Deagreez/iStock via Getty Images

Extreme Networks, Inc. (NASDAQ:EXTR) reports larger partners, and management expects relevant investment in innovative offerings like ExtremeCloud SD-WAN or WAN EDGE. Taking into account the company’s strong backlog and the growth of the target markets, in my view, the stock appears undervalued. My DCF model resulted in a fair valuation that appears larger than the current stock price. Even considering risks from lack of components or negotiations with manufacturers, I believe that EXTR is a stock to follow carefully.

Extreme Networks

Extreme Networks offers cloud management, wireless, routing, and many other network products and services. I believe that the company is worth a quick look because of the partners and the expectations of stock analysts. Keep in mind that management signed agreements with, for instance, NASCAR, the Liverpool team, and some major national football leagues.

Source: Company’s Website

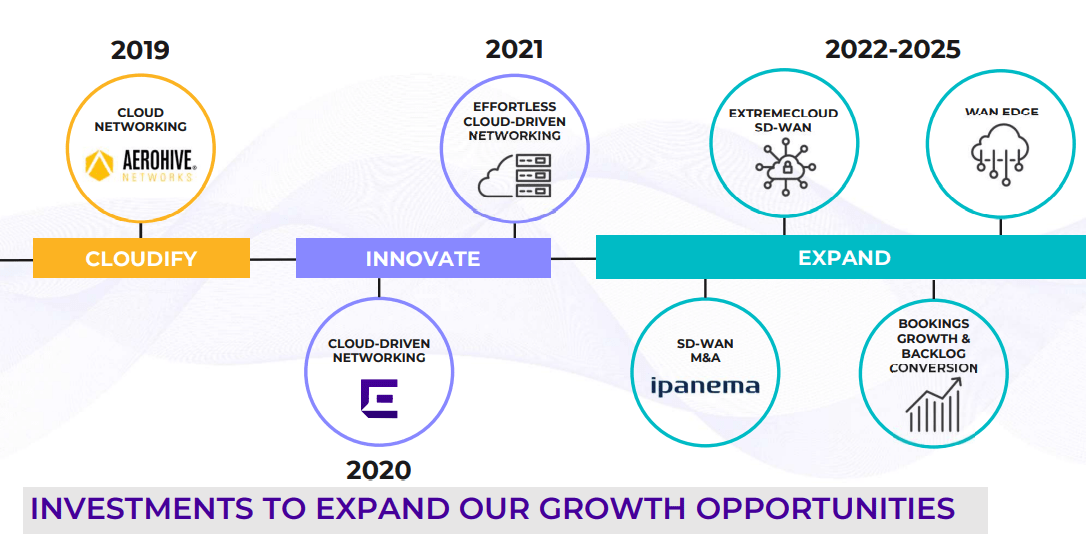

I believe that management commenced several expansionary initiatives, which may serve as a catalyst for revenue growth. The acquisition of Ipanema brings new cloud-managed SD-WAN and security offerings. Besides, from 2022 to 2025, the company expects to invest resources in ExtremeCloud SD-WAN, WAN EDGE, and other technologies, which may enlarge the list of products offered to consumers.

