Vanit Janthra

A year ago, I contributed a SA article about Cummins (NYSE:CMI) in which I said: “a) Cummins has an axle in the old world of fossil fuels and another in the new world of green energy, b) Its leadership and alliances should help ensure that they and their customers can make the transition, c) The company’s strong financial condition and low P/E point to a stock worthy of consideration.”

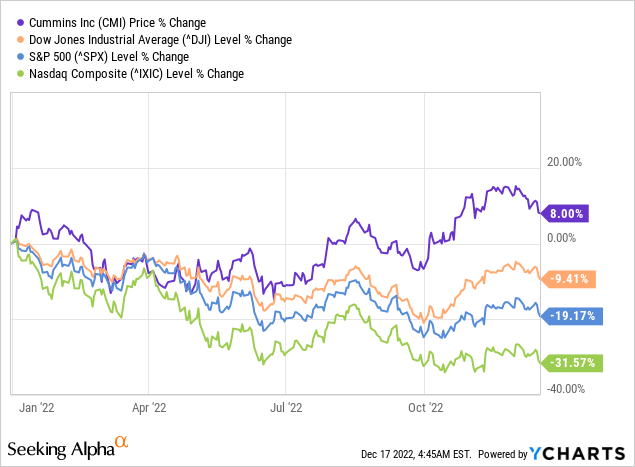

Against this, the company’s stock has come through a tough 2022 in stellar form. Year-to-date, it’s up 8% against the Dow, S&P, and NASDAQ that are down 9%, 19%, and 32%, respectively. That’s alpha:

Circular Hydrogen Energy

Water and power are the fundamental inputs to, and outputs from, versatile and sustainable hydrogen energy. Optimally, on the input side, electrolyzers – powered by wind turbines or solar panels – separate “green hydrogen” from oxygen in H20 in order that these elements can be recombined in fuel cells to produce electric energy (with water and a small amount of heat as ‘byproducts’). If the hydrogen is sourced from fossil fuels / hydrocarbons, such as methane, the process yields lesser quality “gray” hydrogen or, with carbon capture, “blue hydrogen.” Here’s a chart describing all the colors and how they are sourced.

In my earlier SA piece, I referenced Cummins’ insightful 2019 acquisition of Hydrogenics and their prowess in both hydrogen electrolyzers AND fuel cells. Three-and-a-half-years later, earlier this month, Cummins announced that it will team with international gas giant Linde (LIN) that is building the largest green hydrogen facility in the United States. This signals that Cummins is well-positioned in electrolyzers that, together with their fuel cell technology, elevates the company as a leader in hydrogen energy. As far as applications are concerned:

- Electrolyzers can be employed on an industrial scale as it is with Cummins’ project with Linde. The technology is also suitable for “local” uses as in refueling stations. In addition, sub-optimally IMO, separated hydrogen finds use in internal combustion engines instead of gasoline or diesel.

- Fuel cells are likewise available for a wide range of applications. Small cells can power small ‘appliances’ such as laptop computers. Medium-sized ones find use in powering vehicles of all kinds: a) cars – Toyota, Hyundai, Honda, b) trucks – Volvo, as but one example, c) trains – in China and Canadian Pacific, d) ships – Viking Cruise Lines, and e) even airplanes – Airbus. Large fuel cells can supply electricity to power grids, places without that infrastructure, and for backup or emergency power in buildings.

Cummins, Brilliantly Positioned

To reemphasize, Cummins has the “circle” of sustainable hydrogen covered with its electrolyzer and fuel cell technologies that can serve many needs. Lest we forget, the company is also a leader in engines and drivetrains meaning that it can mechanically ‘connect’ hydrogen energy to its end uses whether turbines, pumps, wheels, power take-offs, compressors, mixers, augers, balers, what have you. Many companies are single-product providers, few can boast that they cover this whole “value chain”.

In addition to being ideally positioned strategically, Cummins has generally strong financials. With allowances for inventory fluctuations, the company’s year-over-year numbers are solid by most metrics – revenue / growth, gross profit / margins, net income / growth, operating cash flow / growth except for that inventory blip, working capital / current ratio, liabilities to equity / leverage ratio, and dividend yield / payout ratio (numbers courtesy of SA).

|

2020 |

2021 |

June ‘22 |

Sept ‘22 |

||

|

Revenue / Growth |

$19.8B |

$24.0B/+21% |

$6.6B |

$7.3B/+11% |

|

|

Gross Profit / Margin |

$4.9B/25% |

$5.7B/24% |

$1.7B/26% |

$1.6B/22% |

|

|

Net Income / Growth |

$1.8B |

$2.1B/+17% |

$702M |

$400M/-43% |

|

|

Op. Cash Flow / Growth |

$2.7B |

$2.3B/-15% |

$599M |

$382B/-36% |

|

|

Working Capital |

$5.6B |

$5.2B |

$5.1B |

$3.9B |

|

|

Current Ratio |

1.9x |

1.7x |

1.7x |

1.4x |

|

|

Total Liabilities |

$13.6B |

$14.3B |

$14.8B |

$40.2B |

|

|

Total Equity |

$9.0B |

$9.4B |

$8.7B |

$8.4B |

|

|

Liabilities to Equity |

1.5x |

1.5x |

$1.7x |

2.4x |

|

|

Dividend Yield |

n/a |

n/a |

n/a |

2.7% |

|

|

Payout Ratio |

43.7% |

38.0% |

29.1% |

55.5% |

A Buying Opportunity Here?

The company’s latest quarterly numbers reflect lower liquidity (still strong) and higher financial leverage (still okay). IMO, Cummins’ wobbly quarter was temporary and presents a buying opportunity for those who find their strategic argument and 14x P/E multiple compelling.

With ratings and targets courtesy of MarketWatch, of the twenty-four professional analysts that cover CMI, 10 have it as a “Buy” with 14 a “Hold”. Their median price target of $264 indicates 12% appreciation in 2023 over Friday’s end-of-day price of $236. SA’s authors and quants are indifferent about the stock with both groups having it as a “Hold.” I believe they are missing the strategic argument.

I see two interrelated risks to CMI. The first relates to the speed of adoption of hydrogen energy. Putting aside the technology of electrolysis and fuel cells – they are proven – there is ample debate on the economics of producing hydrogen energy compared, notably, to battery power; here’s one research paper on the subject. A few high-level observations:

- Electrolyzers and fuel cells are more economic for larger applications – power grids, terminal / nodal operations, and big vehicles where battery weight and charging times are suboptimal.

- Given temperature and volatility concerns, the piping of hydrogen is problematic; accordingly, this technology is best deployed near the place of application such as those mentioned above.

- As it is with fossil fuel and other renewable / sustainable energy sources, unaccounted for externalities and the prevalence of government subsidies, distort, but don’t invalidate, the economic picture.

- The time it will take to transition from extractive to renewable energy sources promises to be protracted; however, as we have seen, incremental progress can occur rapidly.

The good news is that; a) utilities and businesses can consider these factors and make their economic decisions without getting swept up in political / ideological debates, and b) because Cummins serves to the full spectrum of traditional and hydrogen solutions, it is well positioned to meet its customers on their terms.

Still, there is a second risk to owning CMI that being the company’s ability to ‘keep all the balls in the air’ where, in just green hydrogen, Straits Research projects the market will reach $72 billion by 2030 growing at a CAGR of 55%. Especially given its other businesses, that’s a tall order but not impossible for a formidable competitor such as Cummins. I’m bullish and recently added to our holding in the stock.

Be the first to comment