phototechno

Introduction

In the United States, an estimated 135,000 to 200,000 people suffer from narcolepsy. Narcolepsy affects the brain’s ability to control sleep-wake cycles. Patients feel sleepy throughout the day and may fall asleep during activities or work. It affects their work and relationship balance.

There is no cure for excessive daytime sleepiness (also called EDS). Medication reduces the symptoms of EDS and Jazz (NASDAQ:JAZZ) has a portfolio of these drugs. Since narcolepsy is not curable, it will provide a steady stream of income for Jazz.

Jazz’s sales grew strongly at a CAGR of 16% from 2010 to 2021, expectations are positive, Jazz has a monopoly on the narcolepsy drug market and the stock is fairly valued. Still, Jazz is at risk because more than 50% of its revenue comes from selling oxybates. Competitors can capture market share. However, this isn’t material yet, but because of this, I’m not giving Jazz a large share allocation. Despite the risk, the stock is a strong buy.

Company overview

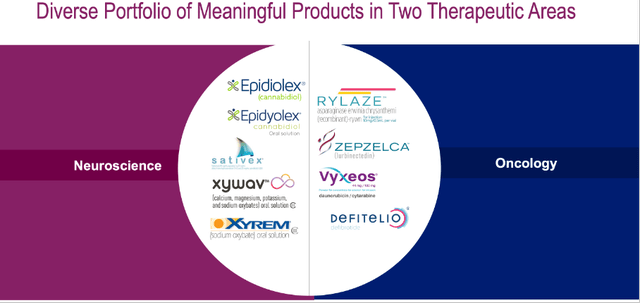

Jazz Pharmaceuticals is a biopharmaceutical company primarily focused on treatments for sleep disorders (neuroscience segment) and oncology. The company offers 7 approved drugs in its neuroscience and oncology segment.

Diverse Portfolio of Meaningful Products (August 2022 Corporate Overview, Jazz Investor Relations)

The portfolio of the neuroscience segment includes:

- Xyrem, and Xywav for the treatment of narcolepsy.

- Epidiolex, and Epidyolex (recently acquired from GW Pharmaceuticals) for epilepsy.

- Sativex (recently acquired from GW Pharmaceuticals) for MS.

Jazz’ portfolio of the oncology segment includes:

- Zepzelca for the treatment of metastatic small cell lung.

- Rylaze for acute lymphoblastic leukemia.

- Vyxeos for acute myeloid leukemia.

- Defitelio for the sinusoidal obstruction syndrome.

|

Revenues |

Three Months Ended June 30 in ‘000s |

||

|

2022 |

2021 |

Revenue growth % |

|

|

Xyrem |

$ 269,421 |

$ 334,182 |

-19% |

|

Xywav |

$ 235,025 |

$ 124,164 |

89% |

|

Total Oxybate |

$ 504,446 |

$ 458,346 |

10% |

|

Epidiolex/Epidyolex |

$ 175,289 |

$ 109,481 |

60% |

|

Sunosi |

$ 12,966 |

$ 12,124 |

7% |

|

Sativex |

$ 4,142 |

$ 1,961 |

111% |

|

Total Neuroscience |

$ 696,843 |

$ 581,912 |

20% |

|

Zepzelca |

$ 68,285 |

$ 55,924 |

22% |

|

Rylaze |

$ 72,954 |

– |

nm |

|

Vyxeos |

$ 33,890 |

$ 31,453 |

8% |

|

Defitelio/defibriotide |

$ 54,696 |

$ 48,096 |

14% |

|

Erwinaze/Erwinase |

– |

$ 28,314 |

nm |

|

Total Oncology |

$ 229,825 |

$ 163,787 |

40% |

|

Other |

$ 1,632 |

$ 2,641 |

-38% |

|

Product sales, net |

$ 928,300 |

$ 748,340 |

24% |

|

Royalties and contract revenues |

$ 4,578 |

$ 3,471 |

32% |

|

Total revenues |

$ 932,878 |

$ 751,811 |

24% |

Source: 2Q22 Quarterly Earnings And Author’s Calculations.

