peeterv/iStock via Getty Images

Spirit Realty (NYSE:SRC) is cheap, but that seems to be a common theme for the company. The stock has often traded at a discount to peers and after the recent slide it is trading at an outsized 7% dividend yield. Even after its closest peer STORE Capital (STOR) was taken out at a significant premium, SRC still trades at discounted valuations. While SRC has had its fair share of troubled tenants in the past, its portfolio appears as strong as ever. The dividend sustainability and growth potential of this company are not being adequately reflected in the stock price – I rate the stock a buy for long term investors.

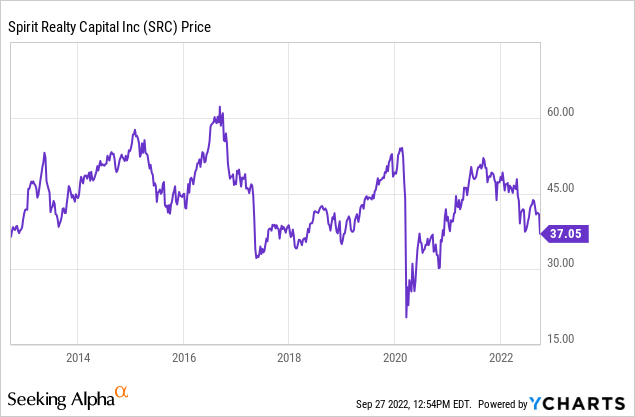

SRC Stock Price

SRC is still trading at the same levels it did 10 years ago, though it should be noted that the company spun off some troubled assets in 2018.

I last covered SRC in October of 2020 where I called it a strong buy on the strong performance during the pandemic. The stock has delivered 26% returns since then, but I still see more upside to come.

