Justin Sullivan

Nvidia (NASDAQ:NVDA) is scheduled to report its Q2 FY23 results after market close on Wednesday. The chipmaker has already pre-released disappointing revenue and gross margin results for the quarter but there’s a lot of ambiguity about its near-term prospects in light of crashing cryptocurrency mining interest, tough macroeconomic environment and intensifying market competition. In this article, I’ll discuss some of the key items that investors should be watching closely, when the company releases its earnings report tomorrow. Let’s take a closer look to gain a better understanding of it all.

Plummeting Demand

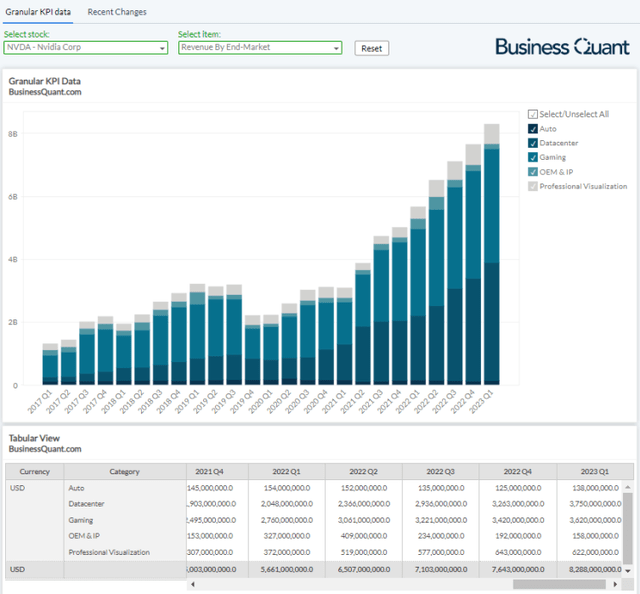

Let me start by saying that Nvidia has grown its top line at a spectacular pace in the last decade. It remained at the forefront of technology innovation (like data center accelerators, professional visualization cards etc.) which enabled it to expand target addressable market and brought along market share gains. It also benefited immensely from the surging GPU demand from cryptocurrency miners in recent years. But the chipmaker’s blistering growth momentum seems to be taking a breather, at least for the time being.

In a press release issued earlier this month, Nvidia’s management guided for their Q2 revenue growth to amount to a mere 3%. This is a far cry from the 30%-plus rates that the company has been posting for the better part of the past decade and also lower than its management’s prior guidance of 19%. As it turns out, this slowdown isn’t driven by 1 revenue stream, but rather due to 3 of its 5 revenue streams.

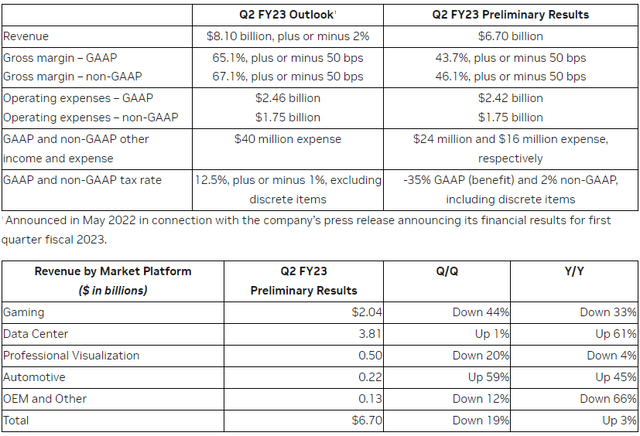

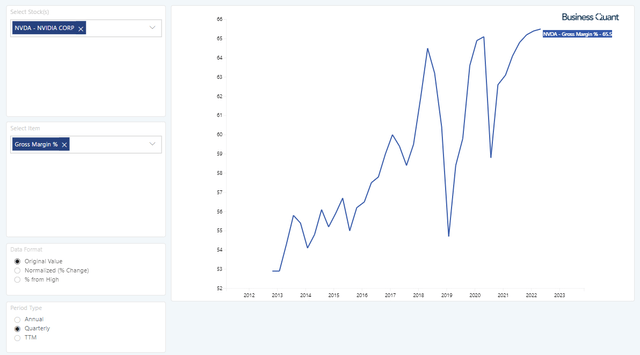

To make matters worse, Nvidia’s management expects its Q2 gross margin to amount to 43.7%. This figure may not mean much in isolation but it’s actually at a decade low level for the chipmaker and drastically lower than its management’s initial guidance of 65.1%. Although the company claimed in its press release that their long-term gross margin remains intact, it’s unclear how long it’ll take for its margin profile to bounce back to its usual 60%-plus levels.

Nvidia also noted in its press release that the revenue shortfall was “…primarily attributable to lower sell-in of Gaming products reflecting a reduction in channel partner sales likely due to macroeconomic headwinds.” We can speculate that the revenue shortfall is likely to have occurred due to plummeting cryptocurrency mining demand. After all, crashing crypto prices have rendered crypto mining less lucrative over the recent months.

I think it’s needless to say but this sudden slowdown in Nvidia’s otherwise-rapid growth momentum caught many investors off guard. But this shouldn’t come across as a surprise to my readers. I had actually warned about this slowdown in a prior article back in April, citing sluggish channel sales data.