Jazz Pharmaceuticals derives most of its revenue from its neuroscience segment. The segment contributes 75% to the total sales. The Oncology segment contributes 25% of the total sales.

Most of the revenue comes from two similar oxybate drugs (Xyrem and Xywav), both contain the same component also known as GHB. The oxybate drugs account for 54% of the total sales. Xyrem’s sales declined while Xywav’s sales rose sharply because patients from Xyrem switched to the safer Xywav. Xywav contains less sodium, and a high amount of sodium intake is linked to a high risk of heart disease.

|

Top 5 product revenue |

% of revenue |

|

Oxybates |

54% |

|

Epidiolex/Epidyolex |

19% |

|

Rylaze |

8% |

|

Zepzelca |

7% |

|

Defitelio/defibriotide |

6% |

Source: Author’s Calculations.

Epidiolex (also called Epidyolex in Europe) comes in second, contributing 19% to total sales. Epidiolex product sales grew the strongest year-on-year in dollars. Jazz is confident they can achieve blockbuster status for Epidyolex.

In percentage terms, Sativex is growing fastest in sales. With the acquisition of GW Pharmaceuticals, Jazz’ is now a leader in rare epilepsy drugs.

In the Oncology segment, Rylaze contributes the most to total sales (8% of total sales), and Zepzelca comes in second (7% of total sales). Rylaze is the only drug available in the United States for patients experiencing a hypersensitivity reaction to E.coli-derived asparaginase. Zepzelca is the treatment of choice in second-line small cell lung cancer. Zepzelca sales grew strongly, with sales increasing 22% year over year.

Narcolepsy Medication Ensures Stable Sales For Years To Come

Narcolepsy patients experience a sudden need for sleep during the day, also known as excessive daytime sleepiness. This hinders their daily activities and work. Unfortunately, there is no cure for narcolepsy. Medications combined with changes in the patient’s lifestyle help reduce daytime sleepiness.

Common medications to treat narcolepsy patients are:

- Modafinil or armodafinil (wakefulness-promoting stimulant)

- Methylphenidate (addictive wakefulness-promoting stimulant)

- Sunosi (as an alternative to modafinil) (wakefulness-promoting stimulant)

- Sodium oxybate (reduce cataplexy, EDS, and nighttime sleep disturbances)

- Pitolisant (wakefulness-promoting stimulant for cataplexy patient)

Drugs written in italic are provided by Jazz Pharmaceuticals.

Sodium oxybates such as Xywav and Xyrem are the only drugs currently available on the market to reduce nighttime sleep disturbances for narcolepsy patients. Jazz Pharmaceuticals has a complete monopoly here.

Patients with narcolepsy are likely to first be given daytime wakefulness medications such as modafinil, Jazz’s Sunosi, or in rare cases methylphenidate (high addiction potential). In addition to the stimulant, doctors prescribe the oxybate formulation (Xywav or Xyrem) to see how they are doing. For cataplexy patients, the oxybate formulation is started at the same time as the stimulant.

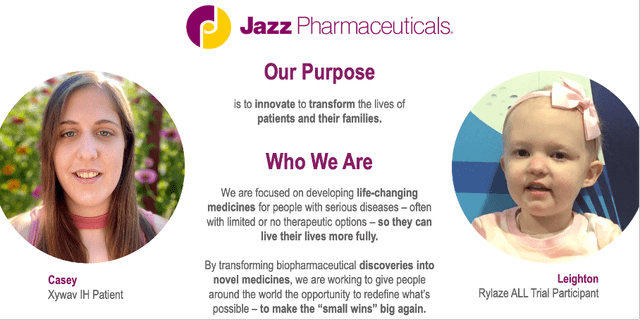

Jazz Introduction (August 2022 Corporate View, Jazz Investor Relations)

How do patients react to Xywav or Xyrem? Well, pretty good. A total of 103 patients gave sodium oxybate (Xywav) a satisfactory 7.7 rating, and 94 patients gave Xyrem a 7.6 rating. They are satisfied with Jazz’s narcolepsy products and live a good and balanced life.

