gremlin

Well-performing international tourism after global vax campaign

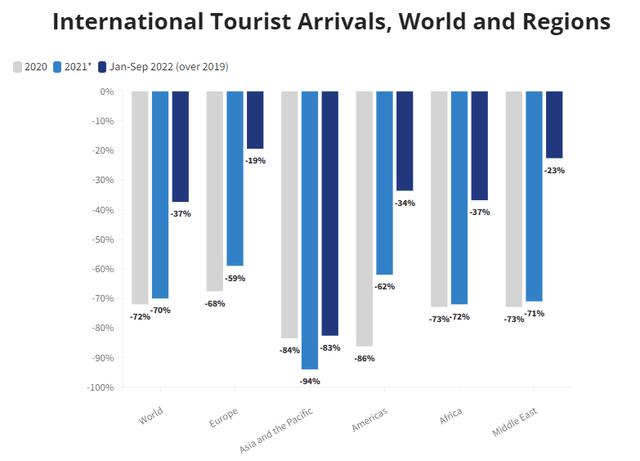

International tourism showed much better performance during 9M 2022 than in 2021: with arrivals reaching 62% of pre-pandemic levels in 9M 2022, while in 2021 it was only 30%. According to UNWTO, it is estimated that 700 million tourists travelled internationally between January and September, more than double (+133%) the number recorded in the same period of 2021. Europe leads the international tourism recovery, growing from 41% of pre-pandemic levels in 2021 to 81% in 9M 2022. The second well-performing region is the Middle East, with a growth of 29% of pre-pandemic levels in 2021 to 77% in 9M 2022. According to the estimations of UNWTO, export revenues from tourism could reach USD 1.2 to 1.3 trillion in 2022, a 60-70% increase over 2021, or 70-80% of the USD 1.8 trillion recorded in 2019.

International tourist arrivals: world and regions

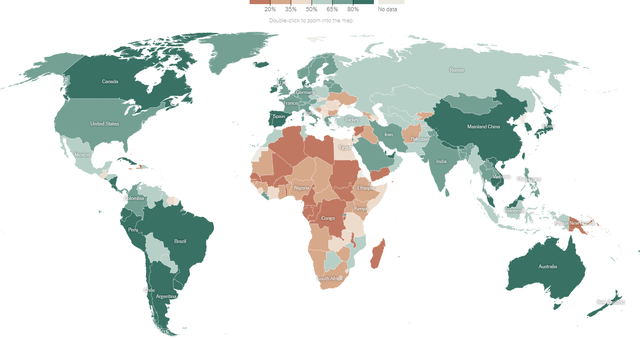

As of November 2022, more than 5.46 billion people worldwide have received a dose of a Covid-19 vaccine, equal to about 71.1 percent of the world population. Fully vaccinated coverage achieved 65%. Dynamics of travel recovery by regions are correlated with the share of the population fully vaccinated and coverage by the most effective vaccines (Pfizer (PFE) and Moderna (MRNA)).

Share of population fully vaccinated

University of Oxford, The New York Times

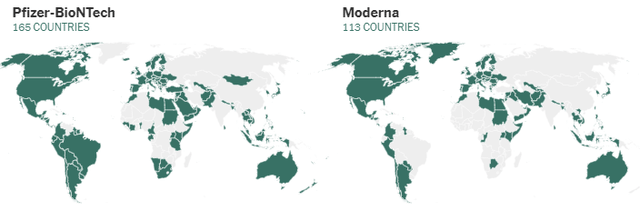

Vaccines’ global coverage

University of Oxford, The New York Times

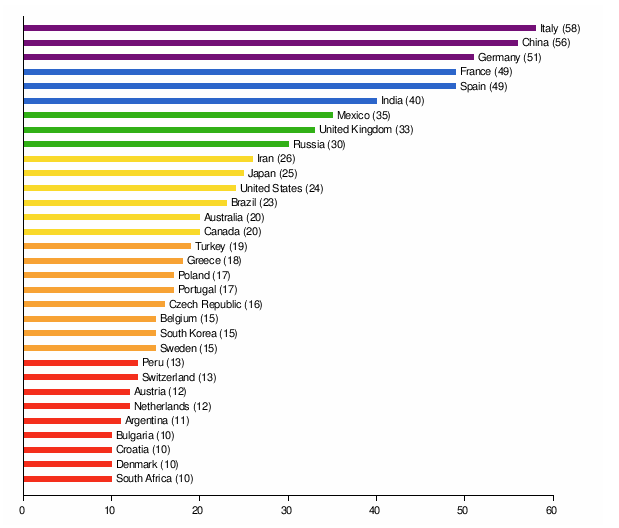

The whole of Europe has access to the most effective vaccines, but only North, Central and West Europe have a high share of the population fully vaccinated. It was enough to make Europe as the region with the best recovery performance, since these parts of Europe are united by easy movement zones and these counties are destination points for international tourism (distribution of UNESCO heritage sites can be used as proxy of attractiveness).

