Andrii Dodonov

(This article was co-produced with Hoya Capital Real Estate)

Introduction

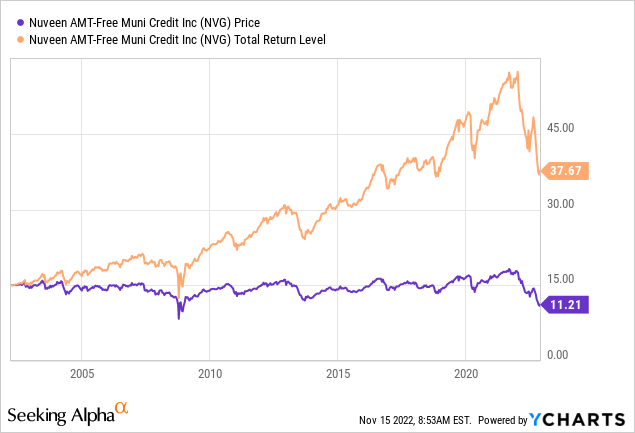

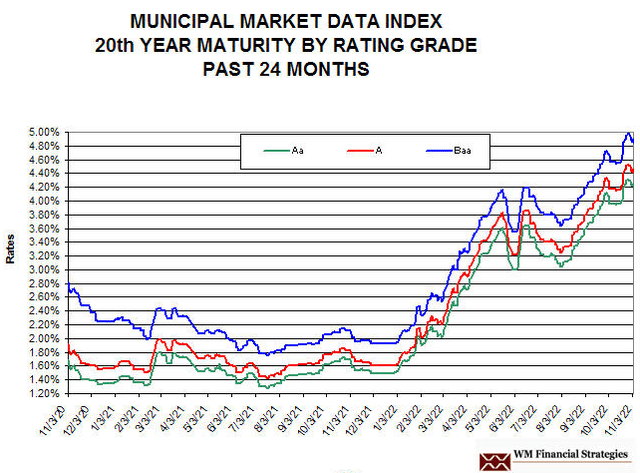

Charles Dickens starts his novel The Tale of Two Cities with one of the most famous lines in literature: “It was the best of times; it was the worst of times!”. Not sure the first part applies to the fixed income market of the past year as the next chart indicates.

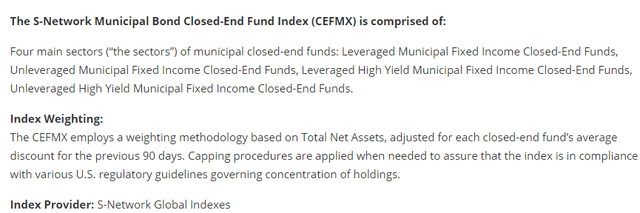

The following describes the Index presented above.

NYSE:NVG is the 3rd largest component of this index, roughly a 6% weighting. With NVG providing the best returns and highest income of these three funds, I would rate it a Buy though near-term results could be poor if the FOMC keeps rising rates.

Nuveen AMT-Free Municipal Credit Income Fund Review

Seeking Alpha describes this CEF as:

The fund invests in undervalued municipal securities and other related investments exempt from regular federal income taxes that are rated Baa/BBB or better by S&P, Moody’s, or Fitch, and that have an average maturity of 17.02 years. It employs fundamental analysis with bottom-up stock picking approach to create its portfolio. It seeks to maximize total return, consistent with income generation and prudent investment management. Benchmark: S&P Municipal Bond High Yield TR. NVG started in 1999.

Source: seekingalpha.com NVG

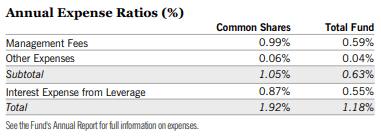

NVG has $2.6b in AUM and has a Forward yield of 5.7%. Fees are:

documents.nuveen.com NVG

The effective leverage ratio is just over 47% and NVG’s average cost of that is currently 2.48%. That cost moves in the same direction as interest rates.

