Editor’s note: Seeking Alpha is proud to welcome Coffee Tea Investment as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

ChrisHepburn

Manchester United (NYSE:MANU) is one of the greatest football clubs to have graced the sport in Europe. Having won a record 20 League titles, 12 FA Cups, 5 League Cups, and a record 21 FA Community Shields, winning the European Cup/UEFA Champions League thrice seems to be icing on top of the cake. The cherry on top, and the club’s longest-serving and most successful manager, was Sir Alex Ferguson, who led much of the Red Devil’s success from the 1980s until his retirement in 2013.

Since then, the stock price has tanked by over 30% despite the number of outstanding shares remaining relatively constant. This could only be attributed to a decade of poor performance from the first team and the lack of a sustainable strategy by the management team to recruit and train young players. We think that MANU is not a buy now because of ballooning expenditures and huge levels of debt, with management having no clear strategy to address the issues that will affect its business model.

Huge Recurring Expenses With Negative ROI

Total Players’ Salaries Expenditure by Season ($million) (Capology)

Transfer fees paid for midfielders and forwards were a big contributor to the Red Devil’s £1.2b spending for the past decade. Compared to their rivals, Manchester City and Liverpool paid out £1.39 billion and £974 million in transfer fees over the decade respectively. In total, they had 6 top-league finishes with 1 UEFA Champions League bagged by Jurgen Klopp’s Liverpool in 2021. A very disappointing decade of expenditure resulted in negative ROI just from the transfer market.

Since players’ salaries are somewhat correlated to the transfer fees, Manchester United ended up footing an unreasonable bill for a team that does not deliver results. For the 2022/23 season, the entire team requires an annual salary of £252 million with 4 of its players within the top 10 highest salaries paid in the entire Premier League. The 10-year average annual salaries paid to the players climbed after Sir Alex Ferguson’s retirement, once again revealing the ballooning recurring expenditure.

Trading Comps (CapitalIQ & Pitchbook)

Precedent Transactions (Pitchbook)

This directly affects the valuation of the club as players are the bloodline of the club. Taking a look at the trading comparables of its peers in the public markets, we have decided to choose clubs that are either consistently the top few names in their own respective leagues, or frequently appeared in European championships. Comparing the enterprise value to LTM total revenue, Manchester United commands almost 2 times as much as the median values of its peers. The club is trading closer to the median post-money valuation to revenue figure of precedent transactions of football clubs that have taken place in the recent few years, which stands at 4.6x. This means that analysts are more likely to benchmark the valuation of Red Devils to the “Big Six” clubs in the private markets, despite possessing the ability to raise capital in the public markets.

Speaking of capital, the LTM total-debt-to-capital ratio of the club does not look promising compared to its peers, despite issuing no extra shares. Manchester United’s net debt is the same as where it was a decade ago, decreasing slightly from £550 million to £495.7 million, revealing that the Management Team has no concrete plan to pay down its debt from the days of the unloved leveraged buyout (LBO) plan. This is also at the expense of the club’s total capital as it continues to shrivel due to increasing purchases of intangible assets. It primarily relates to net acquisitions of players and key football staff management as it is industry practice for payment terms to spread over the years. Given that the club continues to spend quite a bit on the signings of Casemiro, Sancho, Maguire, Fernandes, Wan-Bissaka and Fred (just to list some examples) in recent years, their registration costs would be slowly amortised throughout their contract, costing the club probably just as much to record the purchase of intangible assets in the years to come.

Problems With The Management Team

The reason why the supposedly incompetent management team has no concrete plan could be attributed to one person, Edward Woodward, an accountant and investment banker. He has since stepped down, but his controversial career started with advising the Glazers’ family on the takeover of the club with a typical investment banking strategy – LBO -much to the fans’ dismay for United has been debt-free for many years. This has caused a lot of debt to be loaded up onto the club, £550 million to be exact, while the Glazers committed only a small portion of the deal with cash. This brought the valuation of the club to just under £800 million but the loans soon added up to a stunning £660 million, with interest payments of £62 million a year. No doubt this has suffocated the club’s spending on players and training facilities, forcing the club to issue around £500 million in bonds to pay down the debts that have since kept the club enslaved.

Financially, the Red Devils were in shambles with their former chief having no football experience at all. Yet, he intervened in the decisions of transfers, which should have been the responsibility of the managers. Club legend Paul Scholes remarked about the difference between former CEO David Gill and his successor was that “[Gill] was a football man, he knew what the club needed.” A series of panic buys, missed opportunities, and a lack of long-term planning drove the stake into the hearts of Manchester United’s fans for a decade.

Foreseeable Expenditures In The Near Future

The iconic “Theatre of Dreams,” Old Trafford, is in dire need of an upgrade since 2006. With a leaky roof and peeling paint, the stadium would likely need to be rebuilt and that could cost up to £1.5 billion, according to the club’s estimations. For a decade, the club has only spent £94 million on infrastructure. Compare to Tottenham Hotspurs, who spent a billion pounds on their new stadium alone and a gradual expansion of Liverpool’s Anfield, the Red Devils are not investing in the future of better amenities for both the players and the fans. The club’s Academy and Carrington training site was once the finest in the world, producing the Class of ’92 and training some of the best players in the world.

However, it has been blown out of the water by rival clubs like Chelsea which saw Mason Mount and Reece James being introduced into the first team from their academy. The state of the Carrington training site was in such bad shape that it caught the criticism of returning superstar Cristiano Ronaldo. He claimed that the pool is dangerous with loose and chipped tiles and has not been refurbished since he left the club in 2009 for Real Madrid.

