Kateryna Onyshchuk

Introduction

In July, I wrote a bullish article on SA about Sierra Metals (NYSE:SMTS) in which I said that the company looked cheap as it was still profitable despite suffering from COVID-related issues and the net present value (NPV) of its projects was above $700 million.

Well, Sierra Metals booked an adjusted net loss of $11.6 million in Q2 2022 due to setbacks at Bolivar and Cusi. On September 11, operations at Yauricocha were suspended and later residents from the nearby town blocked access to the site. As a result, the company has suspended its production and financial guidance.

In my view, Sierra Metals has serious troubles at all of its operations, and I think that there could be significant stock dilution in the near future unless Yauricocha resumes operations soon. The uncertainties are too many here and I’m no longer bullish. Let’s review.

Overview of the recent developments

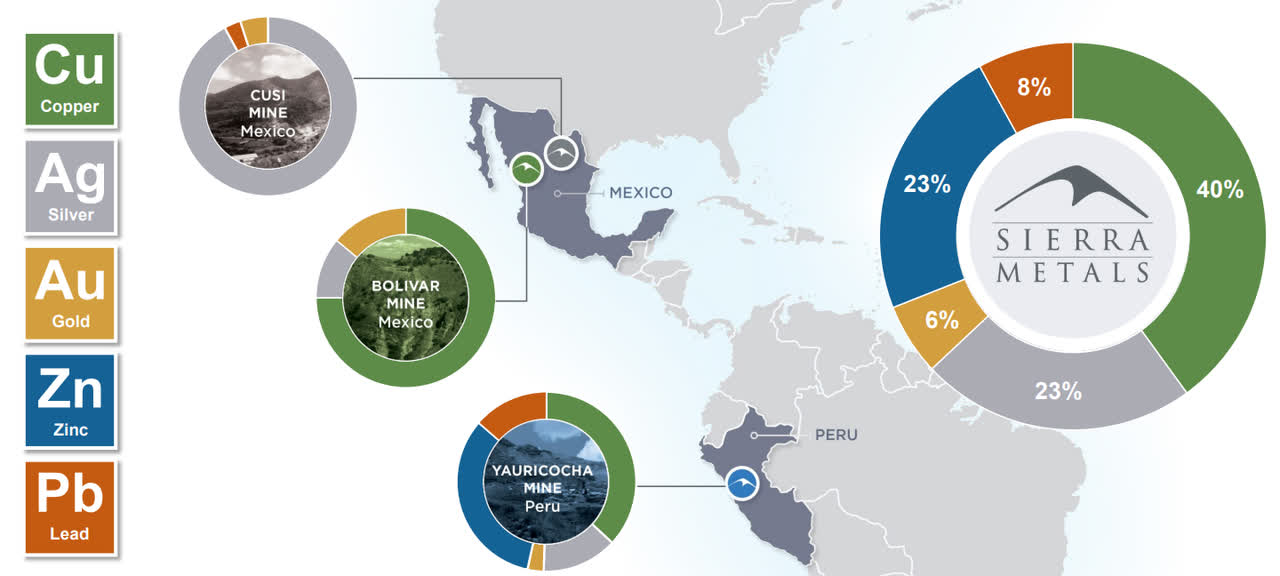

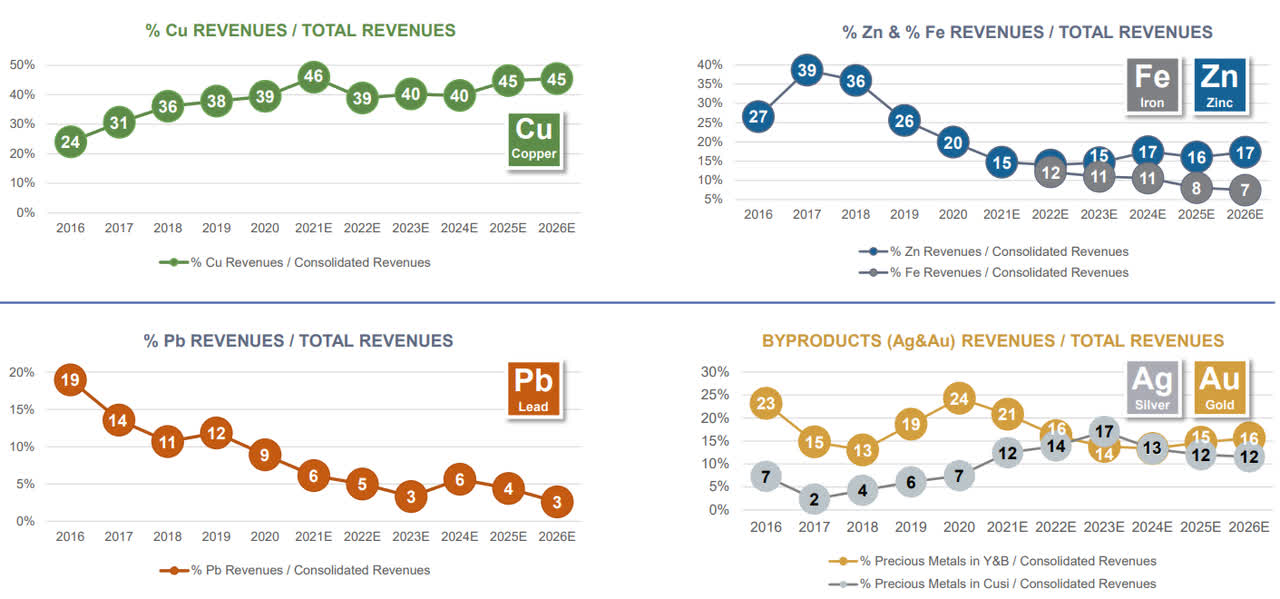

In case you haven’t read any of my previous articles about Sierra Metals, here’s a short description of the business. The company owns the Bolivar copper mine and the Cusi silver mine in Mexico as well as an 81.84% interest in the Yauricocha polymetallic mine in Peru. Copper accounted for about 40% of revenues during the year ended June 2022 and this share is expected to remain almost unchanged over the coming years despite planned expansions of Bolivar and Yauricocha in 2024 and 2025, respectively.

