Justin Sullivan

On Wednesday, Apple (NASDAQ:AAPL) held its main product launch of 2022, the Far Out Event. In the event, Apple revealed a number of new products, including:

-

An extreme sports watch (the Apple Watch Ultra).

-

The iPhone 14.

-

Some incremental upgrades to AirPods.

The baseline iPhone 14 was a pretty incremental improvement over the iPhone 13, but the 14 Pro came with a genuinely new feature:

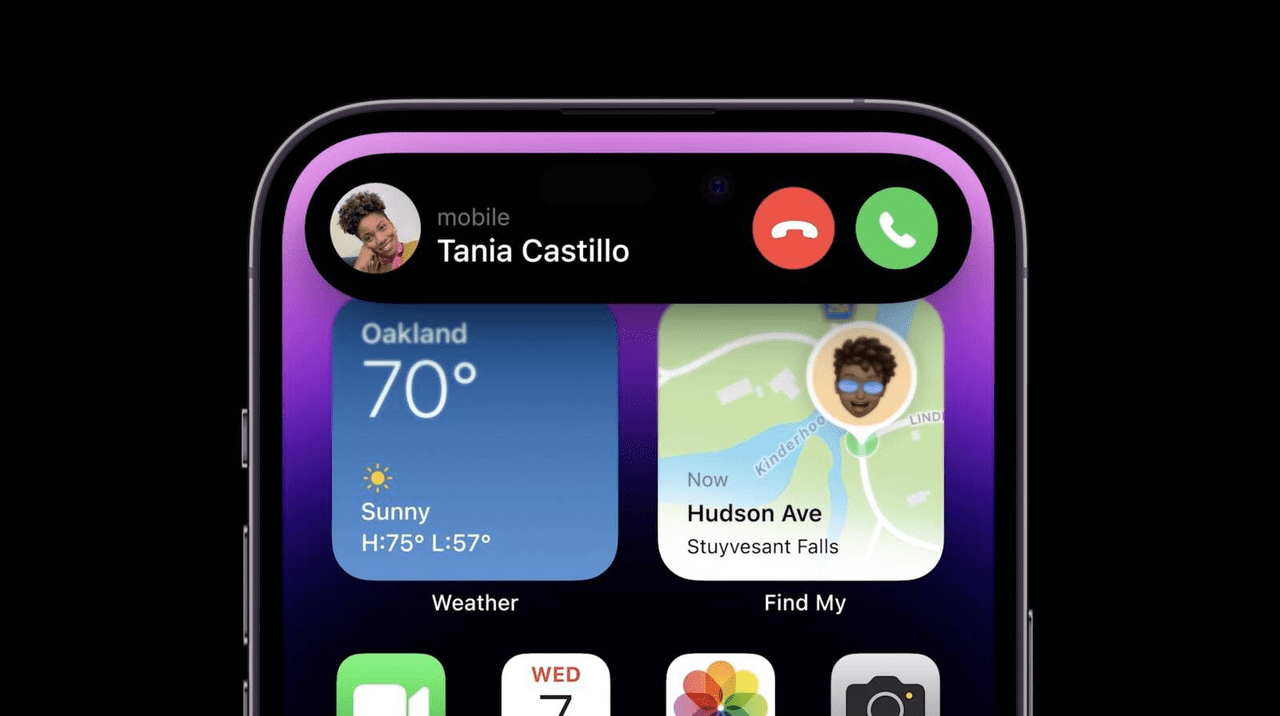

Dynamic Island.

Dynamic Island is a pill shaped camera cut out that integrates with iPhone’s UI, so that the cut out becomes a UI feature rather than empty screen real estate. Compared to the previous notch, this feature appears to be a vast improvement. Apple has long been criticized for using notches when other manufacturers had switched to smaller pill shape cut outs. The Dynamic Island addresses these criticisms and then some. Not only is the camera cut out smaller now, it actually transforms into usable screen real estate that can show volume controls, incoming calls, directions, and more. As you can see in the image below, the camera ceases to be noticeable when one of these UI features is activated.

Dynamic Island (Apple)

Dynamic Island was well received by reviewers in their first impressions videos. Marques Brownlee, for example, mentioned in a September 8 video that he found it useful and ‘friendly’. Although internet commenters made jokes about the feature’s name, tech reviewers who tried it after the event found it enjoyable to use.

Dynamic Island could be a real catalyst for Apple stock. Apple has received a lot of praise lately for its success with the M-series chips and services, but has been suffering from a perception that its pace of innovation has slowed down. With the iPhone 14 Pro, Apple has taken a major step in UI/UX design, accommodating its camera in a way that is not only not intrusive, but actually an improvement to usability. For this and a few other reasons, I have upgraded my Apple rating to strong buy. When I last covered it, I rated Apple a buy, but not a strong buy, as I found it somewhat expensive. Today, AAPL is much cheaper than it was when I last covered it, and if the new features announced Yesterday take off, they could collectively serve as a catalyst that drives strong revenue growth.

Apple’s Recent Product Successes

Apple has been having a lot of successes with products in recent years. Many of the company’s new launches have been wins, some notable hits including:

-

The AirPods lineup, which does more revenue than many entire NASDAQ companies.

-

M-series chips, which improved the performance of Macs and iPads.

-

The Apple Watch, which quickly rose to become the #1 Smart Watch in the world.

These were all successful products. However, they were not Steve Jobs calibre innovations. The Apple Watch would probably be the closest thing Tim Cook has had to a Steve Jobs era launch: it quickly swept most competitors under the rug after launching. Apart from that, though, we haven’t seen a whole lot.

The Dynamic Island is the biggest UI innovation on an iPhone since Face ID. It takes the camera cut out and uses it as the center of a black screen widget that displays information that’s useful to the user. You can make it bigger or smaller by touching it, and use it to control music and other such features. This is an approach that no other smartphone company has taken before, and it could make the iPhone 14 Pro the go-to phone this Holiday Season.

Perfectly Primed for Christmas Shopping

You might wonder why I’ve spent so much time on a UI feature given that this is a stock analysis article, rather than a product review. The answer has to do with the upcoming Holiday season. The Christmas shopping season is around the corner, and the number of Gen Z members owning iPhones is on the rise. According to Piper Sandler, 88% of Gen Z members (i.e. teens) want an iPhone for their next phone. New features like Dynamic Island and satellite connectivity add to the case that they should get one. The Far Out event didn’t contain any true game-changers that would turn Android users into Apple users, but it might have been enough to make iPhone 14 Pro the must-have gift this Christmas. That provides reason to think that Apple will meet or beat expectations in next two earnings releases (at least on the top line).

Apple’s Financials

Speaking of the top line, it’s now time to take a look at Apple’s financials. Apple is a very profitable company with decent historical growth. However, its most recent quarter featured only 2% revenue growth and -7.7% earnings growth. We’ll need to see some acceleration from there in order for Apple’s stock to really start moving.

In its most recent quarter, Apple delivered:

-

$83 billion in revenue, up 2%.

-

$23 billion in operating income, down 4.3%.

-

$19.4 billion in net income, down 10.5%.

-

$1.20 in diluted EPS, down 7.7%.

It was a reasonably good quarter. Obviously, the growth was pretty slow, but that’s expected for a tech company during an economic contraction. Not only did the economy contract this year, but Apple hadn’t done many big launches in the lead up to the second quarter release. The biggest one was the Mac Studio, a high power computer for creatives–it was popular with its user base but was not a mass-market device. So, we’d expect Apple’s sales to have slowed down in Q2.

We might potentially see them accelerate in Q3. The iPhone 14 features the biggest upgrades to the iPhone in years (Dynamic Island and Satellite), so we could see a lot of orders come in. Potentially enough to make revenue growth pick up a percent or two.

Next, we can look at Apple’s balance sheet. This is one of the weaker points for the stock: Apple is much more indebted than Alphabet (GOOG) (GOOGL) or Meta Platforms (META), but it’s not in bad shape. Some highlight balance sheet metrics include:

-

$336 billion in assets.

-

$278 billion in liabilities.

-

$58 billion in book value.

-

$112 billion in current assets.

-

$129 billion in current liabilities.

-

$119.6 billion in debt.

To be quite frank, this isn’t the best balance sheet in big tech. Apple has a current ratio of 0.86 and a debt/equity ratio of 2. Normally we want to see a current ratio above one and a debt/equity ratio below one. Google and Meta have achieved both, so they’re not unrealistic targets. On the plus side, Apple’s low book value (relatively speaking) means that it has a very high 33.4% return on equity, higher than Meta and Google. Still, the company appears more likely to have liquidity issues than its peers.