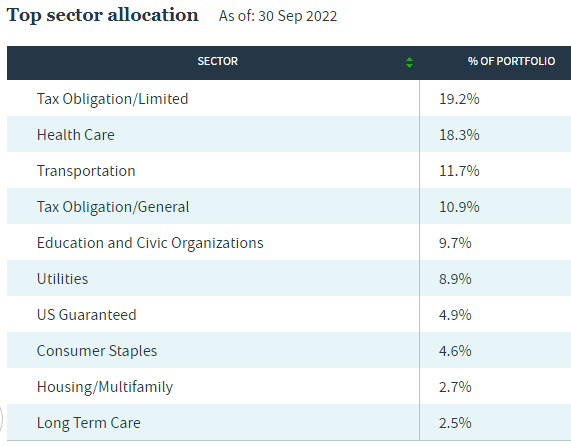

Holdings review

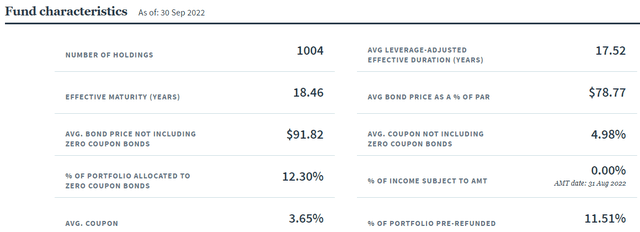

Nuveen provides useful information about the portfolio.

Later, I will compare some of these against the other two AMT-Free Nuveen CEFs.

nuveen.com sectors

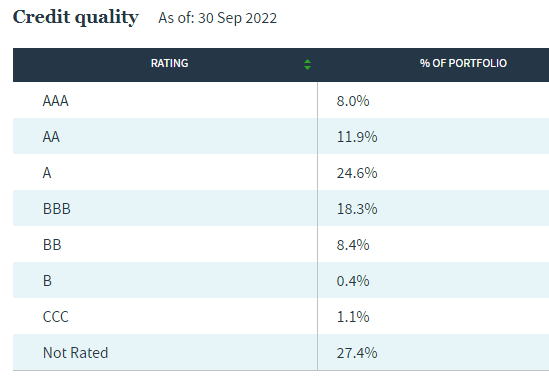

The two tax obligation sectors represent 30% of the portfolio’s exposure. Depending on which state and what is backing those bonds should be reflected in the bond ratings they have and thus an expression of the risk level. Health Care and Transportation both can be negatively affected by any imposed “lock downs”. Since I mentioned ratings, that chart is presented next.

nuveen.com ratings

I calculated the average rating to be a “A-“; whereas the other Nuveen CEFs I rated at “A+”. NVG also has a much higher percent in “Not rated” bonds, which was ignored in the weighted rating.

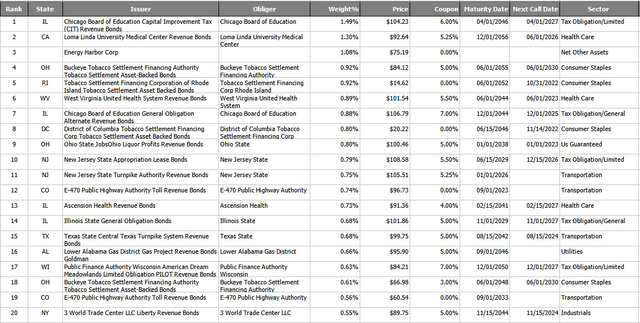

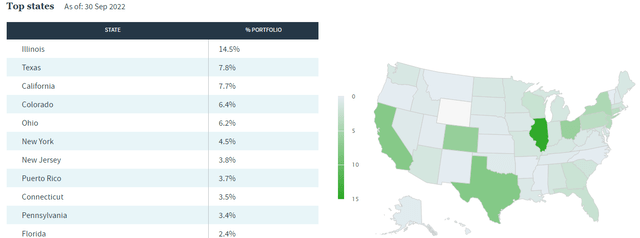

NVG owns bonds from almost all 50 states, though that does not mean from a state-level issuer. The next list shows the top issuers, and this could mean multiple bonds.

