Iryna Tolmachova/iStock Editorial via Getty Images

Sometimes great investments can be simple. Well, many of the best performing stocks over the last 20 years have been large cap tech stocks with complicated business models. However, the best-performing stocks lists also have included traditional companies such as Costco Wholesale Corporation (NASDAQ:COST).

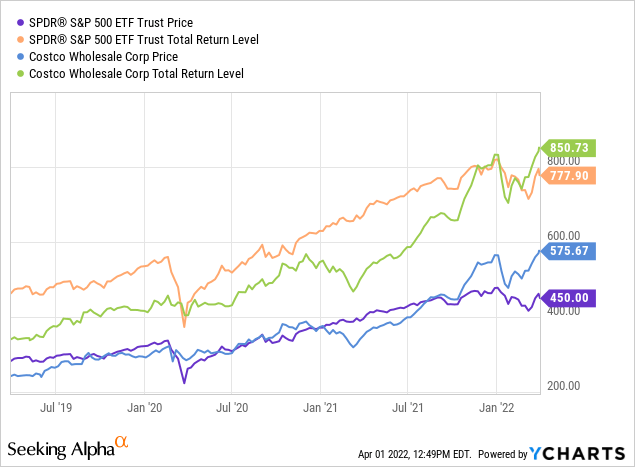

Costco is one of the best-run companies in the United States. This retail giant has significantly outperformed the S&P 500 (SPY) and most stocks in the retail sector for some time.

Costco’s stock has been one of the best performing stocks in the market for some time, and the stock has more than doubled in just the last 3 years.

Company Overview

Costco is a big box retailer that sells almost everything. The company sells sporting goods, food, electronics, furniture, jewelry, small appliances, and many other products. Costco even has a food court at many stores. Membership fees are a very cheap $60 a year, and members make up nearly 75% of Costco’s overall sales.

Costco stores often feature gas stations that offer inexpensive gasoline to customers who are Costco members, and the company also does basic auto maintenance work such as changing tires. The company has 636 gas stations, most of which are right next to stores, and Costco frequently offers gas prices at around 15 percent below market prices. Costco operates internationally, but the company is predominantly a US company, with 564 of 815 membership warehouses in the U.S.

Costco is one of the best run big box retailers in the US, and the company benefits from high gas prices and rising consumer prices in several ways. Stores focus on offering value and larger portions, and as prices have risen, stores such as Costco have been more appealing to value shoppers. Costco also requires individuals who want to take advantage of the cheap gas the company offers to become Costco members, and high gas prices have also resulted in higher membership numbers and stronger overall sales.

Recent Earnings Reports

Costco’s first and second quarterly earnings reports for 2022 compared favorably to the company’s sales in 2021, and the reports also show the strong momentum the company has. Costco reported first-quarter earnings showing that year-over-year sales were up 16.7%, with stores traffic was up 6.8% internationally and 5.9% in the U.S. Membership fees also grew 9.9% on a year-to-year basis.

The company also added 836,000 new executive members, increasing the number of executive members up to 26.5 million. This is very important, since 70 percent of the company’s sales are to executive members. The average ticket per customer excluding gas sales was up 2.5% worldwide and 3.5% in the US.

Most impressively, the company’s margins, which have moved consistently higher over the last 12 years, held up nicely as well. Costco’s net margins have moved from 1.5% to 2.5% over the last decade, and the company is still seeing margins come in higher than 2 years ago, with net margins consistently at 2.54%. This number is right at the high point of the range within which this company has seen margins at over the last 12 years. Even though gross margins predictably fell by 49 basis points on a year-to-year basis, gross margins fell by just 6 basis points excluding gas inflation.

The company’s second quarter earnings report showed that the same positive trends from the first quarter are continuing as well. Costco reported 11% same store sales growth on a year-to-year basis in the second quarter, Membership fee revenue up 9.7% on a year-to-year basis, and revenues up 16% on a year-to-year basis. There was no significant margin compression despite the inflationary environment in the US and worldwide.

The company also saw online sales moderate to 13% of total sales, down from 75% of sales a year ago. This drop in online sales is good because the company has far higher margins and bigger tickets when consumers come to the store. The company’s retail gas business obviously also benefits from consumers coming to stores.

A Summary of Costco’s Fundamentals

Costco has taken significant market share from competitors without having to push lower prices and promotions that would compromise the company’s margins. The only margin compression Costco is seeing is from gas sales, but high gas prices have been a big reason why Costco has been able to grow membership and sales.

Predicting commodity prices is very difficult, but gas prices are expected to remain high for much of the year, as President Biden refuses to promote new drilling domestically, and geopolitical events such as the recent Russian invasion of Ukraine are pushing prices up as well. Since membership is required for consumers to take advantage of Costco’s inexpensive gas prices, and Costco also focuses in offering good value to consumers, the company should be able to continue to grow membership and take market share in the current inflationary environment.

Costco is an exceptionally well-run company, and the company’s employees are very well trained and taken care of. Costco recently paid a special dividend to employees’ 401k’s, and the company also raised wages for existing employees. The average Costco worker makes $20 an hour, or nearly $41,000 a year, which is significantly more than what competitors such as Walmart pay employees. Walmart employees, for instance, make on average around $31,000 a year.

Possible Risks for Investors

Still, all investments involve risk, and Costco has benefited significantly from the recent rise in gas prices and the rise in consumer price across the board. If gas prices and consumer prices in general were to fall significantly in the near-term, there is a possibility that Costco’s market share gains made over the last year would slow down or reverse.

Costco’s growth rate has accelerated in the past year as the company has made significant market share gains primarily because of rising gas prices and rising prices, both factors that have led customers to search harder for extra value at warehouse stores such as Costco. The stock has had a big run over the last 3 years, and the company trades at a high growth multiple. A slowing growth rate could lead to multiple contraction and sell-off from current levels.

Valuation

Analysts have been consistently wrong about Costco, and the stock still looks undervalued. Even though some analysts list Coscto at 40x forward earnings estimates and 13x book value, the company has consistently and significantly beaten analyst estimates. This is why most analyst price targets for this company have also consistently been too low.

Costco has beaten earnings estimates in five of the last six quarters, and the company has beaten earnings expectations by $.30 a share or more in three of the last four quarters. The company is forecast to grow earnings by 13% this year and 8% next year, but as same store sales growth and market share gains to be strong, Costco should easily be able to grow earnings at a double-digit rate next year.

The company also has a very strong balance sheet, with over $12 billion in cash and just $9 billion in debt. The company is generating nearly $10 billion in cash in operating cash flow, so management has the flexibility to increase dividend payouts and buybacks as well as pursue acquisitions. Costco is just beginning to expand internationally as well, with nearly 70% of the company’s stores currently in the US, so there is a lot of opportunity there.

Conclusion

Many of the best performing stocks over the last two decades have been complex big cap tech companies such as Apple (AAPL), but Costco’s stock has also been one of the best performing stocks in the market for over a decade now. Costco is one of the best run companies in the world, and the company’s strong management team is taking advantage of current market condition. With consumer prices high and likely to remain high for some time, consumers are searching for discounts, and Costco is taking significant market share from the company’s competitors. Analysts have consistently been wrong about Costco, and with a strong balance sheet and good growth prospects both domestically and abroad, Costco should continue to outperform.

Be the first to comment