Source: Investor Presentation

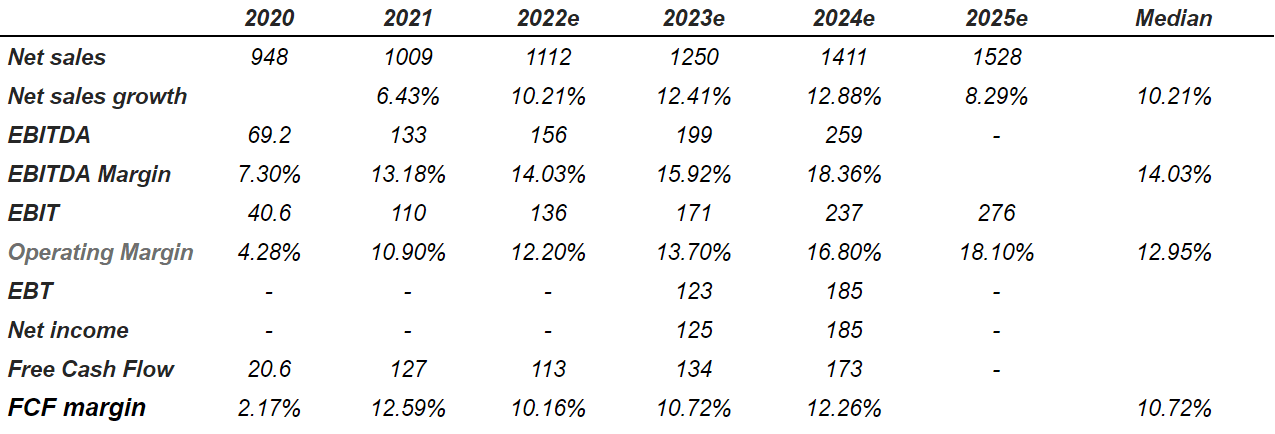

Beneficial Expectations From Management And Analysts Expect 2023 Sales Growth Of 12% And FCF Margin Of 12%

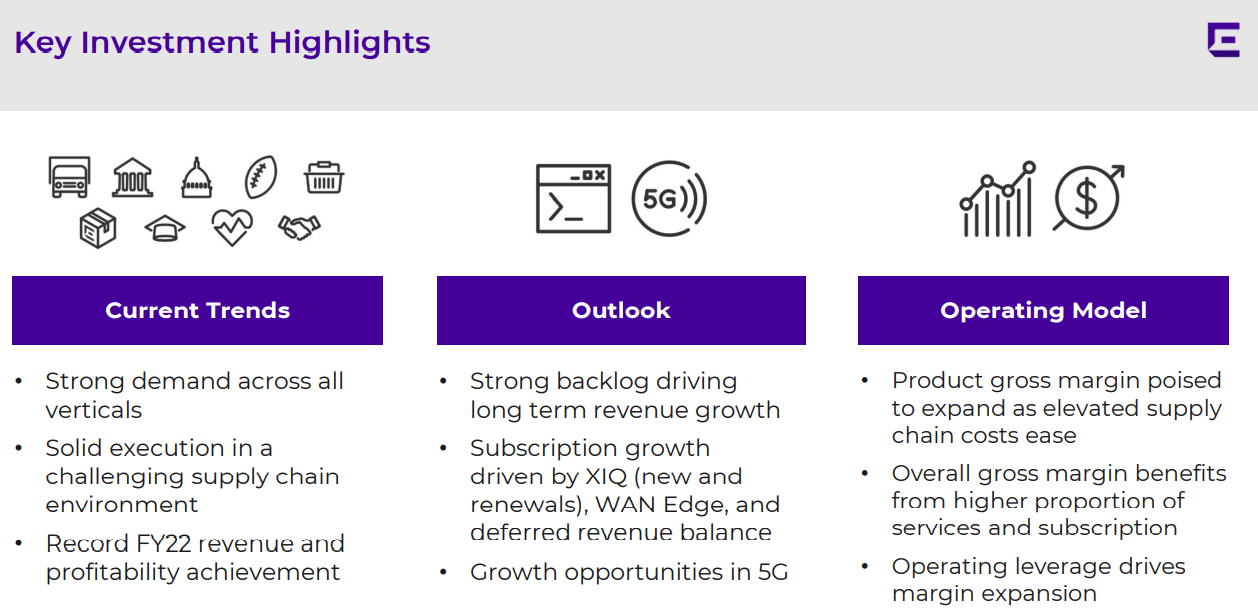

In my view, Extreme Networks was quite optimistic in the most recent investor presentation. The company’s outlook includes beneficial information about new subscription growth driven by XIQ, WAN Edge, and growth opportunities in 5G. Management also noted a strong backlog and gross margin expansion from a higher proportion of services.

