huettenhoelscher/iStock Editorial via Getty Images

Introduction

The agriculture and farming machinery industry is linked mainly to net farmer income and commodity prices. These two are, in turn, driven by three great macro-trends that are taking place:

- increasing world population

- scarcity of land as the urbanization process goes on

- scarcity of labor force

The combination of these three factors leads to a predictable growing demand for farming that has to be done on less land and with fewer workers. In other words, precision and autonomous agriculture will see increasing demand. This makes AGCO Corporation (NYSE:AGCO) one of the most interesting play to become invested in the industry by picking one of the most promising companies in terms of precision agriculture machinery.

Summary of previous coverage

The first time I shared my research on the company, I pointed out how AGCO, though very interesting as a company, is still posting results that are lagging behind those of its two main peers Deere (DE) and CNH Industrial (CNHI) because of two reasons: low U.S. exposure and lower margins.

In the summer, I compared CNHI versus AGCO and I pointed out that, so far this year, the thesis that CNHI was set to benefit more than AGCO from the current market environment has proven true. Nonetheless, though I have not yet initiated a position in the stock, I always gave a buy rating to the stock which has performed better than SPY during these past months.

The reason why so far I deemed AGCO a buy, but I didn’t initiate a position in the stock was that the company still seemed to be a bit behind, compared to CNHI, struggles to reach a double-digit margin because of low exposure to higher margin markets such as the U.S. In any case, when the stock was downgraded by Morgan Stanley earlier this year, I felt it compelling to write an article explaining that, though a recession is probably taking place, AGCO has such a full order book that generated by massive demand and supply chain bottlenecks, that it could have enough orders to weather a mild recession without almost noticing it.

After AGCO reported its 1H results, I still saw the company a bit behind CNH.

Now, while we wait for CNH’s results, AGCO has released its quarterly report and it seems to me that we are before a turning point.

Q3 Results Overview

Let’s recap some standard numbers that can be easily found, just to make it easier for readers to follow along. Here are the main highlights AGCO reported:

- Record net sales of $3.1 billion, up 14.5% year-over-year, driven by North and South America

- North American sales up ~43% year-over-year from growth in Fendt and Precision Planting products

- Record operating margin of 10.6%, expanded 140 basis points through pricing and improved mix

- South American operating margin of nearly 19%

- Reaffirms full year operating margin and earnings per share outlook

Furthermore, net sales increased by 26.3% YoY. Reported EPS was $3.18 per share for compared to $2.41 last year. This is a 32% increase in EPS, which is quite strong growth.

Q3 Results Analysis

Let’s understand better where these results come from and what they may mean for the future.

First of all, farm economics continue on being favorable, with rather high crop prices that give farmers enough income to replace or upgrade their aging fleet. This is even more true as the industry as a whole is witnessing an impressive turn as smart technology and precision agriculture become more and more necessary to help farmers improve their productivity thanks to better machinery efficiency. Here AGCO is poised to be one of the leaders, together with its peers DE and CNHI. In particular, AGCO plays a major role in precision planting, a business unit that is growing at a fast pace.

Secondly, let’s consider net sales geography in order to see how AGCO is executing its strategy to grow in North America thanks to its premium brand Fendt.

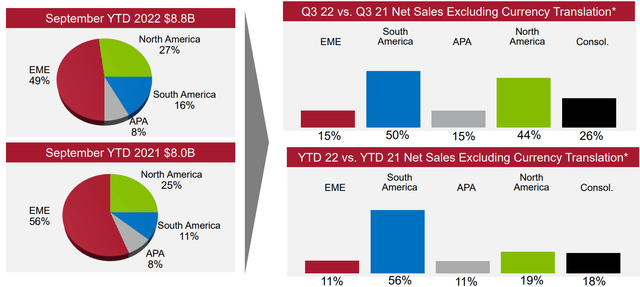

We see from the slide below that in one year EME has shrunk by 7 percentage points as a total of sales. This is good because it enables the company to be more diversified by gaining exposure to different economies and different cycles. In just one year, AGCO has improved its Americas net sales by impressive numbers. While we all know that South America machinery and vehicle market is booming (every automaker and machinery manufacturer keeps on posting staggering results) and thus the 50% growth may have been somewhat expected, it catches the eye that the company grew net sales by 44% in North America (ex FX), with quarterly net sales jumping from $638.7 million to $910.5 million. YtD, North America has grown by 19% YoY,

AGCO Q3 2022 Results Presentation

In North America, AGCO declared that the strong year-over-year growth was driven by the success of Fendt large tractor sales, significant increase in demand for Precision Planting products, as well as overall solid pricing.