SRC Stock Key Metrics

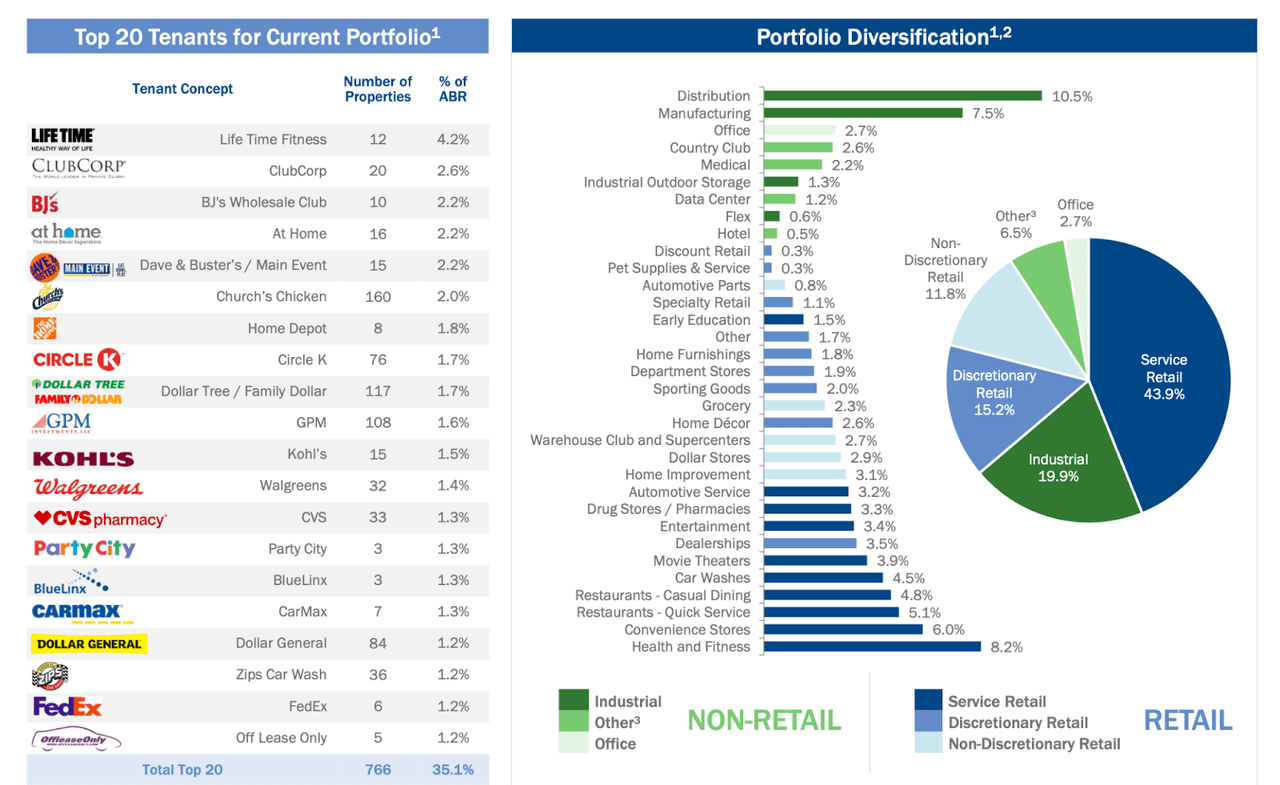

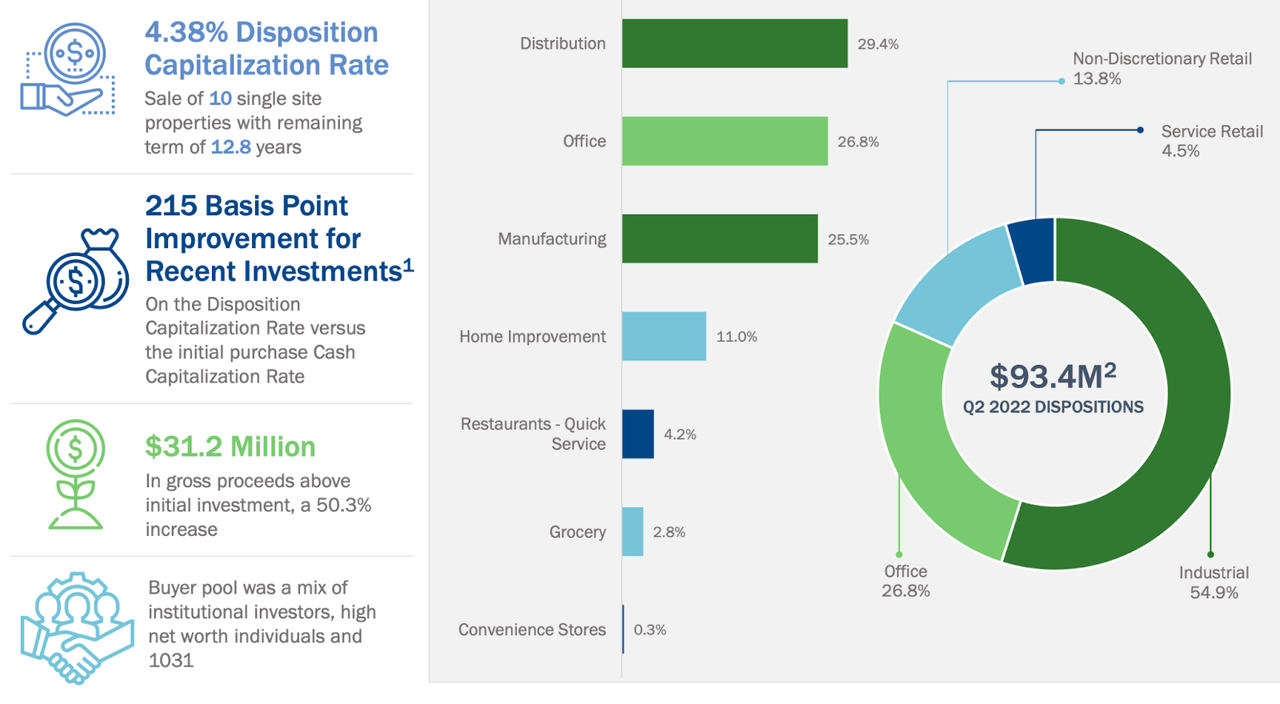

SRC owns a net lease portfolio with a steadily increasing allocation towards industrial sectors.

