ipopba/iStock via Getty Images

Thesis

I previously covered BioVie on June 7, 2022. BioVie Inc. (NASDAQ:BIVI) is a largely underfollowed biotech firm targeting both Alzheimer’s and Parkinson’s with a same drug, NE3107, and refractory ascites with BIV201. Apart from some articles relating to its IPO in 2019, the company had not been covered further on Seeking Alpha, and coverage on other media is scarce too.

For Alzheimer’s and Parkinson’s, the company is repurposing an anti-diabetes drug candidate recovered from the bankruptcy of Hollis-Eden Pharmaceuticals. In my previous coverage, I had given the company a Buy rating, which I will repeat here, but not a Strong Buy rating for lack of enough biomarker data to go on. BioVie has not yet reported these, but there is a reason for that, and that’s about to change.

Things seem to be stirring behind the scenes at BioVie. On no particular press release in a down-trending market, the stock has managed to move up considerably.

Since my coverage, the company has been highlighting and/or setting up quite some things that may be indicative of what is to come, which I believe to be bullish. I would like to point investors’ attention to those recent events in the coverage below.

Company

Introduction

BioVie aspires treatments in Alzheimer’s and Parkinson’s with its drug candidate NE3107. NE3107 had originally been developed to treat diabetes and inflammatory diseases in 2006 by Hollis-Eden Pharmaceuticals, after which it has been incorporated in Terren Peizer’s Neurmedix for the treatment of neurological diseases. Neurmedix has later been incorporated into BioVie, also run by Terren Peizer. In that framework, NE3107 has already been the object of several Phase 2 trials in inflammatory diseases. BioVie claims that within Neurmedix, the drug’s mechanism has been further studied and understood, while at the same time, science in neurological diseases was catching up the idea that underlying inflammatory and glia-related pathways may be an important cause of these diseases.

With its second drug candidate BIV201, BioVie aspires treatment improvement for refractory ascites.

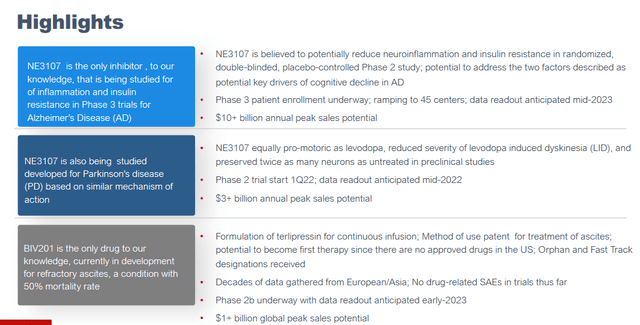

Drug asset overview (Corporate Presentation)

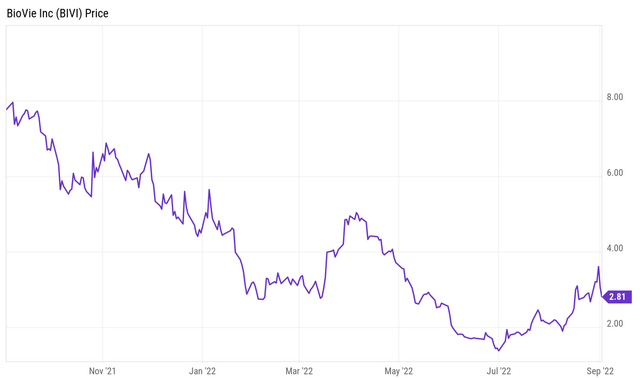

For a first coverage of those assets, I would like to refer readers to my previous coverage of BioVie of June 7, 2022. Since that coverage, there has only been one press release from the company, June 23, 2022, announcing patent issuance for its ascites treatment with BIV201, which did not relieve the downward pressure on the share price. BioVie’s share price however took a turn for the better since July 1, 2022, and has been moving up since that moment. This is its one-year price chart.

One-year price chart (Ycharts for Seeking Alpha)

The company’s market cap is now $70 million. After a brief overview of the company, I will focus on the recent developments below.