As with diabetic patients who need daily insulin products, the narcolepsy patients also require daily medication to keep functioning properly throughout the day. The sales of oxybates can therefore be called stable.

Recent quarterly earnings

Second quarter earnings were strong as revenue grew 24% and non-GAAP EPS grew 10%. Both numbers beat analysts’ estimates. Bruce Cozadd, chairman and CEO of Jazz Pharmaceuticals was very optimistic:

Execution remains our primary focus as we aim to maximize the value of Xywav in idiopathic hypersomnia and narcolepsy, grow Epidiolex® in the U.S. and expand the launch of Epidyolex® globally, build on the successful launch of Rylaze® and progress the development program for Zepzelca®. We are also advancing a number of mid- and late-stage programs in our pipeline with multiple Investigational New Drug applications expected through 2023, and are pleased our pan-RAF inhibitor, JZP815, was cleared by the FDA to enter clinical development.

Renée Galá, executive vice president and chief financial officer, was also very pleased with the results. The company recently acquired GW Pharmaceuticals, which is partly financed by debt. Jazz’s net leverage was its highest at 4.9x in the third quarter of 2021. Second quarter results showed their net leverage was 3.2, which is two quarters ahead. Their strong balance sheet leaves room for further acquisitions or cash allocation to shareholders.

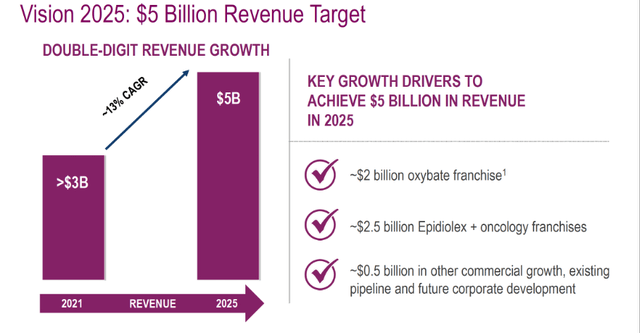

Business Outlook

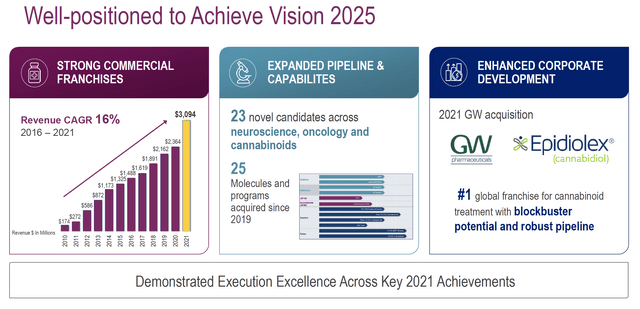

Jazz’s Vision 2025 describes their vision for the coming years. The company expects consolidated sales to grow by double digits (at a CAGR of 13%). Oxybate revenue was $1.8 billion in 2021 and is expected to grow 2.7% annually through 2025. Epidiolex + oncology franchises delivered $1.2 billion in revenue in 2021 and is expected to grow double digits at a CAGR of 20%.

Vision 2025 Target (August 2022 Corporate View, Jazz Investor Relations)

Their growth ambition is still intact, as the company exceeded analyst expectations in the second quarter of 2022.