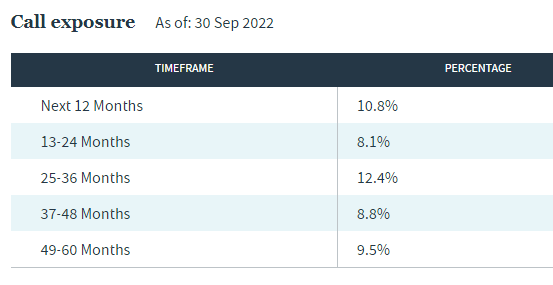

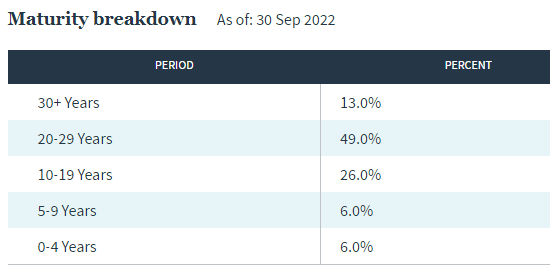

The above illustrates the prior statement as only one issuer is dependent on state tax revenue: unfortunately that is a low-rated state. The next two factors guide investors in understanding the effect of changing interest rates: Call and Maturity schedules. When rates are rising as is now the case, maturing bonds help by allowing reallocation into, hopefully, higher coupon bonds. Calls can help though the odds of a call lessen as rates climb.

nuveen.com Call schedule

So while 19% of the portfolio being call eligible within 24 months sounds great, unless the issuer plans on retiring the debt, being called is not likely. Also, maturing bonds offer little income growth support as only 6% come due over the next four years.

nuveen.com Maturity schedule

Top holdings

nuveen.com; compiled by Author

Despite holding over 1000 bonds, the top 20 holdings are still over 16% of the portfolio’s weight. Of these, five are not-rated and two more have only one of the three leading rating agencies having done so. Holding #20 is a good example of why some bonds do not pay to get rated: its risk is well known by the market.

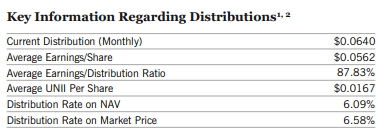

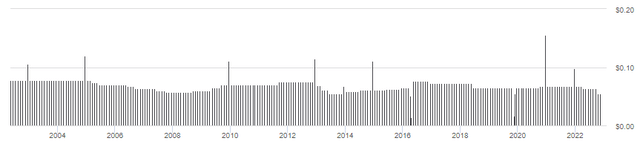

Distribution review

This year has seen two distribution cuts, a total of $.013 per month. As of the last report, NVG was not earning its payout, but this predates the recent reduction to $.0545, which eliminates the shortfall.

documents.nuveen.com NVG

These cuts will reduce one of the benefits of owning NVG over of the other Nuveen AMT-Free funds, income generation, for which NVG has been the leader for years.

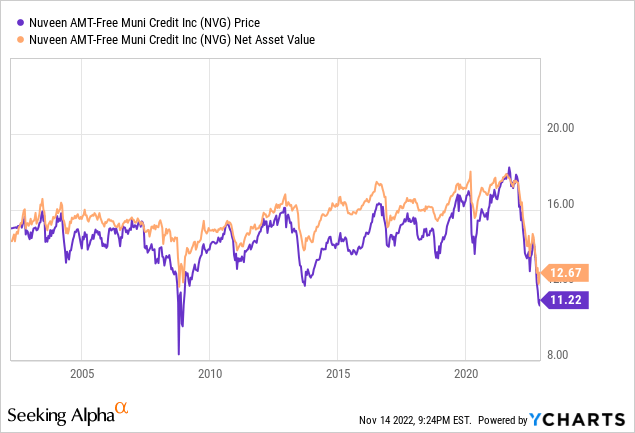

Price and NAV review

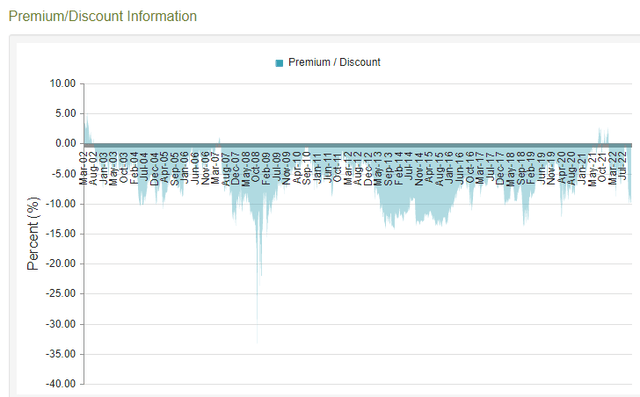

Like its sister CEFs, NVG is now price at a level not seen since the GFC of 2008-09. The next chart gives a clearer view of the price/NAV relationship.