NE3107 for neurological diseases as main asset

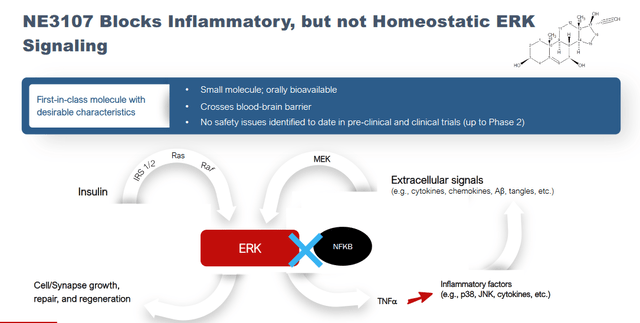

NE3107 is pursuing the reduction of neuroinflammation and insulin resistance in Alzheimer’s and Parkinson’s patients by inhibiting ERK signaling without compromising immune function.

ERK and NFkB slide (Corporate presentation)

ERK, or extracellular signal regulated kinase, is an interesting pathway as it blocks NF-κB or nuclear factor kappa b signaling, which in its turn is closely related to TNF signaling. TNF, or tumor necrosis factor, is often considered as the main driver of neuroinflammation. This is valid in my eyes, as ERK plays a prominent role in inflammatory signaling and activation of glial cells, and NF-κB regulates proinflammatory cytokines such as TNF-α, IL-1β and IL-6. Additionally, NF-κB is involved in Aβ and phosphorylated tau, the typical hallmarks of Alzheimer’s disease.

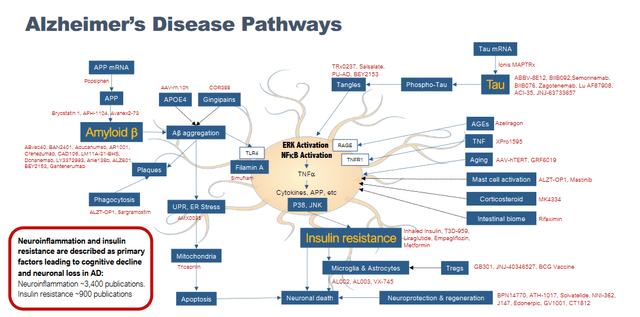

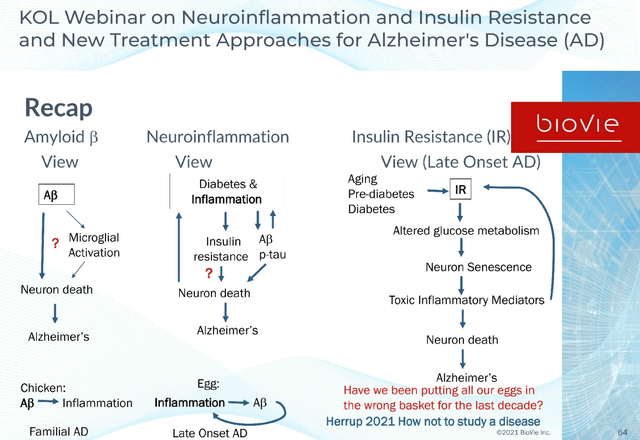

BioVie itself sets out the different drug targets and molecular pathways involved in the Alzheimer’s space as follows.

Alzheimer’s pathways slide (Corporate presentation)

Whereas most of the past research has focused on amyloid oligomers or phosphorylated tau tangles, research in recent years has shown that Alzheimer’s disease is triggered by a chronic inflammatory reaction which leads to a dysregulated state of the immune cells of the brain, also called glial cells. Though many different factors may lead to neuroinflammation, targeting one mechanism may lack efficacy. Targeting neuroinflammation instead may be best to prevent disease progression. BioVie alleges that in glial cells, NE3107 essentially shuts down inflammation where it really starts by modulating ERK. In doing so, the production of TNF-alpha is hampered and the cascade of pro-inflammatory factors as a result of that is diminished as well.

Old versus new approach slide (KOL webinar on neuroinflammation)

Alzheimer’s is essentially seen by many of the typical example of ageing and a failing metabolism, meaning a combination of mechanisms of action may yield best results.