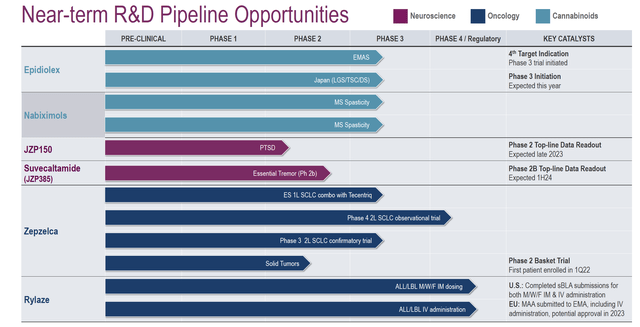

Jazz has grown strongly in recent years. From 2010 to 2021, sales grew at a CAGR of 16%. Jazz currently has 23 new candidates in the neuroscience, oncology, and cannabinoids segments. There are 6 mid to late-stage candidates, readings are expected in 2022-2024.

Well-Positioned To Achieve Vision 2025 (August 2022 Corporate Overview, Jazz Investor Relations)

Growth in their current portfolio and growth through new products from their pipeline contribute to the strong expectations of their Vision 2025.

Near-Term R&D Pipeline Opportunities (August 2022 Corporate Overview, Jazz Investor Relations)

One of the promising R&D Pipeline candidates is Nabiximols. Nabiximols is an oral mucosa spray that provides a balance between THC and CBD, helping with spasticity in patients with multiple sclerosis.

Nearly 1 million people in the US have multiple sclerosis and less than half of patients are satisfied with their current treatment. Between 31-47% of MS patients have used cannabis for self-medication. Jazz’ sees an important growth opportunity for Nabiximols to MS patients.

Risks

Jazz Pharmaceuticals relies heavily on revenues from Oxybate (Xyrem and Xywav) and Epidiolex. This poses a major risk to the company if its sales begin to decline.

A generic alternative to Xyrem was approved in 2017 but has since been discontinued. There are no generic alternatives available, but this may change.

As previously described, patients taking Xyrem are switching to the newer Xywav, which is safer to use. Fortunately, there are no generic alternatives available for this drug.

Jazz’ generally needs to diversify more because a large part of its sales depends on a few drugs. This poses a major risk as generic drugs enter the market and gain popularity. Jazz therefore focuses on corporate acquisitions and has recently acquired GW Pharmaceuticals, Werewolf and Sumitomo Pharma.

GW Pharmaceuticals brought Epidiolex/Epidyolex and Sativex into the portfolio. Epidiolex contributes strongly to the total turnover of Jazz. Sativex contributes just 0.4%, but revenue grew 111% year over year. As sales of the rest of their portfolio grow, Jazz will be more diversified. This reduces their risk of a sudden drop in sales.

