Zerbor

Thesis

Capital Southwest (NASDAQ:CSWC) is a leading business development company focusing on lower middle market deals. It derives most of its total investment income from interest income, with its portfolio mainly weighted toward first lien debt. Notwithstanding, it also invests in the equity of its portfolio companies to leverage upside potential from their exits.

Therefore, it provides investors with a high level of dividend security, given the stability of its interest income. Furthermore, Capital Southwest has also benefited tremendously from a hawkish Fed, as rate hikes are considered tailwinds for its investment income.

Despite that, Capital Southwest’s portfolio companies have also been impacted, as its NAV per share declined markedly in Q2, given the broad market downturn. Therefore, we believe the market had anticipated these headwinds, as it sent CSWC down 36% from its September 2021 highs.

Notwithstanding, we believe that CSWC is close to its long-term bottom, despite the near-term headwinds. Its robust dividend yield should continue to underpin buying sentiment at its current valuations, given the massive battering from its 2021 highs.

As such, we rate CSWC as a Buy.

CSWC’s Valuation Has Been De-Risked

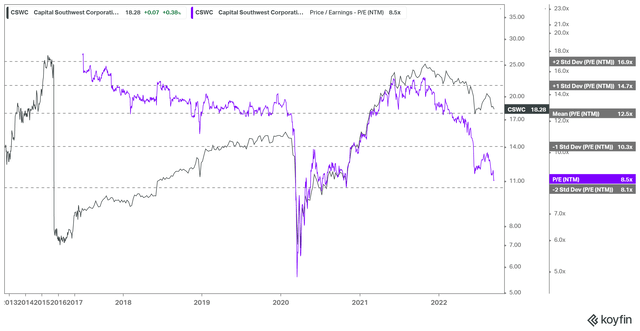

CSWC NTM P/NII multiples valuation trend (Koyfin)

We prefer to use CSWC’s Price/Net Investment Income (NII) multiple as our valuation benchmark. Given Capital Southwest’s robust and relatively stable investment income, it allows investors to assess the earnings multiple asked by the market. Therefore, it helps investors to understand the relative valuation levels compared to previous bear market bottoms.

As seen above, CSWC has been battered from its overvalued zones in 2021. Accordingly, its NTM P/NII multiple has collapsed toward the two standard deviation zone below its mean. Therefore, we believe CSWC has been de-rated markedly by the market, leading to less aggressive entry points at the current levels.

Notwithstanding, the critical question investors need to ask is whether Capital Southwest can withstand the current market mayhem, even as macro headwinds intensify.

Capital Southwest Is Confident About Its Opportunities

Despite the recent market pessimism, Capital Southwest remains optimistic about its investment opportunities. CEO Bowen Diehl articulated:

I think we’re seeing kind of, for quality deals that you can underwrite, especially given the economic cycle and with reasonable leverage levels, there’s still a lot of competition for those deals. And so we haven’t really seen [the] spread widen tremendously. Maybe a little bit on margin, 25 basis points, plus or minus. And so still seeing strong activity, still seeing kind of spreads kind of where they are, where they’ve been. (Capital Southwest FQ1’23 earnings call)

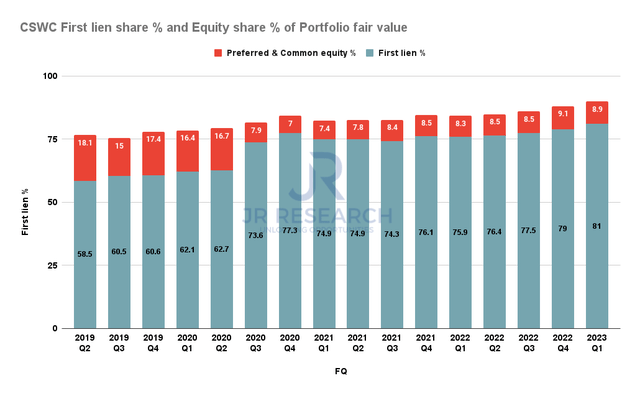

Capital Southwest First lien share % and Equity share % of Portfolio fair value (Company filings)

We are cautiously optimistic about management’s confidence in continuing to deliver value for investors. Capital Southwest’s portfolio is structured mainly around its first lien debt, which constituted 81% of FQ1’s portfolio fair value.

It had 9% equity exposure, providing additional upside to its exit strategy. With the market mayhem in debt securities, we believe it provides solid opportunities for Capital Southwest to make accretive debt investments. Hence, we deduce that the market environment is favorable for Capital Southwest’s investment strategy.

