Abstract Aerial Art

Here at the Lab, we closely follow renewable energy players’ performance and today we are back to comment on Northland Power (OTCPK:NPIFF). For various reasons, the renewable sub-sector continues to be Mare Evidence Lab’s favored area for energy exposure. In our initiation of coverage, we emphasized the following:

- Strong European presence and support from regulators to accelerate energy independence from Russia and energy transition from fossil fuels. In this context, we like Northland Power’s diversification in terms of different geographical areas as well as renewable energy productions;

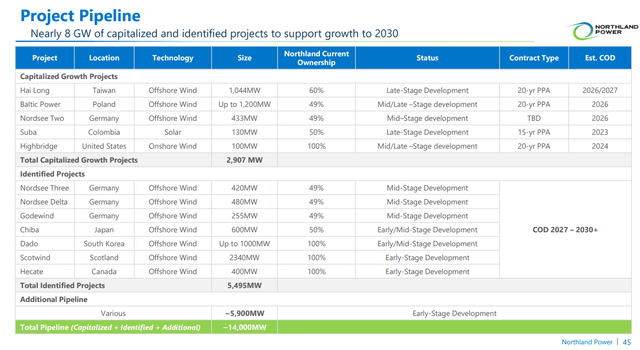

- Under development installed capacity with a superb pipeline up to 14 GW;

- Last time, we had mixed feelings about the European energy crisis but we clearly said that under the Power Purchase Agreement (PPA), the company would record better profitability (mainly driven by energy price evolution);

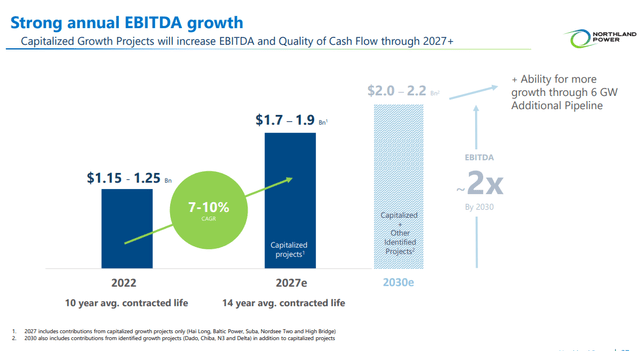

- Over the long-term horizon, we reaffirmed management’s guidance to double NPI’s EBITDA by 2026.

Source: Northland Power Q2 Results

Looking ahead the Q2 results

In our forecast numbers, we should consider Northland Power’s European exposure and profit potential. However, during the second quarter call, the CEO stated that:

“the revised guidance ranges may be subject to the further upside should power prices in Europe. However, given this is difficult to predict and there are a number of factors that impact our results, we do not incorporate this potential upside for Q3 or Q4 in our guidance”.

Given the company’s unique exposure, our internal team is not modeling for higher profit in the long-term horizon. Briefly looking at the Q2 results, the company delivered an earnings per share of C$1.01 versus the Wall Street analyst expectation of C$0.11. On an adjusted basis, NPI’s EBITDA was above consensus that was forecasting on average C$241 million against the company that delivered C$335 million. Looking at the exposure that drove the beats, energy production was 33% higher and a considerable EBITDA development was recorded in the onshore renewable energy production. In addition, as already explained in our past analysis (Eni, Iberdrola and Enel), there is a windfall profits tax that might offset NPI’s financial performance. The company operates in different jurisdictions and for this reason, we should maintain a conservative approach. In the Q&A session, the CEO explained that NPI does not “have any indication of anything happening in Germany and the Netherlands at this point“.

Our internal team expects that offshore wind will lift the company’s growth in the short/medium term horizon and we are confident that Northland Power has the financial resources to support its near-term CAPEX plan. The ATM’s latest news is a positive catalyst that will support NPI’s growth expansion.

Conclusion and Valuation

As we can note in our forecast number model, we were already in line with management’s guidance and therefore we are not adjusting our long-term financial assumptions. However, we expect that Wall Street analysts will revert their expectations on the upside, increasing NPI’s target price. With the latest numbers, we reaffirm our positive view of renewable energy players and we are confident in Northland Power’s future. Our internal team reiterates its C$51 target price based on the company’s growth prospects and the positive results achieved in this complicated 2022. Valuation and risks are included in our previous analysis.

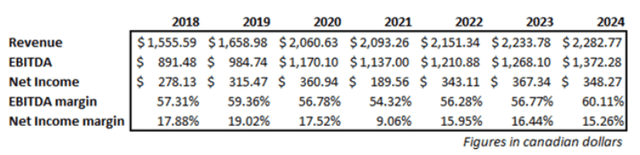

Source: Mare Evidence Lab’s forecast numbers

Source: Northland Power Q2 Results

Be the first to comment