The inflammation and TNF-pathways seem to be validated to me, as INmune Bio is pursuing them similarly by selectively inhibiting soluble TNF, with outstanding preclinical and clinical results so far, well validated by the scientific field. It is also my understanding that many other drug candidates in the neurodegenerative space have seen good results caused by drugs that lower neuroinflammation, which makes me wonder whether we are not seeing the first results of an identical underlying cause in treating these diseases.

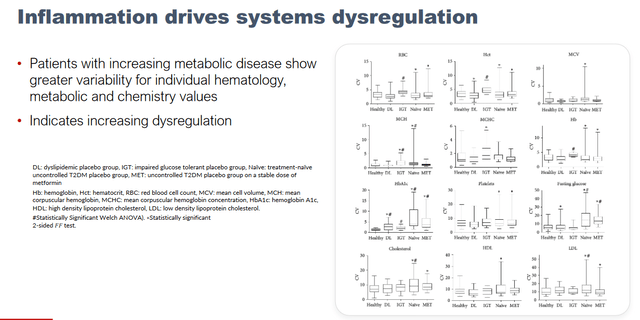

Inflammation drives dysregulation slide (KOL webinar on neuroinflammation)

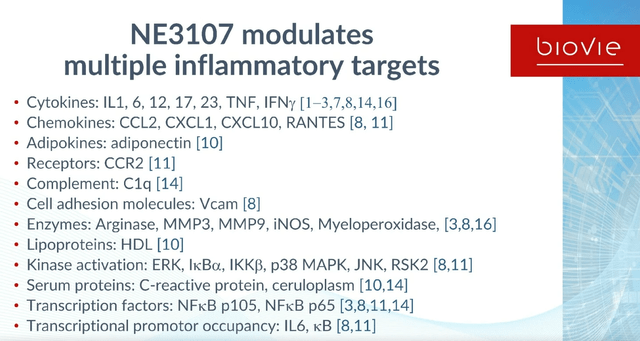

BioVie itself considers itself to be part of a set of companies targeting neuroinflammation in Alzheimer’s disease, some of which I have covered already such as INmune Bio (INMB) and Athira Pharma (ATHA). INmune Bio’s XPro had reduced an entire pre-defined set of more than 30 biomarkers of neuroinflammation, with the ensuing beneficial downstream effects. Neuroinflammation, if properly reduced without affecting normal immune function, is clearly a target. BioVie shows how NE3107 modulates multiple inflammatory targets such as a wide range of cytokines and chemokines.

NE3107 drives multiple inflammatory targets (KOL webinar on neuroinflammation)

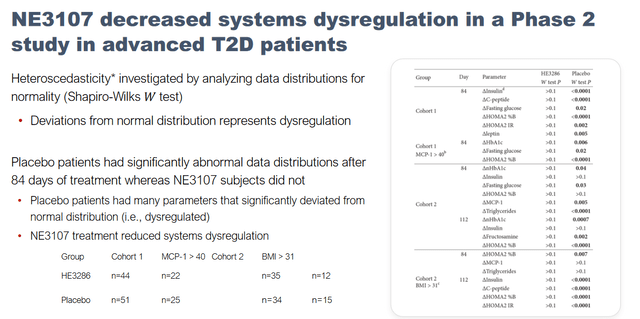

Targeting insulin-resistance is also validated , as several reports implicate type 2 diabetes in Alzheimer’s disease. Earlier results also show that NE3107 decreased metabolic dysregulation in type 2 diabetes.

NE3107 decreases systems dysregulation (KOL webinar on neuroinflammation)

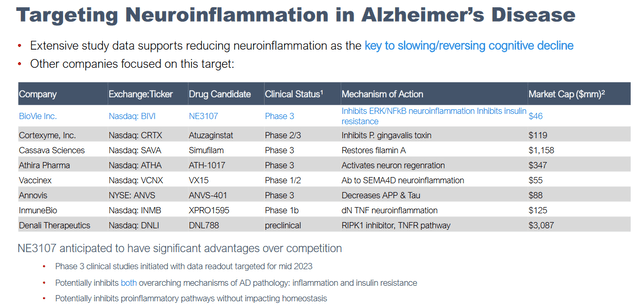

Worthwhile mentioning is that BioVie’s own overview of peers in the neuroinflammation-targeting space also mentions better-known companies such as Denali Therapeutics (DNLI), Quince Therapeutics (QNCX) previously called Cortexyme, Cassava Sciences (SAVA) and Annovis (ANVS).

