viper-zero/iStock Editorial via Getty Images

Product tanker rates have steadily increased in 2022 on the back of recovering oil demand and slowing tanker fleet growth. This rise in the cost of seaborne transportation of refined petroleum products such as gasoline, diesel and liquified petroleum gas has been a huge boon for Scorpio Tankers Inc (NYSE:STNG), a Monaco based shipping firm that operates a fleet of 124 product tankers.

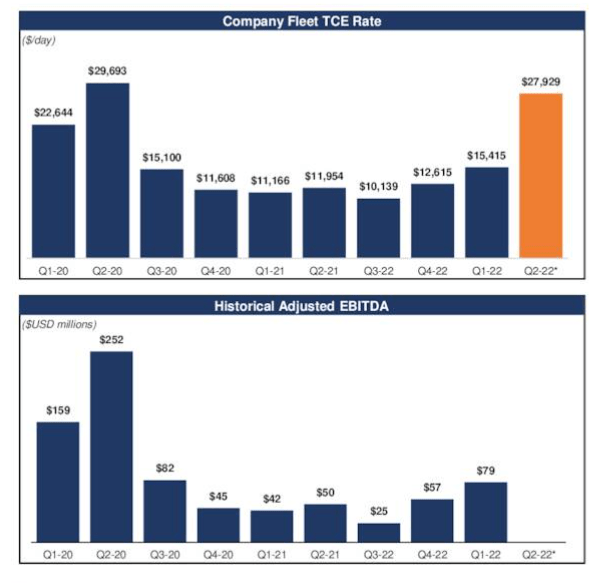

STNG’s financial performance is positively correlated with product tanker rates. The chart below from its Q1 2022 investor presentation illustrates this correlation, indicating that adjusted EBITDA has historically been highest when TCE has been highest. TCE, or Time Charter Equivalent, is a shipping industry measure used to calculate the average daily revenue performance of a vessel. It typically reflects the prevailing product tanker rate in the market.

STNG’s financial performance positively correlated with product tanker rates (STNG Q1 22 Investor Presentation)

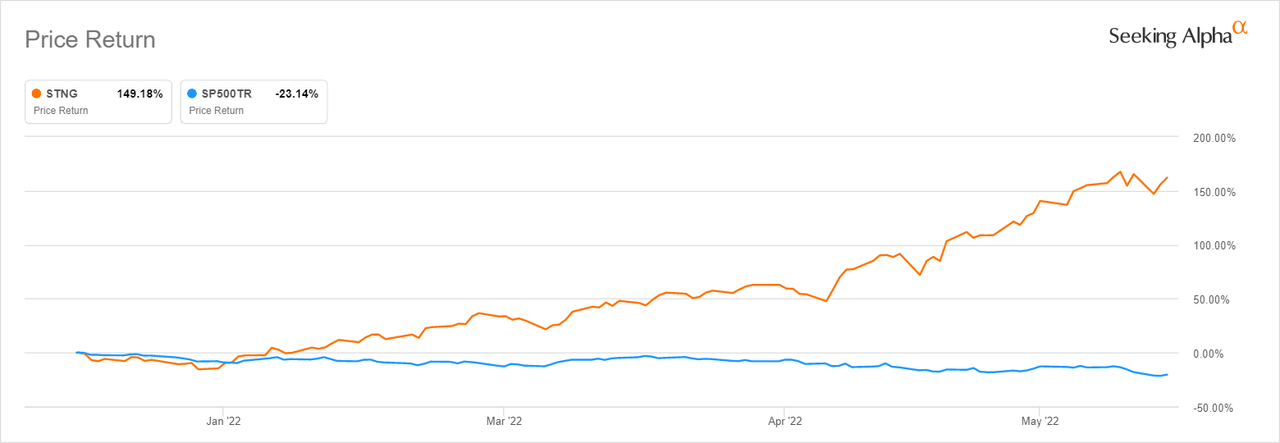

Given this positive correlation between product tanker rates and STNG’s financial performance, investors have been keen to gain exposure to the stock amid the increase in product tanker rates in 2022. As a result, the stock price has more than doubled since the beginning of the year. At the time of writing, the stock had returned an impressive 149% YTD vs the S&P 500’s 23% decline over the same period.

STNG has more than doubled YTD (Seeking Alpha)

The fact that STNG has been able to double investors’ money at a time when major indices are down more than 20% YTD (classic definition of a bear market) makes it a stock worth looking into. The important question at this point is whether it can sustain its upward momentum given how quickly it has galloped ahead of the broader market.

We feel that STNG still has more room to run. It is, however, not a “set and forget” investment and investors need to closely watch out for a couple of significant downside risks which we will elaborate in greater detail towards the end of the article. For now, let’s first discuss the key reasons why STNG is likely to continue moving up.

Sustained high rates and shareholder friendly management decisions

When we last covered STNG a year ago and recommended buying it, our bull thesis was premised on product tanker rates increasing on the back of the post-COVID economic recovery. We also noted that the constrained supply of product tankers will help support rates. These catalysts are still in play today and our view remains unchanged about their positive impact on product tanker rates.

In addition to economic recovery and tight product tanker supply, there are several new catalysts in 2022 that further suggest a sustained period of high rates is in the cards.

The first catalyst is the impact of the Russia- Ukraine conflict on product tanker trade routes. According to a report by Greg Lewis, a BTIG analyst and Managing Director who covers STNG, the conflict has driven oil products dislocations around the world. The net effect is an increase in the distance traveled by vessels transporting refined petroleum products. This supports high product tanker rates, which is good for STNG’s financial performance and stock price.

