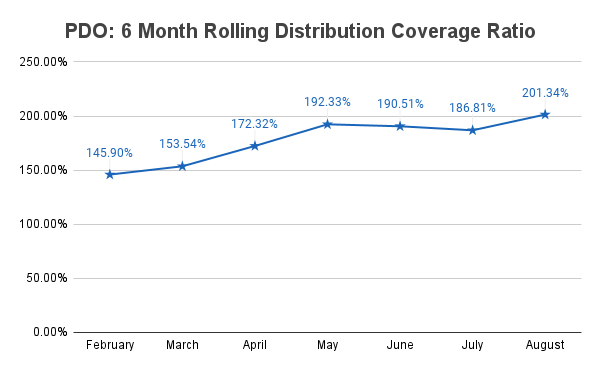

PDO distributes $0.1279/share every month, a substantial 11.1% annual yield. It is noteworthy that PDO made an 8% distribution increase effective from August. This reveals the fund managers’ confidence in the CEF’s ability to sustainably support the payout. YTD, PDO has maintained excellent distribution coverage from its Net Investment Income (‘NII’).

Created by Author (data source: PDO UNII Report)

Despite the raise last month, PDO still holds $0.95 of undistributed NII, which is almost 7.5 months of dividends! PDO investors can expect another handsome special distribution in December, similar to the Christmas present we got last year.

Despite PDO executing well in all aspects, the fund has sold off this year amidst bear market fears. The CEF is now available at an attractive 6.1% discount to NAV. With solid distribution coverage, excellent prospects of a special payment, and a portfolio composition designed for rate increases, PDO is a great buy to navigate this market uncertainty.

Pick #2: PAXS, Yield 11.3%

PDO’s younger sibling is another quality pea from the PIMCO pod.

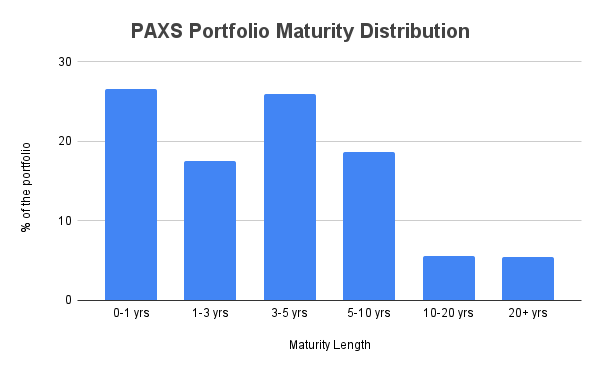

PIMCO Access Income Fund was born earlier this year, in February 2022, before the Fed began its quantitative tightening spree. PAXS maintains a portfolio of fixed-income securities with a total leverage-adjusted effective duration of 3.86 years, which is slightly more middle-term compared to PDO, yet attractive during rate hikes.

Created by Author (data source: PIMCO website)

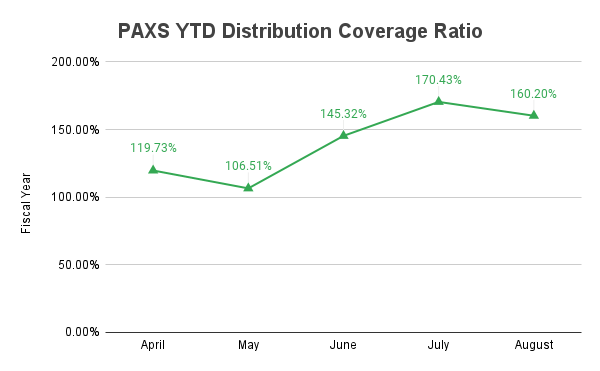

Right off the bat, PAXS has had the opportunity to expand the use of its leverage to buy higher-yielding short-to-mid-term bonds and support its distribution. PAXS has demonstrated fantastic distribution coverage in its infancy and recently announced a whopping 28% increase in monthly distributions to shareholders.