Source: Investor Presentation

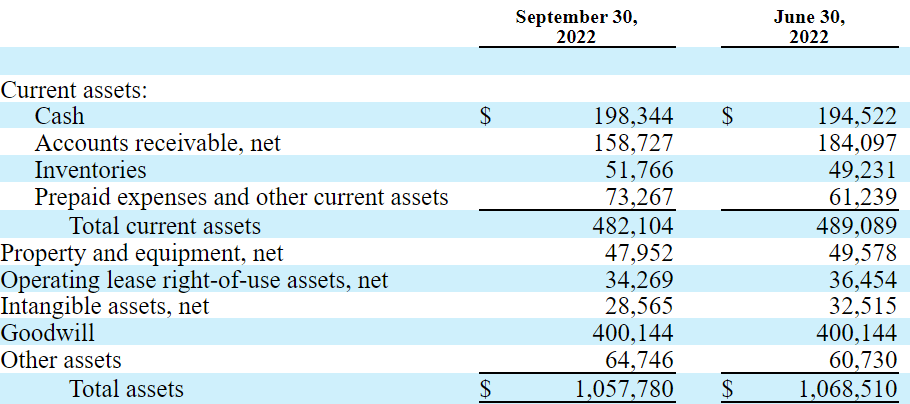

By 2025, analysts expect net sales of $1.528 billion with net sales growth of 12.88% and 2024 EBITDA margin of 18.36% with 2024 EBITDA of $259 million. EBIT would stand at $237 million with an operating margin of 16.80%. Besides, EBT is expected to be close to $185 million, and 2024 net income would be $185 million. Finally, expected 2024 free cash flow would be close to $173 million with an FCF margin of 12.26%.