Sierra Metals

Sierra Metals

Sierra Metals

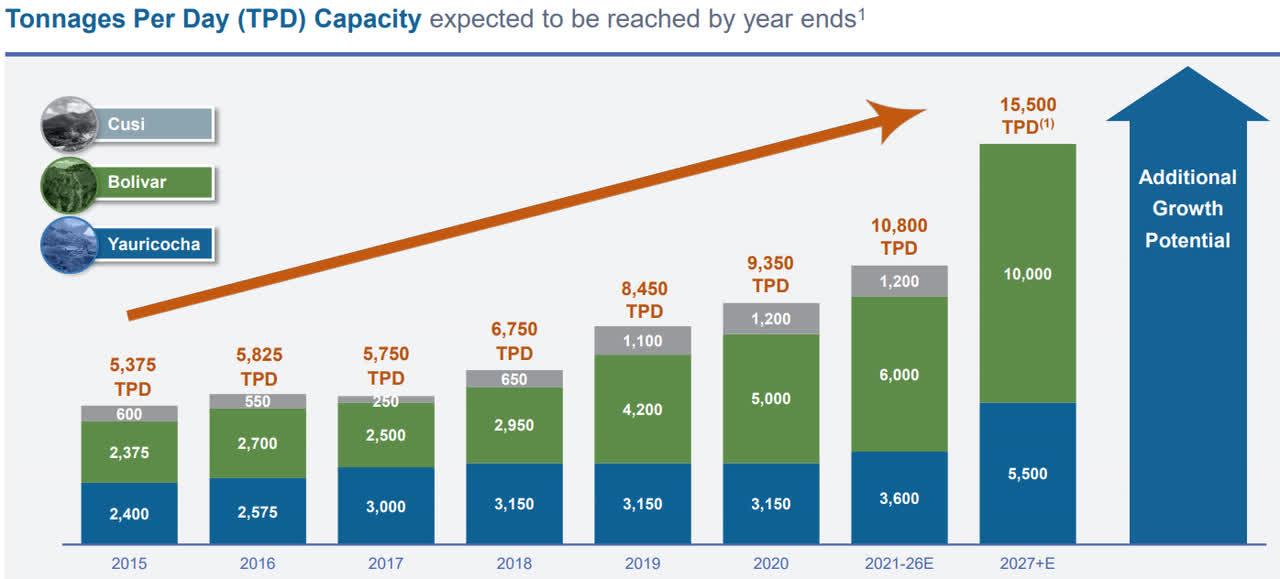

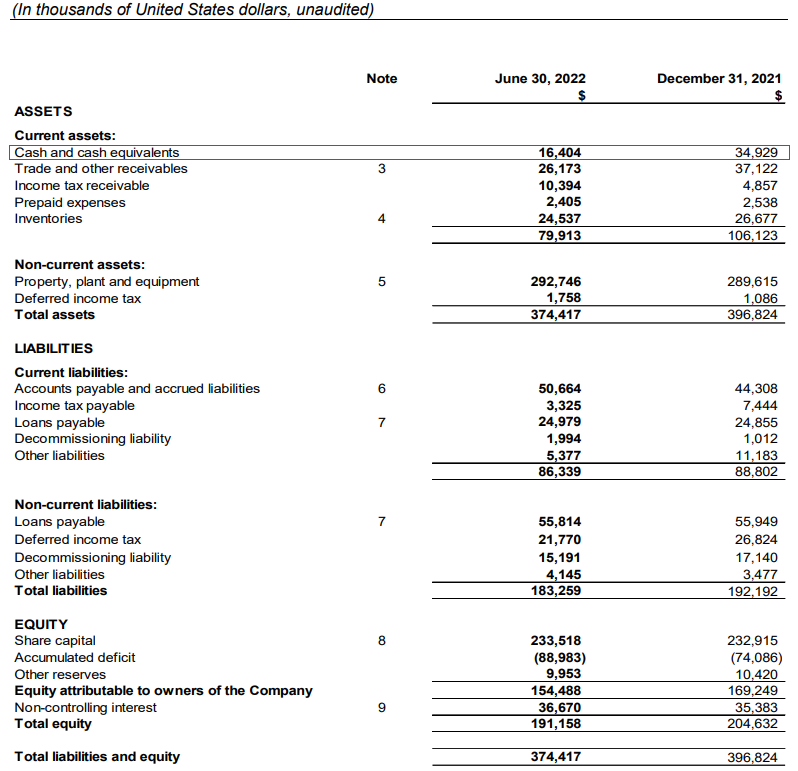

The capex required to increase throughput at Bolivar is expected to stand at about $67.5 million while the upgrade to the concentrator plant at Yauricocha is forecast to require another $47.4 million. These amounts don’t seem large at first glance, but I’m concerned that Sierra Metals won’t have anywhere close to enough in the bank to fund these projects without significant stock dilution. You see, cash and cash equivalents were down to $16.4 million