cagkansayin

Co-produced with Beyond Saving

The GEO Group (NYSE:GEO) has announced the exchange offer for its 2023 and 2024 bonds that we have been anticipating. Since late last year, GEO has been in negotiations to handle the refinancing of the debt it had coming due. The exchange offer gives the 2023 and 2024 bondholders the option to either swap for New 2028 Notes with a coupon of 10.5%, or a combination of cash and New Notes.

In the past few years, you’ve likely seen in the news that some prior lenders announced that they would no longer be lending to any private prisons. This caused GEO to de-REIT in an effort to increase the cash flow available to pay down debt. The most recent agreement provides a path to lengthen its maturity schedule and provides ample time for GEO to deleverage.

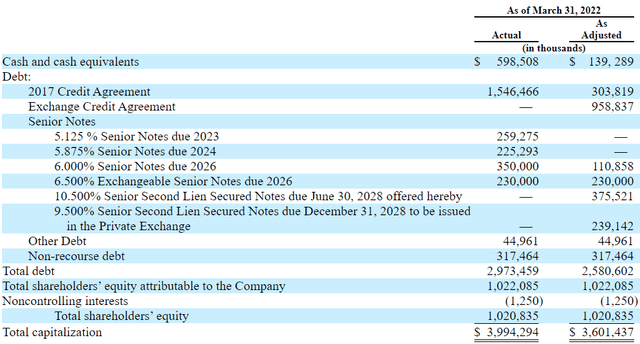

Below is an excerpt from GEO’s S-4 filed on July 19th, showing the impact of this exchange offer, assuming that 50% of bondholders opt for the cash option and 50% opt for the new Notes. The numbers on the left are as of March 31st, and the numbers on the right are adjusted for what it might look like after the exchange offer is closed:

Note that GEO intends on entirely discharging its 2023 and 2024 bonds. The only debt GEO will have maturing in 2024 is the $304 million from the 2017 Credit Agreement lenders, who are not expected to take GEO up on its offer. GEO’s 2026 maturities will be reduced from $580 million to $340 million. The Exchange Credit Agreement will mature in 2027, and the New Notes will mature in 2028.

This provides GEO with a lot more time to pay down debt. As part of the transaction, GEO will be required to dedicate 80% of excess cash flow to paying down debt. That should be $150-$200 million per year, about what the common share dividend used to be. This aggressive debt reduction will be a huge benefit for bondholders. GEO’s problem never was cash flow. As Moody’s pointed out when it downgraded GEO’s debt earlier this year, GEO’s operations are “stable”, the concern was ESG risks and whether lenders would be willing to lend to GEO.

This is a benefit for all the bonds, including the 2026 Notes, making them lower risk and greatly improving the likelihood that they are redeemed at par in 2026. For the 2023 and 2024 Notes, there is a decision to make. Do you want to accept the exchange, do a partial exchange, or refuse to exchange?

Now we see the exchange offer, and investors have options. Let’s walk through your choices if you hold the 2023 or 2024 bonds.

The Exchange Offer: To Tender Or Not To Tender?

Here is the exchange offer for each $1,000 in principal:

2023 Notes (36159RAG8): either A) $1,050 of New Notes, or B) $700 in cash and $300 in New Notes.

2024 Notes (36162JAA4): either C) $1,030 of New Notes, or D) $250 in cash and $750 in New Notes.

As an example, if you own 10 of the 2023 bonds ($10,000 face value):

- you can get $7,000 in cash and have $3,000 in the New 2028 Notes,

- or $10,000 in New Notes and $500 in cash.

Why not $10,500 in New Notes? Since bonds are in increments of $1,000 if the amount of new bonds you are entitled to is not divisible by $1,000, it will be rounded down, and you will get cash for the difference. You would need to exchange at least 20 bonds for the $50 extra principal to add up to a full bond. Otherwise, the $50 (or $30 for the 2024 Notes) will come as a cash payment.

