FatCamera/E+ via Getty Images

Omega Healthcare Investors, Inc. (NYSE:OHI) continued to perform well in the second quarter, with adjusted funds from operations covering its dividend.

While Omega Healthcare Investors is still dealing with operator issues, the trust remains undervalued in my opinion, and the stock provides income investors with attractive and sustainable passive income.

Omega Healthcare Profits From Long-Term Aging Trends

Omega Healthcare Trust is the owner of a nursing home and senior housing portfolio. The COVID-19 pandemic has had a significant impact on the real estate investment trust, resulting in lower occupancy and cash flow, but Omega Healthcare Investors is moving forward by collaborating with operators and resolving payment issues.

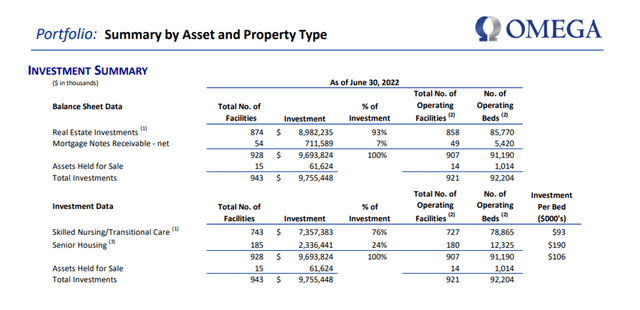

The trust owned 928 real estate facilities as of June 30, 2022, not including those that are expected to be sold, with nursing homes accounting for the majority of those facilities (743).

Omega Healthcare Investors’ total portfolio included 943 properties, including 15 marked as ‘held for sale,’ for a total investment value of $9.76 billion. 76% of this investment was in nursing homes, while the remaining 24% was in senior housing facilities.

Portfolio Summary (Omega Healthcare Investors)

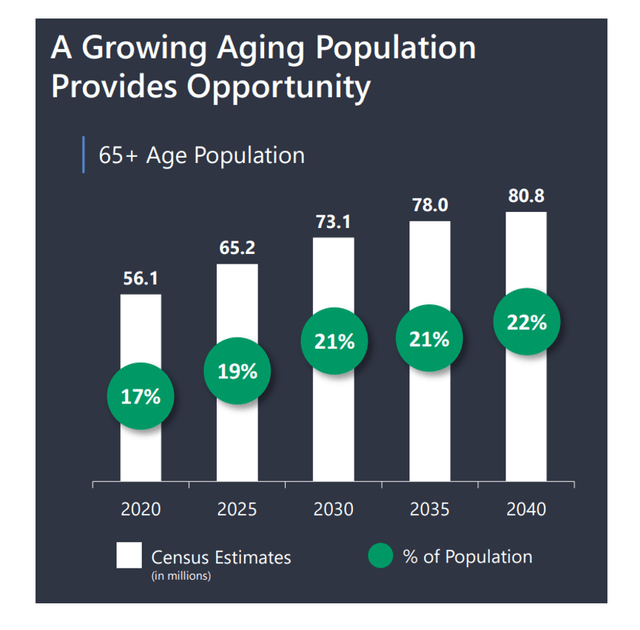

The best reason to consider Omega Healthcare Investors as an investment is that long-term industry trends favor the trust. The 65+ age group is expected to represent a growing share of the U.S. population, implying that demand for Omega Healthcare Investors’ nursing homes will increase. Between 2020 and 2040, the 65+ age group is expected to grow by nearly 25 million, representing a 44% growth rate.

Ageing Population (Omega Healthcare Investors)

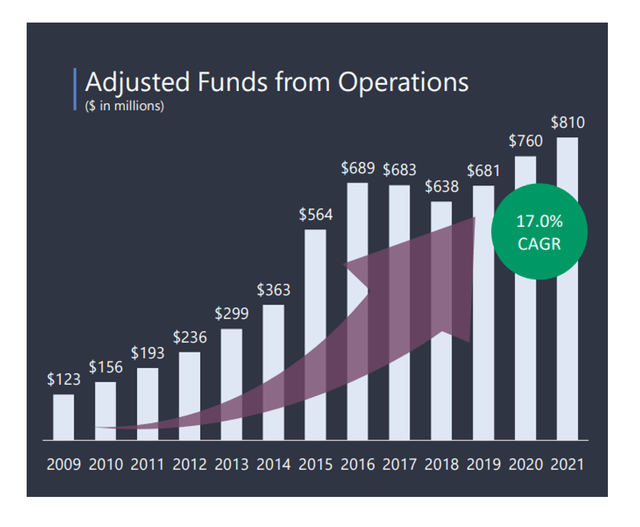

The aging of the population, combined with increased investment in nursing home stock to meet demand, has resulted in a significant increase in Omega Healthcare Investors’ adjusted funds from operations. Since 2009, the trust has produced 17% annual AFFO growth.