as of June 2022 as cash generated from operating activities in H1 2022 was just $5.5 million.

Sierra Metals

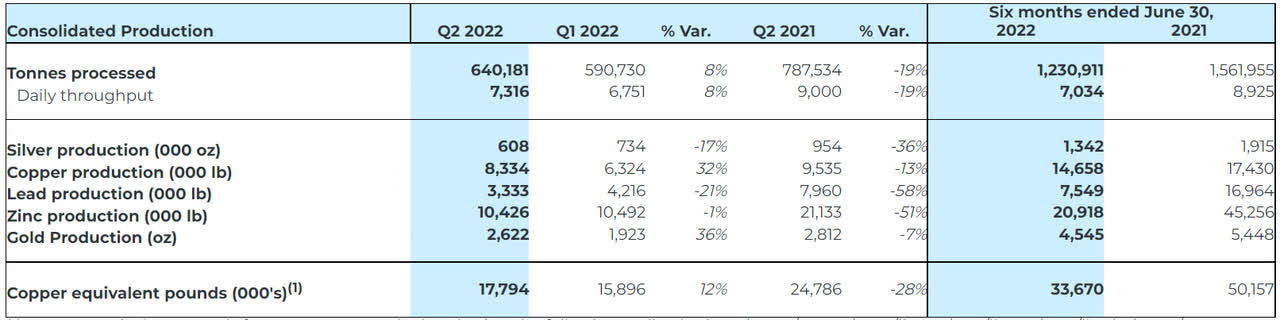

This second quarter of 2022 was supposed to be a period of improving production after a tough few months due to COVID-related issues, with Bolivar transitioning to a new zone and mill throughput at Cusi ramping up above 1,000 tpd. However, the production results were mixed as daily throughput rose by just 8% compared to Q1 2022 while copper equivalent production increased by 12%. Both figures remain far below 2021 levels.

