vzphotos/iStock Editorial via Getty Images

The Ethereum Foundation, which manages the Ether cryptocurrency, has announced completion of what it calls the Merge, whereby validation of new blocks of transactions no longer takes place by “mining”. The millions of high-end graphics cards that are used for this will no longer be needed for the new “proof-of-stake” approach, so that most of these will likely find their way into the used card market. This will depress demand for new graphics cards just when Nvidia (NASDAQ:NVDA) is set to announce its next-generation GeForce 40 series.

Ethereum completes its transition to proof-of-stake, ending lucrative and energy consuming “mining”

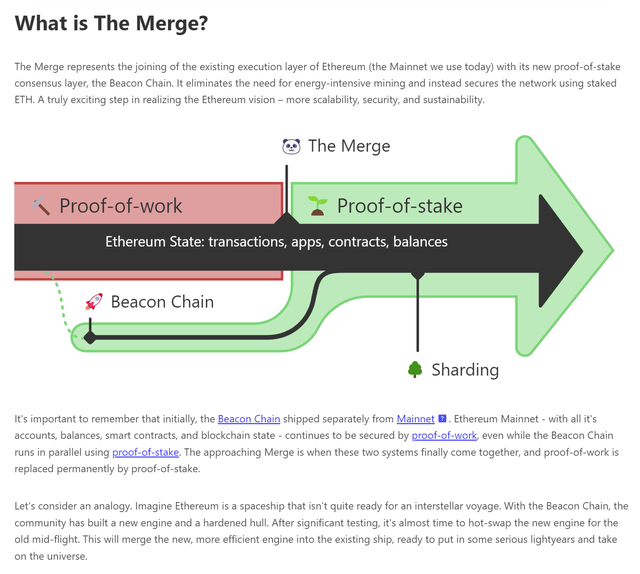

The transition of Ethereum to proof-of-stake was called the Merge because it involved combining the parallel block chain that was already using proof-of-stake experimentally with the main block chain that was using traditional mining, called proof-of-work. This is shown below in this diagram from the Ethereum Foundation:

Mining was really just transaction processing, in which a number of Ethereum transactions would be bundled into a block and encrypted. But the encryption process was made artificially difficult, requiring millions of high end graphics cards in the mining pool to process a block in a reasonable period of time.

In the new proof-of-stake approach, the artificial difficulty is removed, so that hardware requirements can be met by almost any computer, ending the need for graphics card processing and the attendant energy consumption. Ethereum claims this will reduce energy consumption by 99.95%.

Some miners may go to work on a “hard fork” of Ethereum, in effect, a secession of the currency into a new one called EthereumPOW. This currency will continue to use proof-of-work, but it’s unclear whether mining this will be profitable.

Probably, the vast majority of cards will go on the used card market and be sold on venues such as eBay.

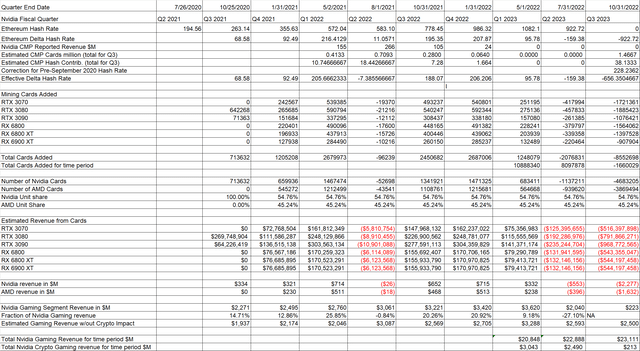

Correcting the Ethereum hash rate model to account for used graphics card sales

Following Nvidia’s revised guidance for its fiscal 2023 Q2, I realized that I needed to revise my model of Ethereum-related sales of graphics cards. I had published an article detailing the model in July.

The problem with the model was that it only accounted for sales into the Ethereum mining pool when the pool was adding capacity, i.e., adding new cards to the pool. It worked fine as long as the pool was still growing.

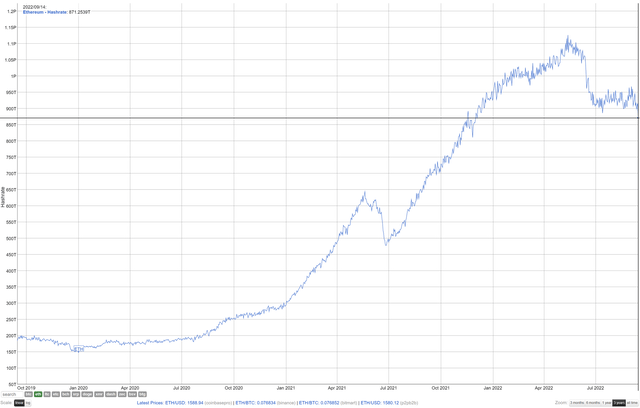

However, starting in mid-May, the Ethereum mining pool hash rate, a measure of mining capacity, started to decline, as shown in the following chart from BitInfoCharts:

This implied that a substantial number of graphics cards were being removed from the pool. If I assumed that these cards were comparable to current generation Nvidia and AMD (AMD) cards, then it was reasonable to assume that every used card sold was a lost new card sale.

