Md Ariful Islam

Shares of cell therapy upstart Nkarta (NASDAQ:NKTX) have lost over 80% of their value in the past 3 years. In 2022 alone they are down 45%.

This interesting name in the NK (natural killer) cell therapy space drew my attention earlier this year in April when it released promising preliminary data for early stage drug candidates in AML (acute myeloid leukemia) and NHL (non-Hodgkin lymphoma). While share price more than doubled from lows on these results and allowed the company to access much-needed funding, recently (for reasons I’m not aware of) the stock is trading at lows and EV (enterprise value) is getting closer to zero.

When debating valuation disconnects in the biotech sector, I’ve found it’s better to approach any given company in question as “guilty until proven innocent”. From that starting point, I still wish to dig deeper into the story here to gauge prospects for a rebound in 2023 as well as whether the company is worth adding exposure to my ROTY (Runners Of The Year) clinical stage portfolio.

Chart

Figure 1: NKTX weekly chart

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what’s going on. In the weekly chart above, it’s hard to believe that share price hit a high above $70 before the peak of the biotech bubble in early 2021. From there they steadily declined to below $10, with April’s data update causing a temporary spike to $20. My guess is that as these results were early and a significant catalyst desert followed, current decline to high single digits could be a buying opportunity. Thus, readers who believe 2023 updates will be incrementally positive should take advantage of current lows to purchase a pilot position.

Overview

Founded in 2015 with headquarters in San Francisco (155 employees), Nkarta currently sports an enterprise value of only ~$20M given Q3 cash position of $395M. The cash provides them operational runway into 2025.

As of Q3 there are 48.6M weighted average common shares outstanding, up nearly 50% from prior year’s total of 32.9M weighted average common shares outstanding. Such a level of dilution is quite high, but not outside of the norm especially during the recent biotech bear market as companies struggle to keep the lights on and advantageously access capital to extend runway for years to come.

Nkarta’s presentation at Evercore ISI is just 16 minutes but provides an excellent overview of current operations.

President and CEO Paul Hastings believes the company is in the lead in the innate cell therapy (off-the-shelf) space. The principal autologous CAR-T players out in the front say 20% to 30% of patients eligible for therapy actually get therapy and a year later 63% of those patients who respond relapse. In contrast, the beauty of NK cells is that they can be redosed both cycle to cycle as well as months later. NK cells are uniquely set up to be an outpatient, cryopreserved, off-the-shelf, available in that outpatient setting (not in hospital-based setting in intensive care unit) for patients who need them on an immediate, as demanded schedule.

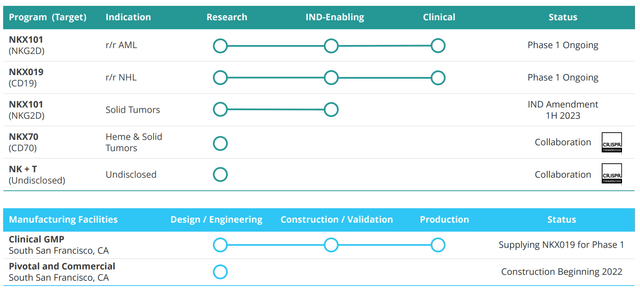

Nkarta’s modular NK cell engineering platform allows them to generate new candidates in a rapid, cost-efficient manner. Their approach for engineering NK cells involves CARs on the surface to enable the cell to recognize specific proteins or antigens present on the surface of tumor cells. This has led to a steadily growing pipeline with multiple novel candidates set to enter the clinic in the next year or so, as seen below.

