imaginima

Global X Robotics & Artificial Intelligence Thematic ETF (NASDAQ:NASDAQ:BOTZ) is a concentrated niche investment vehicle providing exposure to the growth themes that are supposed to deeply reshape the global economy over the long term, bolstering profitability and unlocking growth opportunities. The fund is managed passively, tracking the Indxx Global Robotics & Artificial Intelligence Thematic Index.

Robotics & AI were in the cohort of the themes that have been awash with investor cash during the pandemic and shortly after the introduction of the coronavirus vaccines. Investors were betting on steady, unhindered growth of capex that enterprises were supposed to pour into automation, a highly promising theme to capitalize on.

According to the January 2021 forecast from Mordor Intelligence mentioned by BOTZ in its factsheet, the global robotics market was estimated to have a value in excess of $23 billion in the pandemic-torn 2020, with forecasts suggesting it to swell almost 3x to touch $74 billion by 2026. This is a gargantuan total addressable market growth investors could profit from, especially considering industrial robots were becoming cheaper which could support quicker adoption motivating more companies to retire legacy systems and invest in innovation. No coincidence valuation of AI & automation plays ballooned.

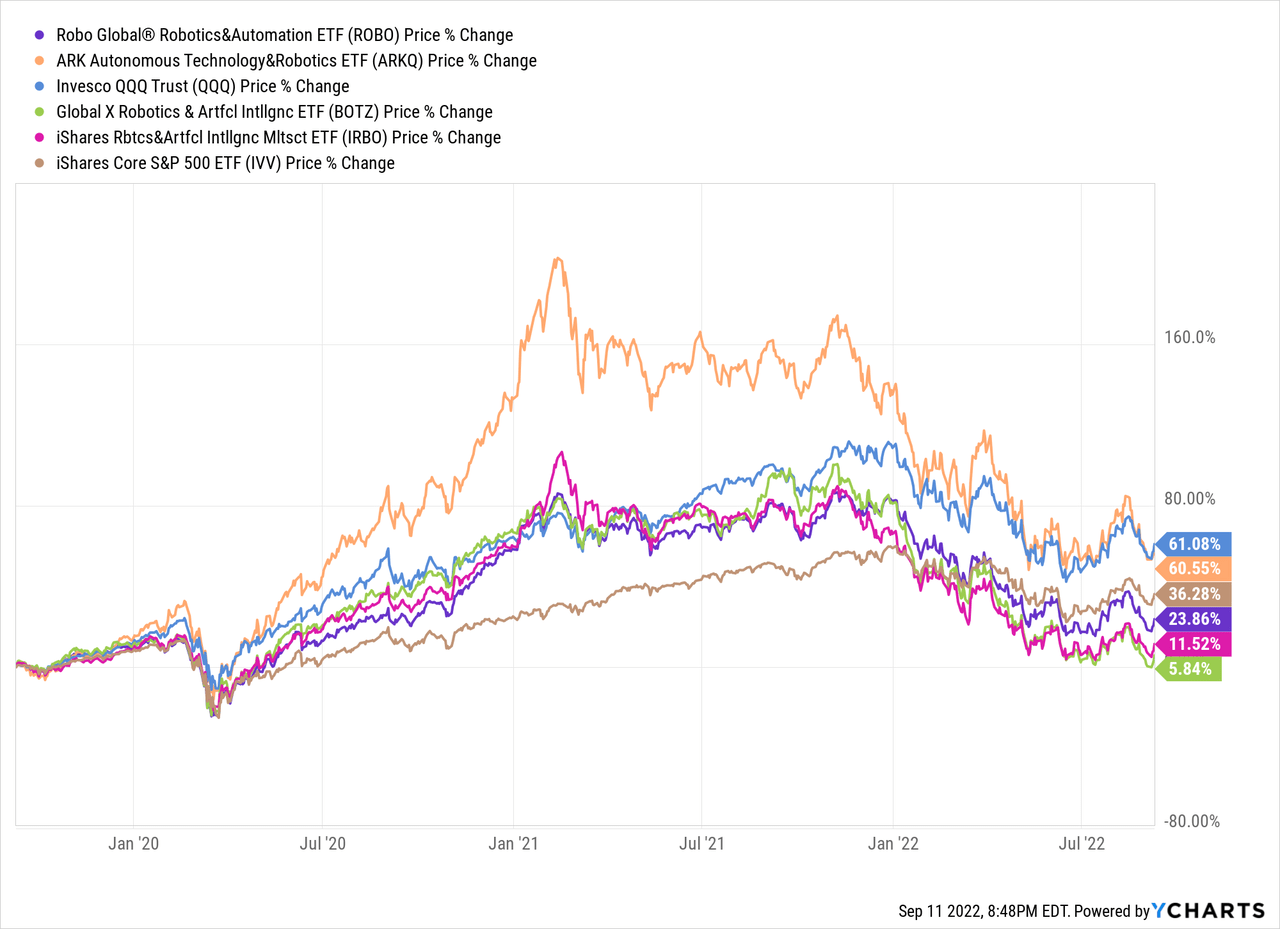

BOTZ itself advanced by almost 53% in 2020, dwarfing its peers ROBO Global Robotics & Automation Index ETF (ROBO) and iShares Robotics and Artificial Intelligence Multisector ETF (IRBO), and the Invesco QQQ ETF (QQQ) which saw a 48.4% gain, let alone the iShares Core S&P 500 ETF (IVV) representing the U.S. bellwethers that delivered just 18.4% total return. Anyway, the actively-managed ARK Autonomous Technology & Robotics ETF (ARKQ) was unrivaled with its stupendous ~107% gain.

