David Becker

Thesis

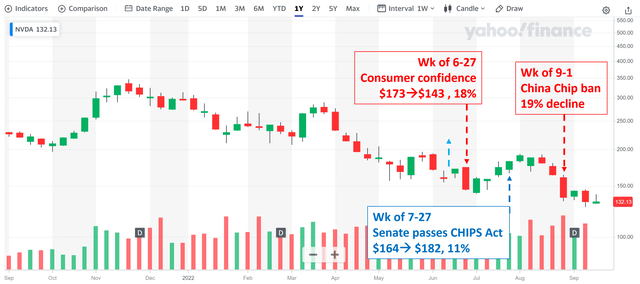

Lately, Nvidia’s (NASDAQ:NVDA) stock prices have been largely driven by short-term events and news. Looking forward, I see no lack of such news on the horizon. And as a result, I foresee its stock prices continuing to oscillate widely in the next 1 or 2 years. A few specific examples are highlighted in the following char.

- During the week of June 27, NVDA share prices declined by $30 in one week. The shares fell from $173 to $143, a loss of 18% in one week, due to market concern about falling consumer confidence and rising inflation.

- Then only a month later, during the week of July 27, NVDA share prices rallied from $164 to $182, staging a rally of 11% in one week on the news the Senate has passed the CHIPS Act.

- During the week of September 1, its share prices plummeted by more than $30 again. This time it fell from $163 to $132, a decline of 19% on the news that it had received notice from the U.S. government to restrict the export of certain chips to China to Russia.

Source: Author based on Yahoo data

When the market sentiment is on a high alert (as it is now with NVDA), it tends to overact and the reactions can be very disconnected from fundamentals. Such disconnections and the wild volatility can be certainly frustrating for long-term investors. And to make things even worse, I do not see these above events going away anytime soon. For example, there would be definitely ups and downs in the execution of the CHIPS act. The trade tension between U.S., China, and Russia would almost certainly persist into the future.

And this leads to the thesis of this article, which is twofold. First, I will argue that the development of the above events will keep impacting NVDA stock prices disproportionally going forward. And second, I will argue that the current option market underestimates the implied volatility of NVDA, especially considering the potential price fluctuations (like those we just witnessed) to be caused by these events. And as an actionable idea, investors could consider an option play here. You could consider a long call option to limit your risk exposure (in terms of total dollar amount), or a long put option to hedge your existing shares.

Business outlook and catalysts

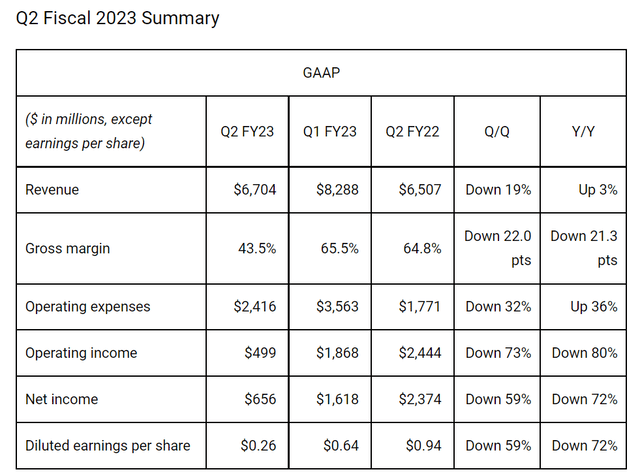

There are plenty of uncertainties facing the business currently, full of both upside and downside catalysts. All signs show the chip sector is currently in its contracting phase and NVDA is no exception. Its quarterly revenue declined to $6.7 billion in the latest quarter. This was mainly caused by the contraction of its gaming segment, its second-largest segment, and also the professional visualization segment. Gross margin contracted by 22 basis points too.

On the positive side, the above decline was partially offset by growth in its data center (its largest market) and automotive divisions. Although data center demand in China fell significantly, one of its key markets. Going forward, China faces uncertain macroeconomic prospects, and the U.S. government’s restrictions on its exports of certain products to China further compound the uncertainties.