Source: Marketscreener.com

Balance Sheet: The Total Amount Of Debt Does Not Seem Substantial

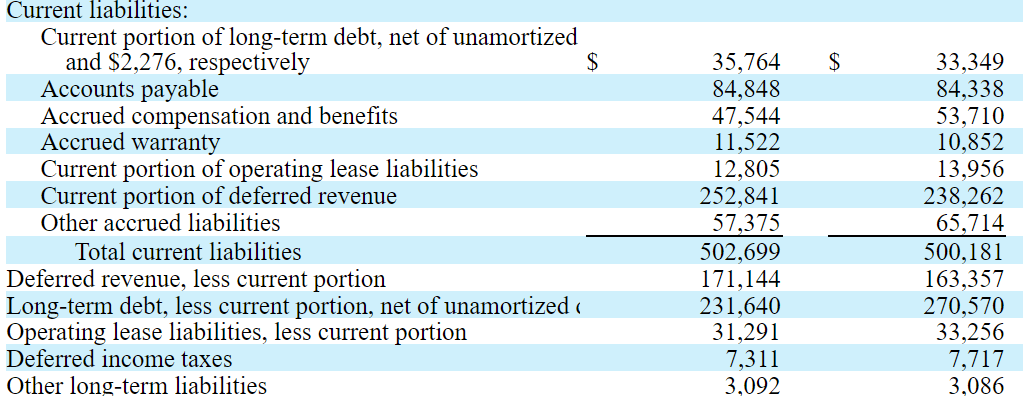

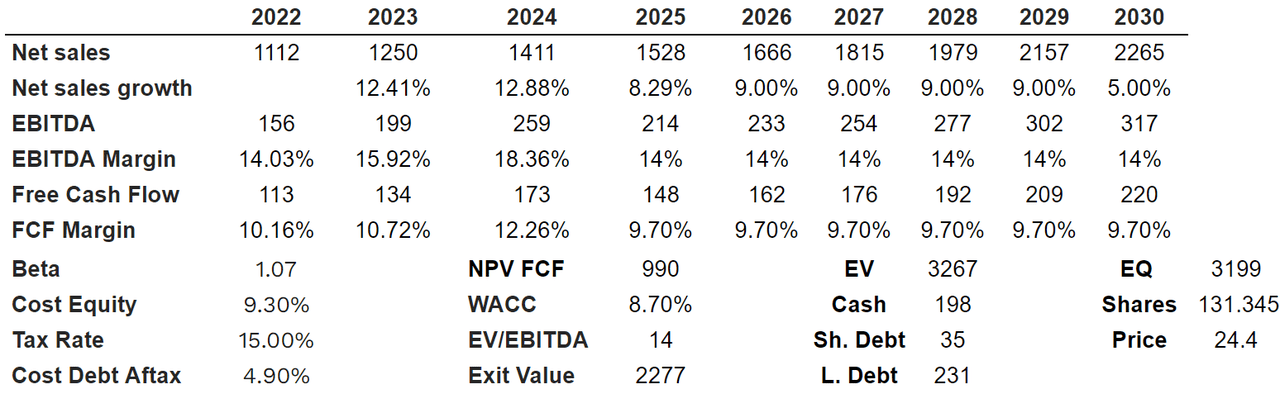

As of September 30, 2022, the company reported cash of $198 million, with accounts receivable of $158.727 million and inventories worth $51.766 million. In addition, the prepaid expenses and other current assets were $73.267 million with total current assets of $482.104 million.

Besides, property and equipment stood at $47.952 million with an operating lease right of use assets worth $34.269 million. The total amount of liquidity appears substantial as close to 50% of the total amount of assets is represented by current assets. With that, current assets/current liabilities stand at less than 1x.

I believe that impairment of goodwill and intangibles could occur. Intangible assets were $28.565 million with goodwill worth $400.144 million together with other assets of $64.746 million. Finally, total assets stood at $1.057 billion.

10-Q

With regards to the list of liabilities, I wouldn’t expect many investors to worry. The current portion of long term debt stood at $35.764 million with accounts payable worth $84.848 million. Accrued compensation was equal to $47 million with an accrued guarantee of $11.522 million.

Deferred revenue was equal to $252.841 million, which I do appreciate. It means that the company receives payments in advance from customers. Management may not need to use substantial debt to finance its operations as clients do help. Total current liabilities were equal to $505 million, which is close to the total amount of current assets.

Long term liabilities include deferred revenue worth $171.144 million, long-term debt worth $231.640 million with an operating lease liability of $31.291 million, and deferred income taxes worth $7.311 million. In sum, I obtained net debt worth $69 million, which appears limited.

10-Q

Extreme Networks Will Likely Grow Because The Target Market Grows

Under normal circumstances, I believe that the company’s business model will benefit from the increase in the target markets. Let’s note that Extreme Networks is working in some of the most innovative IT markets including 5G services, networking software market, on-premise network management, and SD-WAN market. Management provided an estimation of the total target market and growth, which I believe is impressive.

This is comprised of $22 billion for campus networking, $4.6 billion for 5G service available market in 5G and data centers, for which Extreme is targeting growing to approximately $50 – $100 million per year over the next three to five years, and a $2.2 billion SD-WAN market. We also participate in the $4 billion networking software market for solutions such as cloud-based network management, network automation, on-premise network management, and other networking related software. Source: 10-K

I also believe that clients will likely appreciate the company’s scalable cloud and infinitely distributed connectivity offered. Management discussed these characteristics in a recent annual report:

Scalable cloud allows administrators to harness the power of the cloud to efficiently onboard, manage, orchestrate, troubleshoot the network, and find data and insights of the distributed connectivity at their pace in their way.

Infinitely distributed connectivity is the enterprise-grade reliable connectivity that allows users to connect anywhere, from anywhere. It is always present, available and assured, while being secure and manageable. Source: 10-K

Finally, under this case scenario, I assumed that the bet that the company is making to focus on the mobile user will likely enhance future revenue growth. In this regard, management offered the following explanation.

Within the campus, we focus on the mobile user, leveraging our automation capabilities and tracking WLAN growth. Our data center approach leverages our product portfolio to address the needs of public and private cloud data center providers. Source: 10-K

By 2030, I forecast net sales of $2.265 million with net sales growth of 5%, EBITDA of $317 million, and an EBITDA margin of 14%. With 2030 free cash flow of $220 million, the FCF margin would stand at 9.70%, which I believe is achievable.

My CAPM model includes a beta of 1.07x, with a cost equity of 9.30%, a cost debt after tax of 4.90%, and a WACC of 8.7%. With an EV/EBITDA multiple of 14x, the exit value would be $2.2 billion, and the net present value of FCF would be $990 million. If we also subtract the debt, and add the cash in hand, the implied equity would be $3.199 billion. Finally, the implied price would be $24.4.