2022 Q2 Presentation

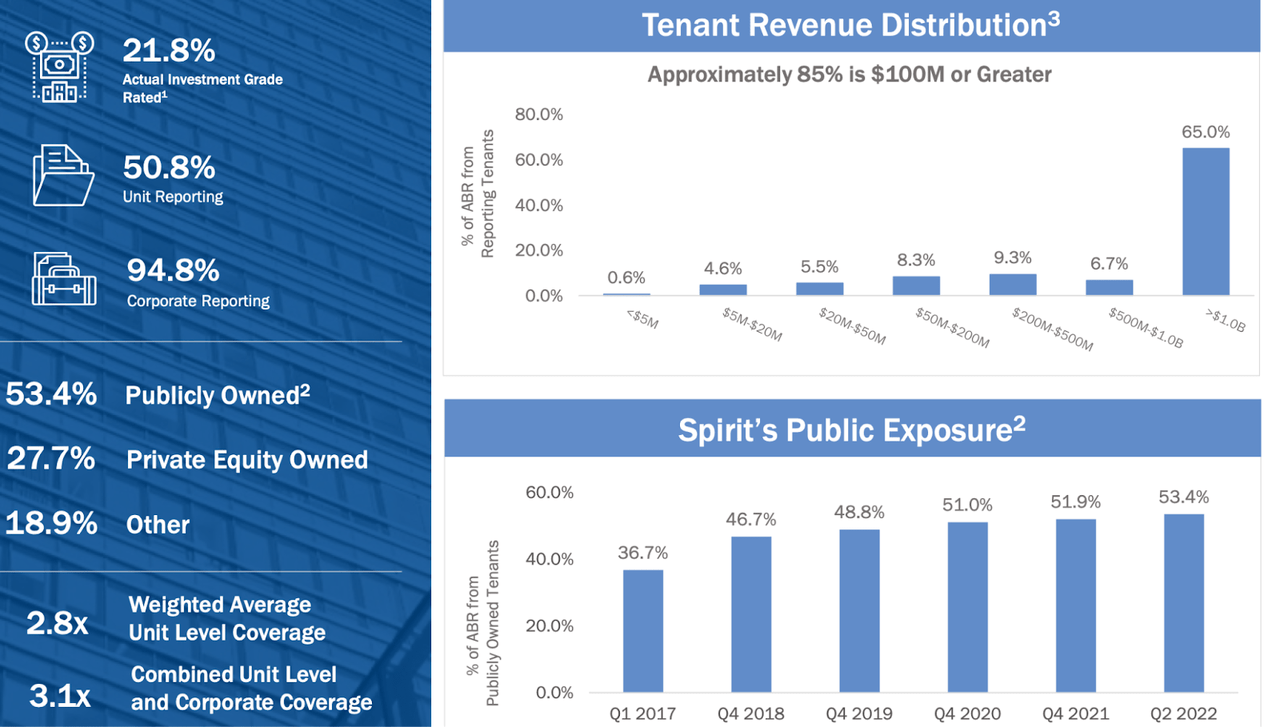

21.8% of the portfolio is investment grade rated and the portfolio overall has a 3.1x unit level rent coverage.

