Leon Neal

Thesis

Meta Platforms, Inc. (NASDAQ:META) CEO Mark Zuckerberg’s announcement to freeze hiring and downsize the company didn’t surprise us. We noted that Meta has continued to grow its full-time headcount aggressively, even though revenue per employee and net income per employee have been slowing since Q2’21.

With the macroeconomic headwinds worsening, and the ad industry expected to enter a recession in 2023, Zuckerberg can no longer look away without reining in Meta’s unsustainable headcount growth. Moreover, TikTok (BDNCE) continues to power ahead as e-commerce advertisers increased spending by 60% on its platform in Q2, as it continued to take share.

Furthermore, YouTube (GOOGL) (GOOG) has furthered its ambitions to supplant TikTok as the leading short-format video platform by extending its ad-revenue sharing with YouTube Shorts creators. Notably, YouTube has been leveraging its competitiveness by taking on TikTok’s still fledgling Creator Fund. According to TechCrunch, TikTok’s Creator Fund “doesn’t work,” as it articulated:

TikTok’s Creator Fund model simply doesn’t work. The Creator Fund is a static pool of money that is divided each day among users in TikTok’s creator program based on how many views they get – but since the pool doesn’t grow, that means that as TikTok gets bigger, creators earn less money. – TechCrunch

With Meta’s Instagram Reels still facing significant monetization and advertisers’ adoption challenges, we believe Zuckerberg was forced to acknowledge that Meta needs to rationalize its spending, scale, and work to improve its efficiencies further.

Unfortunately, Meta seems to be behind the curve on Reels as TikTok is growing extremely fast. eMarketer even forecasted that TikTok is set to overtake YouTube in US ad revenue by 2024. Therefore, Meta is coming from a position of weakness as it battles video-native TikTok and YouTube in their dominance, which was never really the underlying strength of the Instagram platform.

Notwithstanding, we postulate a significant level of damage had already been inflicted against the valuation of META. Despite that, META has been struggling to regain upward momentum, suggesting the market believes it was necessary to de-risk its valuation further.

We posit that the consensus estimates (which have likely reflected significant near-term downside) could be revised further to reflect potentially slower ad revenue growth through the cycle. However, Meta’s cost-cutting efforts could help mitigate the impact of its operating margins and, therefore, potentially limit the downside risks on its valuation.

Given our assessment of a well-battered valuation, we are confident that META proffers investors an attractive reward-to-risk profile at the current levels.

We reiterate our Buy rating on META.

Meta Needs To Downsize Because It Grew Too Fast

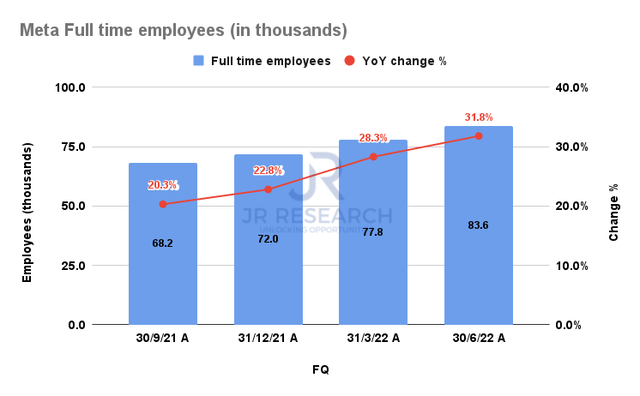

Meta full-time employees metrics (S&P Cap IQ)

As seen above, Meta grew its headcount by nearly 32% YoY in FQ2’22. Furthermore, it has been steadily increasing its growth cadence from Q3’21, even though its revenue growth has slowed dramatically.

Therefore, we believe Meta is carrying too much baggage toward the ad industry recession in 2023, further weighed down by the coming economic downturn. As a result, we think it’s apt for Meta to rationalize its headcount, which Bloomberg suggested that a 5% cut could be necessary.

As such, we posit that the consensus revenue estimates for H2’22 are likely at risk, given META’s move to freeze hiring and restructure its headcount.

