Fly_dragonfly/iStock via Getty Images

Foreword

About the Ben Graham Formula

The Ben Graham Formula strategy contains ultra-stable stocks that will infrequently lose money if held over a long period of time. It was developed based on a screen in Graham’s book, The Intelligent Investor. For those who have read the book, it is the “Defensive Investor” screen. It selects stocks that are large in terms of sales and total assets, have a strong track record of earnings and dividend payments, have a reasonable current ratio and level of long term debt, and have a low valuation given by P/E Ratios and Price to Book Value ratios. —YCharts

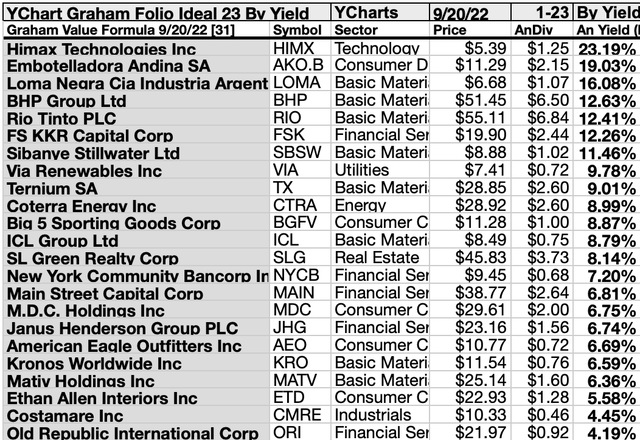

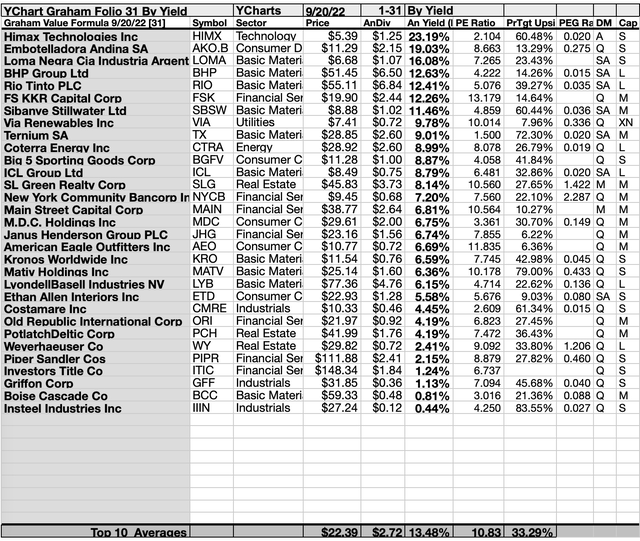

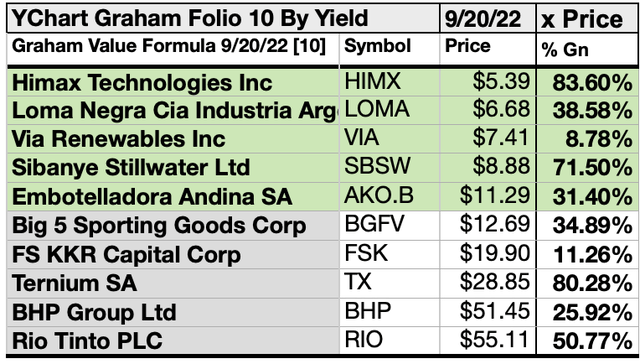

While 8 out of this collection of 31 Graham Dividend stocks are too pricey to justify their skinny dividends, 23 of the 31, by yield, live up to the ideal of offering annual dividends (from a $1K investment) exceeding their price per share.

I’m cooled to note that the original list of September Formula derived stocks contained therefore members, namely ZIM, KEN, QIWI. ZIM showed an unsustainable yield of 94.10% so it was left out. KEN also showed an unsustainable yield of 34.99%. Gone. Finally, the saga of QIWI an unavailable yet still-listed Russian stock on the charts. Thus are the war casualties for this week.

In the current market bounce, the dividends from $1k investments in any of the twenty-three stocks listed above met or exceeded their single share prices as of 9/20/22.

As we are now six months past the second anniversary of the 2020 Ides of March dip, the time to snap up some the twenty-three top-yield Graham value dogs is now… unless another big bearish drop in price looms ahead. (At which time your strategy would be to add to your position in any of these you then hold.)

