Just_Super

When markets cratered in March, Nokia (NYSE:NOK) fell with it. Suggested as a stock due for a rally after that dip, the stock ended up falling further. Sentiment shifted to the upside when Nokia posted second-quarter results. NOK stock jumped when it beat market expectations and reaffirmed its guidance for the year.

After years of going nowhere, will this 5G network supplier finally break out and trade at new multi-year highs?

Nokia Posted Strong Second Quarter

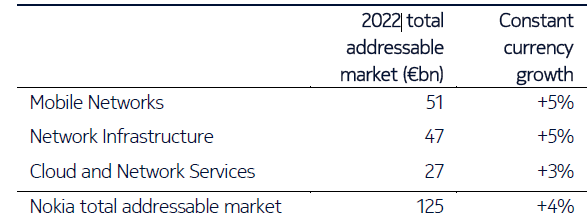

Nokia reported revenue growing by 11.1% Y/Y to EUR 290 million. Network infrastructure led the rise, while net sales from its Cloud and Network Services did not change. Still, the gross margin improved by 150 bps. Its investments in private wireless should lift sales in future quarters. On a constant currency basis, Nokia saw a market share for Mobile Networks of EUR 51 billion.

Nokia Q2/2022 Earnings Presentation

Chart from Nokia Q2/2022 presentation

The table above shows that gross margins rose since Q1/2020.

Its business grew by 5% Y/Y and represents a EUR 51 billion opportunity this year.

Nokia Q2/2022 Earnings Report

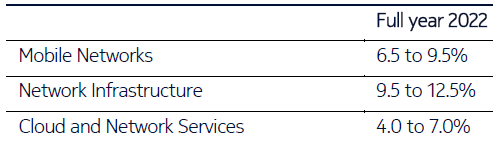

Based on the above addressable market growth, the company forecasted strong operating margins in all divisions. Network Infrastructure has the highest margin potential at up to 12.5% this year:

Nokia Q2/2022 Earnings report

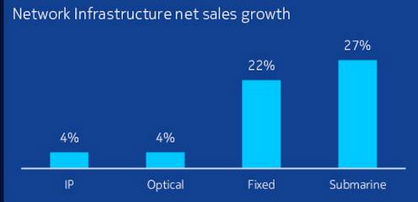

In the table below, net sales grew the most from Submarine and Fixed Networks:

Nokia Q2/2022 Earnings Presentation

In the last quarter, the company experienced some supplier-specific shortages. This hurt its Optical Networks unit. Nokia expects conditions will improve in the second half of the year.

Negative macro trends could hurt the company’s business. However, Nokia continues to benefit from strong investment trends in connectivity. Its customers are not cutting back on 5G and fiber deployments. They need upgrading networks to handle higher data consumption. Companies are demanding increased productivity, so they will not cut back on investing in their network.

Outlook

Nokia expects net sales of between EUR 23.5 billion to EUR 24.7 billion. It will post an operating margin in the double-digit percentage at between 11% to 13.5%. The margin strength is notable. The outlook accounts for inflationary pressure and currency headwinds. Nokia had around 55% of net sales in US dollars in Q2. It benefited from large hedges. For every 10% US dollar strengthening, Nokia’s net sales benefit by 5%. But since Nokia hedged the currency for 12 months, currency fluctuations will not affect its operating profit.

For now, the currency will harm its operating margin. When hedges expire, shareholders should expect higher profitability.