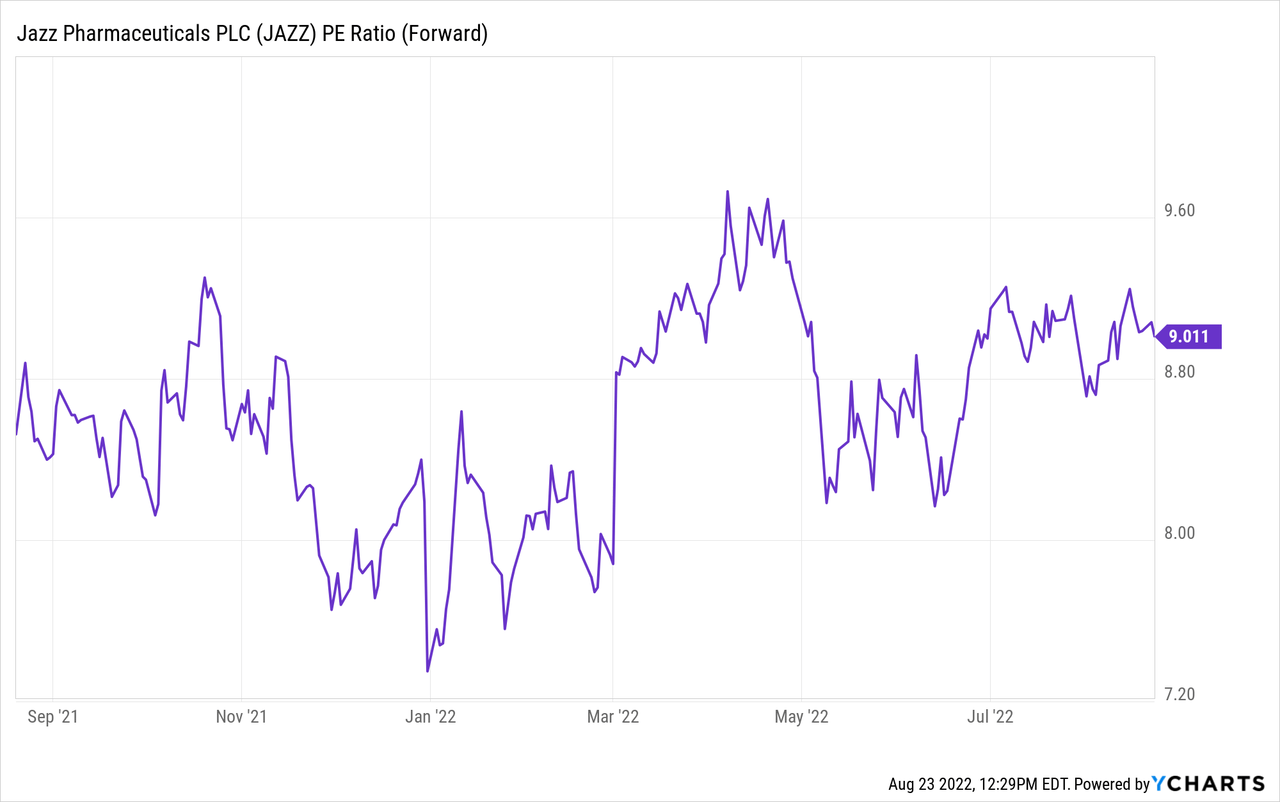

Valuation

Jazz’s stock valuation looks very attractive at first glance when looking at the forward PE ratio. The forward PE ratio is only 9. Because Jazz has made corporate acquisitions in recent years and funded them through a combination of cash on hand and debt financing, I think the PE ratio is a mediocre method of comparing current stock valuation to historical valuation. The EV/EBITDA is therefore the right instrument to compare the valuation with the history of Jazz.

