PM Images

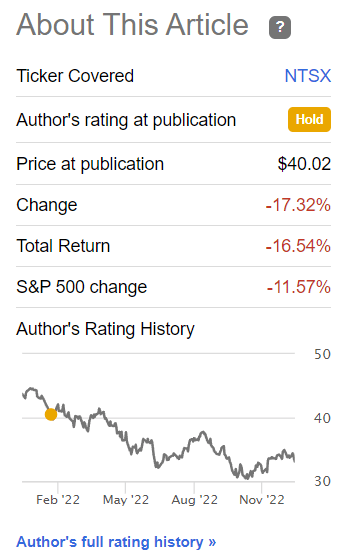

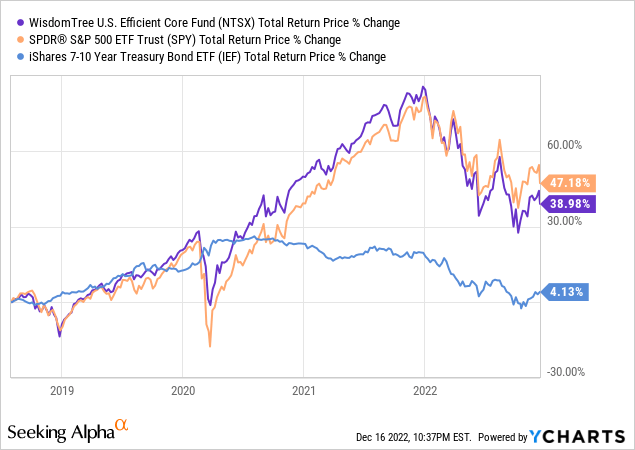

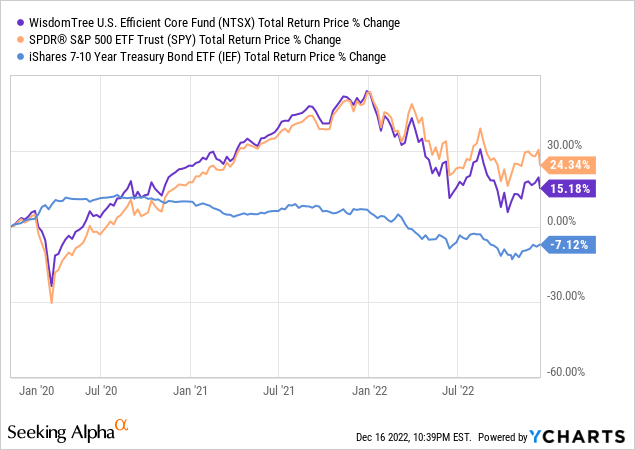

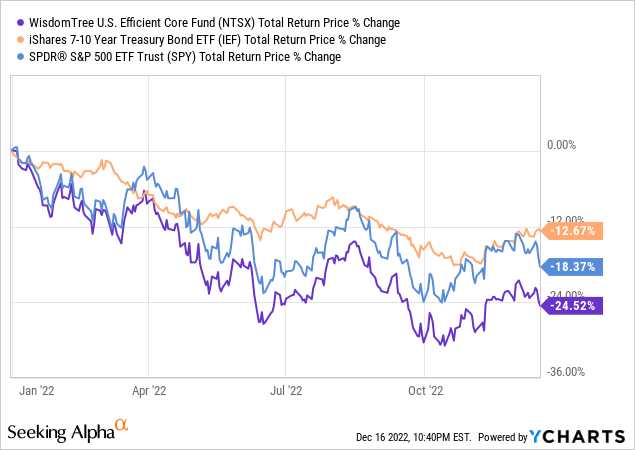

I last wrote about the WisdomTree U.S. Efficient Core Fund (NYSEARCA:NTSX), a 1.50x leveraged equity and treasury fund, in January 2022. In that article, I explained why NTSX underperforms when both treasuries and equities are down, and argued that underperformance was likely as long as inflation remained elevated. Since then, inflation has remained elevated, and NTSX has underperformed, as expected.

NTSX Previous Article

Economic conditions have markedly improved since, with inflation starting to normalize, and with economic growth resuming. As inflation recedes the risk of NTSX seeing further losses declines.

Market fundamentals have improved as well, with treasuries offering higher yields, and equities sporting cheaper valuations. NTSX invests in both asset classes, and so offers investors stronger potential returns now than before.

NTSX’s potential returns have improved while it risks have declined, a solid combination. In my opinion, the fund is now a reasonable investment opportunity, and a buy.

NTSX – Basics

- Sponsor: WisdomTree

- Strategy: 90% S&P 500 exposure, 60% treasury exposure

- Dividend yield:. 1.37%

- Expense Ratio: 0.20%

- Leverage Ratio: 1.50x

NTSX – Quick Overview

I’ll start with a quick overview of NTSX’s strategy and holdings, before looking at the fund’s improved expected returns and risks. I have a longer, more in-depth explanation of the fund here.

NTSX is a 1.50x leveraged equity and treasury fund. Holdings and exposures are as follows:

- Equity: NTSX has $90 invested in S&P 500 equities for every $100 invested in the ETF. The fund experiences about 90% of the returns and losses of the S&P 500.

- Treasuries: NTSX has $60 in (notional) treasury futures for every $100 invested in the ETF. In simple terms, the fund invests a tiny amount of cash in financial derivatives which are functionally equivalent to investing $60 in treasuries. The fund experiences about 60% of the returns and losses of average maturity treasuries.

- Cash: NTSX’s treasury futures require that for every $100 invested in the fund, $10 must be kept as short-term collateral.

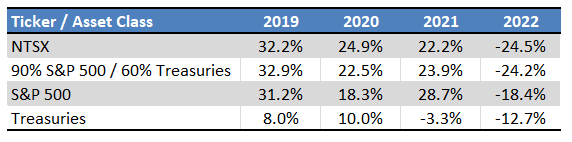

NTSX’s holdings entitle investors to returns which closely track the returns of a 90% investment in the S&P 500, and a 60% investment in treasuries. This is the case in a very literal sense: fund returns are generally roughly equivalent to 90% of S&P 500 returns plus 60% of treasury returns. For reference.

SeekingAlpha – Chart by Author

NTSX is basically 90% of the S&P 500 plus 60% treasuries, and behaves exactly as one would expect a fund with these characteristics. With this in mind, let’s have a closer look at the fund’s returns.

NTSX – Expected Returns Analysis

NTSX invests in equities and treasuries, so the fund’s future returns will ultimately depend on the performance of these two asset classes.

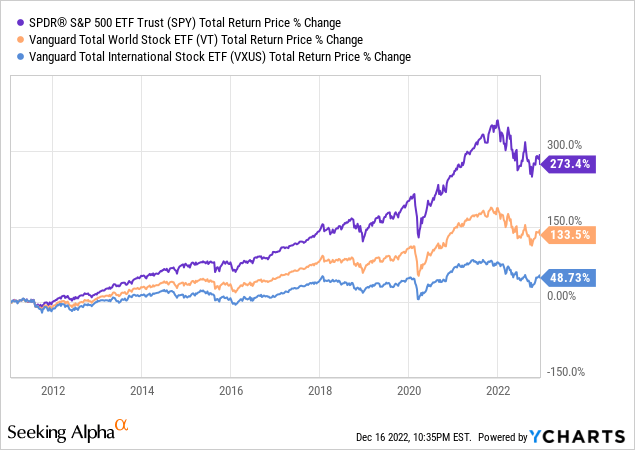

Equities entitle investors to the underlying earnings and cash-flows of their respective companies. Companies are generally profitable, so equity returns tend to be quite strong, if somewhat volatile. U.S. equity returns are even stronger than average, due to the resiliency, size, and strength of the U.S. economy. U.S. equities have been the best-performing asset class of the past decade, and their performance has been quite strong for most other relevant time periods as well.

NTSX invests 90% of its assets in the underlying holdings of the S&P 500, the benchmark U.S. equity index. The potential returns from this investment are quite strong, if somewhat volatile.

NTSX also invests in treasuries, with a 60% notional allocation / exposure to these securities. Treasuries entitle investors to extremely safe, but low, dividends. Treasuries are income vehicles, so do not provide investors with meaningful potential long-term capital appreciation, although investors might experience moderate short-term gains. Low yields and non-existent capital gains mean treasury potential returns are quite low, albeit still positive.

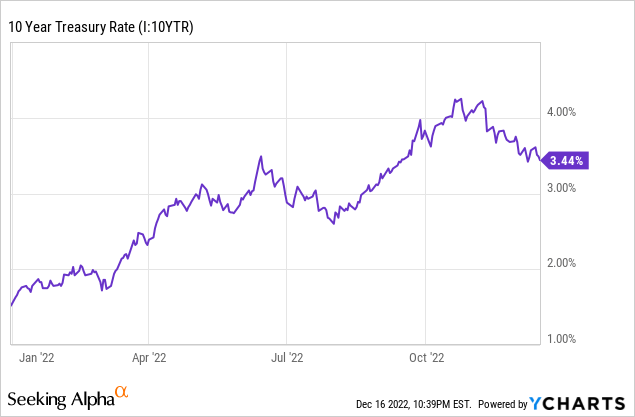

The iShares 7-10 Year Treasury Bond ETF (IEF), the treasury benchmark, has seen annualized returns of 3.5% since inception, while 10Y treasuries currently yield 3.8%. From these figures, seems reasonable to imagine treasuries returning 3.0% to 4.0% from here on out, although much will depend on the future path of interest rates.

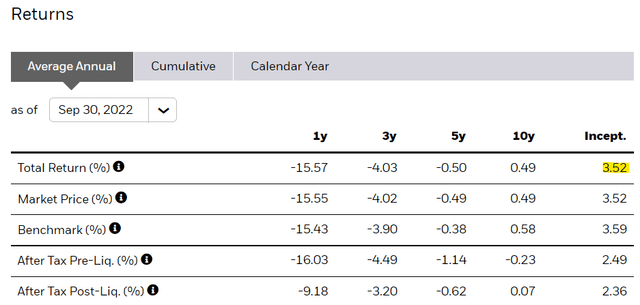

NTSX invests 90% of its assets in equities, which have strong expected returns. NTSX also has a sizable 60% exposure in treasuries, which have low, but positive, expected returns. Exposures add up to more than 100%, due to the fund’s use of leverage. With these exposures, long-term returns should be quite strong, a bit higher than those of the S&P 500. NTSX has lagged behind said index since inception, underperforming relative to expectations.

NTSX’s underperformance is partly due to low treasury returns these past few years, and partly due to small, technical details concerning portfolio rebalancing, differences between simple and compound returns, and decay. In very simple terms, leverage amplifies losses when asset prices decline, leading to lower asset values, which reduces gains when asset prices inevitably recover. Particularly severe bear markets could lead to irrecoverable losses for leveraged funds, but that has not been the case for NTSX.

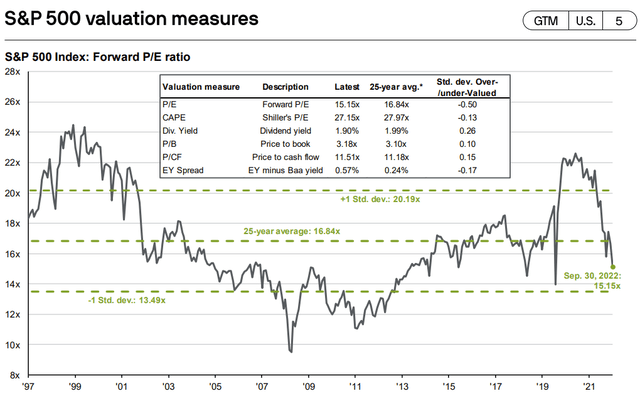

On a more positive note, NTSX’s potential returns have markedly improved these past few months. U.S. equity valuations have softened, with the S&P 500 trading below its historical average valuation for the first time in years. Cheaper valuations could lead to strong capital gains moving forward, contingent on valuations normalizing.

J.P. Morgan Guide to the Markets

Treasury rates have more than doubled, with 10Y rates increasing from around 1.5% to 3.4%. Higher rates means higher treasury rates, boosting NTSX’s potential returns in turn.