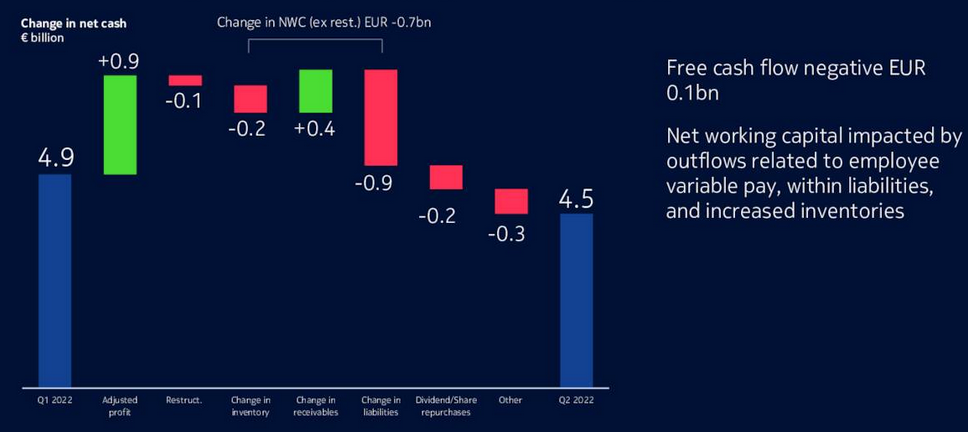

Free cash flow is a 25% – 55% conversion from comparable operating profits. Its recent EUR 0.02 a share dividend is a token amount. After suspending dividends previously, investors should not expect this firm to raise dividends. In the chart below, Nokia posted a negative FCF of EUR 0.1 billion. Employee variable pay and increased inventories hurt its net working capital.

Nokia Q2/2022 Earnings Presentation

Income investors may buy Cisco Systems (CSCO) for its $1.52 a share or 3.35% dividend yield. Ericsson (ERIC) pays a 4.18% dividend yield. However, the SEC is probing its 2019 Iraq report. Ericsson’s Vonage acquisition may have unexpected issues, increasing risks for shareholders.

Opportunity

Nokia increased inventories by EUR 240 million to dampen the risks of the supply chain constraints. When supply chains return to normal, Nokia will have normal lead times again. That will lead to improved operating margins.

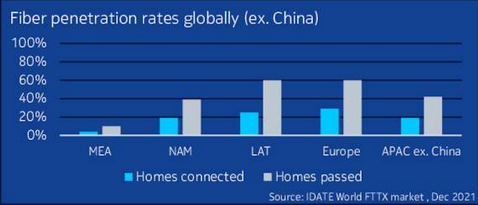

Nokia’s Radio Access Network (or “RAN”) has strong prospects in 2023. Several countries have yet to start 5G. This includes India and Latin America. This rollout should sustain Nokia’s addressable market size. The penetration for 5G is only at 15% (excluding China).

Nokia Q2/2022 Earnings Presentation

Nokia did not change its demand outlook despite the macroeconomic uncertainty. Demand appears inelastic, since the industry benefits when it invests in structural technology.

Supply constraints will limit the business’s growth. Fortunately, these issues will ease in the second half of the year and through the first half of 2023 (H1/2023).

CEO Pekka Lundmark said that Nokia lost market share over a year ago in the early stages of 5G deployment. That trend changed. Now that Nokia caught up on technology, it is returning to growth.

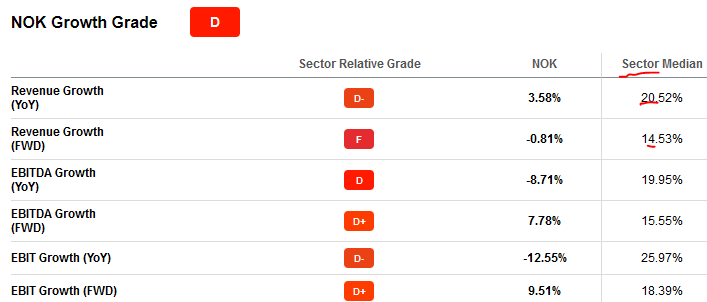

SA Premium

In the Seeking Alpha stock score above, NOK stock scores poorly on growth. Its revenue, EBITDA, and EBIT growth are poor. It is in the single-digit percentage or negative. By comparison, the sector median growth is in the positive double-digit percentage.

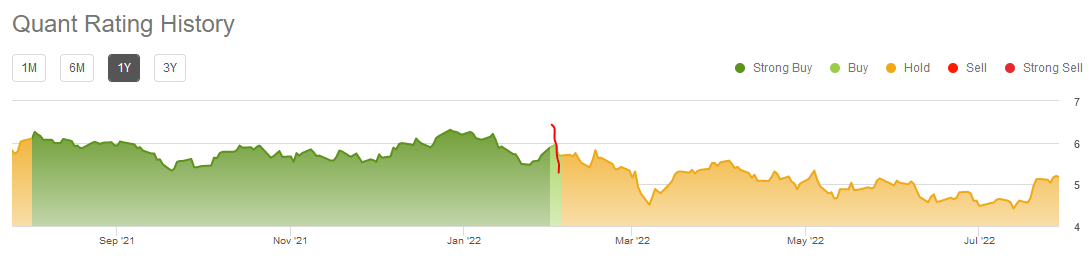

Due partly to the weak growth score, Nokia’s quant rating switched from a “buy” to a “hold” in February 2022:

SA Premium

Nokia will need to post a few quarters of profit growth to earn back a “buy” rating.