Figure 2: Pipeline

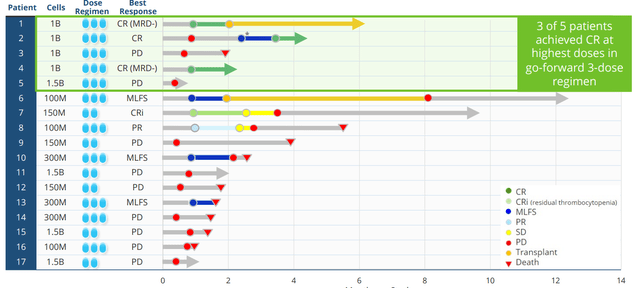

NKX101 is their lead candidate and involves the primary activating receptor for NK cells, known as NKG2D (works through detection of stress ligands displayed by cancerous cells). They have engineered NKX101 to increase cancer cell killing ability by raising levels of NKG2D at least ten-fold (compared to non-engineered NK cells) and by adding a costimulatory domain (signaling element for white blood cells). For this program, they treated first patient in late 2020 in a phase 1 study looking at those with relapsed/refractory acute myeloid leukemia (AML) or higher risk myelodysplastic syndromes (MDS). The goal is to find the right dose then expand at recommended phase 2 dose. Initial data in April was interesting with 60% complete response (CR) rate in 3 of 5 AML patients. However, 0 of 2 MDS patients responded (more on this in a later section).

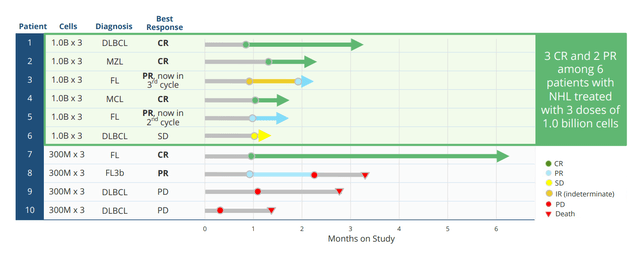

Moving on to NKX019, this drug candidate is based on the ability to treat a variety of B-cell malignancies by targeting the CD19 antigen. It bears noting that at this point I’m not a fan of this space, as it’s quite crowded with other NK, CAR-T and monoclonal antibody players already setting a high bar in terms of efficacy. Anyway, in October 2021 Nkarta treated the first patients and goal here to is to find recommended phase 2 dose then move into expansion. Initial data here was quite promising with 83% ORR at the high dose (1B cells x 3 doses) and 50% CR rate. While this was in a low number of patients, it’s still interesting considering heavily-pretreated nature with 4 median prior lines of therapy (again, more on this below including my notes on the associated conference call).

Figure 3: Rapid responses including CRs for NKX019 monotherapy

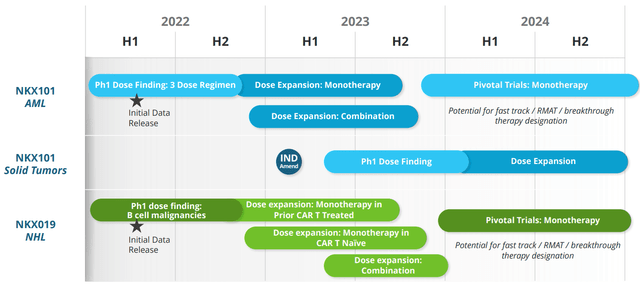

Nkarta will provide an update by end of the year on 6 additional patients on 1.5B x 3 dose cohort (days 0, 7 and 14) following cycle of lymphodepletion. Those will be best response patients and they will also provide update on earlier patients as well. Right now it’s a monotherapy program and they are seeing single cycle CRs and durable responses. In the future, they will go single agent as well as combination at the same time (expand trials in both). Combo partners could include rituximab (top of the list) or other agents given in this disease space.

For this lymphoma program, the objective is that they can continue to demonstrate activity on par with autologous CAR-T (the bar) with 30% to 40% CR rate as well as in terms of durability. The big question is whether an allogeneic product can demonstrate durability on par with those and again whereas CAR-T can overshoot or undershoot, NK cell therapy is adaptable (give patients what they need). As a leader in the field, Nkarta aims to demonstrate that off-the-shelf cell therapy can be disruptive and can un-entrench the dogma that auto CAR-T is the only one that can get durable responses. Nkarta says they are the only NK company with single agent, dose escalation activity so far (most peers are going directly into combo). Thus, management believes they have a dual path to registration if response rates hold up and can be maintained with single agent or via rituximab combination. As data evolves, they’ll know whether to go both ways or just one way. Goal right now is to get the update out there, then talk about where they could go next and path to registration.