To learn which of these 23 ideally-priced opportunities are “safer” to buy (namely which have ready cash to pay their dividends). Use the last bullet in the Summary above to navigate to my dividend dogcatcher follow-up article after September 30 in the SA Marketplace.

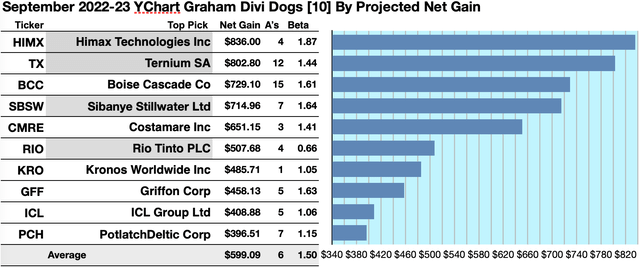

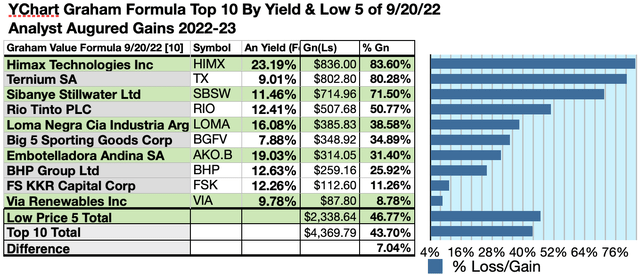

Actionable Conclusions (1-10): Analysts Estimate 39.65% To 83.60% Top Ten Graham Net Gains To September 2023

Four of the ten top Graham Formula picks by yield were verified as also being among the top ten gainers for the coming year based on analyst 1-year target prices. (They are tinted gray in the chart below). Thus, this yield-based forecast for Graham-derived dividend dogs (as graded by Brokers) was 40% accurate.

Estimated dividend-returns from $1000 invested in each of the highest-yielding stocks and their aggregate one-year analyst median target-prices, as reported by YCharts, created the 2022-23 data-points. Note: target prices by lone-analysts were not used. Ten probable profit-generating trades projected to September 20, 2023 were:

Himax Technologies Inc (HIMX) was projected to net $836.00, based on dividends, plus the median of target price estimates from 4 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 87% greater than the market as a whole.

Ternium SA (TX) was projected to net $802.80, based on a median of target estimates from 12 analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 44% greater than the market as a whole.

Boise Cascade Co (BCC) was projected to net $729.10, based on the median of target price estimates from 15 analysts, plus dividends, less broker fees. The Beta number 61% over the market as a whole.

Sibanye Stillwater Ltd (SBSW) netted $714.96 based on a median target price estimate from 7 analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 64% greater than the market as a whole.

Costamare Inc (CMRE) was projected to net $651.15, based on dividends, plus the median of target price estimates from 3 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 41% over the market as a whole.

Rio Tinto PLC (RIO) was projected to net $507.68, based on dividends, plus the median of target price estimates from 4 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 34% less than the market as a whole.

Kronos World Wide Inc (KRO) was projected to net $485.71 based on dividends, plus the median of target price estimates from 2 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 5% more than the market as a whole.

Griffon Corp (GFF) was projected to net $458.32, based on the median of target price estimates from 5 analysts, plus the estimated annual dividend, less broker fees. The Beta number showed this estimate subject to risk/volatility 63% greater than the market as a whole.

ICL Group Ltd (ICL) was projected to net $408.88, based on a median target price estimates from 5 analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 6% over the market as a whole.

PolatchDeltic Corp (PCH) was projected to net $396.51, based on dividends, plus the median of target price estimates from 7 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 15% greater than the market as a whole.

The average net-gain in dividend and price was estimated to be 59.91% on $10k invested as $1k in each of these ten stocks. The average Beta showed these estimates subject to risk/volatility 35% greater than the market as a whole.

Source: Open source dog art from dividenddogcatcher.com

The Dividend Dogs Rule

Stocks earned the “dog” moniker by exhibiting three traits: (1) paying reliable, repeating dividends, (2) their prices fell to where (3) yield (dividend/price) grew higher than their peers. Thus, the highest yielding stocks in any collection became known as “dogs.” More precisely, these are, in fact, best called, “underdogs.”