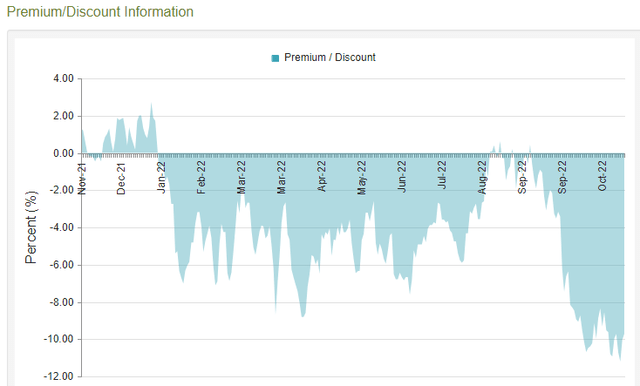

This shows NVG selling at a discount most times with the current level being one it has bounced back from regularly. To show that more clearly, the next chart is limited to the past year.

As recently as this past August and September, NVG sold at a premium. One feature of CEFs investors desire are ones that have shown the ability to move from a deep discount to selling at a premium.

Comparing Nuveen’s AMT-Free Funds

The other two CEFs are the Nuveen AMT-Free Quality Municipal Income Fund (NEA) and the Nuveen AMT-Free Municipal Value Fund (NUW), which are reviewed together here:

| Data point | NVG | NEA | NUW |

| Asset Size | $2.6b | $3.4b | $255m |

| Assets held | 1004 | 1311 | 374 |

| Fees | 192bps | 183bps | 68bps |

| Leverage/Cost | 47%/2.48% | 43.9%/2.53% | 1.5%/2.2% |

| Yield | 5.72% | 4.98% | 3.55% |

| Discount |

-11.48% |

-9.92% |

-8.91% |

| Average Bond price | $91.82 | $97.29 | $93.68 |

| Average Coupon | 4.98% | 4.93% | 4.91% |

| Percent Zero Cpn Bonds | 12.3% | 11.1% | 16.8% |

| Effective maturity (yrs) | 18.5 | 17.4 | 16.0 |

| Effective duration (yrs) | 17.5 | 15.4 | 8.5 |

| Tax Obligation bonds | 30.1% | 30.7% | 38.5% |

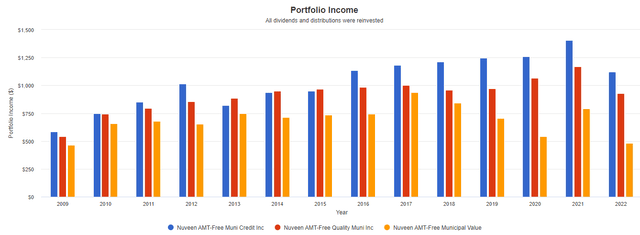

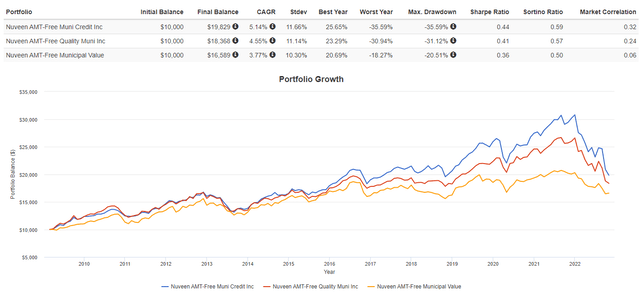

Above, I showed that NVG generates the most income; it also does for CAGR:

NVG comes with the best return but highest StdDev, though the combination still results in the best Sharpe and Sortino ratios.

Portfolio Strategy

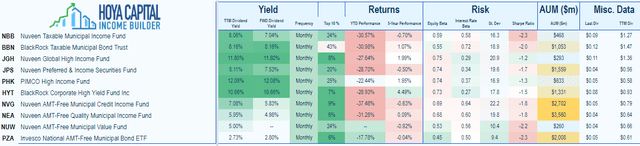

As I mentioned in m6 first NUVEEN AMT-Free fund article, saving taxes is great but not if one’s after-tax total return is less than generating income from regular Municipal bond funds or choices available from taxable funds. Here is some basic data on some of those options.

Except for the BlackRock Corporate High Yield Fund (HYT), the rest are in the red for the past five years. Only one is down less than 20% YTD. I admit I got caught flat-footed, in both my Buy calls from last fall and in my own accounts. Maybe I bought into the “temporary inflation” the FOMC was selling at the time. With so many similar funds to pick from, taking a tax loss and reinvesting seems logical; just avoid the “wash rule” restriction when executing any swap trade!

Be the first to comment