As for the big question of whether autologous CAR-T cell therapies will be easy to displace or difficult, management notes that the stickiness of auto CAR-T therapies is that they work. They postulate that if you have something that works equally but doesn’t have cytokine release syndrome, doesn’t have neurotoxicity or graft-versus-host disease or has marked decrease in those things, they can overcome that stickiness. CAR-Ts are entrenched in certain areas (large academic or medical center), so this is an access issue too (sticky where they can get it). The 80% or so that don’t have access to that transformative therapy is where Nkarta (and other allogeneic companies) can be disruptive.

The company has additional early-stage candidates in the pipeline as well as an interesting discovery collaboration with CRISPR Therapeutics (CRSP) starting with CAR-NK program targeting CD70 for the treatment of solid tumors and NK+T program which seeks to take advantage of both the innate and adaptive immune system (potential applications to a variety of cancers). Under the 2021 agreement CRISPR also granted them non-exclusive licenses to up to five gene-editing targets to enable Nkarta to independently research and commercialize NK cell therapies utilizing CRISPR/s gene editing technology.

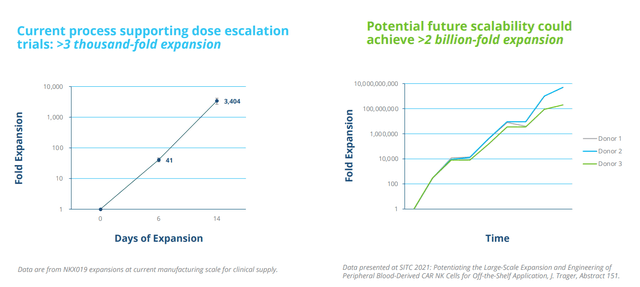

Of note in the context of supply disruptions faced by auto CAR-T companies, Nkarta has an intensive focus on internal manufacturing capabilities and currently produces NKX019 at its 2,700 square foot cGMP facility in San Francisco. The company is also constructing an 88,000 square foot facility to support pivotal studies and commercial supply. In terms of advances with NK cell expansion, they are scaling up manufacturing and SITC data showed 2B fold expansion (pretty unheard of when even a billion-fold expansion would be terrific).

Figure 4: Proprietary expansion and engineering enable industrial-scale manufacturing

These incremental improvements will be built in (will take a while to get to that multiplication of cells). This will give Nkarta the flexibility to redose cost-efficiently (ie. if a patient relapses one year later).

The company will provide update by end of the year on 6 additional patients on 1.5B x 3 dose cohort (days 0, 7 and 14) following cycle of lymphodepletion. Those will be best response patients and they will provide update one earlier patients as well. Right now it’s monotherapy program and they are seeing single cycle CRs and durable responses. They will update the last patients updated in April and give best response for the new responses. They will go single agent as well as combination at the same time (expand in both). Combo partners could include rituximab or other agents given in this disease space. As for whether autologous CAR-T cell therapies will be easy to displace or difficult, the stickiness of them is that they work. If you have something that works equally but doesn’t have cytokine release syndrome, doesn’t have neurotoxicity or graft-versus-host disease or marked decrease in those things, they can overcome that stickiness. CAR-Ts are entrenched in certain areas (large academic or medical center), so this is an access issue too (sticky where they can get it). The 80% or so that don’t have access to that transformative therapy is where Nkarta can be disruptive.