(Read – Nvidia: We Have a Problem)

But that’s now in the past and we need to look forward.

Variables to Watch

For starters, look for Nvidia management’s comments around the exact nature of this sales slump. Did the gaming sales slump take place because the demand from cryptocurrency miners has waned off or is it some other reason? If it’s the former, like many of us suspect, then how much revenue does Nvidia generate from its sales into the cryptocurrency mining channel. This shouldn’t be all that difficult for its management to report now that it has LHR (or Low Hash Rate) and non-LHR versions of its cards to isolate sales meant for cryptocurrency mining. This piece of information is vital to understand the severity of this slowdown and it’ll help us in building financial projections for Nvidia’s Q3 and Q4.

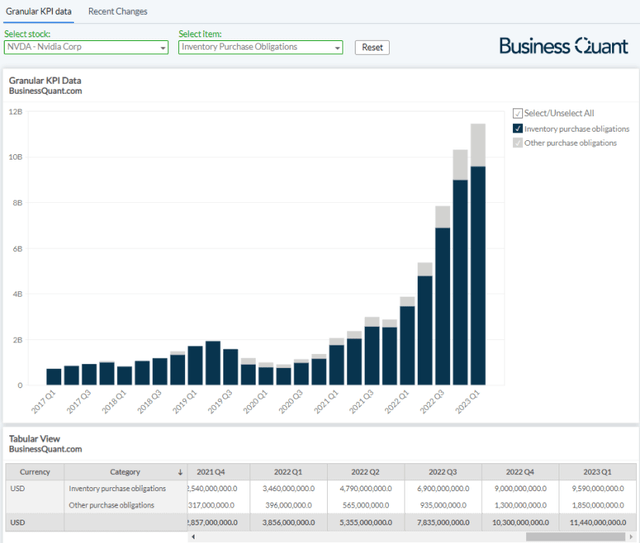

Secondly, if Nvidia’s management expects sales slump to be seasonal, and forecasts a demand resumption once RTX 40-series SKUs are released in a few weeks, then they’re likely to keep ordering inventory at their elevated rate in order to kickstart their growth engine as quickly as possible. We can monitor the chipmaker’s inventory purchase obligations figure for this. However, if the company’s management believes this sales slump to be long-lasting, then they’re likely to cut back on their pace of purchase orders which will reflect in the form of plateauing inventory purchase obligations.

Third, listen in on management’s comments around their supply situation. There are contradicting reports on how many SKUs will Nvidia release this year under its RTX 40-series line-up. With the historic semiconductor shortage nearing its end, I expect Nvidia to have sufficient inventory and it should be able to release several new SKUs in coming weeks. However, speculative reports (such as this) suggest that Nvidia will release only 1 SKU this year until its older inventory of RTX 30-series GPUs is cleared. There are also reports which suggest that Nvidia is increasing production of RTX 30-series cards for the time being. If true, then it may be a knee-jerk reaction to quickly reinvigorate sales growth, by selling volume quantities at plummeting ASPs (or average selling prices). So, look for clarity around their supply situation.

The last thing to monitor would be Nvidia management’s revenue and gross margin outlook for Q3. We just don’t know whether this sales slump is seasonal, or if it’s the result of shrinking consumer disposable income. If it’s the former, then this issue is likely to persist only for a few weeks until RTX 40-series GPUs are released. However, if it’s the latter, then the sales slump is likely to last for a quarter or two at the very least as the Fed is expected to continue hiking interest rates in order to limit personal disposable income and curb inflation along the way. The chipmaker’s management will be able to comment on this dynamic by comparing demand trends from countries that aggressively hiked interest rates (like US, Canada) against demand from countries that are going slow with rate hikes (like India, China).

Investors Takeaway

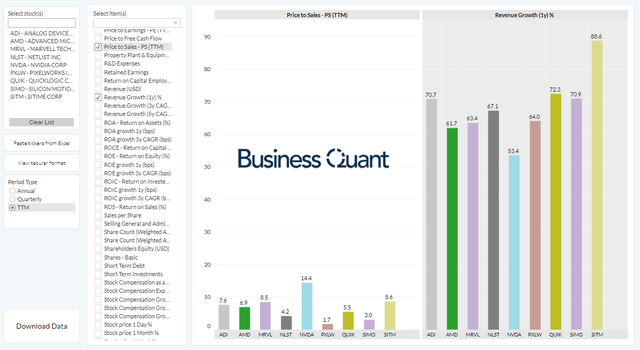

As far as valuations are concerned, Nvidia’s shares are currently trading at over 14-times their trailing twelve-month sales. This is significantly higher than many of the other rapidly growing semiconductor companies, such as AMD (AMD), which calls for a price correction in Nvidia’s shares in the coming weeks. So, risk-averse investors may want to avoid investing in the chipmaker’s shares for the time being at least.

At the same time, the issues that are currently plaguing Nvidia’s growth momentum seem seasonal and should last for a quarter or two at most. I personally expect Nvidia to reinvigorate its growth momentum from Q1 CY23 onwards. So, this potential price correction could be a buying opportunity for investors with a multi-year time horizon. Good Luck!

Be the first to comment