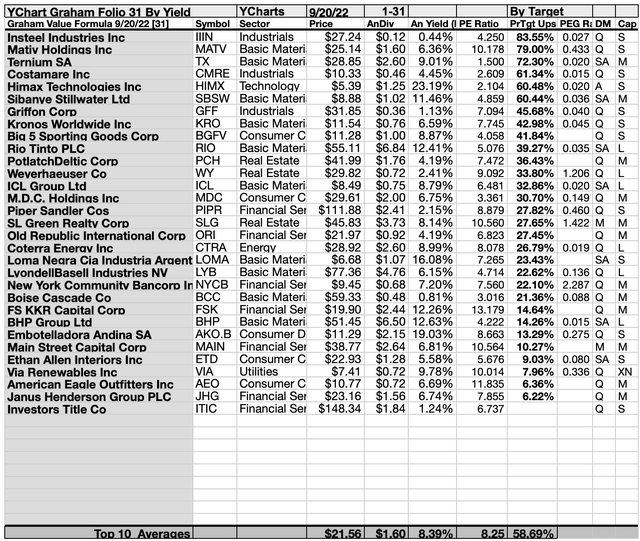

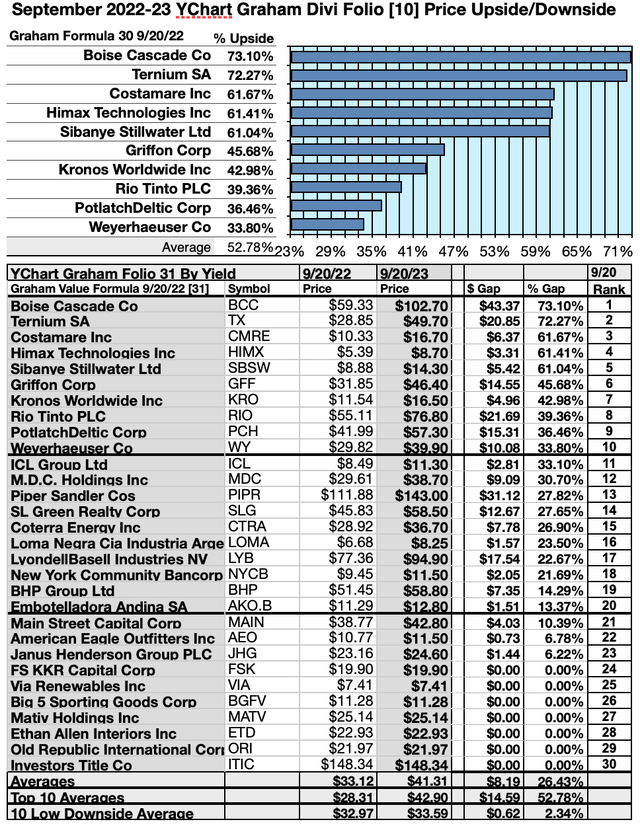

Top 31 Graham Value Formula Picks By Broker Targets

This scale of broker-estimated upside (or downside) for stock prices provides a scale of market popularity. Note: no broker coverage or 1 broker coverage produced a zero score on the above scale. This scale can be taken as an emotional component as opposed to the strictly monetary and objective dividend/price yield-driven report below. As noted above, these scores may also be taken as contrarian.

Top 31 Graham Value Formula Picks By Yield

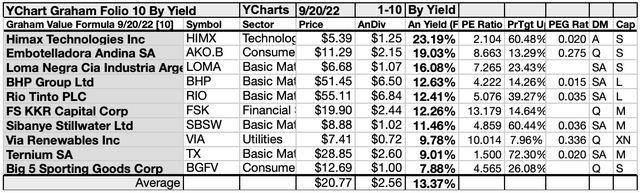

Actionable Conclusions (11-20): Ten Top Stocks By Yield Are The September Dogs of The Graham Formula Pack

Top ten Graham stocks selected 9/20/22 by yield represented five of eleven Morningstar sectors. First place was secured by one technology member, Himex Technologies Inc [1].