Yet there was one vulnerability, which later sent valuations back to reality. Amid record exultancy, the market ignored the relationship between the growth premium and the cost of capital. When inflation spiraled (almost) out of control, it faced a rude awakening. Risky assets came from boom to bust, with the BOTZ ETF and its robotics-focused brethren bearing the brunt.

The first cracks had appeared in February 2021 already, when the growth party seemingly peaked but inflation was yet to become a gnawing concern for regulators across the globe. And when 2022 arrived, with a slew of downside catalysts that resulted in speculative tech valuations cratering.

The Fed stepped in to tame inflation, interest rates edged higher. And a solid slice of the pandemic premium evaporated for most of those that were in the limelight before.

Let us provide more context with a few tables.

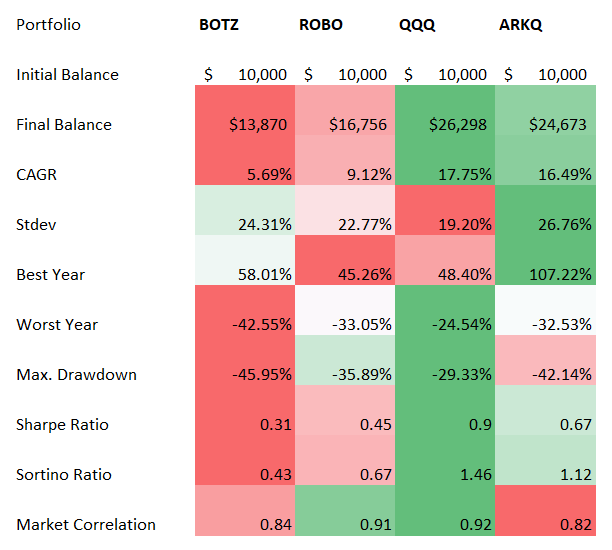

The first table below combines data for ARKQ, ROBO, BOTZ, and QQQ for the Oct 2016 – Aug 2022 period. BOTZ was incepted on 12 September 2016.

Created by the author using data from Portfolio Visualizer

BOTZ’s lackluster risk-adjusted returns, the second-highest standard deviation in the peer group, and the weakest compound annual growth rate speak for themselves. So as the entire cohort has been impacted by prevailing hawkishness, BOTZ has been bearing the brunt.