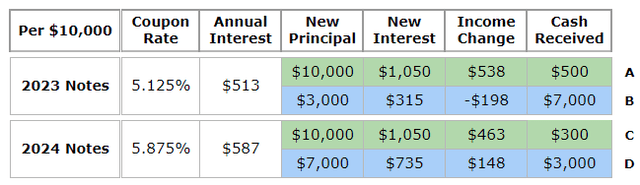

Here is what each offer would look like if you exchanged 10 bonds. The green section is if you take New Notes, and the blue is if you take the Cash/Notes combination.

Note that the deal clearly favors making an exchange over holding the current Notes. You receive a much higher income by exchanging; the 2028 bonds have a 10.5% interest rate. Even though the cash option B of the 2023 Notes leads to lower interest, since you receive $7,000 in cash, you would only need to re-invest that capital at a 2.8% yield to replace the “lost” income.

If you choose not to tender, your Notes will remain outstanding as they are and will be redeemed at par upon maturity. However, it is important to note that after this transaction closes, it is very likely that trading the old notes will be nearly impossible due to liquidity issues and the much higher coupon of the New Notes. If you choose to hold the Old Notes, be prepared to hold them until maturity.

Pros/Cons

Here are the three main alternatives to accepting the full exchange offer:

1) Keep Old Bonds

Pros:

- The original maturity date remains binding.

- With few bonds likely to remain outstanding, GEO will easily be able to pay at maturity, creating little risk.

- Yield to maturity is currently about 10%.

- Overall, you will receive a very good total return with minimal risk.

Cons:

- Income is much less.

- At maturity, you will need to reinvest in something different. Bond opportunities are good today, they might not be in 8 to 24 months.

- The New Notes will be structurally senior.

- Selling the Old Notes after the exchange might be challenging due to low volumes and the low coupon. Investors choosing to hold should be prepared to commit to holding until maturity.

- Last week, Moody’s and S&P both downgraded GEO’s 2023 and 2024 bonds.

2) Accept the Offer for a Partial Exchange

Pros:

- Receive cash at closing. This is the equivalent of “taking some chips off the table”. You receive a portion in cash that you can reinvest elsewhere and still hold some of the higher-yielding New Notes.

- Income will go up (though for the 2023s might require reinvestment of some of the cash payment elsewhere)

- Gain a 2nd Lien interest in GEO’s real estate. This provides a little more security and slightly improves the odds of recovery if GEO defaults in the future.

- You will have the option to sell your New Notes at market price whenever you want.

- This option is best for those who want to derisk while still receiving income from GEO.

Cons:

- You maintain exposure to risks at GEO. The New Notes don’t mature until 2028, after the credit facility.

- There is no guarantee of what the price of the new bonds will do once they are traded publicly. They could trade at a premium, or they could trade at a discount.

- Roughly half of GEO’s debt ($1.25 billion) will be first lien and, therefore, still senior to the New Notes.

3) Sell GEO Bonds

Pros:

- Receive immediate cash.

- Realize your gains/losses and not have to think about GEO again.

Cons:

- Prices are above average compared to the past few years, but are still at a discount to par.

- It is unlikely to find something of a similar or lower risk at a similar or higher yield.

- Your income would decline.

HDO’s Decision

For the HDO Model Portfolio, we will be taking advantage of exchanging the full amount (options A and C above). This leads to a significant increase in income, and we remain very confident that GEO is on the right path to deleveraging and creating a much more stable balance sheet.