Another catalyst for continued high product tanker rates is the record high refining margins. During the pandemic, a lot of refineries shut down due to the collapse in fuel consumption caused by lockdowns. Most of these refineries have never reopened. Now that oil demand is back and refining supply is constrained, refining margins have increased astronomically. There is therefore an incentive among refiners to increase production volume and capture profits before margins revert to the mean. What makes this trend durable is that there is demand to absorb increased output. This situation is positive for the product tanker market as the volume of products shipped is steadily increasing.

STNG’s bull case is further strengthened by the fact that the management has taken shareholder friendly decisions to maximize value creation in the current favorable product tanker rate environment. The company, for example, has one the youngest fleets with an average age of 6.2 years. It also has no plans of buying new ships as per management statements in its Q1 2022 earnings call. These factors limit capex (low maintenance cost for young fleet and no asset acquisition costs) and make cash available for other shareholder friendly purposes such as paying down debt, paying dividends and funding share repurchases.

Indeed, STNG is aggressively paying down its debt. The management expects its debt to reduce by $500 million by the first half of 2022 as per statements in the Q1 earnings call. The company has further instituted a $250 million share repurchase program, which is significant given its current market cap is around $2 billion.

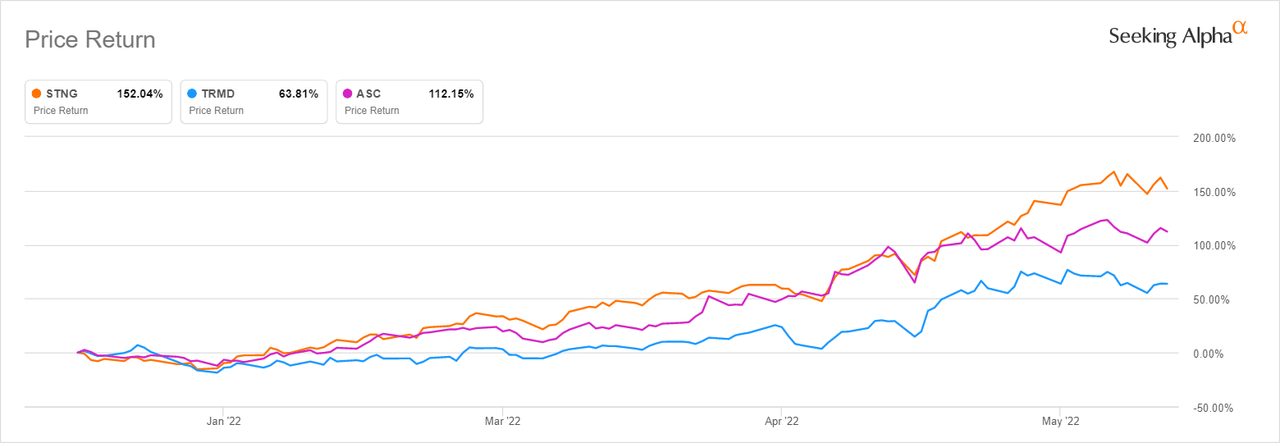

If product tanker rates stay elevated, which is the general expectation, STNG looks well positioned to continue on its uptrend. Management’s decisions to reduce debt, buy back shares and preserve cash through low capex are also positive for the stock. It’s telling that compared with listed shipping firms with high exposure to the product tanker market such as TORM Plc (TRMD) and Ardmore Shipping Corporation (ASC), STNG is the best performer YTD.

STNG has outperformed ASC and TRMD (Seeking Alpha)

Don’t ignore the downside risks

Despite the positive outlook, we reiterate that STNG is not a set and forget kind of investment. It has significant downside risks that need to be closely monitored. The first risk is its debt profile. Although the company is aggressively cutting back on debt, it still had a net debt of $2.6 billion as at March 31, 2022 – more than 10 times its cash equivalents at the time of $242 million.

To service its debt, STNG forked out $136.1 million in net interest expenses in 2021, $146.2 million in 2020, $173 million in 2019. The company essentially spends as much as 25% of its annual revenue servicing debt. Even with the commitment to lower debt, this is worrying given where interest rates are headed. Moreover, with a dividend of $0.40 per share and around 55 million shares outstanding, the company also needs to fork out around $22 million in dividends annually on top of its debt repayment.

STNG’s high cost of capital – and investors potentially discounting this – could explain why it has historically traded well below its Net Asset Value, which as per company President Robert Bugbee’s remarks in the Q1 2022 earnings call is around $35 per share.

Looking at STNG’s NAV and current share price, it’s tempting to think it is an undervalued play. This is, however, not the case. The company is actually overvalued using traditional metrics such as EV/EBITDA. It is currently trading at 38.65X EV/EBITDA for the trailing twelve months.

Another cause for concern is that, though effective at generating cash and raising debt financing, STNG is not profitable. To be fair, this is largely the case in the shipping industry where net income margins are in the single digits or negatives. However, for STNG, the quantity and frequency of losses are alarming. It has posted negative annual net income six out of 10 times in the last 10 years and its deficit is now at $623 million for the trailing twelve months – that’s around 25% of its market cap for context.

These risks are significant and will at some point catch up with the stock. It’s important to note that the product tanker market is highly cyclical. When the cycle changes and assuming the company hasn’t addressed these issues by then, the stock’s decline could be just as dramatic as its recent increase. At current levels, we recommend buying the shares opportunistically for the short-term, but remaining vigilant and hitting the sell button in case the tide changes.

Be the first to comment