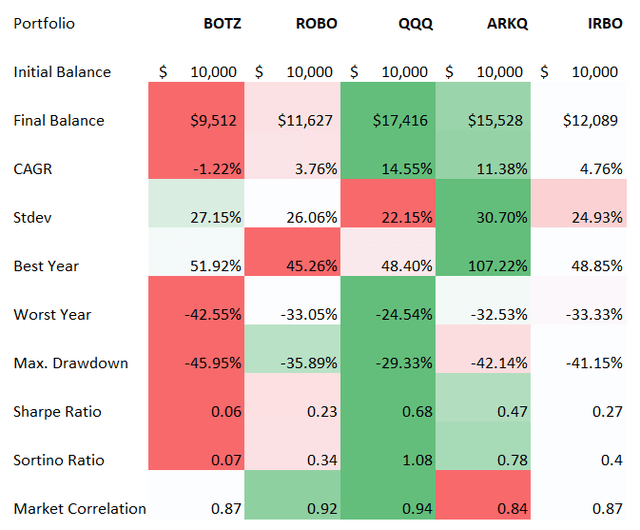

The second table adds IRBO which has the shortest trading history in the selected peer set. The data are for the August 2018 – August 2022 period.

Created by the author using data from Portfolio Visualizer

Almost every metric points to the fact that BOTZ is the weakest fund in the group. Please do note that it is not the most expensive, with a 68 bps ER, while ROBO charges 95 bps.

A fairly gloomy picture. Is there a silver lining?

The yen tumbled and inflation seemingly peaked. A new dawn in sight?