Risks

Currency fluctuations may hurt customer affordability in emerging markets. Nokia assumed the supply chain issues would ease. If this does not happen, the company may lower its outlook.

High inflation rates led to a sudden drop in consumer demand. CEO Pekka Lundmark said:

we are now seeing that demand on some consumer equipment is going down.

This is potentially related to the semiconductor and the foundry capacity. In addition, substrate capacity released on the market will have an impact on pricing.

Your Takeaway

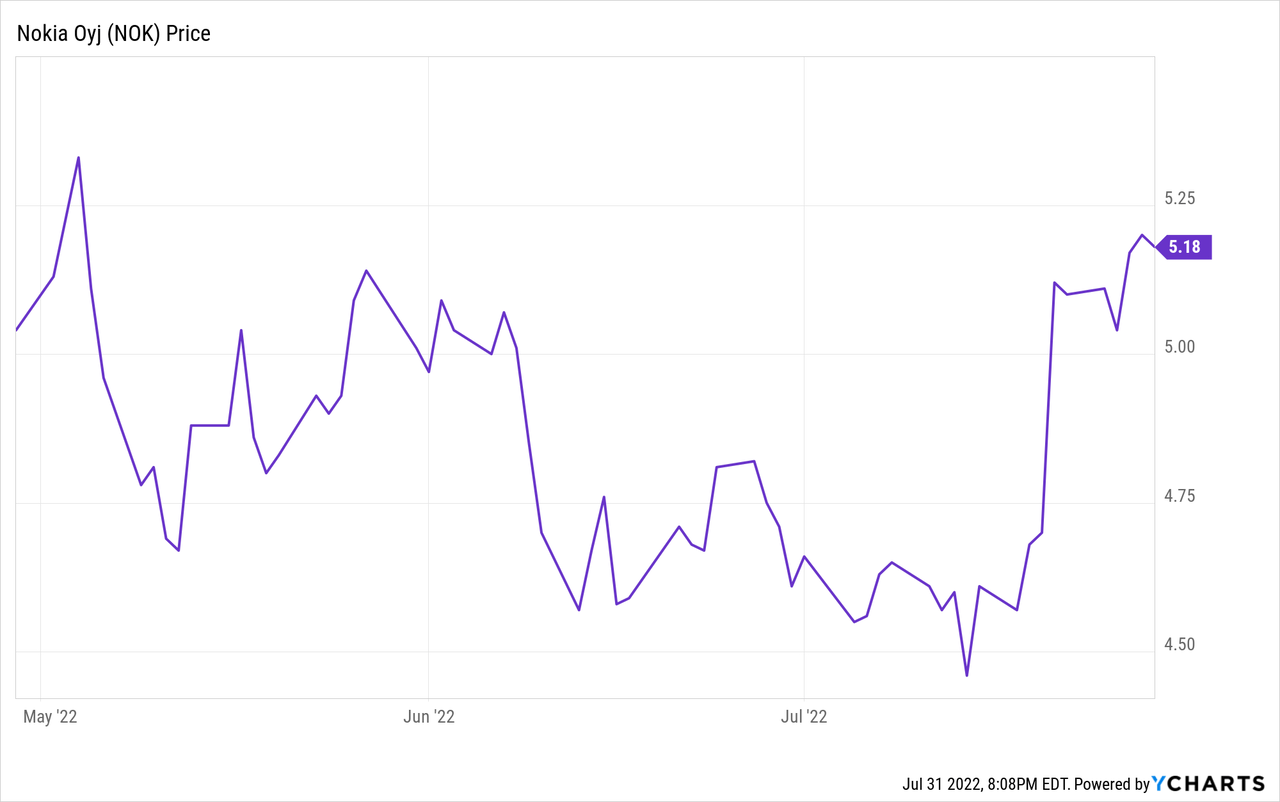

Nokia’s long journey resulted in uneven quarterly results. After management reaffirmed its guidance in last quarter’s report, shareholders praised the company. Shares bounced from a “double bottom” at $4.50.

In the chart above, Nokia bounced at around $4.50 in mid-June and again in mid-July 2022, before the Q2 earnings report.

Should stock markets continue their month-long rally, Nokia could return to 2022 highs.

The stock trades at a low valuation. This will limit any selling downside in the near term.

Be the first to comment