2022 Q2 Presentation

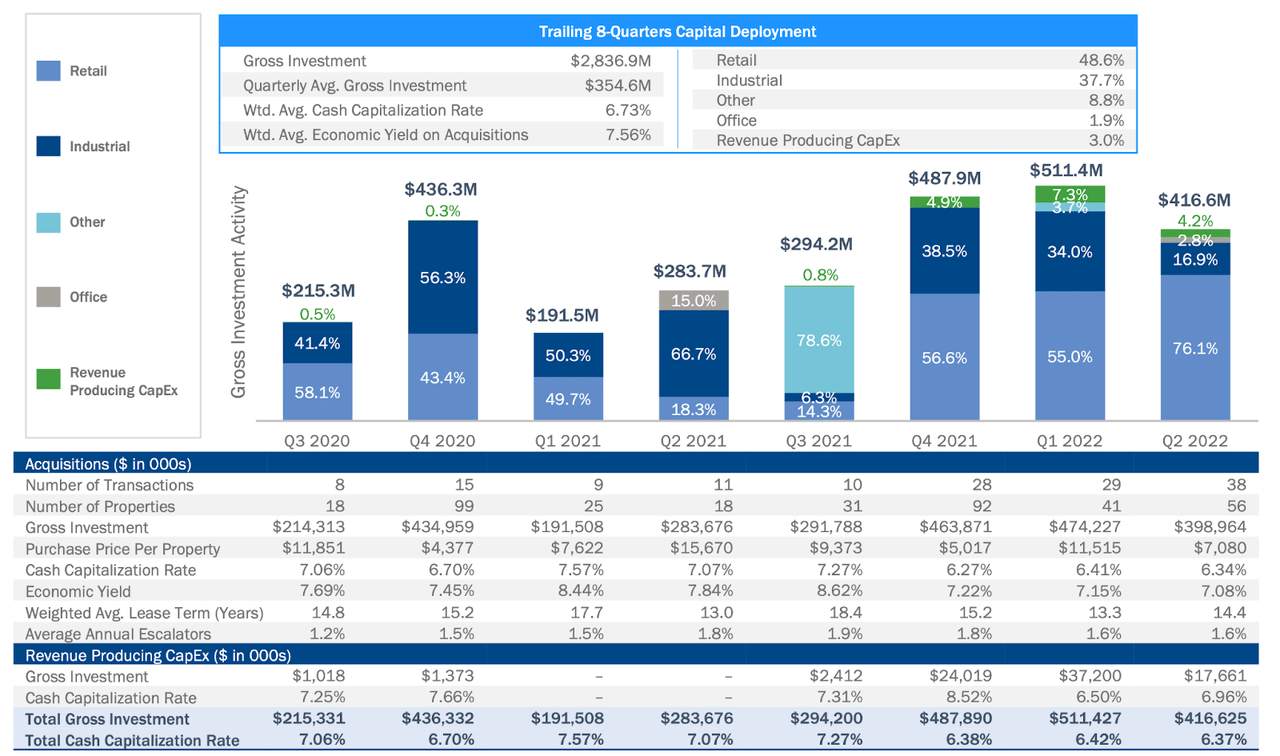

The latest quarter saw SRC grow adjusted funds from operations (‘AFFO’) 4.7% to $0.90 per share and 9.9% to $1.78 per share year to date. A big part of that growth came from a strong acquisition pipeline, as the company deployed $417 million of capital in the quarter at an average cap rate of 6.37%.

2022 Q2 Presentation

On the conference call, management noted that they were seeing cap rates expand by 25 to 50 basis points, with an expectation for acquisition cap rates to be stronger later in the year. I wouldn’t be surprised if cap rates stood more around the 7% to 7.5% range over the next few quarters.

SRC sold $103 million of properties in the quarter, including 10 occupied properties at an attractive 4.38% cap rate. It should be noted though that there were also seven sold properties which were unoccupied and not factored in that disposition cap rate.