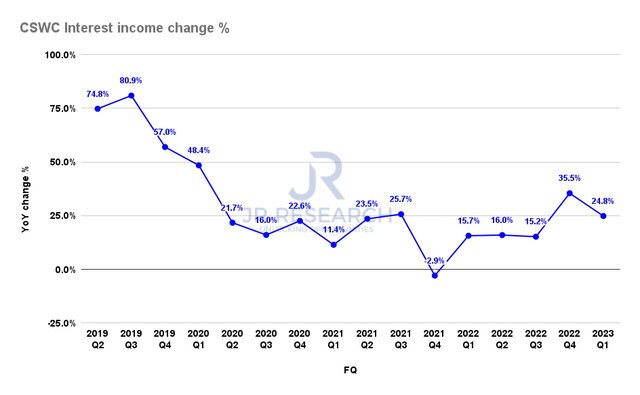

Capital Southwest interest income change % (Company filings)

Capital Southwest’s interest income has continued to help drive its investment income. The company posted an increase of 24.8% in Q2, which continued to drive growth in the current heightened rates environment. Therefore, we believe it’s unlikely for CSWC to fall to the valuations seen at its COVID lows, given the interest income tailwinds.

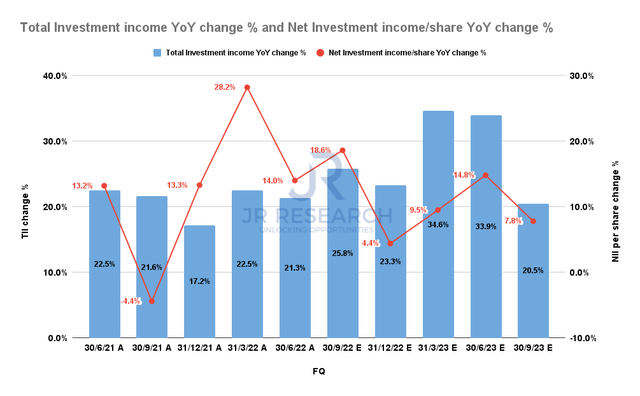

Capital Southwest total investment income change and NII per share change % consensus estimates (S&P Cap IQ)

Therefore, we are confident that the consensus estimates (bullish) are credible. Moreover, as seen above, the Street continues to project robust growth in its investment income, underpinning its NII growth cadence.

Is CSWC Stock A Buy, Sell, Or Hold?

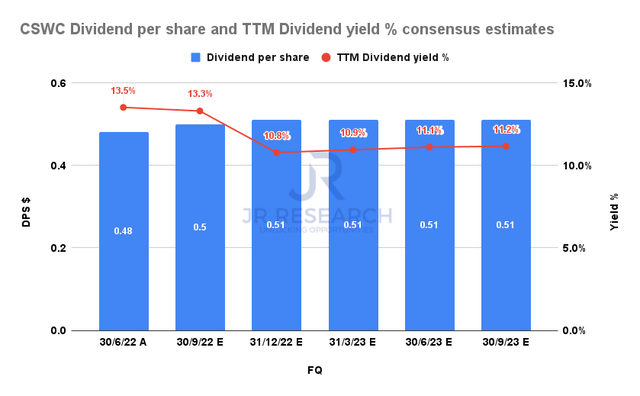

Capital Southwest Dividend per share and TTM Dividend yield % consensus estimates (S&P Cap IQ)

We are confident that investors can continue to rely on its aggressive dividend strategy, which should help underpin buying sentiment to support its valuation.

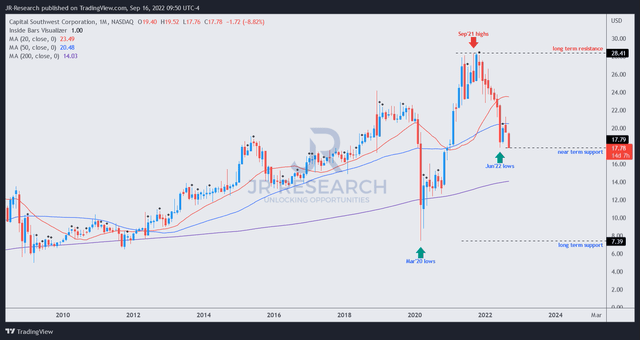

CSWC price chart (weekly) (TradingView)

CSWC is currently re-testing its June lows, given the broad market pullback. Therefore, we believe investors should be primed for near-term downside volatility.

Our analysis suggests that more conservative investors can wait for a bullish reversal before pulling the trigger.

Despite that, we believe the current levels are appropriate to layer in, capitalizing on the volatility to add more exposure.

As such, we rate CSWC as a Buy.

Be the first to comment