Justin Sullivan

Nvidia (NASDAQ:NVDA) is back down to a $430 billion market capitalization, and down almost 50% from its 52-week highs, as the company announced incredibly weak preliminary earnings. We expect that the company’s weakness isn’t over; however, despite that, we’re starting to see opportunity for the company’s stock.

Nvidia Preliminary Results

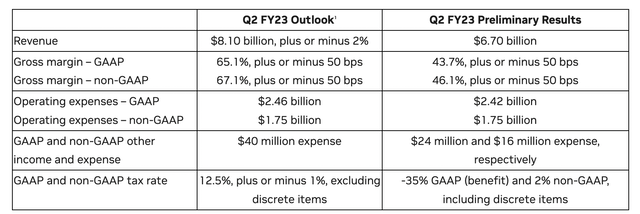

Nvidia’s preliminary results led to an almost double-digit drop in its share price, as incredibly ugly results.

The company is announcing revenue 20% below its guidance combined with a more than 20% drop in gross margin. That double impact is from operating expenses remaining roughly constant, meaning that profits are expected to be fairly minimal. On the plus side, the company’s taxes are expected to be nearly $0.

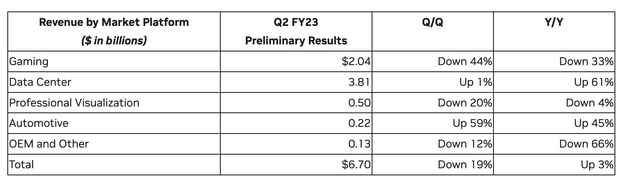

These weak preliminary results are primarily caused by a massive decline in gaming revenue.

Glimmer of Hope

Despite the company’s tough earning guidance, there is some glimmer of hope.

The company’s datacenter business has continued to outperform. In the company’s datacenter GPU space, the company has much less competition in the consumer space, with Intel and AMD much less powerful customers. The segment already represents more than 50% of the company’s preliminary revenue results with Y/Y up 61%.

Datacenter demand is continuing to grow as ML, computation, and other workloads increase substantially in size. Nvidia, we feel, is well positioned to take advantage of all of that.

Consumer GPUs

The disappointing gaming performance, in our view, is primarily timing based. The company launched its 3xxx GPUs in late 2020, in the middle of massive fanfare, onto a 7 nm node with TSMC. Crypto prices were rising and the GPU shortages made it incredibly hard to secure capacity of the various GPUs. Just a year ago, Nvidia said the GPU shortages would continue through the year.

Times have changed.

Crypto has crashed it’s not currently the massive source of demand. At the same time, crypto miners are selling their GPUs as profitability dropping. That’s what’s happened during crypto boom and bust cycles. General consumer GPUs are in many ways a luxury item, so they are susceptible to economic cycles such as inflation caused cycles.

However, just like the iPhone sells more in the fall, we expect the company to work to resolve this. The 4xxx series will be launching soon and the company has spent almost $10 billion to secure capacity. Those who upgraded two years ago or missed the 3xxx cycle might now be ready to upgrade. Especially as despite rising interest rates, the economy remains strong.

We expect what we’re seeing in the current quarter represents the bottom before a recovery.

Our View

Nvidia clearly had a terrible quarter. They felt the need to release their financials early. The company’s revenue dropped almost 20% and the company saw a similar drop in their gross margins which is a much more significant impact on the company’s profits. That weakness has caused a strong impact to the company’s share price.

However, we also feel that that weakness is an opportunity. The company normally sees demand decline before new GPU releases and the company has a major 4xxx GPU release coming out in the fall. The company’s datacenter business has continued to perform incredibly well with more than 60% YoY growth and consistent QoQ performance.

Putting all of this together, we expect that Nvidia’s recent weakness makes now a valuable time to invest.

Thesis Risk

The largest risk to the thesis in our view is a more substantial economic downturn. Gaming GPU demand clearly fell off of a cliff in the most recent quarter and with continued subscriber inventories etc. we expect additional short-term weakness. A more substantial downturn and the company’s revenue could remain much weaker from longer.

The company is also dealing with increased competition. Intel is looking to release a discrete GPU. Competitors could hurt the company’s long-term potential.

Conclusion

Nvidia announced an incredibly weak quarter with early earnings coming out significantly below guidance. The company’s gaming GPU revenue dropped significantly as a result of weak crypto prices and the age of its 3xxx GPU series. There’s also still significant inventory moving through partner pipelines that needs to be sold.

However, the company’s share price has dropped 50%. We expect the 4xxx series to be released later this year. That will open a substantial amount of demand that’s been waiting. With the economy remaining strong despite rising interest rates, we also expect that’ll keep the demand drop down short. That helps make the company a valuable investment.

Be the first to comment