2022 Q2 Presentation

Dispositions made up 25% of acquisition activity in the quarter – a rather high percentage. SRC has guided for up to $300 million of dispositions this year, representing 20% of planned acquisitions. In comparison, best-in-class peer Realty Income (O) has typically seen that ratio hover in the single digits. These landlords generally do not want elevated disposition activity – a low ratio of dispositions to acquisitions can reflect stronger underwriting standards.

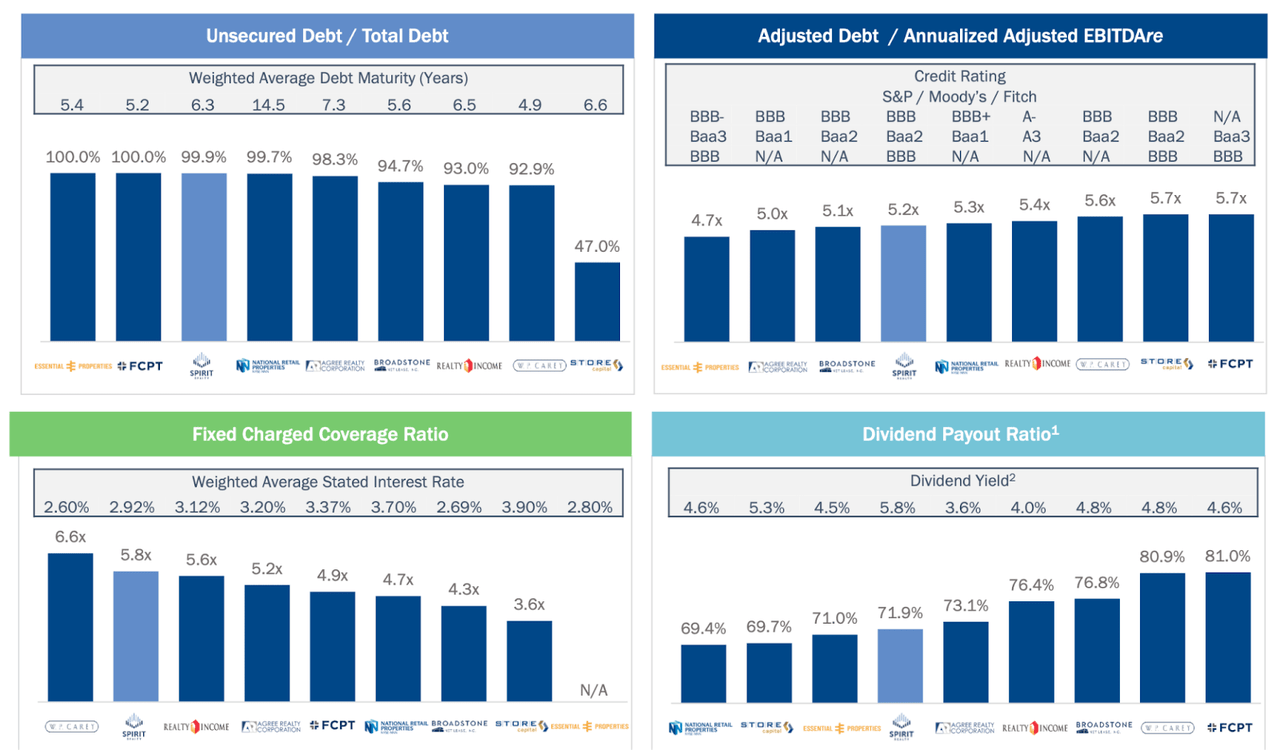

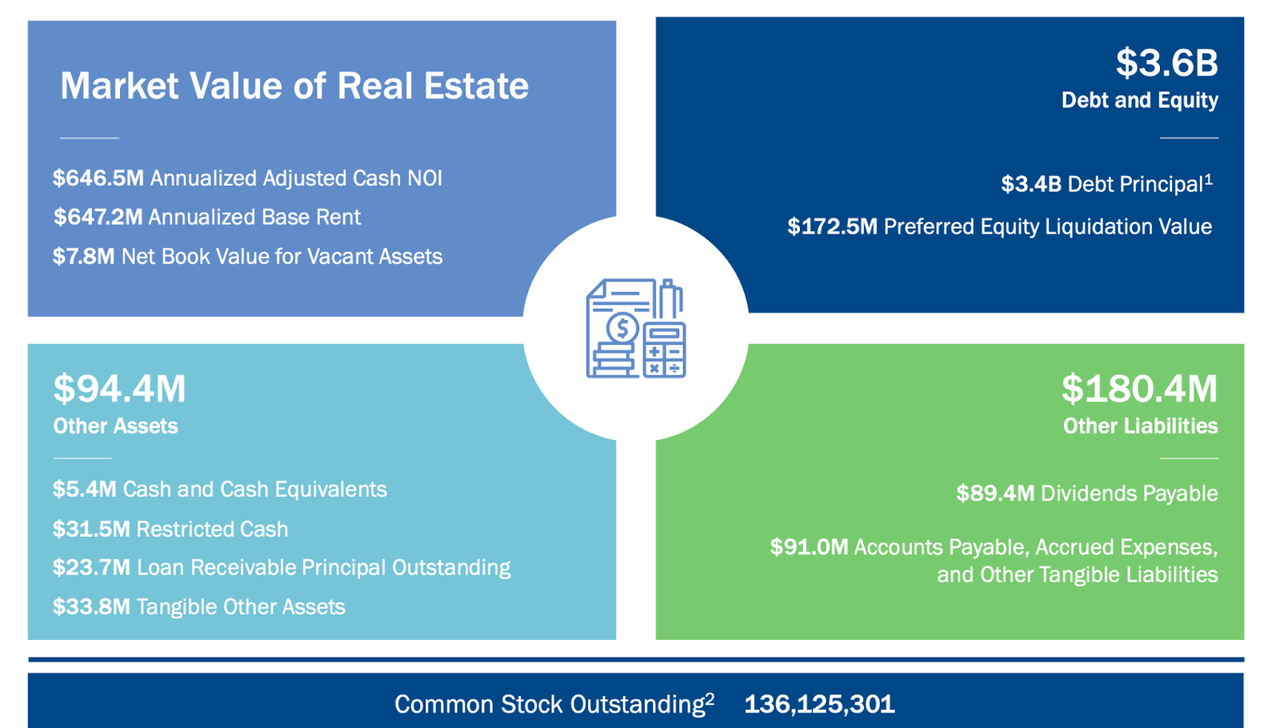

The company ended the quarter with strong credit metrics. Inclusive of preferred stock, debt to EBITDA stood at 5.5x, comparable with peers.