Valuation

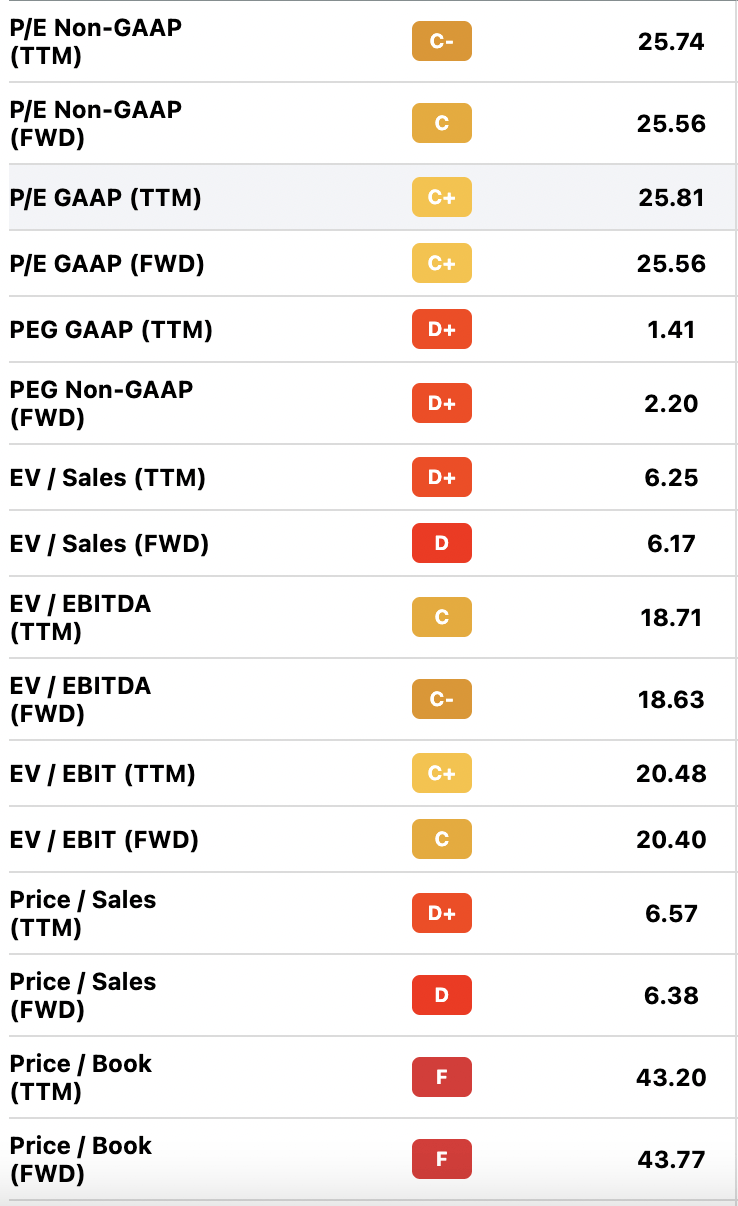

Having looked at Apple’s finances, our last stop is to look at its valuation. Below is a selection of valuation multiples that Seeking Alpha Quant has on file for AAPL:

Apple valuation multiples (seeking alpha quant)

As you can see, they’re relatively high, but not stratospheric. The earnings multiple is lower than that of Microsoft (MSFT) and Amazon (AMZN), as is the cash flow multiple (21.2). On the other hand, most of the multiplies above are higher than for Google or Meta. So Apple is in the middle of the ‘FAANG’ pack for multiples-based valuation.

To arrive at a precise price target for Apple, we can do a discounted cash flow analysis on it. In a previous article, I arrived at a range of price targets from $90 to $290 depending on the discount rate used. Since writing that article, the 10 year treasury yield has risen from 2.88% to 3.32%. Plugging that discount rate into my previous model, and leaving everything else unchanged, I get a high-end intrinsic value estimate of $249. My low end estimate of $90 does not change, as that one uses Apple’s weighted average cost of capital instead of the treasury yield.

Overall, the rising treasury yield has reduced the range of value estimates that my old Apple model yielded. However, that model assumed only 5% annual growth. Today, with Apple’s new iPhone set to launch, we have a catalyst in the picture that could take growth higher. I think growth acceleration has a bigger impact than a modest increase in treasury yields, plus Apple’s stock price has gone down, so I’m upgrading AAPL from ‘buy’ to ‘strong buy.’

One Big Risk to Watch Out For

As we’ve seen in this article, Apple is a relatively expensive stock, but a highly profitable company, with an economic moat. On the whole, my analysis favors an investment in Apple. However, there is one big risk investors will want to look out for:

Continued macro weakness that impacts the consumer. Apple is the most consumer focused of all the big tech giants. Unlike Microsoft, Google and Amazon, it does not have a big cloud division that sells to enterprises. It does sell computers to schools and creative businesses (e.g. ad agencies), but these activities are small as a percentage of Apple’s revenue. If we were to enter a high unemployment environment, then Apple’s sales would likely suffer. There’s a perception that Apple customers are rich, and can keep buying tech during recessions. That would explain Apple’s rising sales during the 2008 recession, but today, 87% of Gen Z are iPhone users. That many American Youths can’t be rich, as they’re an overwhelming majority of their age cohort. So, this time around, we might see Apple take a hit.

The Bottom Line

The bottom line on Apple is that it’s a highly profitable tech company with an economic moat and modest but respectable growth. On the whole, it’s a worthy tech name. To be sure, it is exposed to risks owing to the fragile economic environment we find ourselves in. But for long-term investors, they are risks worth taking.

Be the first to comment