AlexSava

Canadian junior gold miner IAMGOLD (NYSE:IAG) offers compelling value after three recent transactions have likely addressed liquidity concerns in developing the new Cote mine. This suggests significant potential upside for the equity from current levels.

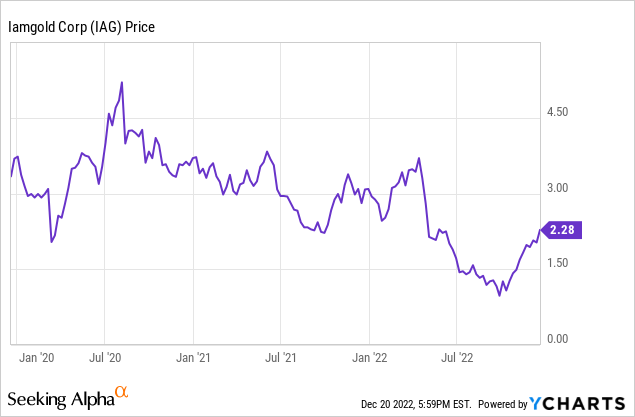

Yes, the stock has rallied since the summer, but it remains inexpensive relative to longer-run history and, also the value of its assets. The reason the opportunity exists is because the market was (rightly) worried about share issuance. That risk has recently faded, given recent disposals, and the market hasn’t completely factored that in yet. Also, the Cote mine is also perhaps something of a ‘show me’ story in that the market wants to see that management’s assessments are accurate; however, management’s numbers may be conservative if gold continues to trade at current levels.

Valuation

This summarizes the equity’s potential value at a high-level.

| Asset | Value | Notes |

| Cash balance | $536 | 9/30/22 balance sheet |

| Bambouk asset sale | $282 | expected close Q2-Q3 2023 |

| Cote Gold Project (60% stake less $1.1B future capex for 100% of project) | $1,380 | implied value of 60% stake, based on sale of 10% Sumitomo in 2022, this is also broadly consistent with management projections shown below |

| Rosebel | $360 | expected close Q1 2023 |

| Westwood | $250 | Canadian mine, has disappointed due to seismic risks, $9M FCF in Q3 |

| Essakane | $700 | $40M FCF in Q3 2022, ~7 year life |

| Additional exploratory assets | $100 | Various assets that are not currently producing |

| Debt (inc. letter of credit) | $845 | |

| Implied share price (473M shares out) | $5.84 | implies 142% upside |

From the table above the key uncertainties surround Cote and Essakane. Everything else either has a clear price from being cash, debt, in the process of being sold (Bambouk and Rosebel). Westwood and Essakane can have their valuation debated, but are less material to the thesis. Significant tax on the Bambouk and Rosebel disposals could eat into liquidity, but with the company trading at around half of book value, significant gains on sale appear unlikely.

Another way to think about the valuation is that the Cote mine after announced disposals should support a valuation of ~$3/share when/if it is operational in 2024 even if you value all other operating assets at zero (excluding those held for sale). However, the converse is not true, it is hard for the investment to work without the Cote mine becoming operational.

Liquidity Issues May Be Resolved $1.1B Needed, $1.6B On Hand

One issue that has plagued IAMGOLD in 2022 is obtaining sufficient funding for the Cote mine. I believe that is now complete. From September 2022, the company estimated that $1-$1.1B was needed to launch the mine. With the sale of Bambouk (announced Dec 2022), Rosebel (announced October 2022) and the sale of Cote stack (announced December 2022) and cash the company has just over $1.5B, and $1.6B if it fully draws down its credit line.

Of course, the company can’t draw down its cash balance to zero because of working capital swings, and may some tax on disposals, but it will receive some cash from operations of around $100M-$200M in 2023 depending on when disposals close. It is therefore reasonable to think that the development of Cote is now fully funded. That was not the case earlier in 2022.

Cote Valuation

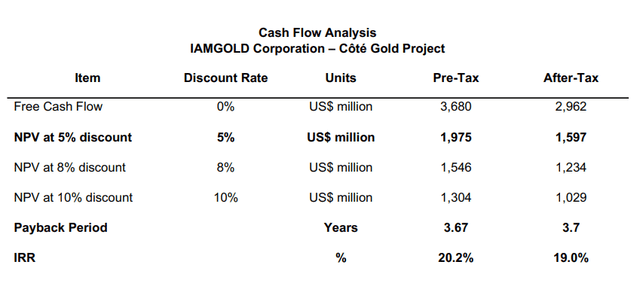

So let’s first dive into Cote, this is the company’s analysis at a gold price of $1,600/oz (current price is $1,827/oz) this is before the capex needed to create the mine. This suggests that a valuation in the range of $1B-$2B for the asset is reasonable, and that the company’s numbers may be conservative in the context of the current gold price.

Cote overview (Annual information form (SEDAR) 2/2022)

Risks

- Most obviously, the company needs to deliver on time and on budget for the Cote mine. Significant delays or the mine delivering below expectations will materially impact the company’s valuation. The asset being located in Canada reduces some of the geo-political risks.

- The gold price also presents risk to the business, Cote is estimated to be a relatively low cost mine, but others are not. Current futures pricing suggests the gold price will steadily move up over time.

- The company is also a beneficiary of the weak Canadian dollar, if the Canadian dollar strengthened, that would push up Cote development costs relative to expected gold revenue once the project is complete.

- This is a mining company and periodic disasters can materially impact production

Catalysts

- Closure of disposals in Q1-Q3 2023

- Cote mine hitting development milestones for early 2024 production start

- Cote mine meeting development budget

- Confirmation that the company is indeed fully funded

Why The Opportunity Exists

It appears that the stock traded down on the summer on fears of an equity raise. This was understandable, an equity raise was quite probable, and something management were hinting at. However, now assuming planned disposals and the Cote budget remains on track, that may not be necessary.

Summary

IAMGOLD is close to starting the Cote mine in 2024. Assuming they can fund the material remaining Cote expenses with their upcoming disposals, the shares should re-rate to the fair value of the assets which appears to be around $5/share. If the company can execute well in 2023 and the gold price doesn’t unexpectedly collapse, then the shares could more than double.

I like this setup. We’re close enough to the Cote launch that the value creation should soon be obvious to investors. Some are likely selling on the recent rally from the summer lows, but the company’s valuation appears extremely attractive with the risk of equity issuance largely removed.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment