adaask

Both Ares Capital Corp. (NASDAQ:ARCC) and SLR Investment Corp. (NASDAQ:SLRC) are high yield business development companies (i.e., BDCs) (BIZD) that boast investment-grade credit ratings. In this article, we will compare them side by side and offer our take on which one is a better buy.

Ares Capital Vs. SLR Investment – Balance Sheet

As was already stated, both boast investment grade credit ratings of Baa3 (Stable) or equivalent.

When we look at ARCC’s specifics, we find that it has total liquidity of $4.6 billion (slightly more than one-fifth of its total enterprise value) with a leverage ratio of 1.23x.

Meanwhile, SLRC’s leverage ratio is much lower at 0.96x, at the lower end of its 0.9x to 1.25x leverage target range. While management did not provide a specific number, it said that it had “ample available capital to take advantage of the current attractive investment environment.”

While both appear to be in solid shape, we give SLRC the slight edge here given that its leverage ratio is considerably lower than ARCC’s.

ARCC Vs. SLRC – Investment Portfolio

SLRC’s portfolio is quite defensively positioned with 97.2% of its comprehensive debt portfolio invested in first lien senior secured loans, which provide greater downside protection during recessions. On top of that, 99.8% of the portfolio consisted of senior secured loans, with the remaining 2.6% that are not first lien senior secured loans being second lien cash flow loans and second lien asset-based loans.

The company’s investments are very well diversified across 780 distinct issuers and over 100 industries. The average exposure to a single counterparty was $3.5 million or 0.1% of the total portfolio and its largest industry exposures were defensive in nature (health care, diversified financials, life sciences and recurring software). The weighted average interest coverage for their cash flow loans to upper mid-market sponsor-backed companies was strong at 3.1x. Finally, their conservative portfolio construction seems to be paying off with nonaccruals at 0.6% of fair market value.

ARCC’s portfolio meanwhile, enjoys strong interest coverage of 2.9x and an average loan to value ratio of only ~44%. Meanwhile, 71% of its total investment portfolio is senior secured debt, with average position size exposure of 0.3%. On top of that, ARCC’s non-accruals were just 0.9% at fair market value. Finally, like SLRC, its top 5 industries are all relatively defensive, (software, healthcare, financials, commercial and professional services, and insurance services).

Both businesses appear very well positioned to benefit from rising interest rates, with SLRC’s management stating on its most recent earnings call:

our funding profile is in a strong position to weather a rising rate environment with $506 million up to $1 billion of funded debt comprised of senior unsecured fixed rate notes at a weighted average annual interest rate of 3.9%… if interest rates were to move another 100 basis points or 200 basis points, the portfolio at June 30, 2022, would generate $0.08 per share and $0.18 per share of incremental net investment income, respectively, on an annualized basis.

Meanwhile, ARCC’s CEO stated after their most recent earnings call:

As of quarter end, holding all else equal and after considering the impact of income-based fees, we calculated that a 100-basis point increase in short-term rates could increase our annual earnings by approximately $0.23 per share, a 14% increase above this quarter’s core EPS run rate.

A 200-basis point increase in short-term rates could increase our total annual earnings by approximately $0.44 per share, a 26% increase above this quarter’s core EPS run rate.

Both businesses have strong underwriting performances and have conservatively positioned portfolios that are poised to benefit from rising interest rates. Overall, we assign a draw here as SLRC’s portfolio is slightly more conservatively positioned and also has a higher weighting towards loans while ARCC is poised to benefit slightly more from rising interest rates.

Dividend Safety

ARCC’s dividend is clearly safer than SLRC’s at the moment as its core income in Q2 matched its dividend payout and it has significant spillover income that will support its dividend in the quarters to come alongside its strong expected per share growth in earnings due to rising interest rates:

We currently estimate that our spillover income from 2021 into 2022, will be approximately $651 million or $1.32 per share. We believe having a strong and meaningful undistributed spillover supports our goal of maintaining a steady dividend throughout market cycles and sets us apart from many other BDCs that do not have this level of spillover.