Select Recent Developments

On April 25th the company announced positive preliminary phase 1 data from dose finding studies of two lead CAR-NK candidates NKX101 and NKX019 in two distinct groups of hematologic malignancies. NKX101 achieved 60% complete response (CR) in 3 of 5 heavily pre-treated AML patients who received the higher dose level via 3-dose regimen. Importantly, two of these 3 responses were MRD (minimal residual disease) negative and it’s worth noting there is currently no standard of care for these patients. This is critical information as MRD negativity is broadly is associated with increased disease-free survival and decreased risk of recurrence. Data looked less promising across all dose cohorts, with 47% ORR (8 of 17 patients) and 18% CR (3 of 17 patients). Patients had received median 3 prior lines of therapy (range 1 to 12) and ALL had received prior treatment with venetoclax. Baseline median percentage of blast cells in bone marrow was 27% (range 3% to 85%). Of 4 MDS patients treated, zero responded.

Figure 5: NKX101 data across dose levels

In the second trial evaluating NKX019 in r/r B cell malignancies, 3 of 6 patients on the higher dose (also 3-dose regimen) achieved complete response including one patient with aggressive DLBCL and one patient with MCL. Patients had received median 4 prior lines of therapy (range 2 to 7). Across all cohorts, 7 of 10 NHL patients had an objective response (70% ORR) and 4 of 10 achieved complete response (40% CR). Also, 3 patients with ALL were treated with zero responses observed.

In both studies, there were no dose limiting toxicities and no CAR-T like adverse events of any grade. From there, Nkarta continued to enroll patients at the highest 3-dose regimen of 1.5B cells per dose for both candidates (updates coming year end and later in 2023).

Figure 6: Upcoming milestones

On the heels of these results, the company was able to raise $230M in a secondary offering via sale of 15.3M shares at price point of $15 (nearly 50% higher than current levels).

In May I didn’t appreciate the format of press release where the company highlighted appointment of new VP Clinical Development David Shook followed by brief mention that Chief Medical Officer Nakya Rajangam left the company to take another position at a private biotech company (I view the latter as a potential red flag). New hire Dr. Shook has plenty of experience in the cell therapy space including leading multiple first-in-human studies including CD19 CAR-NK and CD45RA-depleted BMT.

Other Information

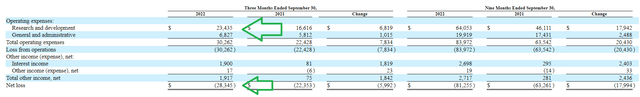

For the third quarter of 2022, the company reported a net loss of $28.3M, and cash and equivalents balance of $395M. Research and development expenses came in at $23.4M, while G&A expenses totaled $6.8M. Management continues to guide for operational runway into 2025. Looking at trends in expenses (image below), 50% increase in R&D costs year over year is more than reasonable considering progress the company is making in early-stage studies. Similarly, increase in net loss of less than 30% is a reflection of management’s judicious capital use. Accumulated deficit since inception was just $285M (appears reasonable).

Figure 7: Expense trends

As for upcoming catalysts that could move the needle, management stated in the recent Evercore presentation that there is a chance of a lot of catalysts in 2023. However, they have not updated guidance yet and will do so in the near term. For NKX101, updated data is expected 1H 23 and a separate update for NKX019 will come at some point in 2023 as they do both combination and monotherapy expansion. They are also moving forward with both CD70 and NK+T programs.

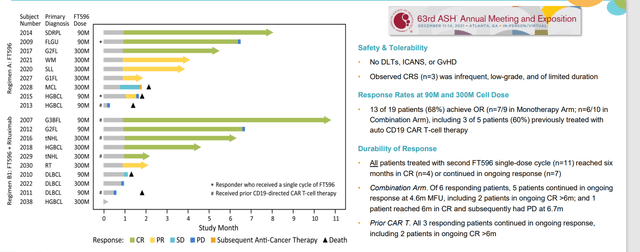

While it would be impossible to outline all of the major competitors in the crowded cell therapy space Nkarta is going up against, one I’d like to highlight is Core Biotech holding Fate Therapeutics (FATE). An Evaluate Vantage article that was published around the same time as Nkarta’s initial data suggests that results were “at least as good as Fate at a tenth of the price”. However, I believe this is could be construed as disingenuous as Fate achieved similar responses at fractions of the dose Nkarta utilized. FT516 and FT596 monotherapy arms achieved 61% ORR and 68% ORR, respectively, at lower doses (FT596 at just 90M and 300M!).

