imaginima

Imperial Oil (NYSE:IMO) has outperformed the broad market by a wide margin over the last 12 months, as it has rallied 62% whereas the S&P 500 has shed 13% during this period. Thanks to the sanctions of western countries on Russia and the resultant rally of the price of oil, Imperial Oil is poised to achieve 30-year high earnings per share this year. As this high-quality oil producer is also trading at an exceptionally low price-to-earnings ratio of 5.2, some investors consider the stock a great bargain. However, they should be aware of the material downside risk of the stock.

Business overview

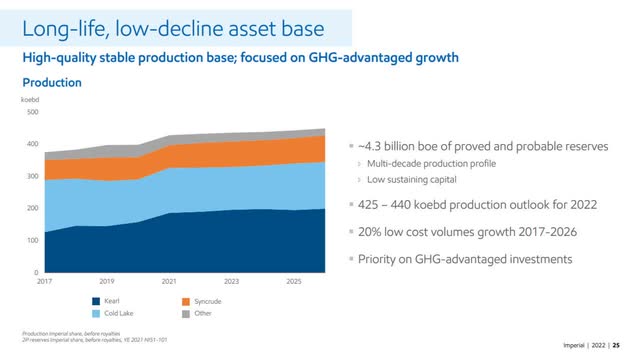

Imperial Oil is one of the largest integrated oil companies in Canada. Exxon Mobil (XOM) has a 70% stake in Imperial Oil and hence the latter benefits from the unparalleled expertise of the oil giant. Imperial Oil also has a major competitive advantage, namely the low-decline, long-life nature of its reserves.

Imperial Oil Overview (Investor Presentation)

Most oil producers suffer from high natural decline of their producing fields and hence they have to invest excessive amounts in new growth projects in order to replenish their reserves. The reserves of Imperial Oil have low decline rates and thus they can last for several decades. The company currently has approximately 4.3 billion barrels of oil equivalent of proved and probable reserves. At the current production rate of 413,000 barrels per day, these reserves have a lifetime of 28.5 years, more than double the average reserve life in the sector, which is in the range 11-13 years.

Moreover, Imperial Oil is thriving this year thanks to the sanctions of the U.S. and Europe on Russia for its invasion in Ukraine. As Russia was producing approximately 10% of global oil output before the sanctions, the oil market has tightened to the extreme and thus the price of oil has rallied to 13-year highs this year.

Imperial Oil is highly leveraged to the oil price and thus it is thriving right now. In the second quarter, the company grew its production 3% over the prior year’s quarter, to a new 30-year high, thanks to a recovery of production at Kearl and benefited from the excessive oil prices that prevailed during the quarter. As a result, it grew its earnings per share more than 7-fold over the prior year’s quarter and achieved nearly 30-year high earnings. Thanks to the sustained favorable business environment, Imperial Oil is expected by analysts to more than triple its earnings per share in the full year, from $2.74 to a 30-year high of $9.01.

However, it is critical to always remember the dramatic cyclicality of the oil industry. Whenever oil prices are high, producers increase their output and thus supply exceeds demand at some point, thus triggering the next downcycle. The current boom is somewhat different, as very few countries, namely the U.S., Canada and Saudi Arabia, can boost their output meaningfully. As a result, some investors think that the prevailing oil prices will last for years.

However, most countries have been severely hit by the ongoing energy crisis. As a result, they are now doing their best to shift from fossil fuels to clean energy sources. Therefore, numerous renewable energy projects are under development right now. These projects will undoubtedly take their toll on global oil demand in a few years, when they come online.

It is also important to note that the oil price has declined lately below its level just before the invasion of Russia in Ukraine. This is a strong bearish sign for the oil price, as it signals that most of the supply damage caused in the global oil market by the Ukrainian crisis has already been absorbed thanks to lower consumption and hefty investment in clean energy projects. In other words, the price of oil has probably peaked and the next downturn may show up at some point in 2022 or 2023. No-one can predict the time of the next downturn but investors should rest assured that the oil industry will remain highly cyclical.

Although Imperial Oil is an integrated oil company, with a downstream and a chemical segment, it is highly sensitive to the cycles of the price of oil, just like all the well-known oil majors, such as Exxon Mobil and Chevron (CVX). The high sensitivity of Imperial Oil to the oil price is clearly reflected in its performance record, which is extremely volatile. To be sure, in the downturn of the energy sector in 2015, its earnings per share slumped 75%. In 2020, which was marked by the onset of the coronavirus crisis, Imperial Oil saw all its profits evaporate and incurred a loss per share of –$1.99. To cut a long story short, just like all the oil producers, Imperial Oil is extremely sensitive to the gyrations of the oil price and hence the stock will have significant downside risk whenever the next downcycle of the oil industry shows up.

Valuation

Imperial Oil is currently trading at a price-to-earnings ratio of only 5.2. This valuation level, which is a 10-year low for this stock, seems extremely low on the surface, especially when compared to the price-to-earnings ratio of 19.7 of the S&P 500.

However, there is a good reason behind the exceptionally low earnings multiple of Imperial Oil, namely its blowout earnings this year. In other words, the abnormally low price-to-earnings ratio of the stock reflects the expectations of the market for much lower earnings in the upcoming years due to a reversion of the oil price to normal levels.

Notably, many oil stocks are trading at 10-year low valuation levels right now for the same reason. To be sure, TotalEnergies (TTE) and BP (BP) are currently trading at price-to-earnings ratios of 3.6 and 3.7, respectively. Overall, the market views the blowout earnings of oil producers this year as unsustainable in the long run due to an expected reversion of the price of oil towards normal levels.

It is also worth noting the words of wisdom of Peter Lynch, the legendary investor. According to Peter Lynch, the fastest way to lose 50% of capital is to invest in a cyclical stock near the peak of its cycle. At that point, cyclical stocks tend to look extremely attractive, as they enjoy excessive profits and trade at extremely low price-to-earnings ratios. This piece of advice of the legendary investor seems highly relevant at the current phase of the oil sector.

Dividend

Imperial Oil has paid uninterrupted dividends for several decades and has raised its dividend (in Canadian dollars) for 27 consecutive years. This is a rare achievement for an oil stock, as the vast majority of oil companies cannot grow their dividends for more than a decade due to the dramatic cyclicality of their commodity business.

Imperial Oil has grown its dividend by 8% per year on average over the last decade. This is far better than the 10-year average dividend growth rate of -2% (negative) of the energy sector. Due to the impact of the pandemic on the oil industry, Imperial Oil paid the same dividend for eight consecutive quarters, but the company raised its dividend by 23% in 2021 and by 26% this year. Nevertheless, despite its exceptional dividend growth record, Imperial Oil is currently offering a lackluster dividend yield of 2.1%, which is insufficient to support an investment in the stock, particularly given its material downside risk in the event of a downturn of the sector.

Final thoughts

Imperial Oil is one of the highest-quality oil companies in the investing universe thanks to its long-life, low-decline reserves. In addition, the company benefits from the unmatched expertise of its major shareholder, Exxon, and does its best in the factors of its business it can control. While the oil producer is thriving right now thanks to multi-year high oil prices, the oil industry is infamous for its cyclicality. Whenever the next downturn of the oil industry shows up, Imperial Oil will have significant downside risk, along with the entire oil sector. The whole sector, as measured by the Energy Select Sector SPDR ETF (XLE), has outperformed the S&P 500 by an impressive margin in the last 12 months (+60% vs. -13%) but a reversion to the mean is likely to prove inevitable for this cyclical sector at some point in the future.

Be the first to comment