Adjusted Funds From Operations (Omega Healthcare Investors)

Dividend Comfortably Covered

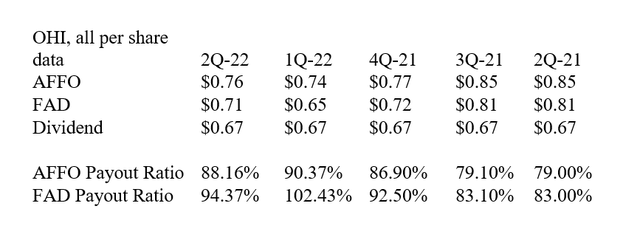

In the second quarter, Omega Healthcare Investors continued to cover its $0.67 per share dividend with adjusted funds from operations, which are typically used to calculate pay-out ratios. Funds available for distribution are sometimes used, and some REITs report both measures.

Adjusted funds from operations and funds available for distribution are non-GAAP financial measures that help investors understand the core operating performance of a REIT.

For example, adjusted funds from operations begins with FFO and excludes the impact of non-cash expenses such as stock-based compensation and transaction costs.

Funds available for distribution are calculated by subtracting adjusted FFO from non-cash interest expenses and revenue. Adjusted FFO and FAD are used to calculate pay-out ratios, which can help investors determine the safety of a trust’s dividend.

Omega Healthcare Investors had an AFFO-based pay-out ratio of 88.2% in Q2-22, which was slightly better than the 90.4% pay-out ratio in 1Q-22. The trust’s higher adjusted funds from operations in the second quarter contributed to the QoQ improvement in coverage.

Omega Healthcare Investors’ pay-out ratio over the last twelve months was 86.0%, indicating that the dividend has been adequately covered throughout. And, if management did not cut the dividend during the COVID-19 pandemic, it is highly unlikely that it will now.

Pay-Out Ratio (Author Created Table Using Company Supplements)

Omega Healthcare Investors Is Working Through Its Payer Problems

The trust has been plagued by low occupancy rates as a result of the emergence of COVID-19 and operators’ inability to make rental payments.

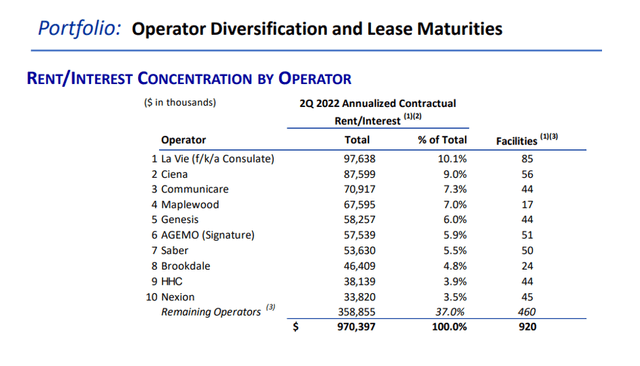

Some Omega Healthcare Investors’ operators are still struggling, such as AGEMO, the trust’s fifth largest operator, which is undergoing restructuring.

AGEMO failed to make contractual rent and interest payments in the second quarter. In addition, in Q2-22, the trust made rent concessions to Guardian, deferred $18.0 million in rent payments to 2024, and sold seven facilities leased to Guardian. Omega Healthcare Trust appears to be making significant progress with its operator situation, as the trust collected 91% of its scheduled rent and mortgage payments in the second quarter.

Operator Diversification And Lease Maturities (Omega Healthcare Investors)

Omega Healthcare Investors Has An Attractive Valuation

Due to ongoing payment issues with operators and an uncertain outlook for occupancy trends, Omega Healthcare Investors has not issued guidance for its adjusted funds from operations for 2022.

However, based on the $1.50 per share AFFO achieved this year, I believe the trust could earn $3.25-3.35 per share in adjusted funds from operations, representing a $0.05 per share increase on the bottom and top end of guidance compared to my previous forecast. The stock has an AFFO-multiple of 9.9x based on $3.25-3.35 per share in AFFO.

Given that the operator situation is likely to improve once COVID-19 is mostly behind us, and that the dividend is covered, I believe Omega Healthcare Investors’ valuation is very appealing.

Why Omega Healthcare Investors Could See A Lower Valuation

An event similar in length and severity to the COVID-19 pandemic could result in a reboot of Omega Healthcare Investors’ occupancy and operator issues, which the trust is still working through.

Omega Healthcare Investors is collaborating with operators to restructure leases and transition facilities to more solvent operators, and the trust’s AFFO prospects are inextricably linked to its ability to successfully address these issues.

A decline in portfolio and lease quality could have a negative impact on the trust’s cash flow prospects and valuation.

My Conclusion

Omega Healthcare Investors can maintain its current quarterly dividend payment of $0.67 per share. While the trust is still dealing with operator issues, long-term trends like the aging of the U.S. population are beneficial to Omega Healthcare Investors’ business. The stock’s yield is appealing, as is OHI’s valuation based on adjusted funds from operations.

Be the first to comment