onurdongel

Investment Thesis: Host Hotels & Resorts (NASDAQ:HST) could see long-term upside given strong revenue growth despite rising hotel prices.

In a previous article back in September, I made the argument that Host Hotels & Resorts could see upside on the basis of an encouraging rebound in RevPAR (revenue per available room) and the potential for a further boost in revenue from the Maui/Oahu portfolio during the winter months.

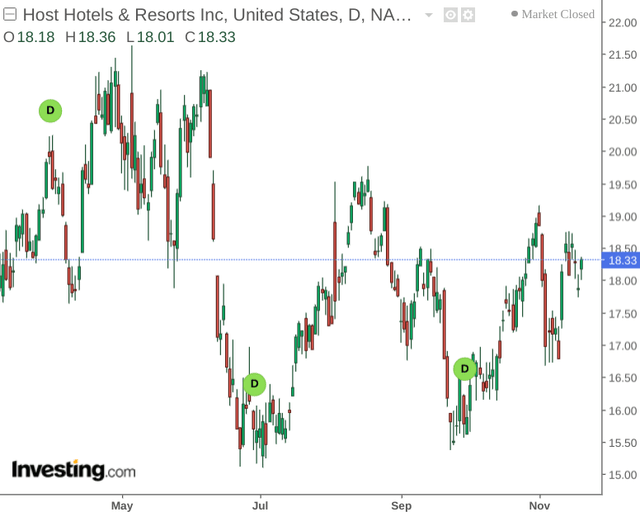

With that being said, we can see that the stock still trades below levels seen in May:

The purpose of this article is to assess whether my case for upside still holds in light of recent earnings results, and whether the stock could be poised for upside from here.

Performance

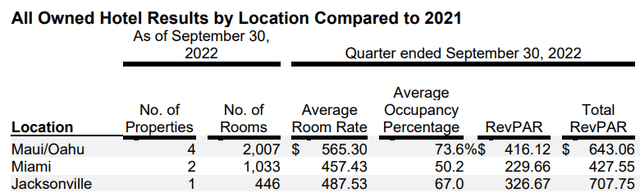

When looking at Q3 2022 results for Host Hotels & Resorts, we can see that total RevPAR for the Maui/Oahu location came in at $643.06.

Host Hotels & Resorts Third Quarter 2022 Operating Results

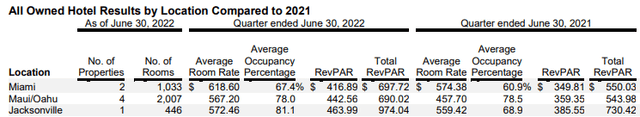

Moreover, while RevPAR is down from the $690.02 as seen in Q2 2022, the current figure is still significantly higher than that of the $543.98 in total RevPAR seen in June 2021 for Maui/Oahu:

Host Hotels & Resorts Second Quarter 2022 Operating Results

From this standpoint, the fact that RevPAR across the company’s higher-priced locations have been holding up in the winter months is encouraging – and serves as a signal that inflationary pressures and dips in seasonal demand may be less of a concern across locations with a higher ADR (average daily rate).

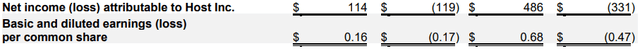

From an earnings perspective, Host Hotels & Resorts has made a strong recovery – we can see that year-to-date earnings are up to $0.68 per share from a loss of -$0.47 last year.

Host Hotels & Resorts Third Quarter 2022 Operating Results

From a balance sheet standpoint, I previously made the argument that while the company’s cash to total debt ratio has fallen from 28% in March 2019 to 16% in June 2022 – investors may be willing to tolerate a lower ratio for as long as RevPAR growth continues to remain strong.

With that being said, we can see that the cash to total debt ratio has actually increased since last December:

| Dec 2021 | Sep 2022 | |

| Cash and cash equivalents | 807 | 883 |

| Total debt | 4891 | 4214 |

| Cash to total debt ratio | 16% | 21% |

Source: Figures sourced from Host Hotels & Resorts Third Quarter 2022 Earnings. Figures provided in USD millions (except the cash to total debt ratio). Cash to total debt ratio calculated by author.

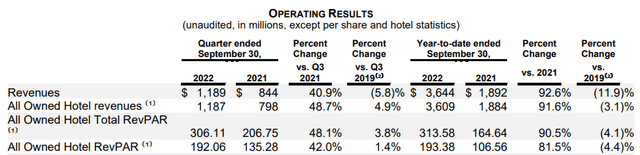

As a major REIT company, investors are likely to tolerate dips in cash reserves for as long as Host Hotels & Resorts can continue to significantly invest in its property portfolio. With that being said, the fact that the company has continued to decrease its total debt while also bolstering year-on-year revenues by over 90% is highly encouraging.

Moreover, total revenues are 11% below that of 2019 revenues – indicating Host Hotels & Resorts are approaching 2019 levels once again:

Host Hotels & Resorts Third Quarter 2022 Earnings

In this regard, I take the view that there could be case for upside going forward if such trends continue.

Looking Forward

Host Hotels & Resorts has seen a significant recovery in revenue growth and the company’s cash position also looks respectable.

Going forward, REITs as a whole may be poised to benefit from an inflationary environment if rents continue to rise faster than inflation. In the case of Host Hotels & Resorts, the main risk at this point in time is if recessionary activity becomes particularly acute and we see a drop in hotel booking demand as hotel prices continue to increase in line with higher costs.

However, this does not appear to have been the case to date, and we have seen RevPAR across certain locations continue to increase even with rising prices. From this standpoint, I am cautiously optimistic that Host Hotels & Resorts has the potential to grow from here.

Conclusion

To conclude, Host Hotels & Resorts has seen significant RevPAR growth and higher prices do not appear to have hindered demand.

While investors appear to have been cautious on the stock to date, I take the view that longer-term upside could be ahead.

Be the first to comment