Andy Feng

Electric vehicle manufacturer NIO (NYSE:NIO) was the only of the top three Chinese EV manufacturers that squeezed out a month-over-month delivery gain for its electric vehicle models in August. According to NIO’s latest delivery card, the EV company once again delivered more than 10 thousand electric vehicles, which is due to delivery growth for the ET7 sedan model. As ET7 production and deliveries ramp up, I continue to see revaluation potential for NIO’s shares, but believe it may take longer than initially expected for NIO to reveal its full potential!

NIO: Growing faster than rivals in August

NIO delivered 10,677 electric vehicles in August of which 7,551 EVs were sport utility vehicles – ES6s, EC6s and ES8s – and 3,126 were electric sedans. On a month-over-month basis, NIO achieved 6.2% delivery growth, which made the electric vehicle manufacturer the best-performing EV company when compared against XPeng (XPEV) and Li Auto (LI). August was the third straight month for NIO where deliveries exceeded 10 thousand electric vehicles despite ongoing supply chain challenges.

While NIO executed well in August, especially with the ET7 ramp, overall delivery growth slowed markedly for NIO’s peers. XPeng delivered 9,578 electric vehicles last month of which 5,745 were P7s, 2,678 were P5s and 1,155 were G3i/G3s. The year-over-year growth rate for XPeng’s deliveries was 33% which is low for XPeng’s standards. Li Auto fell back to a delivery volume of 4,571 electric vehicles, showing the largest year-over-year and month-over-month drop-off in deliveries of the top three EV manufacturers.

|

Deliveries |

June |

June Y/Y Growth |

July |

July Y/Y Growth |

August |

August Y/Y Growth |

MoM |

|

NIO |

12,961 |

60.3% |

10,052 |

26.7% |

10,677 |

81.6% |

6.2% |

|

XPEV |

15,295 |

133.0% |

11,524 |

43.0% |

9,578 |

33.0% |

-16.9% |

|

LI |

13,024 |

68.9% |

10,422 |

21.3% |

4,571 |

-51.0% |

-56.1% |

(Source: Author)

ET7 ramp is seeing momentum

The big story for NIO, at this time, is the ramp of the company’s first sedan product, which has seen growing momentum. NIO started production of the ET7 in March, and the sedan has seen a nice ramp in ET7 production and deliveries in the last few months (see growth figures in the table below).

NIO’s 6.2% month-over-month delivery growth in August was entirely due to the ET7 ramp: ET7 deliveries totaled 3,126, showing 26.4% growth month over month. NIO’s SUV deliveries actually dropped 0.4% month over month to a volume of 7,551, meaning all of NIO’s growth in August was attributable to ET7 production. For that reason, the share of ET7 deliveries also increased 4.7 PP quarter over quarter to 29.3%… meaning every third EV rolling off of NIO’s factory belts in August was a sedan, not an SUV.

|

NIO ET7 Metrics |

March |

April |

May |

June |

July |

August |

|

Total Deliveries |

9,985 |

5,074 |

7,024 |

12,961 |

10,052 |

10,677 |

|

NIO ET7 Deliveries |

163 |

693 |

1,707 |

4,349 |

2,473 |

3,126 |

|

M/M Growth |

0.0% |

325.2% |

146.3% |

154.8% |

-43.1% |

26.4% |

|

ET7 Delivery Share |

1.6% |

13.7% |

24.3% |

33.6% |

24.6% |

29.3% |

(Source: Author)

Growing estimate risks

Despite strong growth in ET7 production, NIO’s topline, production and delivery risks have increased in 2022 because Chinese authorities have locked down entire cities to contain the spread of COVID-19, which has made an already stretched supply chain worse. Just days ago, Chinese health authorities have locked down the city of Chengdu with its 21 million residents. New lockdown measures were also announced in Shenzhen were a lot of Chinese technology companies such as Tencent are located.

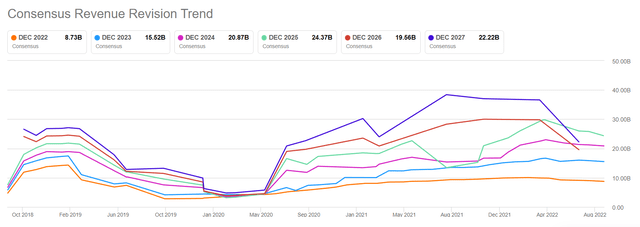

For those reasons, NIO has seen downward revisions for its revenue estimates for FY 2022. NIO has seen 19 downward revisions in the last 90 days and only 4 upward revisions for its annual revenue estimate. NIO’s earnings for Q2’22 are due Wednesday, September 7, 2022 and the estimate is for revenues of $1.42B.

Seeking Alpha: NIO Revenue Estimates

Risks with NIO

The biggest commercial risk for NIO, as I see it, is the production and delivery timeline. NIO will release its guidance for Q3’22 deliveries Wednesday, which is likely not going to be great given the challenges NIO and the EV industry currently face. I expect NIO to shoot for quarterly deliveries of 26,500 to 28,500, mostly because of ET7 momentum.

New factory lockdowns related to COVID-19 are a potentially huge problem for NIO. Although ET7 production is ramping up nicely and NIO is executing well, continual supply chain problems limit the company’s full potential right now and topline estimate may trend down further.

Final thoughts

Heading into Q2 earnings, investors shouldn’t get their hopes up as down-trending revenue estimates already indicate lowered expectations. NIO continues to have a lot of potential but although the EV manufacturer had the third straight quarter in August with deliveries exceeding 10 thousand units, I believe NIO may grow at a lot slower than initially expected rate, which may add new pressure on the stock’s valuation. I don’t believe NIO is necessarily overvalued at 1.9 X revenue, but downside risks have clearly grown in recent months. If this week’s guidance for Q3 deliveries is weak, NIO’s shares may revalue lower.

Be the first to comment