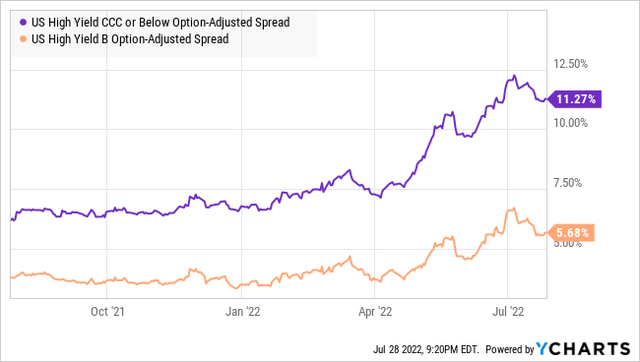

It is also worth noting that bond spreads are very high right now. As I noted recently, this is something I don’t expect to persist long-term. This also creates many opportunities for bond prices to rise. The bond prices will be driven up:

- As GEO deleverages, 80% of the excess cash flow will be directed to pay down debt. This is now contractually required and no longer at the discretion of management. This will result in significant and fairly rapid deleveraging. As debt declines, the risks to the bonds diminish.

- As bond spreads tighten back up, the price will rise. Some people have expressed surprise at the 10.5% coupon. But remember, interest rates and spreads are getting wider. GEO is currently rated CCC by Moody’s, but for a 6-year bond, a CCC would be priced with a coupon of around 14.5%. GEO’s lenders priced GEO closer to B, with a spread of 7.5%.

- If B-rated bond spreads revert to 4%, we could expect GEO’s new Notes to rise and be priced with a yield-to-maturity closer to 8.5% As GEO deleverages, its credit rating should improve, which would provide more uplift for GEO bonds.

- I hate to talk politics, but let’s face it: If political power in Washington D.C. shifts, the perception of GEO can do an about-face in a positive way incredibly fast. So far, absolutely nothing has been done legislatively on the national level to impact GEO. As predicted, even Executive Orders have had no tangible impact on GEO’s earnings. It is the fear that maybe something might happen that has impacted GEO. If Congress returns to two-party rule, the perception of the risk of such a thing happening likely declines considerably. That change in perception could have a huge positive impact on GEO’s bonds.

How To Tender Your Bonds

GEO is aiming to complete this transaction within 30-90 days. The deadline to tender is August 16th, 2022; though, typically, brokers have an earlier cutoff for you to notify them because the process takes time. By now, you should have received information from your broker about how to tender your bonds. Make sure you keep an eye on your e-mail or mail regarding corporate actions. If you don’t yet see anything from your broker, you might want to call the bond desk.

Note that you are not required to tender all of your bonds. You do have the option of tendering some and keeping others. The minimum is $2,000 (2 bonds). You will receive cash if you only own one bond and tender it.

Shutterstock

Conclusion

Fundamentally, GEO’s business has been improving. Their largest challenge through COVID was the shutdown of immigration, dramatically reducing population levels at their ICE facilities. This is expected to remain a headwind this year, but population levels have been ticking up. GEO has ample cash flow and was using a sizable portion to buy bonds on the open market at a discount to par. We can expect GEO to continue to deleverage at a steady pace of $150-$200 million/year, plus this transaction alone is expected to reduce outstanding debt by nearly $400 million.

GEO provides a service that the Federal Government needs, as represented last month when the U.S. Marshals Service got an exemption to maintain its contract with GEO in San Diego through 2027. GEO has also worked with the Marshals Service to provide the services through state contracts. The Marshals pay the state, and the state pays GEO for the same space that GEO was previously leasing to the Marshals directly. At the end of the day, the Feds have nowhere to put the prisoners. An Executive Order can get some great press, but it doesn’t come with the funds necessary to create a viable alternative.

I’ll leave the morality and politics to others. Whether GEO should or shouldn’t exist is a question that is well above my pay grade. But it does exist, and the government needs it to exist for the foreseeable future. This means GEO has significant cash flow, and the bonds are a fantastic way to benefit from that. It is an area where the market is putting politics ahead of financial risk calculations. I’m happy to collect the extra income.

GEO will be reporting Q2 earnings on the morning of August 2nd, before the deadline for the exchange offer. That will allow us to do estimates of GEO’s cash flow and debt coverage levels post-earnings to have more information confirming an exchange decision.

Be the first to comment