Declining Business Models

Manchester United’s business model is rather simple – generating revenue through commercials, broadcasting, and matchday. Looking at their matchday revenue, it is stated in their annual report that it derives from ticket sales, other Matchday revenue for their first team matches at Old Trafford, and their share of gate receipts from domestic cup matches. Based on the latest earnings call, there are over 120,000 people on the waiting list for season tickets, signaling strong membership demand compared to just over 50,000 season tickets that the Red Devils sell per season. However, there is not much room for revenue growth in terms of the sales of single matchday tickets. The average attendance per match over the past decade was 72,108 with the majority being taken up by season ticket holders with prices being stagnant for the 11th consecutive year.

Matchday Revenue in £ thousands Compared to Matches Played (Manchester United Form 20F )

Looking at their matchday revenue, they have stayed constant over the past decade and generally play lesser matches on home grounds. Their share of gate receipts from domestic cup matches is also generally down over the years from playing lesser domestic cup matches with earlier exits against clubs outside of the “Big 6.” That would also mean that the number of spectators for the match is significantly different, which translates to lesser revenue from such gate receipts.

Between the broadcasting revenue and commercial revenue, both would be equally affected should they continue with their poor performance. Although decreasing broadcasting revenue is tied to lesser games played (quite straightforward), commercial revenue is much more reflective of the strength of their branding.

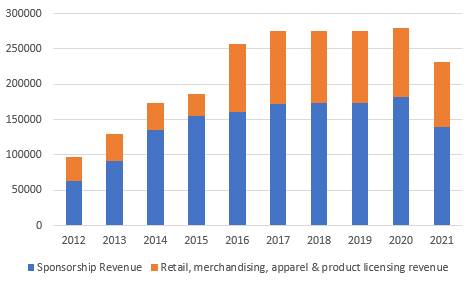

Breakdown of Commercial Revenue in £ thousands (Manchester United Form 20-F )

It is calculated via two revenue streams: one, sponsorship and retail, and, two, merchandising, apparel and product licensing. In the past decade, revenue from these two segments has peaked under Mourinho’s and Solskjaer’s leadership, perhaps the best performance that Manchester United had in a while. Merchandise and apparel sales on both retail and e-commerce platforms could have already peaked considering the mediocre signings for every transfer window since then, inevitably affecting the product sales. For the product licensing, the Red Devils have an agreement with Adidas (OTCQX:ADDYY) that runs until 2025 with respect to global technical sponsorship and dual branded licensing rights.

Payments due in a particular year may increase if the first team wins the Premier League, FA Cup, or Champions League, or decrease if they fail to participate in the Champions League for two or more consecutive seasons. Judging at their current league standing at the lower half of the table and historically volatile performance, it is likely that they could miss the Champions League and even Europa League this season. Should they face relegation, Adidas could even reduce the applicable payments for a year by 50% or even terminate the agreement by giving one full season’s notice.

Risk Factors

One risk factor that we have identified would be potential sales to other investors. The Glazers have slapped a £4.9 billion price tag on the club, which would translate to an annualized ROI of 17.8% if any deal were to go through today. Since then, wealthy individuals like Sir Jim Ratcliffe, Michael Knighton, and their consortium of investors have voiced out their interests in a minority stake. Major private equity firm Apollo was even once in the picture of taking the club private. Thus, any potential deal that matches the Glazers’ price tag would send the price of the stock soaring by 100% based on Manchester United’s enterprise value.

However, we believe that with a conservative estimate and room for negotiation, the valuation of the club would likely be no more than £3.5 billion, reflecting an upside of approximately 20% in share price at the time of writing this article. This is roughly in line with the premium that acquirers pay to take the companies private and also puts the EV/TTM revenue of the club to approximately 5x. It would be a fair deal for both parties, considering the average valuation/revenue in precedent deals for Chelsea and Arsenal is approximately 5.1x.

Another risk factor would be the strategic signing of players. The market reacts wildly to big names being signed, one such example would be Cristiano Ronaldo. At this period last year, the club’s share price soared as much as 7% upon the announcement of the homecoming of a club legend from Juventus. Investors could see such signings as strengths to the overall performance of the club, which is difficult for any analyst to project their financial impact to the club.

However, the biggest risk that would favor our thesis would still lie in the players’ performance. We think that benching players of significantly higher amortization value compared to other higher-performing players would erode the club’s capital. After noticing the trend of not playing Van de Beek, Wan Bissaka, and even Maguire/Lindelof consistently, the costly amortization of the players’ overall registration cost will continue to plague the balance sheet of the club, after the Red Devils paid quite a significant amount for their transfer fee and salaries. Although this could prove to be a prudent move from the perspective of managers and the overall chemistry of the team, the results of this strategy are anyone’s guess.

Conclusion

In all, both investors and loyal fans are done with this club. Once a luxurious ship sailing the seas, it has been parked in the middle of the ocean for the past decade with no captain and no course set in sight. Moving into 2022 with the equities market taking a hit, MANU’s stock price has fallen below a long-term resistance level of $13 as investing in a sports team is definitely not the most profitable of investments, let alone one that is poorly managed. Until the management team makes more definitive signings and necessary expenditures, the revenue streams are not going to see marginal improvements over time. Sponsors are going to walk away after making a loss and irritated fans are going to walk away from their beloved childhood club.

We maintain our view that the club is not a buy for now, despite news of potential takeovers or sales of a minority stake. The performance of the team speaks for the club and the valuation that it truly deserves.

Be the first to comment