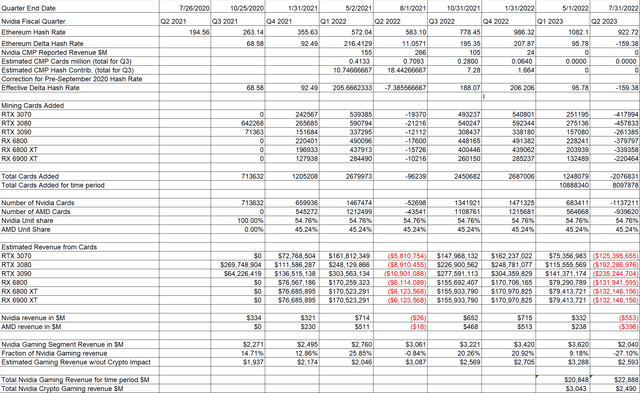

This turned out to account very well for Nvidia’s fiscal Q2 results, if we assume that a normal quarterly revenue in Nvidia’s Gaming segment is about $2.5 billion. During the Fiscal Q2 conference call, Nvidia specifically claimed that this would be their normal average Gaming segment revenue without crypto. In my spreadsheet calculations, it was easy to calculate the used card effect simply by allowing the change in mining pool cards to go negative, with a negative net revenue for the cards:

Note that the revenue impact doesn’t only fall on Nvidia, but the timing of Nvidia’s fiscal Q2 lined up better with the fall in Ethereum mining capacity and likely release of cards into the used card market. AMD will likely feel the impact in its Q3 results.

The impact of the Merge on Nvidia’s sales will be, at best, ugly

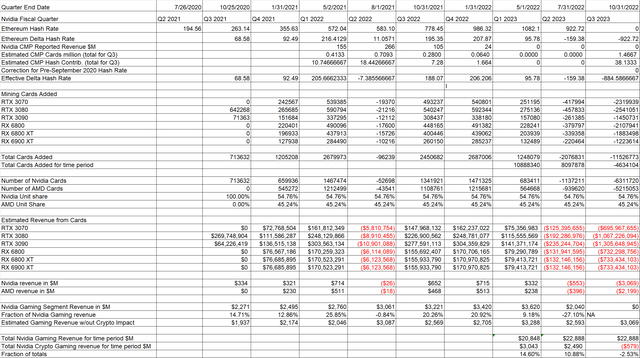

The model provides a means of anticipating what happens when the Ethereum hash rate effectively goes to zero, post Merge. And it’s not pretty. In an article on August 21, I gave my subscribers a heads-up concerning the impact of the Merge, and I further revised my model results on September 11.

If we assume that the entire mining pool consists of newer graphics cards released since September 2020 (RTX 30 series for Nvidia), then Nvidia’s RTX 30 series sales for Q2 are completely wiped out, as shown in the spreadsheet calculations extended to Q3:

The model deducts the hash rate contribution due to Nvidia Crypto Mining Processors (CMP). These cannot be sold into the used graphics cards market, since they lack display outputs.

This amounts to assuming that all of the cards used in mining before September 2020 (about when the RTX 30 series launched) were replaced with newer cards. This probably isn’t absolutely correct, and the mining pool has consisted of a mixture of older and newer cards.

As a lower bound, we can assume that none of the older cards were replaced. These cards would not impact new card sales, since they aren’t comparable to current generation cards. The model can deduct these cards from the calculated revenue impact by simply deducting the pre-September 2020 hash rate of 228.2361 terahash/sec (THASH) for the mining pool:

So the lost revenue impact for Nvidia looks to be in the range of $2-3 billion, and it probably won’t fall all in Q3 but be distributed over several quarters. The effect of the Merge is to effectively zero out Nvidia’s crypto revenue over time. The revenue made during Ethereum’s mining pool expansion is negated by lost revenue post Merge, with the exception of CMP revenue and revenue from older graphics cards that might still have been in the pool at the time of the Merge.

How will the Merge affect Nvidia’s expected RTX 40 series launch?

Nvidia has been expected to announce its GeForce RTX 40 series cards for some time, and Nvidia posted this announcement on its website:

Various tech pundits are claiming that this is the worst time for Nvidia to launch a new generation of gaming graphics cards. One important feature expected of the RTX 40 series is support for PCIE 5.0. This could be important in reducing the impact of the Ethereum Merge.

The current generation of Nvidia and AMD cards only support PCIE 4.0, the prevailing standard at the time of their introduction in late 2020. PCIE 5.0 will double the communication bandwidth compared to 4.0. It’s not clear how critical that will be to gaming performance, but it should eliminate PCIE as a bottleneck, if it ever was.