Meanwhile, SLRC is struggling to cover its dividend due to being on the low end of the leverage ratio and also due to some of its lending categories struggling with growth during the COVID-19 lockdowns. However, underwriting performance has remained very strong and originations are picking up along with rising interest rates, so SLRC has a path towards covering its dividend. This probability grows even stronger when you account for the fact that SLRC is underleveraged and will be reducing its management fees. Last, but not least, management has an authorization to buy back a considerable amount of shares at a steep discount to NAV, which should also help to improve dividend coverage. As management stated on the Q2 earnings call:

I think clearly, there’s a little bit more synergies that we expect from the Solar SUNS merger. The immediate one obviously came right through with the reduction in the management date. The additional opportunities here is clearly not only increased rates on the existing portfolio and yields, but new assets that we’ve been putting on. We did have an active quarter, but a lot of the activity came in late in the quarter.

So you’re not seeing that even though we ended the quarter at 0.96x leverage. You didn’t see the full earnings power of those additions. So that’s part of the bridge. The other part of the bridge is we’re obviously sitting at 0.96, which is the low end of our leverage range. So we see a little bit — based on our pipeline, we see a little bit of increase in the leverage, not material, but then we’ll give some portfolio expansion.

The additional lever that we just touched on is a more efficient vehicle for financing the lower-yielding cash flow assets, which you know in the past has been very accretive. People, including ourselves, that have used that structure. Additionally, as Michael mentioned, our commitment to the buyback will add a couple of cents there as well. So we do have a number of levers. And I think we like that. It’s not just one thing that we’re going to hit a button, and we’re going to get there, but we have multiple levers that we think will, in aggregate, exceed the dividend in terms of the earnings power of the platform.