In second place was the lone consumer defensive stock, Embrotelladora Andina SA (AKO.B) [2]. Then, mid-pack, five basic materials representatives placed third through fifth, seventh and ninth, Loma Negra Via Industria Argentina SA (LOMA) [3], BHP Group Ltd (BHP) [4], Rio Tinto PLC [5], Sibanye Stillwater Ltd [7], and Ternium SA [9].

One utilities representative placed eighth, Via Renewables Inc (VIA) [8]. Finally, one energy representative placed tenth, Coterrra Energy Inc (CTRA) [10],to complete this Graham Formula top ten, by yield, for September.

Actionable Conclusions: (21-30) Ten Graham Value Dividend Stocks Showed 33.80% To 73.10% Upsides To September, 2023, With (31) No Losers

To quantify top-yield rankings, analyst median-price target estimates provided a “market sentiment” gauge of upside potential. Added to the simple high-yield metrics, analyst median price target estimates became another tool to dig-out bargains.

Analysts Estimated A 7.04% Advantage For 5 Highest Yield, Lowest Priced of Top-Ten Graham Value Formula Dogs To September, 2023

Ten top Graham Formula stocks were culled by yield for this monthly update. Those (dividend/price) results verified by YCharts did the ranking.

As noted above, top-ten Graham Formula Dogs selected 9/20/22, showing the highest dividend yields, represented five of eleven sectors in the Morningstar scheme.

Actionable Conclusions: Analysts Estimated The 5 Lowest-Priced Of Ten Highest-Yield Graham Formula Dividend Stocks (33) Delivering 46.77% Vs. (34) 43.70% Net Gains by All Ten by September, 2023

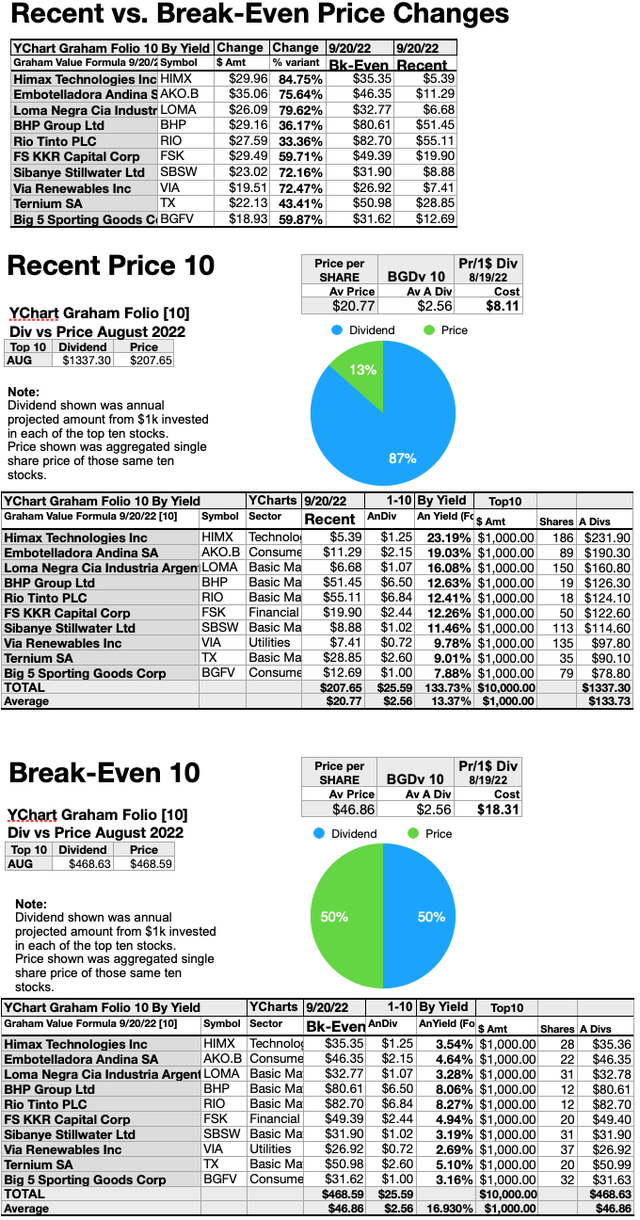

$5000 invested as $1k in each of the five lowest-priced stocks in the top ten Graham Formula dividend pack by yield were predicted by analyst 1-year targets to deliver 7.04% more gain than $5,000 invested as $.5k in all ten. The very lowest-priced Graham top-yield stock, Himax Technologies Inc (HIMX) , was projected to deliver the best net gain of 83.60%.