Now, the company has a clear strategy to reach margins in-line with the industry leaders: it needs to grow its premium brand Fendt’s market share. While this brand may not be among the most renown in the U.S., in Europe it is almost “the brand”, with a strength comparable or even more than Deere’s.

As much as this may be worth, I spoke just the other day with a friend of mine who runs a farm and we were talking about tractors. He had no doubt: had he the money to afford it, he would buy a Fendt and so would many of his colleagues and peers. This is why Fendt is a brand that can find a lot of success in North America, once it is recognized as a very valuable brand before a market that is willing to pay a premium for top-tier products.

The second focus of AGCO to increase margins is linked to precision agriculture, with Precision Planting and Fuse that are growing more than 20% YoY.

Thirdly, AGCO is focusing on spare parts and services, educating its dealer network about it. So far, the company has been able to drive its after sales in parts business to grow at 8% annually over the past three years, compared to 4% for the three years prior.

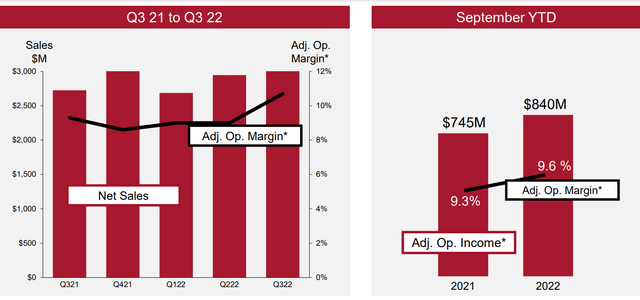

Now, let’s see if this enhanced focus is generating improving results. As the slide below shows, AGCO is finally turning its operating margin north, crossing the double-digit barrier on an adj. basis. This quarter finally saw operating margin above 10%, coming in at 10.6%. This has helped the overall YtD performance grow to a 9.6%.

AGCO Q3 2022 Results Presentation

If we consider how AGCO broke down the regional operating margin performance we see that in EME it came in at 10.2%, North America reached 12.4%, South America went far past expectations with a 18.8%, and APA achieved a 13.2%. These numbers prove once more why it is crucial for AGCO to grow its business outside of Europe.

Mr. Hansotia, AGCO CEO, addressed these improvements in the earnings call:

Adjusted operating income increased nearly 32%, while margins improved about 140 basis points. We are seeing excellent demand for the technology-rich Fendt full line up of equipment, our Precision Planting solutions and replacement parts.

AGCO’s Precision Ag sales are up over 21% so far this year. We have experienced strong growth for both our Precision Planting business, as well as our Fuse suite of products, as farmers see the benefit of these high tech solutions.

In addition, he disclosed that order books are full well into the second half of 2023, which means that AGCO still has a lot to benefit from pent-up demand and the slow easing of supply chain constraints.

Valuation

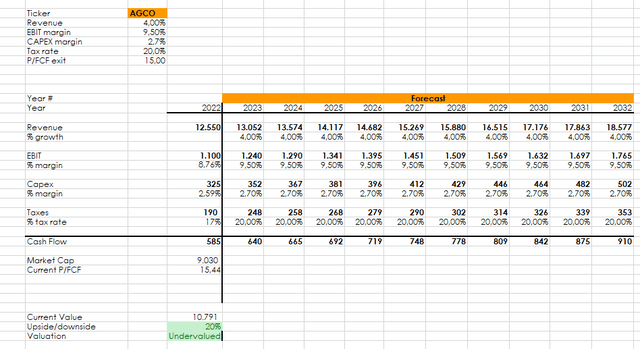

Now, in my last article, I gave a valuation based on a discounted cash flow model that showed a upside that went from 8% to 90% based on different scenarios. The company’s market cap has increased, since then, by 14% so the multiples and the expected returns changed a bit, even though I raised a bit my future expectations for the company. In a base scenario, which pivots around a 15 price/free cash flow multiple exit, we are still before a 20% possible upside. It may not be great, but I think it is enough to consider initiating a position, given the fact that AGCO has, in my opinion, more room to grow in the U.S. compared to its peers.

At the moment, I may initiate a position in the next few days, because the company is becoming more and more interesting as a buy, not only for its potential upside, but for its future developments in terms of market share in the U.S. and profitability. Just to be clear before SA reader, I want to disclose that before I choose definitely where to place my money, I will wait for CNH Industrial results to understand if AGCO really is catching up or if it is just benefitting from a general trend of the market. I am choosing to do this because I already own CNHI and I don’t want over exposure to one industry unless I am confident I am before a significant turnaround for AGCO. Many hints make me think this, but I think for my portfolio it will be safer to wait a few days.

Be the first to comment