Photo Italia LLC/iStock via Getty Images

Investment Thesis

OneWater Marine Inc. (NASDAQ:ONEW) has signed an acquisition agreement with Ocean Bio-Chem (OBCI), which will provide a safeguard against the industry’s cyclicality. The demand of new boat buyers is continuously increasing after the Covid-19, which will be beneficial for the company. I believe the acquisition will be the primary catalyst for the growth of the company due to the expansion of the revenue and margins. After considering all these factors, I assign a buy rating for OneWater Marine.

Company Overview

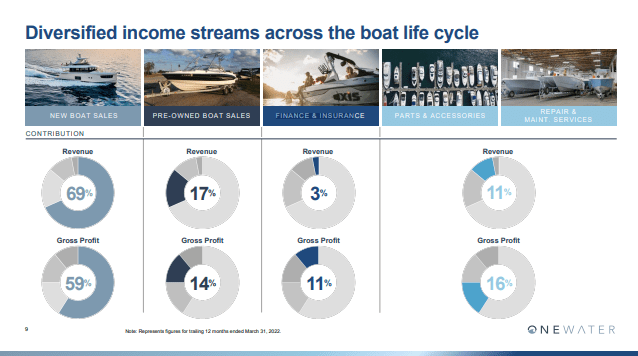

OneWater Marine is a high-quality boat dealership business based in Buford, Georgia. The company offers premium products and services, such as the latest models of new and pre-owned recreational boats, repair and maintenance services, parts and accessories, financing, and insurance plans. The company operates through retail stores generally located in premium areas to maintain its brand value. The company earns 69% of the revenue from New Boat sales, and Pre-owned boat sales contribute only 17% to total earnings. The other two segments, Finance & insurance and parts, accessories and repairs, are quite small compared to the new and pre-owned boat sales. Parts & Repairs segment generates 11% of revenue, while Finance & insurance contributes only 3%.

Investor Presentation: Slide 09

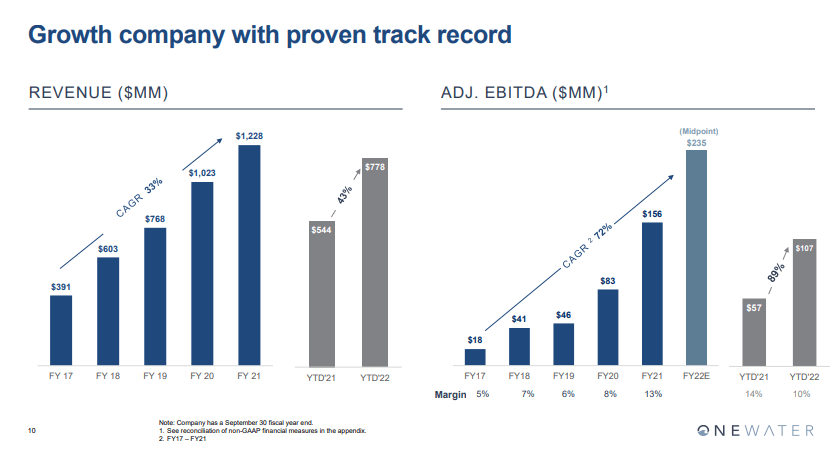

The company has maintained a significant growth track record. The revenue over the last five years has grown at 33% CAGR. This growth rate makes it the fastest-growing boat dealership in the USA. In the previous five years, EBITDA also has improved significantly, with a CAGR of 72%. The growth in EBITDA is a sign of the increased company’s operational efficiency and strong brand value. The company estimates both the revenue and EBITDA of this year will exceed a five-year CAGR with huge margins.

Investor Presentation: Slide 10

To grow its business faster, the company focuses on acquiring existing businesses or dealerships that align with its business model. Generally, after the acquisition, the company tries to make improvements such as the introduction of new brands, upgradation of system, cost reduction etc., to increase the operational efficiency, valuation and synergy between businesses of the acquired company. Recently, the company has made an acquisition which will increase its income significantly.

Acquisition of Ocean Bio-Chem

Last week, OneWater Marine announced the acquisition of OBCI, including all of its brands. OBCI is an appearance, cleaning, and maintenance company, which distributes automotive, Powersports, recreational vehicles, and outdoor power for the marine industry. As per the agreement, OneWater Marine will acquire the OBCI for approximately $125 million or $13.08 per share.