Just as important, new generation CPUs will have to support PCIE 5.0, since the GPU is typically linked directly to the CPU through a built in PCIE 16 lane (x16) interface. This is the preferred architecture for maximum gaming performance, and all modern CPUs provide at least 16 lanes of PCIE for this purpose.

Intel (INTC) already supports PCIE 5.0 in its latest Alder Lake 12th generation Core series of desktop CPUs. Since Alder Lake launched early this year, there have been no PCIE 5.0 graphics cards to take advantage of the interface, but the current installed base of Alder Lake systems represents a waiting market for the new PCIE 5.0 cards.

Unfortunately, I don’t have an estimate of Alder Lake sales, so I have no idea what the size of that market might be. Current generation AMD Ryzen 5000 series desktop CPUs only offer PCIE 4.0, but the Ryzen 7000 series has been announced with support for PCIE 5.0, with a launch expected in October. AMD’s next-generation GPUs have only been “teased” but are expected to support PCIE 5.0 as well.

The performance desktop market (mostly gamers) is moving rapidly to PCIE 5.0, and Nvidia will have, at least for a few months, the only graphics cards that support it. Gamers tend to be early adopters and favor the highest performance technology.

Since none of the used cards released from the Merge will support PCIE 5.0, this may serve to somewhat isolate the RTX 40 series launch from the impact of the Merge. How much isolation is still unclear.

Most of the current population of gaming systems will only support PCIE 4.0, so this part of the market would probably not buy RTX 40 series in any case. Most 40 series sales will go into new system builds.

Certainly, the impact of the Merge will be to weaken sales of the RTX 40 series at launch. However, overall sales in the Gaming segment will probably benefit from the launch. The 40 series launch will give the segment a revenue stream it would not have had otherwise.

Investor takeaways: will Nvidia need to restate guidance for this quarter?

Nvidia guided to revenue of $5.9 billion for fiscal Q3 during the Q2 conference call, and this implies revenue in the gaming segment of about $1 billion. Did Nvidia account for the Merge in their guidance?

When asked specifically about the impact of the Merge, Nvidia management had no comment, and professed an inability to account for the crypto impact. The guidance was claimed to be due to a retail channel inventory glut.

If Nvidia really wasn’t accounting for the Merge, then almost certainly it will need to restate guidance for Q3. Probably, the RTX 40 series launch will not be enough to provide the roughly $1 billion in Gaming segment revenue.

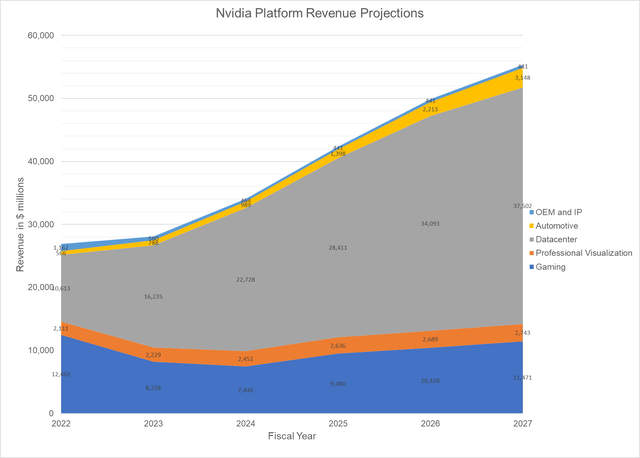

In my Nvidia integrated financial model, I’m assuming a $3 billion hit due to the Merge and another $1 billion due to inventory correction. In the model, this is distributed over the next four quarters from fiscal 2023 Q3 to fiscal 2024 Q2, with Gaming segment sales only starting to recover in fiscal 2024 Q3.

Despite this, I’m still modeling growth in the all-important Data Center segment. Nvidia’s next-generation data center accelerator, the Hopper H100, is testing out to be very impressive and is in production now with deliveries expected by the end of the calendar year.

Hopper should ensure continued growth in the Data Center segment, and the advent of Grace, Nvidia’s ARM architecture CPU for the data center, should further enhance growth. Data Center growth largely compensates for revenue declines expected in Gaming for this year and next, according to the model:

According to my long-term Discounted Cash Flow model, Nvidia has a fair value of $192. I consider Nvidia’s future to be very bright, despite the impact of crypto in the near term.

Currently, I have Nvidia rated at Hold, and Nvidia has been a relatively small part of the Rethink Technology portfolio since selling most of my Nvidia shares (at a substantial profit) in April. I’m pretty close to upgrading Nvidia to Buy, but I’m waiting to see if the Merge (and possible guidance restatement) will drive Nvidia’s price even lower.

Also, I’m waiting to see what Nvidia has to offer in its new 40 series on September 20. Nvidia has consistently set the performance bar in the desktop graphics card market. Most likely, Nvidia is already undervalued.

Be the first to comment