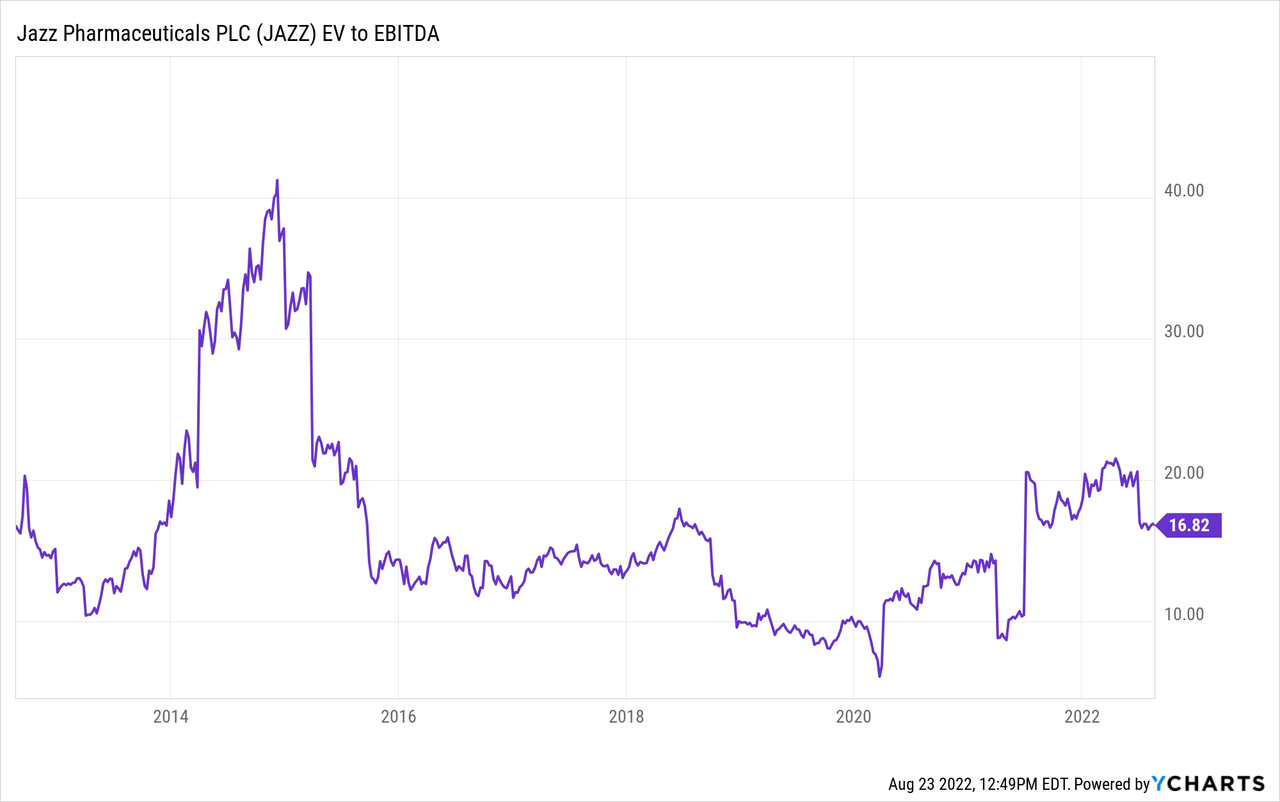

The enterprise value (also called EV) is the market value plus debt minus cash on the balance sheet. At the end of the second quarter, Jazz’s cash balance was $711 million, their long-term debt was $5,990 and their short-term debt was $31 million. The enterprise value is $15.2 billion and TTM EBITDA is $899 million. The EV/EBITDA is calculated as 16.9. In total, there are $109 million in long-term and short-term capital leases on the balance sheet. YCharts’ EV/EBITDA chart includes those, but the difference in EV/EBITDA with capital lease and without is very small, so the chart should be a good indicator.

The average EV/EBITDA over the past 10 years is 14.9. At the current EV/EBITDA ratio of 18.6, Jazz is valued slightly more expensive than its 10-year average valuation. Due to its high free cash flow yield of over 25%, Jazz’s enterprise value will rapidly decline, making the stock more attractive to invest in. Jazz also expects annual sales growth of 13%, with free cash flow growing along with it. Jazz has a strong portfolio under its umbrella.

Conclusion

Jazz Pharmaceuticals focuses primarily on medications for excessive daytime sleepiness. Patients suffering from EDS find it difficult to perform daily activities. It affects their work and relationship balance. There is no cure for EDS, medication will reduce the symptoms. As a result, Jazz can expect a stable income stream in the coming years. Jazz also has a monopoly on the market for narcolepsy drugs.

Jazz revenue grew at a CAGR of 16% from 2010 to 2021 because of organic growth and growth through acquisitions. Their 2025 Vision expects consolidated sales to grow at double digits at a CAGR of 13%. The company expects low-single digit growth in Oxybate sales to continue and Epidiolex + Oncology sales to grow at double digits. In addition to the current portfolio, there are 18 new candidates in the neuroscience, oncology and cannabinoids segments. 6 of them are in a mid-to-late pilot stage, readings are expected in the next 2 years.

Nabiximols is an R&D candidate that has strong growth prospects. Nabiximols was developed to treat Multiple Sclerosis patients, and nearly 1 million people are affected. Less than half of patients are satisfied with current medication and prefer cannabis for self-medication.

Nabiximols is an oral mucosal spray with compounds of THC and CBD. There is significant growth opportunity to provide Nabiximols to MS patients in the United States.

Jazz’s monopoly in the narcolepsy drug market, the company’s strong outlook and fair valuation make this stock a strong buy.

Be the first to comment