solarseven/iStock via Getty Images

Despite a massive drop in pricing since July, NIO (NIO)’s prospects in the EV market look better and better. The electric vehicle startup is going to launch new EV products in FY 2022 and it should see a continual production ramp now that manufacturing lines got upgraded. The cheaper valuation, however, is the real reason to buy into NIO’s growth plan!

The market is wrong about NIO: Expect a massive production ramp in FY 2022

NIO delivered more than 10 thousand of its electric vehicles – including ES6s, EC6s and ES8s – in the month of December, which was the second straight month in which NIO delivered more than 10 thousand EVs. While the competition pulled ahead of NIO regarding delivery growth in FY 2021, NIO is set to catch up to its rivals in FY 2022 as the company gets ready to bring new EV products to market. NIO is going to release the ET5 and the ET7 sedans which will not only increase the density of NIO’s product lineup but also signify the company’s beginning penetration of the sedan market. NIO’s current product lineup consists only of sport utility vehicles – which are selling well – but the narrow SUV orientation nevertheless limits NIO’s sales potential to only a specific market segment.

The ET7, which is a full-size luxury sedan, will be launched in China in early 2022, but the company has said that the next destination for the ET7 will be Europe, Germany. NIO is currently only selling the ES8 sports utility vehicle in Norway, which acts like a gateway market for further penetration of other European countries. The ET7 sedan, which is set to compete with Tesla (TSLA)’s Model S, has been specifically designed to appeal to buyers outside of China.

The ET5, a mid-size electric coupe, is set to see its first deliveries in the fall of FY 2022. The company founder, William Li, said in December that the ET5 sedan has achieved the highest pre-order volume in the history of NIO.

Because of the massive production ramp in FY 2022, especially regarding the ET7 which will launch sooner than the ET5, NIO’s delivery growth prospects have never been better than now. The electric vehicle startup delivered 91,429 electric vehicles in FY 2021, showing 109.1% year-over-year growth. This growth is impressive especially because FY 2021 has seen unprecedented chip shortages that resulted in production delays and underutilized manufacturing plants.

For FY 2022, I estimate that NIO will deliver a minimum of 190 thousand EVs, mostly ES6s which represented just about half of all of NIO’s December deliveries. The ramp for the ET7 and the ET5 will likely start off slowly, but it should see growing momentum in the second half of the year. With 190 thousand potential EV sales this year, 10 thousand of which could be ET5s and ET7s, NIO would generate 108% year-over-year growth in deliveries in FY 2022. But, the EV firm may very well see an acceleration in its production and delivery growth rates if supply chain challenges no longer limit NIO’s business expansion.

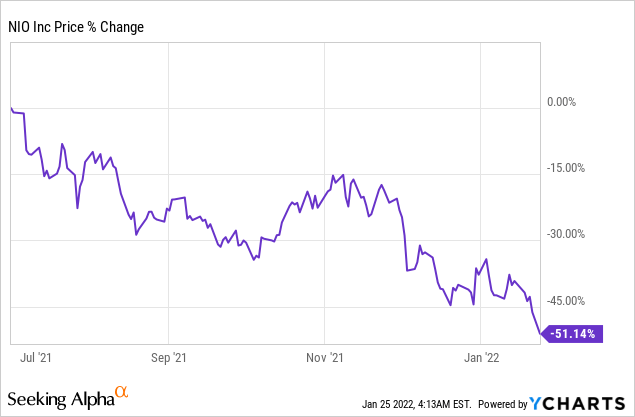

Huge and undeserved drop in pricing

Shares of NIO went through an extremely large and completely undeserved drop in pricing since July 2021 when shares soared as high as $55. Since July, NIO’s commercial prospects in the electric vehicle market have been discounted by an unbelievable 55%, despite a recovery in deliveries in the fourth quarter and the best product lineup available since the firm was started.

Because NIO is going to launch new EV products this year, I believe revenue estimates are set to rise throughout the year. NIO is expected to generate $9.9B in revenues this year and $15.3B in revenues in the following year. I believe that predictions underestimate NIO’s revenue potential, in large part because the EV maker is growing its appeal in the under-served sedan market and looks to expand in Europe… which will lead to more sales. For that reason, I expect NIO to generate higher revenues than are currently estimated for this year and next year.

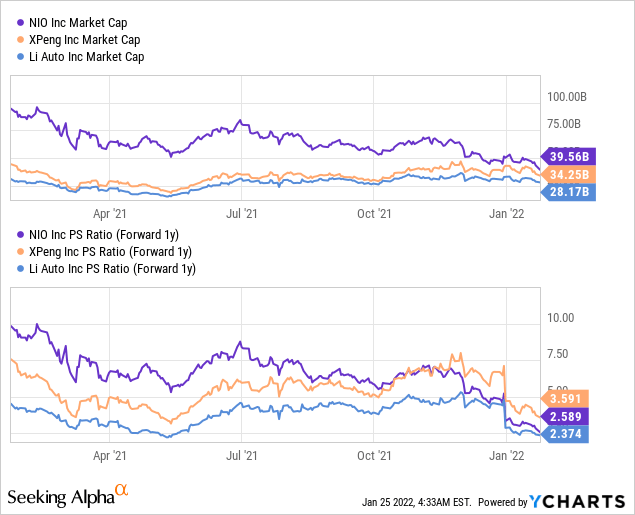

For FY 2022, I expect NIO to generate $11.0B in revenues and for FY 2023, $16.5B in revenues. Since NIO has a market capitalization of $40B, the sales multiplier factors for FY 2022 and FY 2023 are 3.6 X and 2.4 X. These sales multipliers are quite low considering that NIO is set to see a more than 100% increase in EV deliveries this year. Because the sell-off has also affected other Chinese EV startups – XPeng (XPEV) and Li Auto (LI) – the entire sector is now very attractively priced.

Risks with NIO

The biggest commercial risk for NIO, as I see it, is for the EV company to botch its production and delivery ramp. If NIO executes well and delivers without delays, NIO could be catapulted into another valuation category in 2022.

From a macro perspective, new COVID-19 outbreaks and a slowdown in the Chinese economy represent general risks for NIO and other EV manufacturers. China has also slashed subsidies for electric vehicles by 30% this year which may affect demand for EVs in FY 2022. The subsidy rate is set to drop to zero next year, which potentially could slow down NIO’s sales momentum.

Final thoughts

The market has lost its mind regarding EV stocks. Shares of NIO have become way too cheap given the potential the startup has in the electric vehicle market, especially now that more EV products are going to launch and the pre-order status for the ET5, although specific numbers have not been released, is encouraging. FY 2022 could see some nice surprises on the part of NIO and new product launches are set to be catalysts for the stock to power higher!

Be the first to comment