Dean Mouhtaropoulos

Sanctions on Russia’s oil exports and the indefinite shutdown of the Nord Stream 1 pipeline that has, until recently, supplied Europe with natural gas, could drive strong results for Exxon Mobil Corporation (NYSE:XOM) during the winter months. The petroleum producer is set to benefit from a strong pricing environment in the third and fourth quarter, which could reasonably lead to robust free cash flow and an upwards revaluation Exxon Mobil’s shares!

Russia stops energy flows through key pipeline

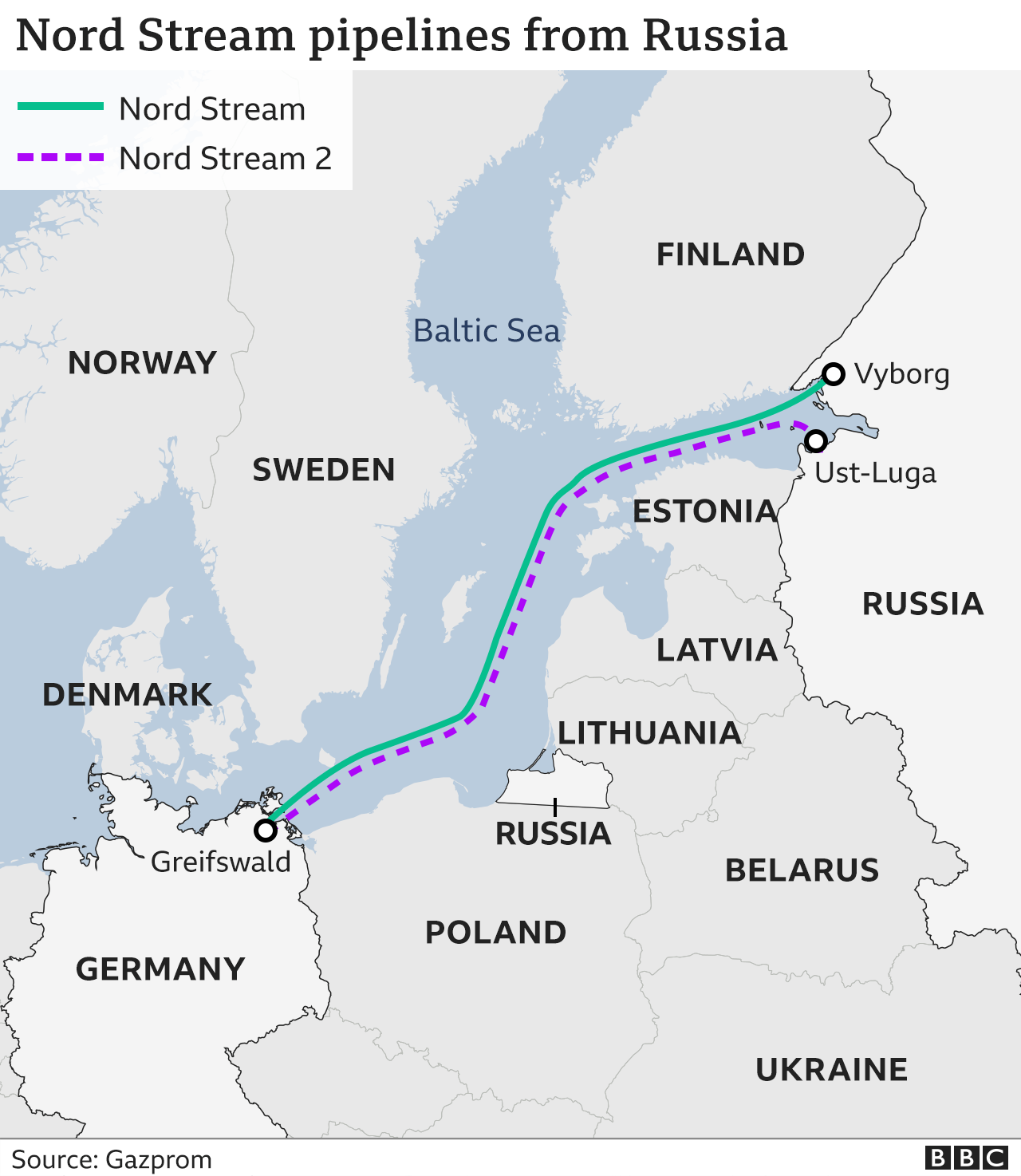

Gazprom (OTCPK:OGZPY), the Russian energy company majority-owned by the Russian state, reduced energy flows through the Nord Stream 1 pipeline to 20% of capacity in July… which already served as a warning sign to Europe that an escalation in the sanctions standoff could result in a complete pipeline shutdown. The Nord Stream 1 pipeline supplies Europe, and Germany especially, with natural gas and has an annual delivery capacity of 55B cubic metres of gas. To accommodate maintenance work, the pipeline has been shut off for a couple of days during the summer as well.