Distribution of World Heritage Sites by country (more than 10)

UNESCO

The global vaccine campaign has made a significant contribution to the recovery of the travel industry, and probably, all other things being equal, would help the industry to fully recover in 2023.

Recession will be the threat for recovery, or not?

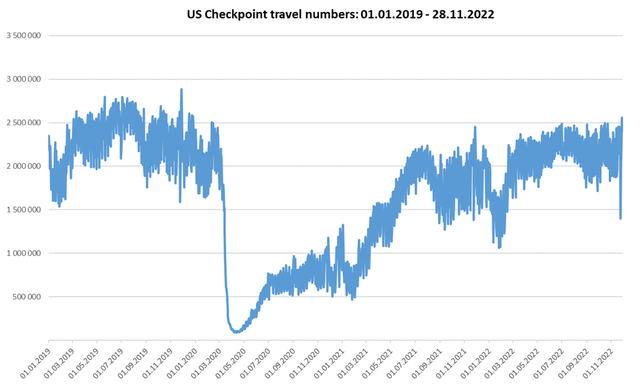

Most likely, a looming global recession and high inflation in many parts of the world will affect consumer spending and tourism demand and, in turn, delay recovery of international tourism. In Europe, an energy crisis and anticipation of a difficult winter are hitting the wallets of citizens and changing consumption patterns, resulting in a decrease in the number of people who are ready to make reservations for the next summer. In the US, savings accumulated during the pandemic have largely been spent, and further demand growth in 2023 will depend more on the disposable income structure, which is declining due to rising prices. Despite a strong USD, which can become a stimulating factor for travel from the US, most likely we will see the growth of domestic tourism at a more confident pace than international tourism.

This trend is reflected in the difference in the performance of the (PEJ) ETF compared to the (JETS) ETF, as the first, unlike the second, includes not only include airlines, but also other companies from travel industry.

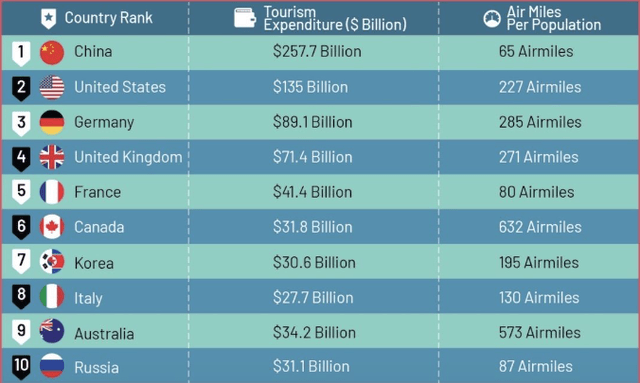

Sooner or later, China will ease lockdown restrictions, and tourists from mainland China will boost the tourism sector around the world. This factor may offset the decline in demand from travelers from the US and Europe, as if China opens up, the industry could get a huge boost from pent-up demand from Chinese travelers. In the pre-pandemic years, China was a leader in tourism spending and was also among the top 5 countries in terms of popularity for tourism. As a result, I think a China reopening can fuel industry performance and soften the recession impact.

World top traveling countries (pre-pandemic)

Hard times require technology development

In an increasingly difficult environment, companies in the sector will look for opportunities to optimize:

- Travel companies can use technologies that increase the effectiveness of operations and reduce costs to fuel revenue and long-term growth. For example, many travel companies today have duplicated booking or accounting systems, it is often required to synchronize them between each other manually. During slowdown, they have to optimize their processes.

- Media and social networks offer travel companies a source of incremental bookings and can “digitalize” the customer experience. Advertisements by customer can take a role of additional recurring revenue, when followers of customers want to experience the same destination.

- Travel companies can expand ways for implementation and promotion using their loyalty programs.

As a result, after an economic recession, we will likely see a transformed and more efficient travel industry as it was after the Global Financial Crisis 2007-2008, with higher margins and more crisis-resistant businesses.

Be the first to comment