NTSX’s strong potential returns are a significant benefit for the fund and its shareholders. As these have markedly improved these past few months, I am much more bullish about the fund’s prospects right now than in the past.

NTSX – Risk Analysis

NTSX invests around 90% of its assets in equities, which are relatively risky, volatile securities. NTSX also has a 60% notional exposure to treasuries, which are relatively safe, stable securities. As NTSX invests in both these securities, risks are additive, although modified by the aforementioned exposures. The result is a relatively risky fund, with a similar risk profile to equities, with two important caveats or complications.

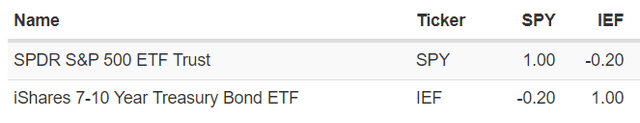

NTSX invests in both equities and treasuries as these asset classes are generally negatively correlated, so investing in both tends to reduce portfolio risk and volatility. As an example, equities plummeted in early 2020, as the coronavirus pandemic led to rapid, significant declines in economic activity, corporate earnings, and investor sentiment. Treasuries, on the other hand, soared, as the Federal Reserve slashed rates as a stimulative measure, and as investors fled to high-quality assets. NTSX’s treasury investments helped shield the fund from the worst of the pandemic, benefitting the fund and its shareholders.

Equities and treasuries are negative correlated, so they generally move in opposite directions, so scenarios like the above are quite common.

Due to the above, one could think of NTSX’s treasury investments as subtracting from the fund’s overall level of risk. That was indeed the case in early 2020, and that is the case for most relevant time periods too. There are, however, some very important exceptions.

Equities and treasuries move together in certain economic scenarios, including periods of rapidly rising interest rates. As rates rise, bond prices decreases, as investors sell older, lower-yielding bonds to buy newer, higher-yielding alternatives. As rates rise, corporate profits start to decrease, from higher financing costs, and from decreased costumer demand. Equities also face some selling pressure, as bearish sentiment intensifies (higher rates could cause a recession), and as investors pivot from equities to securities which have benefitted from higher rates (lots of interest in T-bills right now). As rates rise, both equities and treasuries go down.

NTSX is a leveraged fund investing in these two asset classes, and so sees very significant losses and underperformance during a period of rapidly rising interest rates, as has been the case YTD.

NTSX’s use of leverage amplifies losses, and could lead to significant, irrecoverable losses and underperformance during a particularly severe downturn. As an example, if both equities and treasuries are down 67.5% in a couple of months the fund would suffer losses of around 97.5% (1.5 * 0.675). NTSX would effectively never recover these losses, even if equities and treasuries skyrocket afterwards. As an example, if both asset classes were up 10x the fund would only recover 25% of its original value (10 * 2.5%).

Importantly, these issues only apply to leveraged funds like NTSX, not to unleveraged funds like those tracking the S&P 500. Although losses of this magnitude are incredibly unlikely to happen, relatively large losses do sometimes happen, with a similar, although much smaller, effect. NTSX will have some difficulty recovering from its 25% losses YTD, but it will probably recover.

Considering the above, it seems that NTSX is about as risky than the S&P 500. In most cases, the fund is moderately less risky than said index due to the fact that equities and treasuries are generally negative correlated. During periods of rapidly rising interest rates / inflation, the fund is riskier than the S&P 500, and sees higher losses and underperformance. Leverage magnifies losses during these scenarios, which can lead to long-term underperformance, as has been the case for NTSX since inception, although barely so.

In my opinion, NTSX’s overall level of risk is broadly similar to that of the S&P 500, although not identical. I would avoid NTSX when the risk of higher interest rates / inflation was high, as was the case earlier in the year. Today, with inflation starting to normalize and with the Fed discussing a (possible) interest rate freeze in a couple of months, the risk of higher interest rates is much lower, in my opinion at least. Other investors might disagree, and might wish to avoid NTSX.

Conclusion

NTSX is a leveraged equity and treasury fund. NTSX’s strong potential returns make the fund a buy.

Be the first to comment