Created by Author (data source: PAXS UNII Report)

The current $0.1494/share monthly payment calculates to an attractive 11.3% yield. The CEF maintains $0.48 in undistributed NII, which is roughly equal to the distributions for three months. Like PDO, we expect PAXS to continue out-earning its payout and reward shareholders with a special dividend at the end of the year. It appears that Mr. Market doesn’t like growing dividends. PAXS trades at a 6.9% discount to NAV, a rare phenomenon for PIMCO CEFs. I am snagging this high yield at a bargain and look forward to a special distribution in December.

Deeply Discounted Valuation

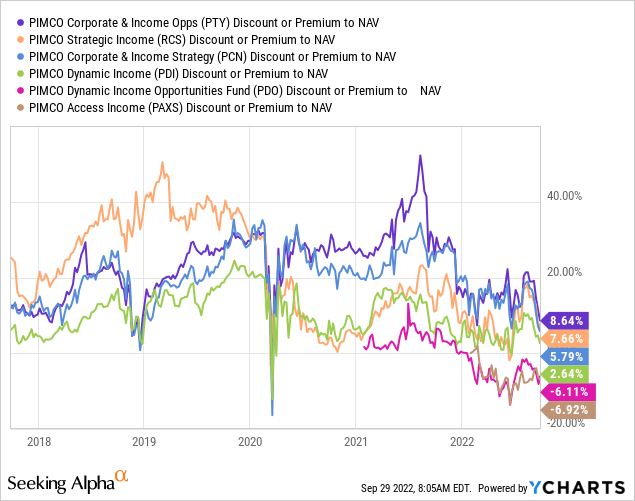

It is worth noting that PIMCO CEFs rarely trade at a discount to NAV, making this a rare bargain to snag PDO and PAXS.

Lower prices lead to higher yields and a higher expected future return. In this case, PDO and PAXS continue to execute strongly and deliver healthy raises to my income stream. Investors should consider seizing the opportunity, not fleeing it.

Risks and considerations

Every investment comes with risks. As investors, we need to be aware of those risks presented by the securities that come our way and make decisions based on the impact of those risks on our respective personal situations.

Use of leverage: PDO (48%) and PAXS (44%) are leveraged CEFs, and holdings can be affected in a rising rate environment. Leverage amplifies returns in both directions. When bonds are selling off, leverage will work against these CEFs. When prices head up, it will work in their favor. PIMCO’s use of leverage results in a more volatile investment. However, as discussed earlier, these CEFs are composed of short to mid-term bonds and are well positioned to handle this risk.

Term Funds: PDO and PAXS are the only term funds in the PIMCO suite of CEFs. Term funds have a planned termination date.

-

PDO – January 2033

-

PAXS – January 2034

Due to this, we don’t expect PDO and PAXS to trade at a significantly high premium to NAV like PIMCO’s other perpetual CEFs. However, having a term feature provides potential upside for investors if the fund trades at a discount and terminates.

Dreamstime

Conclusion

If my grocery store sells a pack of my favorite cookies at 50% off, I don’t wait for the price to increase to make a purchase. Picking up two packs for the price of one is a no-brainer. I am getting more for my money; how can that be bad?

But when the same happens in the stock market, the customers (investors) are skeptical and afraid. They let fear make decisions and cling to their cash, waiting for the sale to finish before deciding to buy.

When stocks go down and you can get more for your money, people don’t like them anymore. – Warren Buffett

We are buyers of sustainable income, and this selloff has produced several higher yields with growing payouts. It may be hard to believe, but these dividends are safer than before. The equity market is facing headwinds, and this time, the performance of bonds is correlated. But investors need to focus not on where returns have been YTD but instead on where they could be going in the months and years ahead.

Funds focused on short and intermediate maturities are a great place to be in a rising-rate environment. Dividends from these funds are a great way to fight market uncertainty and volatility. Despite facing 40-year high inflation and a pace of quantitative tightening that we haven’t seen since the 90s, U.S. dividends have grown YTD, and there is more where that came from. Two bargain picks with up to ~11% yields to fuel a dream retirement.

Be the first to comment