Justin Sullivan

Thesis

NVIDIA Corporation (NASDAQ:NVDA) stunned the market as it announced its Q2 preliminary results that came in well below its guidance and the Street’s consensus. We highlighted in our previous article that NVIDIA could continue to underperform the market, even though we assessed that it was near its bottom.

While we expected NVDA to stage a short-term rally from its June lows, we didn’t envisage NVDA to continue outperforming the market. Notably, NVDA has underperformed the Invesco QQQ ETF (QQQ) and the Technology ETF (XLK) over the past two months (even before yesterday’s sell-off).

We maintain our conviction that the market has materially de-rated NVDA, despite its battering from its November 2021 highs. Management has failed to convince us when chips are down that Nvidia could overcome the market’s cyclical nature with its so-called “secular” opportunities.

Coupled with potentially slowing revenue growth and its steep growth premium, we urge investors to find other well-beaten down opportunities in growth and tech stocks to add exposure. Notwithstanding, we expect semis to have bottomed out and do not expect much further downside in NVDA. As a result, we urge investors not to sell in panic.

Therefore, we reiterate our Hold rating on NVDA for now.

Nvidia Lost Credibility With Its Caution

We are shareholders of NVDA, which account for a reasonable weighting in our portfolio. Therefore, we consider the warning on its Q2 prelim release a massive disappointment but not unexpected.

We vividly remember Broadcom (AVGO) CEO Hock Tan cautioned about the current semi downturn in September 2021, demonstrating his prescience and credibility. We also highlighted his comments in our article last year, as he accentuated:

And to answer your question point-blank, I do not see any specific drivers or reasons why the strength we see today is really nothing more than of an exaggerated up-cycle. We always go through a period of digestion. There’s no way we can consume on all that forever. And that’s what is called a cycle, particularly when we expect supply to come into play out of this – out of the current tightness, but dated back to 2020 to start coming in 2023. And the massive investment and CapEx will start deploying capacity in ’23 earliest. Then I see ’23 where we have supply. And I think digestion of demand might just start to occur. (Broadcom article)

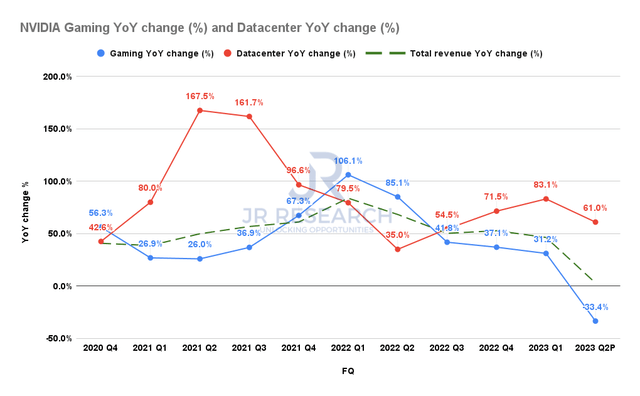

Nvidia gaming and data center revenue change % (Company filings)

Nvidia warned in its preliminary release for FQ2’23 that it expects to post revenue of $6.7B, up by just 3% YoY, down significantly from its previous outlook of $8.1B (up 24.4%).

The main culprit is gaming, as Nvidia highlighted that it expects gaming to post a decline of 33.4%, as seen above, even though data center growth remains robust. However, Nvidia’s gaming growth has already trended down consistently from its peak growth in FQ1’22, as gaming started to lap challenging comps, complicated by the post-pandemic reopening.

Furthermore, the destruction in crypto mining added to the headwinds in gaming cards ASPs, creating further challenges for Nvidia as it prepares to launch its RTX 40-series Ada Lovelace graphics.

But, Nvidia has consistently maintained its “strong” belief in its gaming segment, often accentuating its strength and consistency. CEO Jensen Huang highlighted in a June conference that he expects gaming to continue posting robust growth cadence. He articulated:

China is a significant market. Russia is a meaningful market for our gaming business. However, gaming remains solid even in the face of China and Russia. Q1 sell-through grew year-over-year over last year, which was a really fantastic year. And so gaming sell-through remains solid. (BofA 2022 Global Technology Conference)

But, consider what Huang emphasized two months later in Nvidia’s prelim release. He said:

Our gaming product sell-through projections declined significantly as the quarter progressed. As we expect the macroeconomic conditions affecting sell-through to continue, we took action with our Gaming partners to adjust channel prices and inventory. – Nvidia

Therefore, we believe Huang & team has lost some credibility with us. Moreover, it shows that the company overstated its forecasting models, resulting in weak execution. Given Nvidia’s experience navigating the previous crypto downturn in 2018, we are highly disappointed with how management has managed its guidance heading into its Q2 prelim release.

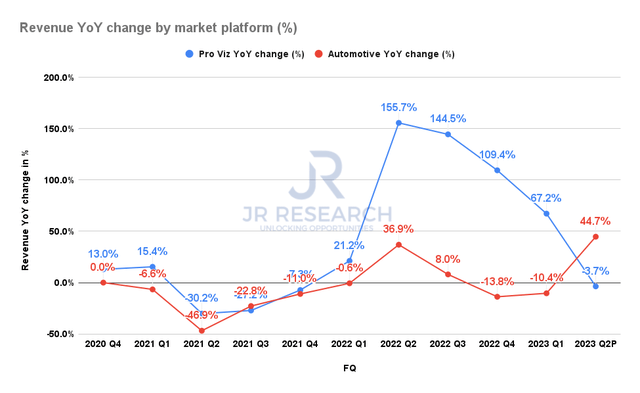

Nvidia pro viz and automotive revenue change % (Company filings)

Nvidia’s pro visualization segment’s growth has also slowed down markedly, reflecting the weakness in its gaming segment. Therefore, the euphoria over the Omniverse opportunity has yet to gain significant traction. As a result, we urge investors to pay attention to its data center growth cadence moving forward, as it’s critical to underpin NVDA’s expensive valuation.

Automotive is the bright spot after tepid growth over the past four quarters. However, QUALCOMM (QCOM) remains confident that it’s the leading player with its digital chassis, given the size of its design pipeline and growth momentum. Therefore, we urge Nvidia investors to pay close attention to Qualcomm’s performance and not simply buy into Nvidia’s commentary on its auto momentum.

Qualcomm highlighted in a May conference that its digital chassis competes with Mobileye (INTC) directly, suggesting two of them are leading the pack, without mentioning Nvidia. Management also accentuated in its recent Q3 earnings that it has garnered more than $19B in its auto design pipeline, and delivered auto revenue of $350M, up 38% YoY. Furthermore, the company emphasized that its open platform helps spur adoption by auto OEMs. Therefore, Nvidia investors need to assess the competition from Qualcomm carefully.

Is NVDA Stock A Buy, Sell, Or Hold?

We are confident that NVDA has likely staged its medium-term bottom in June, in line with its semi peers.

But, growth and tech investors are spoilt for choice, given the tech bear market. Being at a bottom doesn’t necessarily mean that investors should jump on the opportunity to add NVDA, as we believe it could still underperform the market.

Therefore, we reiterate our Hold rating on NVDA and urge investors to look elsewhere.

Be the first to comment