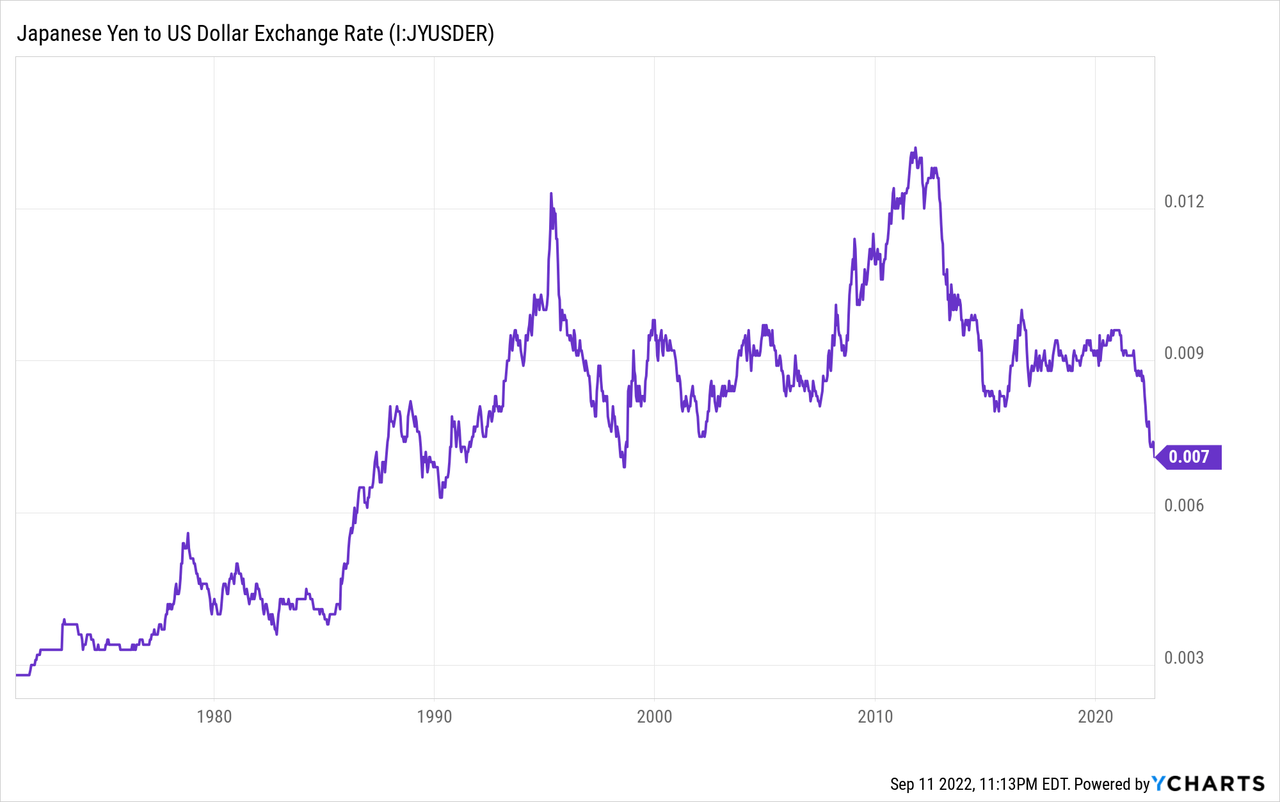

With 41 holdings, BOTZ is an international equity basket, with only around 43% allocated to the U.S. Thus, an FX risk is deeply embedded in its portfolio. And here comes another unobvious casualty of the higher rates in the U.S., namely developed world currencies.

BOTZ has been relatively immune to the horrible decline of the euro as it has exposure to the eurozone only via its investment in the Finnish company Cargotec (OTCPK:CYJBF), a provider of intelligent cargo handling solutions, accounting for just around 87 bps. There are also Norwegian, UK, Canadian, Israeli, and South Korean equities in the mix, but their weight is comparatively small, 7% combined.

So what impacts the NAV heavily is the Japanese yen. Osaka-based Keyence (OTCPK:KYCCF), a factory automation solutions manufacturer, is the fund’s key Japanese holding, accounting for around 9% of the net assets. Overall, close to 37.5% are invested in the Tokyo-quoted equities.

In my article on IRBO from 7 January 2022, I flagged that

… the yen has recently slumped to a 5-year low against the U.S. dollar as there are no hawkish signals from the Bank of Japan.

Oddly enough, since then, this safe-haven currency has crept to a 24-year low.

Inflation is barely a concern as the country fought anemic growth and deflation for years. Now, it sees a rare opportunity to break the deflation trend, and we are uncertain whether the Bank of Japan will reverse the dovish course to support the ailing yen.

So what is the silver lining? The inflation in the U.S. might have already peaked, thus expectations for the rate hikes should become lower, allowing the bruised developed world currencies and growth stocks to recuperate. Yet there is still a risk.

The factor of paramount importance is the inflation data for August which is due to be released this week. Surprise to the downside, especially assuming cheaper petrol should contribute, might spur a rally in growth names as well as developed world currencies, the yen including. Traders might speculate that the cost of capital would go up slower than initially expected, bidding up multiples for names that have seen a rather soft September after the Jackson Hole symposium.

But in case the data surprises to the upside, I anticipate a sore decline in the share prices of the most richly priced names, with ripple effects reaching the FX market. In that sense, is the BOTZ portfolio prepared for that? It seems after a close to 42% decline this year, valuations of its holdings have been mostly reset. But in fact, I am skeptical that they have a sufficient margin of safety.

For instance, among the 20 U.S. stocks it holds, 13 have a D+ Quant Valuation grade or worse; combined, they account for over 38% of the portfolio. For earnings-focused investors, I should also note that only 12 companies in the group are forecast to deliver forward EPS, and the P/Es (Forward) range from 16.8x in the case of Cerence (CRNC), the AI-powered virtual assistants provider, to a gargantuan 159x in the case of FARO Technologies (FARO), a 3D tech player. ~34% of the holdings have a multiple between 20.8x and 78.5x. Invesco shows QQQ’s forward P/E at 19.7x as of June 30.

When it comes to EV/Sales, a better metric to apply to growth players, we see the median in the group at over 5x. The IT sector median stands at 2.8x.

Final thoughts

I like that BOTZ is heavy in Intuitive Surgical (ISRG), with over 9% allocated. This is the company on the very edge of innovative surgery, with a forward revenue growth rate exceeding 17% and the even stronger EBITDA growth rate of ~17.7%. And I love to see margins expanding. Beyond ISRG, BOTZ has a few other appealing growth plays, like its another essential holding Nvidia (NVDA), with a ~7.3% weight, which is forecast to deliver a close to 24% revenue growth next year, or Dynatrace (DT) with its ~25.6% rate. All these add to the allure of this niche ETF.

Summing up, there is no denying that robotics & AI will be among the major drivers of global economic growth over the longer term. Yet as I said above, there is still an inflation risk in this equity mix, which could both compress multiples and inflict more pain on the yen.

Be the first to comment