Sierra Metals

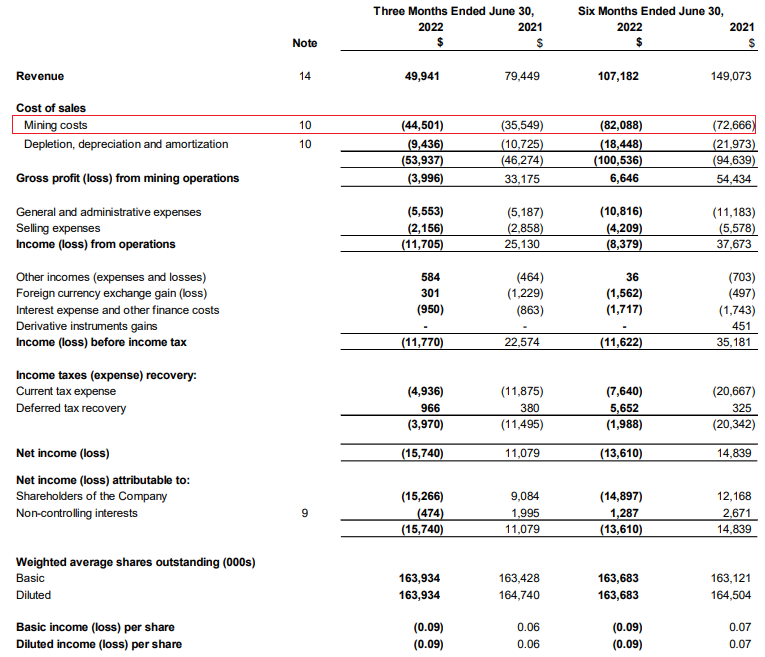

At Cusi, there was unexpected underground flooding in June and throughput slumped by 21% quarter on quarter to 66,722 tonnes. In addition, lower grades resulted in a 38% decrease in silver equivalent production. At Bolivar, the turnaround is going slower than expected and throughput at was 33% lower compared to Q2 2021. In addition, the grades were lower for all metals except for gold, which led to a 46% decline in copper equivalent pounds produced. The bright spot during the quarter was Yauricocha where throughput remained stable and copper equivalent production rose by 11% quarter on quarter thanks to improved grades in all metals with the exception of lead. All-in sustaining cash costs (AISC) per copper equivalent payable pound at Yauricocha declined to $3.39 in Q2 but this wasn’t enough to offset the higher mining costs at Bolivar and Cusi and Sierra Metals slipped to a net loss of $15.7 million. The free cash flow was negative $2.4 million.

Sierra Metals

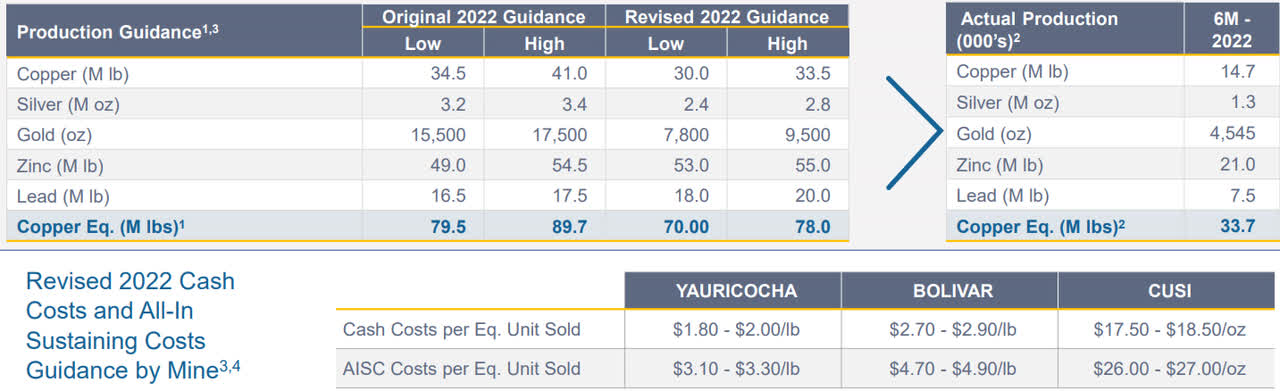

Looking at the future, Sierra Metals revised its H2 2022 guidance to reflect higher production at Yauricocha and lower production at Bolivar and Cusi. The cost guidance was also adjusted on the higher end due to lower production expectations.

Sierra Metals

Overall, I think the revised guidance was disappointing as it puts the company in a tight spot in terms of liquidity. Yet, things got so much worse for Sierra Metals just a few days ago as the residents from the town of Alis near Yauricocha blocked access to the site. The company hasn’t given a reason for the blockade and operations have been suspended since September 11 when a mudslide killed three contractor employees.

In any case, mining operations have been suspended for two weeks now and there are no indications when the situation will return to normal. Sierra Metals has suspended its 2022 production and financial guidance and I think the company could run out of cash soon as Bolivar and Cusi are still unprofitable. Overall, this year hasn’t been going well for the company and it seems that the situation is unlikely to improve over the coming months. In my view, the stock dilution risk is high now and I think that risk-averse investors should avoid this stock.

Is there value at Sierra Metals? Sure – as I mentioned in my last article that Bolivar, Yauricocha, and Cusi have a combined NPV of $715 million if production is expanded as planned. However, I’m concerned investors are unlikely to see much of that value as Bolivar and Cusi have been underperforming for a long time and cash is running out as Yauricocha remains closed.

Investor takeaway

In my view, Sierra Metals is starting to look like a value trap. The company is trading at around 0.2x NAV but it has been unable to turn around its Bolivar and Cusi mines for several quarters now and production at Yauricocha has been suspended. With metal prices starting to decrease due to global recession fears, the future of the company looks uncertain.

In my view, it’s unlikely that Sierra Metals will have enough funds for the planned expansion of Bolivar and Yauricocha, which means significant stock dilution could be in the cards. Avoid this stock.

Be the first to comment