The five lowest-priced top-yield Graham Formula dividend stocks for September 20 were: Himax Technologies Inc; Loma Negra Via Industrials Argentina SA; Via Renewables Inc; Sibanye Stillwater Ltd; Embrotelladora Andina SA, with prices ranging from $5.39 to $11.29

The five higher-priced top-yield Graham Formula dividend stocks for September 20 were: Big 5 Sporting Goods Corp (BGFV); FS KKR Capital Corp (FSK); Ternium SA; BHP Group Ltd; Rio Tinto PLC, whose prices ranged from $12.69 to $55.11.

This distinction between five low-priced dividend dogs and the general field of ten reflected Michael B. O’Higgins’ “basic method” for beating the Dow. The scale of projected gains based on analyst targets added a unique element of “market sentiment” gauging upside potential. It provided a here-and-now equivalent of waiting a year to find out what might happen in the market. Caution is advised, since analysts are historically only 20% to 90% accurate on the direction of change and just 0% to 15% accurate on the degree of change.

Afterword

If somehow you missed the suggestion of the twenty-five stocks ripe for picking at the start of the article, here is a repeat of the list at the end:

In the current market bounce, dividends from $1K invested in the twenty-three stocks listed above met or exceeded their single share prices as of 9/20/22.

As we are six months past the second anniversary of the 2020 Ides of March dip, the time to snap up those twenty-three top-yield Graham dogs is now… unless another big bearish drop in price looms ahead. (At which time your strategy would be to add to your holdings.)

To learn which of these 23 ideally-priced opportunities are “safer” to buy (namely which have ready cash to pay their dividends). Use the last bullet in the Summary above to navigate to my dividend dogcatcher follow-up article after September 30 in the SA Marketplace.

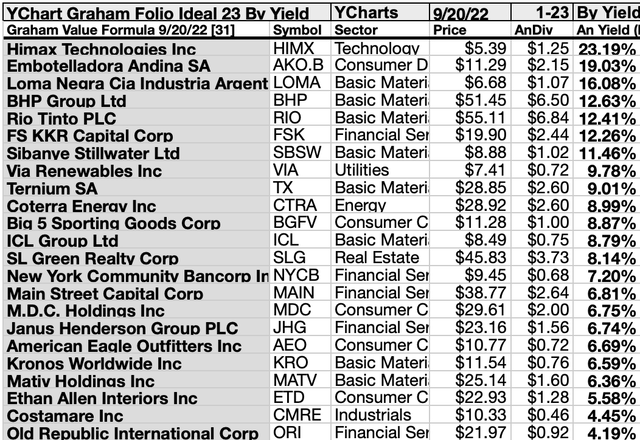

Recent vs Break-Even Top Ten Graham Formula Stock Prices

Since all of the top-ten Graham Value Dividend shares are now priced less than the annual dividends paid out from a $1K investment, the following top chart shows the dollar and percent variants to all ten top dogs conforming to (but not exceeding) the dogcatcher ideal.

Those at recent prices are the subject of the middle chart with the break-even pricing of all ten delivered in the bottom chart.

You could look at the top chart as an indicator of how high each stock might rise in the coming year or two. However, it also shows how much the price must rise (in either dollars or percentage) before it no longer conforms the standard of dividends from $1K invested exceeding the current single share price.

The net gain/loss estimates above did not factor in any foreign or domestic tax problems resulting from distributions. Consult your tax advisor regarding the source and consequences of “dividends” from any investment.

Stocks listed above were suggested only as possible reference points for your Graham Value Dividend dog stock purchase or sale research process. These were not recommendations.

Disclaimer: This article is for informational and educational purposes only and should not be construed to constitute investment advice. Nothing contained herein shall constitute a solicitation, recommendation or endorsement to buy or sell any security. Prices and returns on equities in this article except as noted are listed without consideration of fees, commissions, taxes, penalties, or interest payable due to purchasing, holding, or selling same.

Graphs and charts were compiled by Rydlun & Co., LLC from data derived from www.indexarb.com; YCharts.com; finance.yahoo.com; analyst mean target price by YCharts. Dog silhouette: Open source dog art from dividenddogcatcher.com.

Be the first to comment