Figure 8: FT-596 achieved 68% ORR in monotherapy arm at just 90M and 300M cell doses

As for institutional investors of note, RA Capital has been adding to its position and owns a 16.2% stake. Likewise, New Enterprise Associates owns a 7.4% stake. Samsara BioCapital owns 2.8M shares. Pharma companies Novo Holdings and GlaxoSmithKline own 4.6% and 6.8% stakes, respectively. As for insiders, trend of selling over the past year is not encouraging. To be fair, President and CEO Paul Hastings owns ~250,000 shares and Dr. Simeon George (board of directors) owns ~660,000 shares (equated to a $20M purchase in late April).

As for relevant leadership experience, it does appear a bit on the light side though CEO Paul Hastings served prior as President of Genzyme Therapeutics Europe and Chief Scientific Officer James Trager prior worked at Dendreon as VP Research & Development. Co-founder of NEA Ali Behbahani is on the board of directors is Mike Dybbs (Partner at Samsara BioCapital).

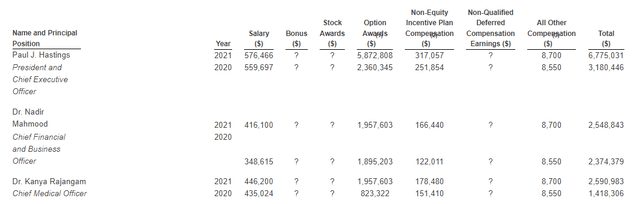

Moving on to executive compensation, cash portion of salaries appears more than reasonable for a company this size ($416k to $576k range). Option award package for the CEO more than doubled year over year to $5.8M, but again overall remuneration levels are not excessive.

Figure 9: Executive compensation table

As for relevant commentary from members of the ROTY community. CM.97 notes the following:

Nkarta is competing in crowded indications, but the collaboration with CRISPR looks interesting. They are also competing against Gamma Delta T cells in these indications. On the plus side, their manufacturing looks very streamlined and efficient, as does scalability. It looks like their treatments require lymphodepletion and I wonder whether it’s a stretch to think that the eventual winners in some of these indications will be those who can get efficacy without lymphodepletion. It does look like they may have a safety edge versus CAR-T therapies cells but durability profile of responses generated is yet to be fully determined.

As for IP, patent portfolio includes at least 15 issued patents and at least 95 pending utility patent applications. Many of these are related to manufacturing process, treatment and composition of matter claims with expirations expected between 2024 and 2035 (with expiration dates from pending claims extending up to 2042).

As for other useful nuggets from the 10-K filing (you should always scan these in your due diligence as many companies like to sweep undesirable elements under the rug), the company clearly outlines the extent of competition it faces in the cell therapy space. This includes allogeneic CAR-NK companies such as Allogene, Artiva Biosciences, Bristol-Myers Squibb, Cellectis, Celularity, Celyad, Fate Therapeutics, Gamida Cell, Gilead, Glycostem, Gracell, ImmunityBio, Legend Biotech, NKGen, Novartis, Sanofi and Takeda to name a few. It also highlights approved autologous CAR-T therapies such as Kymriah, Yescarta, Tecartus and Breyanzi that have a long lead time in terms of being commercially available on the market.

Finally, looking at the story from a different angle, for the bear case one key concern is the early-stage nature of this story. Nkarta is in still in dose escalation of phase 1 and needs to run both monotherapy and expansion cohorts. One could argue they are still in the “science project” phase, where there is no clear path to regulatory approval as of yet.

