skodonnell

What happened?

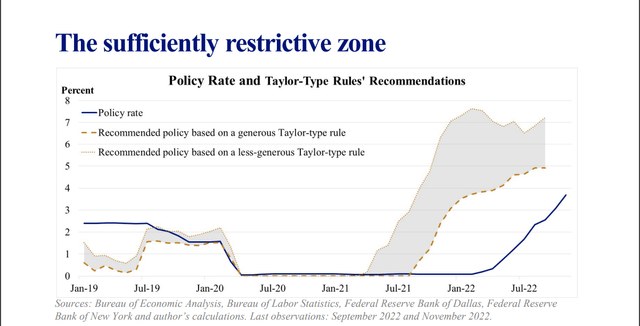

St. Louis Federal Reserve President James Bullard said on Thursday that the central bank still has a lot of work to do before it can bring inflation under control. He noted that the rate is not sufficiently restrictive citing the Taylor rule. According to the rule, the funds rate needs to be between 5-7%. This is much higher compared with the 5% current market estimated by mid-2023.

Many investors anticipating recession posted the following chart from Bullard’s presentation on Twitter. At first sight, it looks a bit scary. Spooked investors started selling on Thursday, but any nervousness faded by the end of the day. To understand if the chart is really frightening, my team and I took a detailed look at the Taylor rule and how closely the Fed’s policy has historically followed it.

Taylor rule explained

Taylor rule is a formula that was originally developed in 1993 by John Taylor. He is a Professor of Stanford University who wrote a paper where he described a recommendation on how central banks should set their interest rates. It is not the first attempt to set the Fed fly with a rule-based autopilot, but it’s definitely one of the most successful.

He argued how the Fed should react if the inflation rate goes above or below the 2% target inflation rate and the economic output differs from the potential GDP, otherwise known as the “output gap.” Potential GDP is the maximum GDP the economy can produce. So if the inflation is high and the economy produces more than it can, then the rates can be increased by a certain % to stimulate it without causing inflation.

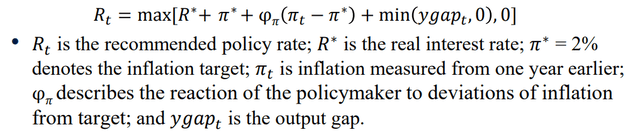

If you like math, then you can have a look at the formula. If not, then jump directly to the text below.

The key question is how strongly the Fed should react if inflation is above the target. There are many answers in literature, but the St. Louis Fed believes that the funds rate should increase by 1.25x or 1.5x for every percentage point in inflation that is above the target level. If the inflation is 5% and the target level is 2%, then the inflation gap is 3%. Hence, the target interest rate should be 3.75-4.5% over the real interest rate and inflation target rate of 2%. The interest real rate is an estimate based on economic literature. It varies from -0.5% to 0.5%. If we consider the maximum values for all parameters, then we get 7% rate according to the Taylor rule.

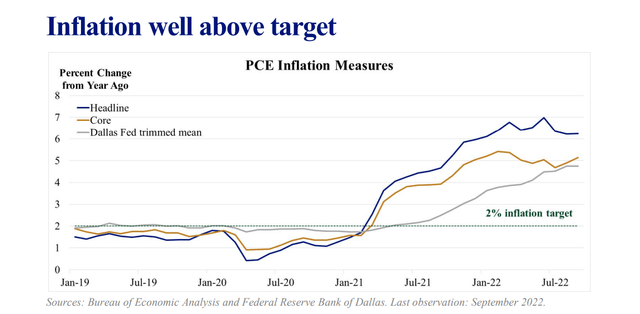

The St. Louis Fed conservatively bases its calculation on PCE inflation that excludes food and energy. This measure is currently lower than the total PCE, and therefore suggests a smaller inflation gap to the target inflation.

In St Louis’s treatment of the Taylor formula, the GDP gap doesn’t play a role if the output gap is positive. It is positive now, so it can be ignored.

According to James Bullard’s assessment, the Taylor rule may reach 7%, which is significantly higher than the current funds’ rate.

Does this mean that the rate reaches 7%?

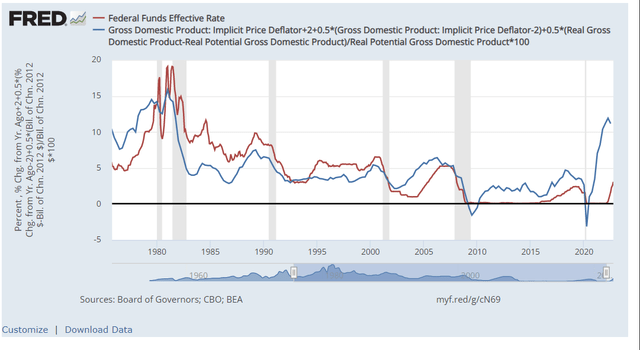

I don’t think so. Many analysts have argued that the Taylor rule provides a fairly accurate summary of US monetary policy in the 80s and 90s. If we look at the chart below, then we see that the funds rate used to be very close to the one suggested by the Taylor rule. But since the financial crisis in 2008, the relationship has changed. Since then the actual rates were below the suggested ones. An especially strong divergence happened after 2020 as the Fed considered the inflation “transitionary” for quite a while.

The rule has also been occasionally criticized by the Fed’s officials. For example, in 2018, the Fed’s chief Janet Yellen expressed doubts about using a rigid formula to set interest rates since doing so could have adverse consequences for the economy.

So the St. Louis Fed’s position is not the opinion of all of the Fed’s members. It’s just an opinion of one of the banks that tended to be more hawkish than the others. For example, in March 22 when the rates were increased by 25bps, Mr. Bullard was advocating for a 75bps hike.

Plus, he acknowledged the limitation of the Taylor rule calculation in the presentation. The formula did not consider that the monetary policy has a lagged effect on the economy. It just recommended the level of the policy rate “independently of the judgment call on policy inertia.” My God, this Fedspeak.

So, will rates go up or not?

Even though I think that the fund rate won’t reach the levels suggested by the Taylor rule, I don’t expect a pivot over the next few months. As San Francisco Fed President Daly told CNBC:

Pausing is off the table right now. It’s not even part of the discussion.

Yes, recent inflation data was good and the market rallied. But we also experienced it once in summer when the good July data was followed by awful August data.

We also need to keep in mind that the recent inflation data was better than anticipated largely due to health insurance. Because of the periodic adjustment, the CPI for health insurance plunged 4.0% in October from September. Inflation in health insurance is difficult to figure out because numerous factors change, not just the premium, but also co-pays, deductibles, out-of-pocket maximums, what is covered and what isn’t covered, etc., and there are all kinds of insurance plans out there.

Wage growth has become more of a hot topic recently. Although the market still doesn’t assume a high long-term inflation, it can become dangerous if wages get automatically raised following the increasing inflation. As I argued in one of my previous articles, the Fed will do everything to avoid such a scenario. It means we should anticipate further rate hikes and downward pressure on markets.

Conclusion

Despite initial frightening announcements, the situation doesn’t look so bad. The Fed is likely to continue rate hikes, but not to the levels suggested by the Taylor rule. Other factors will play a more crucial role for the market over the next months, like earnings revision and labor market situation.

While I am finishing the article, I can already see a message from my team that wants to update me on the research findings. I will be happy to share them with you as we are satisfied with the research depth and quality.

Be the first to comment