Joe Raedle

It’s not hard to find dividend stocks that yield 7%, 8%, or even 9% in today’s market, as such opportunities can be found amongst BDCs, MLPs, and REITs. On the other hand, it’s hard to find dividend aristocrats that yield close to 5%. That’s because dividend aristocrats are comprised of large C-Corporations that do not have the pass-through tax benefits that the aforementioned asset classes have.

This brings me to Walgreens Boots Alliance (NASDAQ:WBA), which is one such dividend aristocrat that comes with a cheap valuation and trades close to 5%. In this article, I highlight why WBA is likely closer to its bottom than its top, and what makes it an attractive stock at present, so let’s get started.

Why WBA?

Walgreens Boots Alliance is a global leader in retail pharmacy with over a century’s experience in the space. It brands itself as “America’s Drugstore” and has 13,000 locations in all 50 states and Europe and Latin America, and in addition, has a material equity stake in the drug distribution giant, AmerisourceBergen (ABC).

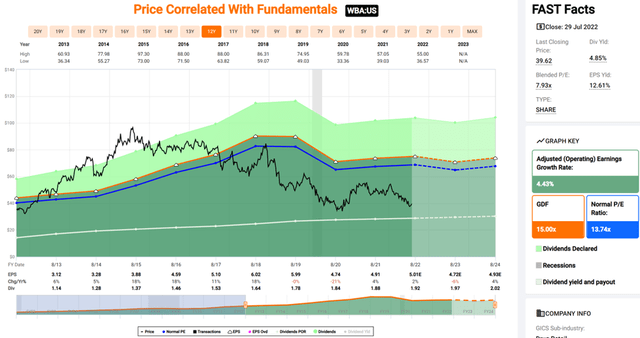

To get a sense of how cheap WBA has gotten, at the current price of $39.62, it’s now trading well below its 52-week high of $55. Looking further back, it’s more than half below its $85 price point from end of 2018.

Of course, WBA does have some headwinds, including competition from Amazon’s (AMZN) entry into online pharmacy and potentially into the primary care space as well with its recently announced acquisition of One Medical. This is one area that WBA and its peer, CVS Health (CVS), are trying to get into as they seek to diversify their business models and achieve growth to offset reimbursement pressures from pharmacy benefit managers.

Moreover, WBA is seeing challenges in top-line growth on back of a 4.2% YoY revenue decline in its fiscal third quarter (ended in May). It’s worth noting, however, that revenue was down by just 2.8% on a constant currency basis due to a strengthening dollar, especially compared to the British pound and the Euro.

Also, U.S. comparable sales increased by 1.8%, but declined on an overall basis due to AllianceRx, which WBA acquired from AmerisourceBergen last year. Boots UK retail saw encouraging comparable sales growth of 24%, and achieved nearly 500K customer orders for the innovative healthcare service, Boots Online Doctor, since launching a year ago.

While some may see WBA with a pessimistic lens, I see a business in transition, as WBA’s digital platform is showing promise, with a robust 25% growth in sales during Q3, driven by 2.8 million same day pick-up orders. This is on top of 95% growth in the prior-year period. Notably, WBA’s rewards and loyalty program, MyWalgreens, now has 99 million members. It also recently opened a fourth automated micro-fulfillment center that supports 1,110 stores, and this could result in operating efficiencies down the line.

Furthermore, it continues to make progress towards primary care services through Walgreens Health, as noted by management during the recent conference call:

We have been agile and proactive in managing inflationary cost pressures and supply chain disruptions while further enhancing our relevance to consumers through our loyalty, omni-channel and owned brand initiatives. Our commitment to serve local communities with convenience and real value is resonating well.

At the same time, we’re making important strides in building our next growth engine, Walgreens Health. VillageMD and Shields continue to realize tremendous top line growth, and we’ve added a third strategic partner for our Walgreens Health organic venture, bringing the number of lives covered above the 2022 year-end target of 2 million.

Additionally, we launched our clinical trials business to improve access and diversity. We are moving quickly to implement our vision of consumer-centric, tech-enabled health care solutions that improve outcomes and lower costs for patients, providers and payers.

Meanwhile, WBA maintains a solid BBB rated balance sheet and pays a well-covered 4.9% dividend yield with a 35% payout ratio. While its 5-year dividend CAGR has been just 5%, I see the high yield as making up for it, with potential for higher increases down the line as growth initiatives come into fruition.

Lastly, I find WBA to be attractively valued at the current price of $39.62 with a forward PE of just 7.9x, which is a valuation generally reserved for companies that are in a perpetual decline. This also sits well below WBA’s normal PE of 13.7 over the past decade. Sell side analysts have an average price target of $42.84 and Morningstar has a $48 fair value estimate, implying a potential one-year total return in the 13-26% range.

Investor Takeaway

Walgreens Boots Alliance is a company in transition, as it looks to diversify its business model and achieve growth. It’s also making progress towards distribution efficiency and is seeing promising growth in its online and primary care offerings. While the near-term may be challenging, I believe the long-term prospects are favorable and the current valuation presents an attractive entry point.

Be the first to comment