Playing devil’s advocate, in the Evercore presentation the analyst says giving up toxicity means Nkarta could be giving up some efficacy. Management responds that so far things are good in the small number of patients treated and they are seeing single cycle CRs without the added toxicity. As for inflammation and its correlation with efficacy, classic CRS with T cells involve a slingshot of rapid proliferation of cells (comes several days later and is an exhaust as those cells take off). NK cells don’t have that rapid proliferation and management does not feel that’s necessary (inflammation and toxicity are just inherent to the T cell product). Nkarta does “response-adaptive dosing”, meaning a single cycle CR could be enough or patients that need additional cycles of therapy could represent the exchange of troublesome inflammation for a more logical, dose adjusted approach.

In regard to higher dose lymphodepletion, which ROTY member CM.97 cited as a key concern, the Evercore analyst also noted that there’s an early movement to move away from cyclophosphamide to bendamustine given more gentle profile (goal to optimize LD component to enable frequent doses). However, Nkarta’s CEO tries to minimize this concern and states they just increased the dose of cyclophosphamide and have patients that’ve seen multiple cycles of therapy and investigators have no issue with that. While people may wish to see lymphodepletion lowered, he asks “why would you do that”? FDA’s concerns are that repeat LD administration could lead to toxicity issues, but management notes that taking up to 5 cycles is adapted to patients’ needs (ie. extremely bulky or resistant disease may need 2 or 3 cycles). The decision on multiple cycles is one of risk/benefit (such as when the tumor has not responded to several cycles of chemo or auto CAR-T prior). From Nkarta’s investigators, the move to bendamustine has been one they regret (won’t see adaptation on large scale as most people want to use fludarabine or flu/cy). Again, there is time in between cycles for patients to recover. CEO thinks the 1B to 1.5B cell x3 cycle is the one they will take forward (could go higher because the safety of cells but the question whether they need to).

Final Thoughts

To conclude, with market capitalization of $415M and EV of ~$20M, my conclusion is that Nkarta is a logical purchase as valuation is at lows, data to date has been promising and additional updates (likely needle-moving) are expected in the near to medium term. Nkarta is a leader in the NK space and importantly safety profile has been favorable at the higher dose of 1B cells x 3 doses. Conceptually, I’d still think that probability of success is still on the lower end (under 40%) as they still need to run dose expansion studies (monotherapy and combination) followed by pivotal studies. Also, the cell therapy field and particularly CD19 space is rapidly evolving and so my concern is that even data on par with other NK players might not be “good enough” to make inroads commercially. I am more interested in Nkarta’s solid tumor efforts starting with NKX101 (NKG2D), but at the current pace of development I would not expect initial data until 2024.

For readers who are interested in the story and have done their due diligence, NKTX is a Buy and I suggest accumulating a position ahead of 2023 data catalysts.

From an ROTY portfolio perspective (focus on next 12 months), I have to admit I’m less interested here given heavy competition in the cell therapy space, current pace of development and lack of clear pathway to market as of yet. I’d be interested in revisiting when pivotal studies are underway or solid tumor data closer.

While dilution in the near term is not a concern, key risks do include disappointing data in the near term for either NKX101 or NKX019 programs as well as potential development delays. Rapidly evolving competition in the crowded cell therapy space is also a principal concern for me, as lead autologous CAR-T players are likely to be firmly entrenched by the time Nkarta’s candidates make it to market and by then it’ll face competition from other allogeneic players such as Fate Therapeutics (not to mention bispecifics and other modalities). Lastly, for the NK space despite monotherapy activity, durability still has not been proven and it will take longer follow up for this to be established (as well as prove the merits of multi-dose regimens).

Author’s Note: I greatly appreciate you taking the time to read my work and hope you found it useful. While I post research on many companies that interest me, in ROTY (clinical stage) and Core Biotech (commercial stage) portfolios I own just 15 or fewer names in order to focus on stories that are highest conviction for me.

Be the first to comment