After the acquisition, the company will also own Star Brite Europe, which will integrate with OneWater’s subsidiary and strategic growth platform, T-H Marine Supplies, which supplies parts and accessories. The growth of OBCI has been robust in the past five years. That’s why I believe this deal is very cheap for the company. It will boost its earnings significantly in the coming times and provide a safeguard against the industry’s cyclicality. I also believe that, after the acquisition, OneWater will start paying a dividend to its shareholders.

Austin Singleton, Chief Executive Officer for OneWater, stated,

OBCI brings aboard a suite of iconic brands and consumable products to the OneWater portfolio, and we are thrilled that OBCI’s experienced and highly regarded team will be joining us. OneWater has made great strides in establishing a parts and accessories business, utilizing our acquisition platform to further enhance our higher-margin businesses, helping to insulate us from the cyclical industry of new boat sales. With a demonstrated track record of growth, OBCI’s shared values and consistent performance make it a tremendous addition to the OneWater family.

Robust Demand after Pandemic

National Marine Manufacturers Association

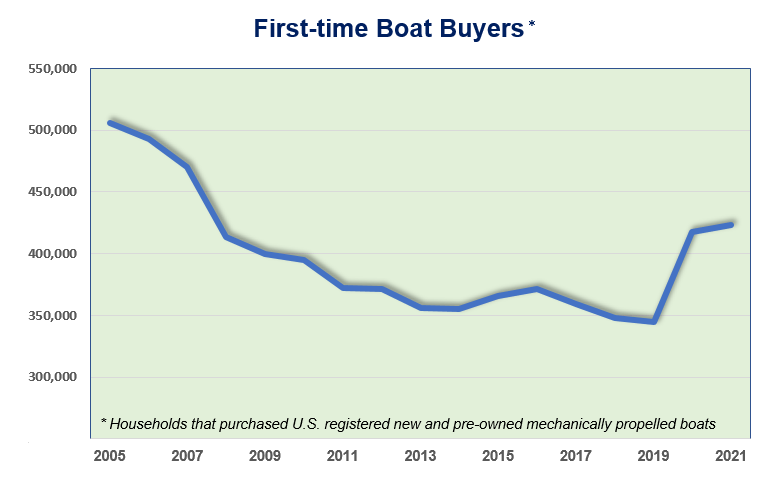

After the Covid-19, the demand for the boat is continuously increasing. Sales of marine products and boats exceeded the 13-year high, and the trend remained strong in 2021. According to National Marine Manufacturers Association (NMMA), this is the first time the new and pre-owned boat sales have exceeded the 415,000 level for two consecutive years.

As we know, a large part of OneWater’s income is generated from new boat sales. I believe this demand from the new buyers will remain strong in 2022 and 2023 as well, slightly offset by rising inflation, as the industry is dependent on the prices of gas. Even the NMMA estimates the sales from the new boat owner to reach healthy levels due to the backlog of new orders. I think, with the operational efficiency and strong brand value, OneWater will be one of the beneficiaries of this rising demand.