BBC, Gazprom

At the beginning of September, however, Russia escalated the stand-off with Europe by indefinitely cutting off energy flows through the Nord Stream 1 pipeline, with the official reason being that Gazprom had maintenance work to do at the Portovaya compressor station near St. Petersburg. The pipeline shutoff, however, likely came in response to Western leaders seeking to place a cap on the price of Russian oil. The cap was proposed to punish Moscow for the invasion of Ukraine and cut into Russia’s profits from its domestic petroleum production.

Why I don’t believe sanctions on Russia will be effective

I believe such a global price cap on Russian oil would be near impossible to implement because the country is already selling crude oil at discounted prices to India and China. The pipeline shutdown is also set to stoke already elevated supply concerns in Europe and could potentially result in even higher prices for petroleum products during the winter months. A big beneficiary of this situation, obviously, could be Exxon Mobil, which already reported record free cash flow in the second quarter. As European leaders scramble to fill their storage tanks with natural gas in order to prepare for the upcoming winter, the pricing environment is extremely favorable for companies like Exxon Mobil.

Positive impact on Exxon Mobil’s free cash flow expected

I believe Exxon Mobil is set to see stronger than expected free cash flow in the third and fourth quarter because of the pipeline shutdown and if the winter gets especially cold, energy prices could soar.

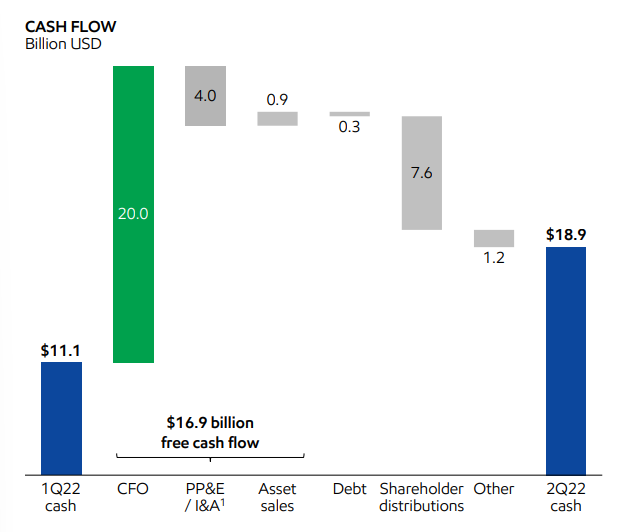

Exxon Mobil generated $16.9B in free cash flow in the second quarter, showing 145% year-over-year growth. Pricing effects on world markets related to Russia’s invasion in Ukraine as well as the sanctions that followed were the key reasons behind the surge in Exxon Mobil’s free cash flow. Energy demand typically rises during the winter months, and with prices stabilizing around $90/barrel, Exxon Mobil may be set for an exceptionally strong period in the next six months.

I believe Exxon Mobil will see between $44-46B in free cash flow in FY 2022, potentially much more if petroleum prices soar again. Exxon Mobil distributed 45% ($7.6B) of its Q2’22 free cash flow to shareholders, and a new round of Russian energy sanctions could be a strong driver of the firm’s free cash flow growth in the next few quarters.

Exxon Mobil: Q2’22 FCF

Attractive valuation based on earnings

Exxon Mobil’s earnings prospects are cheap. The energy firm is expected to generate $12.70 in EPS this year and $10.62 next year, implying P/E ratios of 7.5 X and 9.0 X. I believe Exxon Mobil’s valuation, given the current situation in Europe, is very attractive, and the risk profile is skewed to the upside.

|

Exxon Mobil |

FY 2022 |

FY 2023 |

FY 2024 |

|

EPS |

$12.70 |

$10.62 |

$8.69 |

|

YoY Growth |

135.97% |

-16.34% |

-18.22% |

|

P/E Ratio |

7.53 X |

9.00 X |

11.01 X |

(Source: Author)

Risks with Exxon Mobil

The big commercial risk for Exxon Mobil is the market price for crude oil. Uncertainty drives upwards pricing, and Exxon Mobil is currently making money hand over fist. A downturn in the petroleum market and sharply lower petroleum prices would have an immediate and deep impact on Exxon Mobil’s earnings and free cash flow prospects, and likely on the firm’s valuation factor as well.

Final thoughts

I believe the G7’s attempt to place a price cap on Russian oil is set to backfire big time and new sanctions on Russia could create a gold mine for Exxon Mobil. Other countries, like India, are already buying Russian oil at a discount, which makes a global agreement on price caps unlikely. The indefinite shutdown of the Nord Stream 1 pipeline last week is kind of a big deal for the energy markets as well, and it could create new fears about energy supply security in Europe… which could result in soaring energy prices. The recent escalation in the stand-off between Russia and the West, like it or not, is hugely supportive of the energy pricing environment. For those reasons, I expect that Exxon Mobil will be able to maintain strong free cash flow momentum and shares, given the low P/E ratio, have revaluation potential to the upside!

Be the first to comment