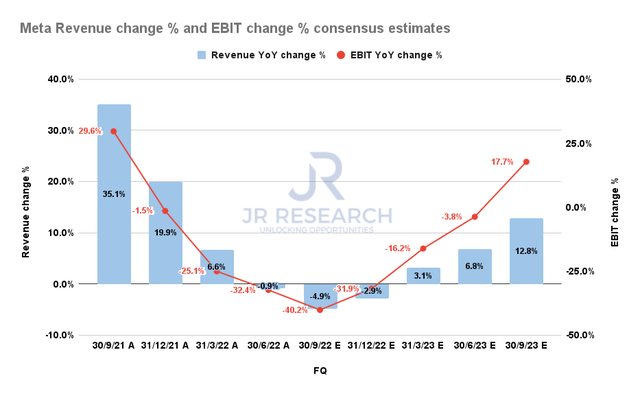

Meta Revenue change % and EBIT change % consensus estimates (S&P Cap IQ)

Accordingly, the current consensus estimates (bullish) see Meta’s revenue decline to bottom out in Q3 before recovering through FY23. However, William Blair sees ad spending potentially entering a recession, falling between 2% to 8% in 2023.

Despite that, the analysts still see Meta’s revenue growing by 4% in 2023 (under a recession base case scenario), much lower than the current consensus estimates of 10.7% YoY for FY23. Hence, we believe Meta’s move to tighten its belt suggests that those estimates could be at risk for further revisions to mitigate the impact on its operating margins.

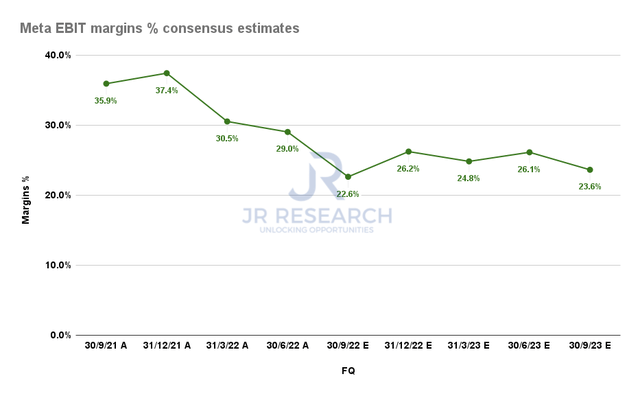

Meta EBIT margins % consensus estimates (S&P Cap IQ)

As seen above, the consensus estimates project for its EBIT margins to remain relatively stable through FY23 from Q3’22’s nadir. Therefore, the execution of Meta’s cost-rationalization plans would be critical to mitigating the likely impact of the economic recession, coupled with the growth in TikTok and YouTube blunting Reels’ adoption.

Accordingly, we urge investors to pay attention to Meta’s upcoming Q3 call to parse for more information on the extent of its cost-cutting strategies to assess the impact on its profitability.

Is META Stock A Buy, Sell, Or Hold?

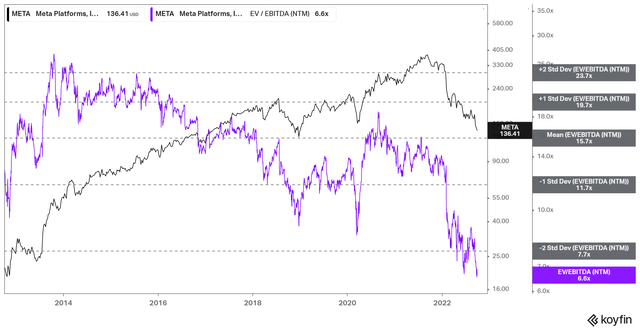

META NTM EBITDA multiples valuation trend (koyfin)

Our analysis suggests that META’s NTM EBITDA multiples have been impacted significantly. As such, we postulate that the market had already de-risked META’s execution risks to a substantial extent.

With its EBITDA multiples well below the two standard deviation zone under its 10Y mean, we don’t expect much more medium-term downside volatility from the current levels.

META price chart (monthly) (TradingView)

Without a doubt, META has failed to regain its long-term bullish bias even though it had attempted to stage a bottoming process over the past several months.

However, we gleaned that its recent pullback has sent it down to its long-term support zone, which saw robust buying support at the March 2020 lows. With well-battered valuations and the current re-test, we expect META to see reasonably solid buying momentum at the current levels.

However, investors must be ready for further near-term downside volatility as the market could continue to draw in more sellers before staging a bullish reversal on its long-term chart, which could take a few months.

Accordingly, we reiterate our Buy rating on META.

Be the first to comment