Financials

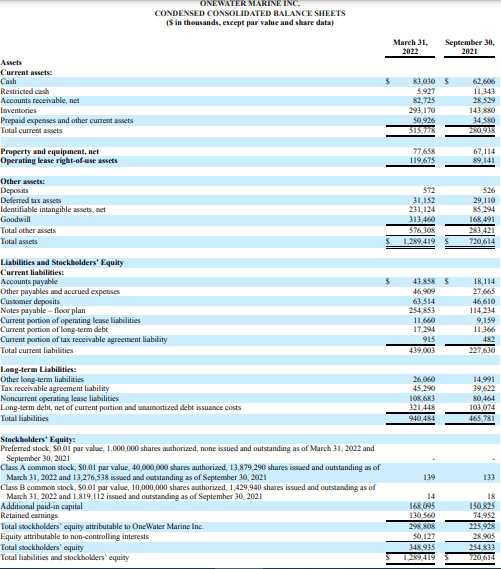

SEC: 10Q of OneWater

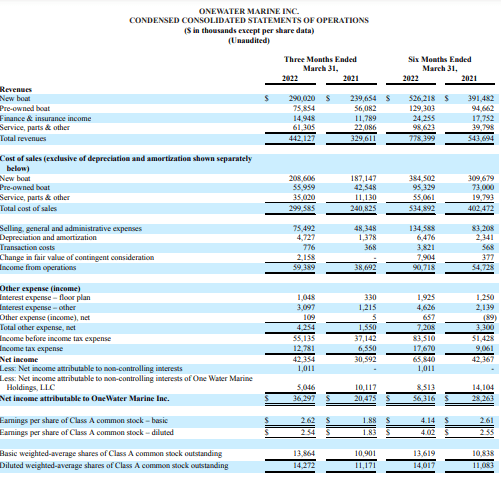

Recently, the company announced the exceptional result of the second quarter of FY2022. The company reported revenues of $442.1 million, which is 34.1% higher as compared to $329.6 of Q2 FY2021. The revenue growth was fueled by growth in same-store revenue and income from acquired businesses. Revenue from new boats and pre-owned boats climbed by 21% and 35.3%, respectively, due to a large increase in the average selling price of new boats and a slight increase in the average unit price of used boats. Income from the finance & insurance segment was up by 26.8%, while parts, service and other sales were up by 177%.

Gross profit of the company expanded by 530 basis points compared to the same period of the previous year due to a shift in the mix and size of boats sold. Net profit increased by 38% in Q2 FY2022 as compared to the $30.6 million of the Q2 FY2021. The company reported a diluted EPS of $2.54. The growth in the second quarter was due to increased operational efficiency. The company has also acquired Denison Yachting, which has increased its presence in the superyacht category. The deal has added 20 new locations across seven states, which will increase revenue growth immediately.

SEC: 10Q of OneWater

The company ended the quarter with $87.9 million in cash and cash equivalents which is a growth of 62% as compared to the $62.6 million of the September quarter. The debt of the company is growing at a concerning level. The reason behind this increasing debt is the frequent acquisitions. The company has $293 million worth of products in inventory, which is a very positive sign for the upcoming quarters.

After the strong results in two consecutive quarters, the company has updated its outlook for FY2022. Management estimates the EBITDA to be in the range of $230 million to $240 million and diluted EPS between $8.60 to $9.00, which excludes the acquisition of the OBCI. I believe that due to the acquisition, real results will be higher than the company estimates.

Potential Risk

Competition: The boating industry is highly fragmented and competitive. The recreational boat industry itself is highly fragmented, leading to fierce competition for customers, high-quality product lines, boat display space, and appropriate store locations. The company’s main rivals are regional maritime merchants with three or fewer locations, along with a select few larger businesses, such as MarineMax and Bass Pro Shops.

Additionally, the company competes with national specialty marine parts and accessory stores, online catalog sellers, sporting goods shops, and retail chains when it comes to the sale of marine parts, accessories, and equipment. The quality and variety of goods on offer, their cost and value, and customer service are the main factors that are driving competition in the retail maritime sector. I believe in the rising inflation, the competition can affect the margins of the company adversely.

Dependency on Limited Number of Manufactures: The company’s large portion of operations is dependent on certain manufacturers. 42% of the total sale is dependent on the supplies from the top ten manufacturers. The loss of any one of them can cause an adverse impact on business.

Quant Rating and Valuation

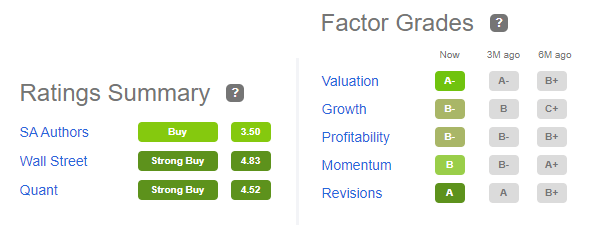

Seeking Alpha

I am not uploading the DCF model for OneWater right now, as the current outlook doesn’t include the effects of the current acquisition. After the third-quarter results, I can estimate the real intrinsic value of the company. I think my thesis and outlook towards the company align with the quant rating and Wall Street rating of the company. Even if we consider the current outlook for the DCF with a discount rate of 14% and perpetuity growth rate of 2.3%, the intrinsic value of the stock is $48.4, which is a 40% upside from the current share price.

Conclusion

After the acquisition of OBCI, the company has insulated itself from the cyclical nature of the industry, which makes it the perfect company to add to everyone’s portfolio. As per my analysis, the company will post staggering results in the coming quarters due to business expansion and higher margins. The company is also going to be the beneficiary of the rising demand and strong order book. According to my DCF valuation, the company is trading at a cheap valuation. After considering all these factors, I assign a buy rating for OneWater Marine.

Be the first to comment