Author’s Materials

Lack Of Components Like Semiconductor Chips

In my view, lack of certain components like Semiconductor Chips or an increase in their price could affect Extreme networks. If management can’t increase the price of its products, the company may suffer a decrease in the FCF margin. In the worst case scenario, I would expect less products offered to clients, which may lower future revenue growth.

We currently purchase several key components used in the manufacturing of our products from single or limited sources and are dependent upon supply from these sources to meet our needs. At present, semiconductor chips and other components are currently in high demand with limited supply. Source: 10-K

Extreme Networks works with several manufacturing partners, which may send products late, or may not send them at all. Inflationary pressures in the sector may also lead to negotiations with manufacturers, which may result in lower FCF margins. Lower revenue than expected could also be a possibility if quality is not ensured.

These or similar problems may arise in the future, such as delivery of products of inferior quality, delivery of insufficient quantity of products, or the interruption or discontinuance of operations of a manufacturer or other partner, any of which could have a material adverse effect on our business and operating results. While we maintain strong relationships with our manufacturing and other partners, our agreements with these manufacturers are generally of limited duration and pricing, quality, and volume commitments are negotiated on a recurring basis. Source: 10-K

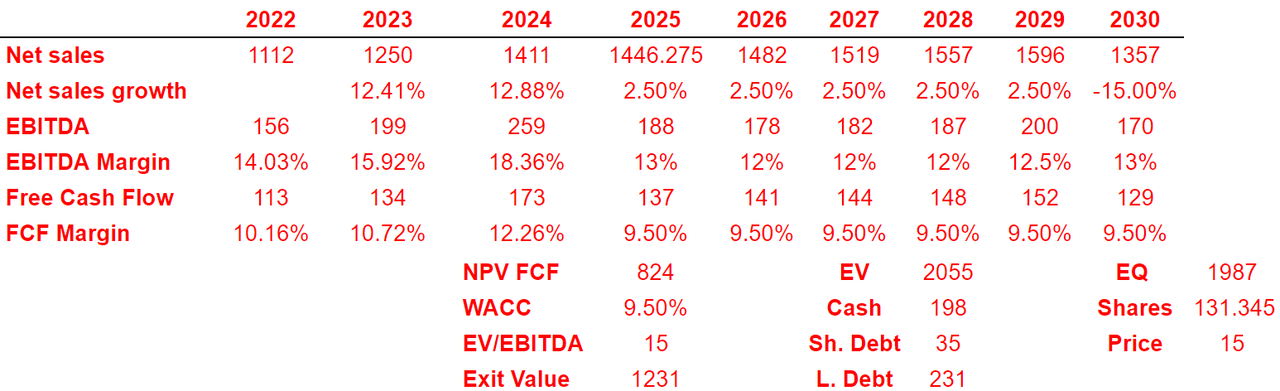

I forecast, for 2030, net sales of $1.357 billion in addition to a net sales growth of -15%. The expected EBITDA will be $170 million along with an EBITDA margin of 13%.

I estimate a 2030 free cash flow of $129 million and a FCF margin of 9.50%. With a WACC of 9.50%, I also obtained a NPV FCF of $824 million. If we also use EV/EBITDA of 15x, the exit value would be $1.231 billion. Finally, my results include an enterprise value of $2.055 billion, an implied equity of $1.987 billion, and a fair price of $15 million.

Author’s Materials

Conclusion

Extreme Networks operates in a market growing at the double-digit, and expects to invest in new innovative technologies like ExtremeCloud SD-WAN or WAN EDGE. In my view, more offerings will likely interest more clients, which may enhance future sales growth. Also, considering recent commentary from management about backlog growth, I believe that Extreme Networks is a must-follow stock. Under my discounted cash flow models, I obtained a valuation that is higher than the market price. Even considering risks from supply chain or lack of components, in my view, the upside potential in the stock price is larger than the downside risks.

Be the first to comment