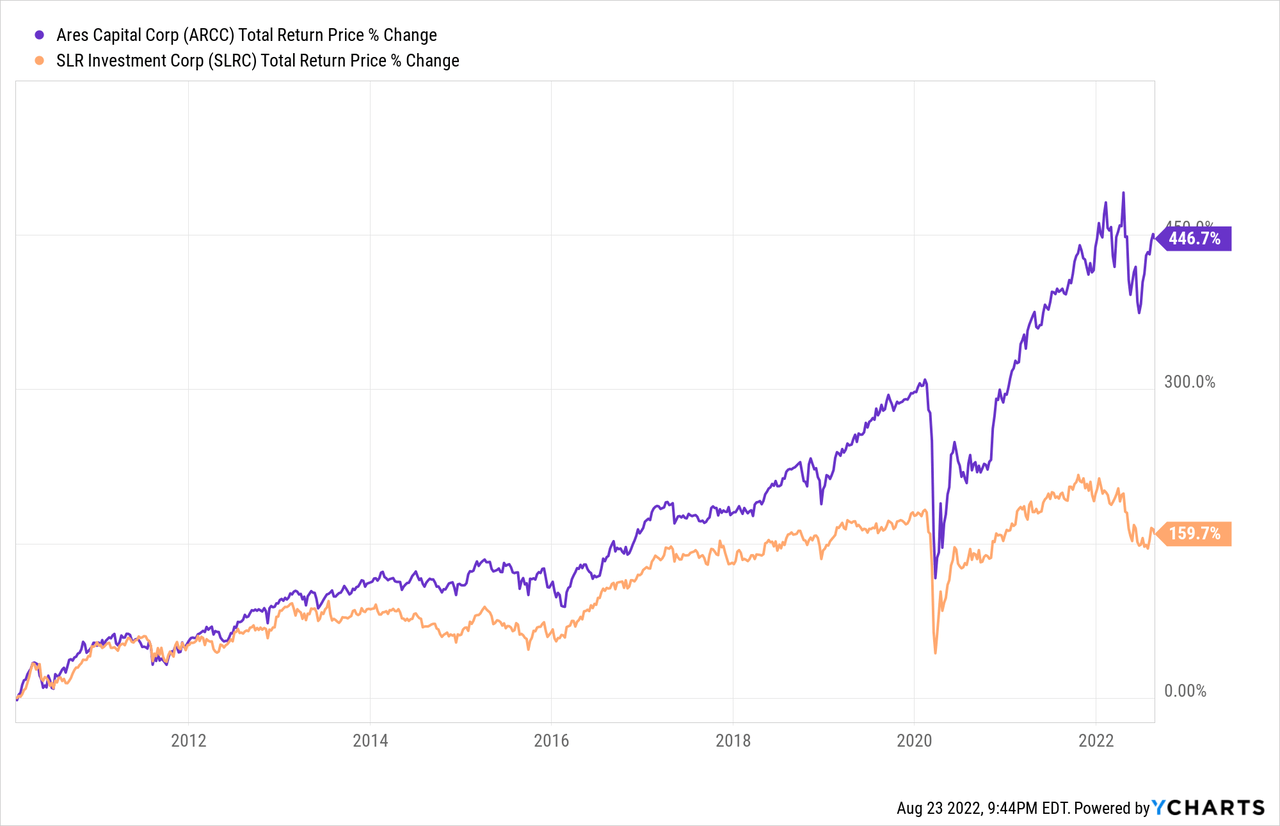

Track Record

ARCC has a hands-down better track record than SLRC, as it has crushed SLRC since SLRC went public:

ARCC Vs. SLRC – Valuation

SLRC’s valuation is considerably cheaper than ARCC’s across a variety of metrics on both a relative and historical manner:

| Valuation Metric | SLRC | ARCC |

| P/E | 9.33x | 10.13x |

| P/E (5 Year Average) | 11.45x | 10.25x |

| Dividend Yield | 11.00% | 8.83% |

| Dividend Yield (5 Year Average) | 8.76% | 9.36% |

| P/NAV | 0.80x | 1.08x |

| P/NAV (5 Year Average) | 0.91x | 1.02x |

The deep value at SLRC is evident given management’s plan to buy back $50 million of the stock in the coming quarters. Given that the current market cap is $816.7 million, the company may buy back over 6% of outstanding shares. This is very significant for BDCs, especially when considering how high the dividend yield already is. Management said on their latest earnings call – when the share price was only a few percentage points lower than it is today – that they “intend to be” aggressive with buying back stock at these levels and also said that:

The current share price is an attractive entry point, significantly more so than we first announced the buyback plan.

On top of that, as part of their recent merger with SLR Capital Partners, SLRC will be reducing its annual base management fee by 25 basis points from 1.75% to 1.5% on gross assets while also eliminated duplicative administrative expenses. Given these factors, SLRC is even cheaper than it looks. Given that it is trading at cheaper multiples than it did prior to its merger, its expenses are declining considerably, and they are planning to buy back shares aggressively, the stock looks very cheap right now.

Additional positives include the fact that SLRC has now switched from a quarterly dividend to a monthly dividend and the management team owns ~8% of the outstanding shares, aligning them strongly with shareholders.

Investor Takeaway

Unsurprisingly, this comes down to a competition between value and quality. When it comes to overall BDC quality, SLRC holds its own, but ARCC ultimately wins given its vastly superior track record of generating phenomenal total returns for shareholders and safer dividend. On the other hand, SLRC’s valuation is vastly more discounted, it has a significantly higher dividend yield, it is buying back shares, and its leverage ratio is quite low. Ultimately, we rate ARCC a Hold at present and SLRC as a Strong Buy. However, SLRC is higher risk than ARCC, so retirees may want to play it safe by investing in ARCC instead of SLRC. SLRC is a more attractive risk-reward for more aggressive total return-oriented investors who do not mind taking on greater risk of a dividend cut.

Be the first to comment