2022 Q2 Presentation

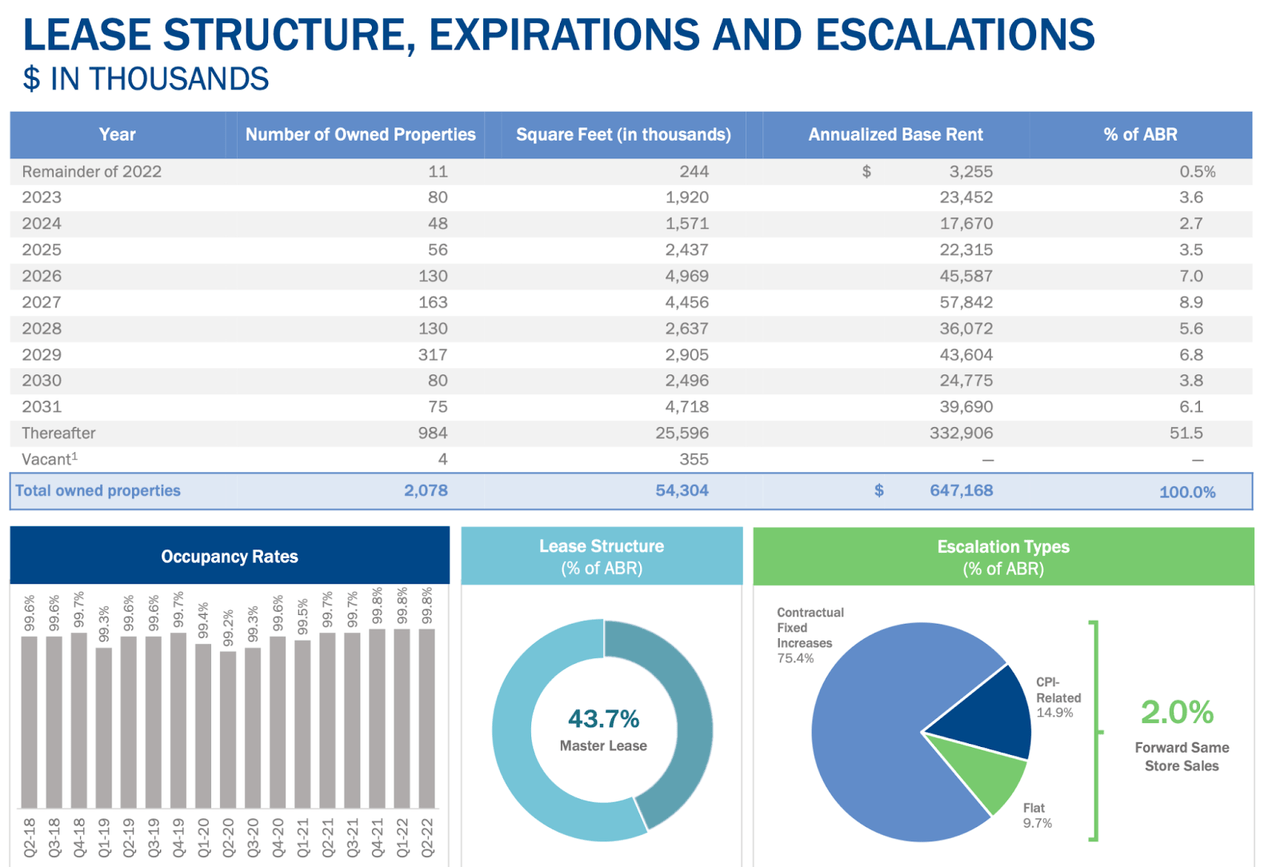

The vast majority of the company’s leases have lease escalations with an average 2% forward rate – undoubtedly boosted by high inflation.

