NicoElNino/iStock via Getty Images

Investment Thesis

Ciena Corporation (NYSE: CIEN) should grow due to six megatrends and improved mix. They hopefully will emerge from supply chain problems in 2023. CIEN can provide an excellent return from covered call premiums even if the stock does not move much.

Ciena Corp.

Ciena Corporation is a network strategy and technology company. It provides network hardware, software, and services that support the transport, switching, aggregation, service delivery, and management of video, data, and voice traffic on communication networks. It serves various industries, such as communication services providers, web-scale providers, cable operators, government, and large enterprises worldwide. The revenue mix by geography was 69.8% Americas, 18.5% EMEA, and 11.7% APAC.

The volume of data is exploding, end-user demands are skyrocketing, and legacy systems are struggling to keep up. Ciena is delivering adaptive, agile networks. More than 1,700 customer networks worldwide use Ciena. They support 85 percent of the world’s largest communication service providers, regional service providers, submarine network operators, data and cloud operators, enterprises, the public sector, and all levels of education.

The networking platforms segment is 78% of total revenue and consists of its converged packet optical (70.5%) and routing and switching (7.5%) product portfolios. The platform software and services segment accounts for 6.4% of total revenue, Blue Planet Automation Software and Services is 2.1%, and the global services are 13.5% of total revenue. Most of their income comes from hardware.

The Company operates through four segments. The Networking Platforms segment consists of its Converged Packet Optical and Packet Networking portfolios. The Platform Software and Services segment provides analytics, data, and planning tools to assist customers in managing Ciena’s Networking Platforms products in their networks. The Blue Planet Automation Software and Services segment includes micro-services, standards-based open software suites, and related services that enable customers to implement large-scale software and information technology (IT)-led operations support system transformations. The Global Services segment includes selling Ciena’s services for maintenance support, training, installation and deployment, and network design activities.

CIEN has annual sales of $3.7B with 3.7K employees. They are 94.6% owned by institutions, with 3.8% short interest. Their return on equity is 7.5%, and they have a 6.3% return on invested capital. The free cash flow yield per share is 0.3%, and their buyback yield per share is 7.9%. The price-to-book ratio is 2.5. Their Piotroski F-score is four, indicating some strength.

Growth from Mega Trends and Mix

CIEN should see growth due to six megatrends. There is no getting around digitization, and it will become more and more a part of almost everything. These are the reasons demand should remain strong for CIEN for more than the next decade.

Customers have opted to run their networks hotter and push back investment in new capacity in the face of economic uncertainty. But the rapid growth in data traffic should force companies to invest in new infrastructure in 2023. Ciena is changing its business mix from mature products to infrastructure equipment for web-based and data center customers. Over time, this supports higher top-line growth with a more favorable product and customer mix.

Strong Balance Sheet

CIEN ended the quarter with approximately $1.3B in cash and investments with no net debt. They repurchased about 3.2 million shares during the quarter for $155 million.

Q3 Earnings & Q4 Outlook

CIEN’s fiscal Q3 (quarter ended 30 July) press release showed supply chain problems negatively impacted results. They expect these problems will dissipate in 2023:

“Despite continued strong customer demand, our fiscal third quarter financial results were negatively impacted by late delivery and substantially lower-than-committed volume from a small number of suppliers for specific components that are essential for delivering finished goods to our customers,” said Gary Smith, president, and CEO of Ciena. “While these dynamics will continue in our fiscal fourth quarter, we expect improvement as we move into fiscal 2023, providing us increased ability to service this unprecedented demand and continue to gain market share.”

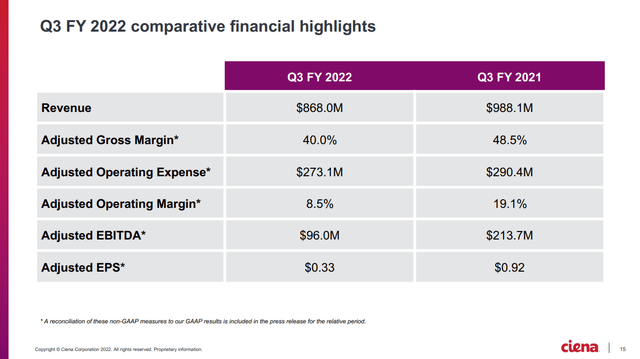

For the fiscal third quarter of 2022, Ciena reported revenue of $868.0 million compared to $988.1 million for the fiscal third quarter of 2021.

Ciena’s GAAP net income for the fiscal third quarter of 2022 was $10.5 million, or $0.07 per diluted common share, which compares to a GAAP net income of $238.2 million, or $1.52 per diluted common share, for the fiscal third quarter 2021. Ciena’s GAAP net income for the fiscal third quarter of 2021 benefited from the recording $124.2 million tax benefit related to an internal transfer of non-U.S. intangible assets.