Source: NVDA Q2 Fiscal 2023 Summary

Last month, the U.S. Department of Commerce notified NVDA that they would not be allowed to sell several AI computing chips to China until they obtained a license. A Reuters report quoted multiple people familiar with the matter as saying that the Biden administration plans to continue to expand AI chip export restrictions to China. A few days later, NVDA confirmed the news and made the following announcements (slightly edited by me):

- That U.S. officials told it to stop exporting two top computing chips for artificial intelligence work to China, a move that could cripple Chinese firms’ ability to carry out advanced work like image recognition and hamper Nvidia’s business in the country.

- The ban affects its A100 and H100 chips designed to speed up machine learning tasks and could interfere with the completion of developing the H100, the flagship chip it announced this year.

Its share price fell by more than 6% after the above announcement. And as aforementioned, its share prices kept sliding during the week and lost a total of $31 that week, a decline of 19%. At this point, I do not think that impacts can be clearly quantified. There might be other actions against China. The restrictions, or their interpretations, could also be changed.

Volatility mispricing

As aforementioned, the second key thesis of this article is that the option market seems to be underestimating the price movement that could be caused by these large uncertainties.

The mispricing in its volatility also provides an attractive setup for a long call play. The setup has a couple of advantages compared to the buy-and-hold strategy. First, it can limit your exposure in terms of the total dollar amount. Second, it can take advantage of the volatility mispricing (the buy-and-hold strategy only benefit from price movements). Third, it provides a definitive expiration date.

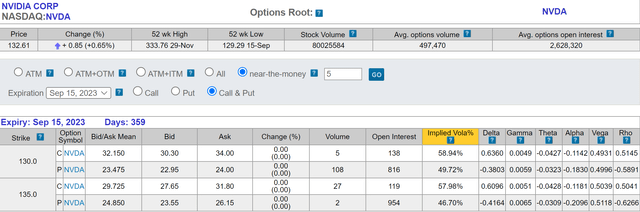

As an example, as of this writing, NVDA call option with a $130 strike price that expires on 9/15/2023 sells at about $32 as you can see from the chart below provided by OIC. So $3.2k would provide exposure to 100 shares, versus $13.2k if you directly own the shares.

You can also see the implied volatility is ~58.9% for the call option. Again, to me, this is an underestimate compared to the recent price movements on the order of ~20% on a weekly basis. To put it into another perspective, GOOG’s call options currently sell at an implied volatility of about 40% (with the same near-the-money strike price and same duration). So NVDA’s implied volatility is only about 47% higher than GOOG. Yet, the price actions in NVDA shares in the past few months have been way more than 47% higher than GOOG’s price fluctuations. And looking forward, the cyclicality and uncertainties GOOG faces is only a fraction of what NVDA faces in my mind.

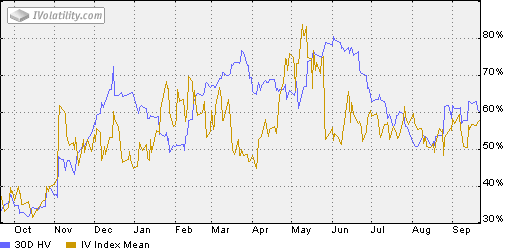

As another sign of the underestimation, the implied volatility is also substantially lower than NVDA’s own historical volatility as you can see from the second chart below. Its historical volatilities (the yellow line) have been close to 80% in June and currently are above 60%. However, its options have traded at implied volatility that has and is below its historical volatility.

Source: oic.ivolatility.com

Other risks and final thoughts

There are plenty of risks surrounding NVDA at this point. Besides all the issues mentioned above, NVDA is also trading at a premium valuation at this point despite the large price corrections. It is currently valued at around 43x PE on a TTM basis. It is at a 34% premium relative relatively to AMD’s 32x PE, and at a premium of almost 100% compared to NASDAQ 100’s ~22x PE. And again, the use of a call option is a way to limit these risks if you want to express your bullish view. And a put option is a way to hedge against these risks if you hold existing shares. Using options is similar to buying insurance. And when the market underestimates the implied volatility, a long option play is equivalent to buying insurance with a discounted premium.

Finally, let me close by emphasizing the risks of the use of options itself. Options can limit risks in terms of the ABSOLUTE DOLLAR AMOUNT. But it is riskier in relative terms. You can lose 100% and there is actually a good chance of that.

Be the first to comment