2022 Q2 Presentation

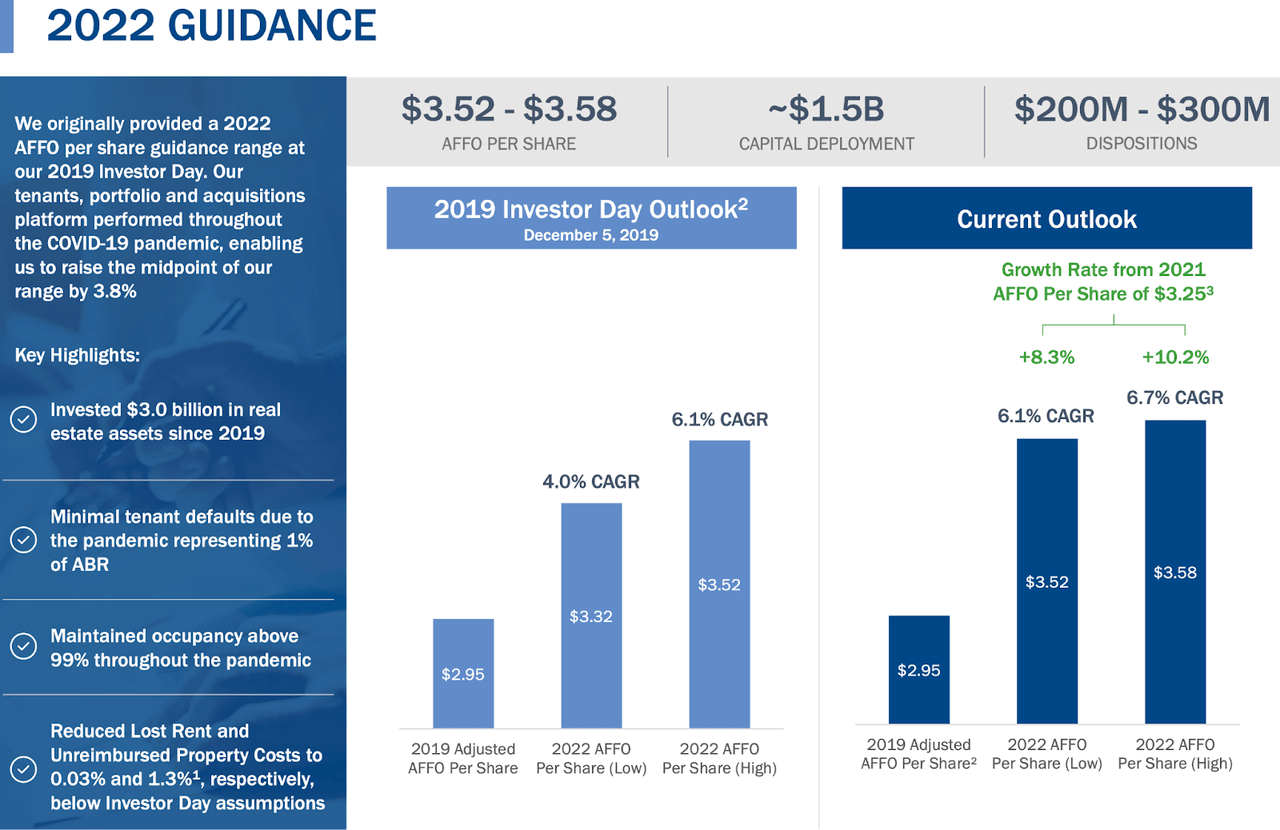

For the full year, SRC guided to up to $3.58 in AFFO per share, $1.5 billion of deployed capital, and up to $300 million in dispositions.

Is SRC Stock A Buy, Sell, Or Hold?

SRC has over delivered on the guidance given in 2019 based on the achieved AFFO per share. This is in spite of having to go through an unprecedented pandemic.

2022 Q2 Presentation

Yet even after generating strong results amidst the pandemic, SRC still trades at an outsized 7% yield. The company on the whole trades at an implied 7.5% cap rate.

2022 Q2 Presentation

That valuation is puzzling, considering that STOR was recently taken out for $14 billion, representing a valuation of 14x AFFO. SRC, in contrast, recently changed hands at around 10.3x AFFO – and I note that SRC has lower leverage than STOR. If SRC were to trade at the same 14x AFFO multiple, the stock would rise 36% which in conjunction with the 7% yield reflects over 40% potential upside. The stock would still yield around 5.3% at that price.

Key risks here mainly revolve around rising interest rates and credit risk. While SRC’s balance sheet is conservatively leveraged, rising interest rates may increase the cost of capital faster than the company can realize higher acquisition cap rates. Moreover, higher interest rates may reduce investor appetite for dividend stocks like SRC. It is also possible that rising interest rates lead to an increased amount of tenant defaults – SRC may need to sell off such properties at undesirable cap rates. I can see the company generating around 3% annual growth – that combined with the 7% yield should be enough for double-digit returns even without multiple expansion. Clearly, multiple expansion drives the bulk of optimistic expectations, but my point is that the stock can be a strong performer even without it. I rate the stock a buy as part of a diversified portfolio of compounding growth stocks.

Be the first to comment