Ciena’s adjusted (non-GAAP) net income for the fiscal third quarter of 2022 was $49.0 million, or $0.33 per diluted common share, which compares to an adjusted (non-GAAP) net income of $144.9 million, or $0.92 per diluted common share, for the fiscal third quarter 2021.

www.investor.ciena.com/static-files/885647da-e80c-4ba7-8943-9a3b432dccb2

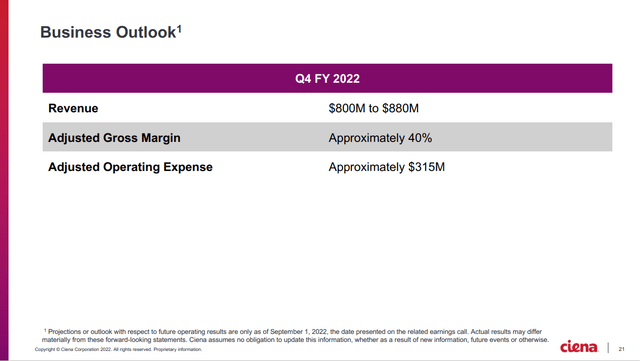

They expect the following Q4 results.

www.investor.ciena.com/static-files/885647da-e80c-4ba7-8943-9a3b432dccb2

Good Technical Entry Point

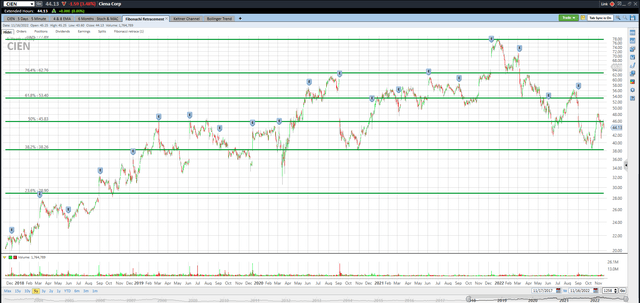

The share price of CIEN closed at $44.14 on November 16th. I’ve added the green Fibonacci lines, using CIEN’s high and low for the past five years. It’s interesting to note how the market pauses or bounces off these Fibonacci lines. They can be one clue as to where the stock price may be headed. CIEN is below the 50% Fibonacci retracement level but could go lower. However, I believe that CIEN will trade at least at the 50% retracement level of $45.83 by April for the reasons in this article.

The fourteen most accurate analysts have an average one-year price target of $58.57, indicating a 32.7% potential upside from the November 16th closing price of $44.13 if they are correct. Their ratings are mixed with eleven buys and three holds. Analysts are just one of my indicators, and they are not perfect, but they are usually in the ballpark with estimates. They often seem a bit optimistic, so I suspect prices may end up lower than their one-year targets to be on the safe side.

Trend in Earnings Per Share and P/E Ratio

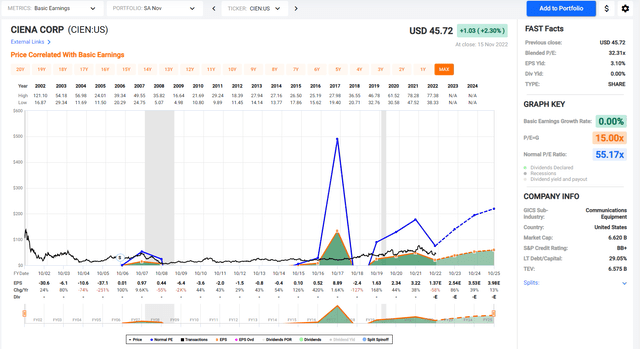

The black line shows CIEN’s stock price for the past seventeen years. Look at the chart of numbers below the graph to see CIEN’s EPS. Earnings were $1.63 in 2019, $2.34 in 2020, and $3.22 in 2021, and they are projected to earn $1.37 in 2022 and $2.54 in 2023.

The P/E ratio for CIEN is currently at 32, but the average ratio over the past ten years is 25. If CIEN earns $2.54 in 2023, the stock could trade at $45.72 even if the market only assigns an 18 P/E ratio.

Sell Covered Calls

My answer to uncertainty is to sell covered calls on CIEN five months out. CIEN closed at $44.13 on November 16th, and April’s $45.00 covered calls are at or near $4.90. One covered call requires 100 shares of stock to be purchased. The stock will be called away if it trades above $45.00 on April 21st. It may even be called away sooner if the price exceeds $45.00, but that’s fine since capital is returned sooner.

The investor can earn $490 from call premium and $87 from stock price appreciation. This totals $577 in estimated profit on a $4,413 investment, a 30.6% annualized return since the period is 156 days.

If the stock is below $45.00 on April 21st, investors will still make a profit on this trade down to the net stock price of $39.23. Selling covered calls reduce your risk.

Takeaway

I expect CIEN’s stock to trade above $45.00 as they emerge from supply chain problems next year. I’m not projecting a significant increase during the next five months because there is pricing pressure on the communications equipment portion of CIEN’s business, and customers are delaying purchases.

Competition in this industry is based on price, established customer relationships, broad product portfolios, large service and support teams, functionality, and scalability. Larger companies with larger R&D budgets, such as Alcatel-Lucent, Cisco, Juniper, and Nokia, dominate the global market. Emerging competitors from China, like Huawei and ZTE, have entered the networking and optical switching markets. However, there is still room for Ciena to do well over the longer term in this growing market.

Ciena is changing its business mix from mature products to infrastructure equipment for web-based and data center customers. Over time, this supports higher top-line growth with a more favorable product and customer mix.

Even if CIEN’s stock price only moves from $44.13 to $45.00 by April 21st, a 30.6% potential annualized return is possible, including a covered call premium.

Be the first to comment