Slide on competitors focused on neuroinflammation (Corporate presentation)

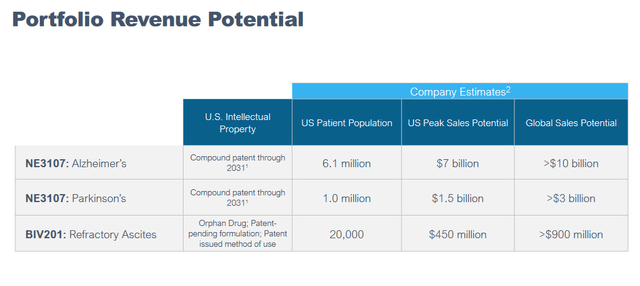

The above slide mentions, among others, that NE3107 is anticipated to have significant advantages over the competition as its Phase 3 clinical study in Alzheimer’s disease is underway. It is worthwhile highlighting that because, if successful in its Phase 2 trial on the basis of information considered relevant, BioVie’s market cap could skyrocket in preparation of its Phase 3 readout. The portfolio revenue potential is surely meaningful, with a 7.1 million patient population in Alzheimer’s and Parkinson’s combined, and >8.5 billion in peak sales potential for both indications.

Portfolio revenue potential (Corporate presentation)

Biogen’s Aduhelm was once thought to be able to reach $10 billion in peak sales over one year alone, but as the drug did not find appraisal both from doctors or patients due to its uncertain effect on cognition and side effects, those hopes were soon slashed. Nonetheless, the potential is there for a successful drug that could prevent decline without side effect.

The recent events

Clarity on what to expect from the investigator-initiated Phase 2 study in Alzheimer’s disease

My earlier coverage mentioned four potential catalysts, two of which were imminent, namely a topline Phase 2a readout in Parkinson’s disease and advanced imaging data of a Phase 2 Alzheimer’s study. I had understood the latter to be merely an imaging study. It however appears to be much more than that.

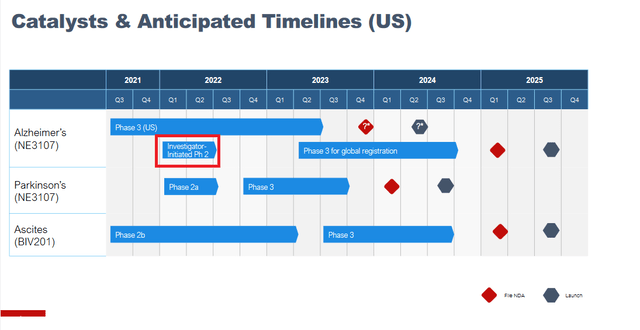

On June 30, 2022, a SEC filing of BioVie included a new corporate presentation. Subsequent to that SEC filing, the stock started to move higher. As I see it, the updated corporate presentation contained two particular differences to the former one. These are the addition to the pipeline of an investigator-initiated Phase 2 study in Alzheimer’s which I have highlighted in red below, and an additional slide on that trial showing the identifier on clinicaltrials.gov.

Catalysts and timeline (Corporate presentation) Investigator-initiated trial slide (Corporate presentation)

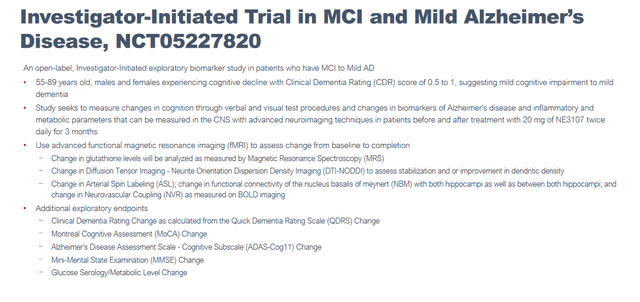

This investigator-initiated open-label Phase 2 trial focuses on functional MRI and biomarkers in Alzheimer’s patients, but apparently also includes cognition data. I missed the company highlighting that before.

The functional MRI measures are change in glutathione levels, change in diffusion tensor imaging – neurite orientation dispersion density imaging, change in arterial spin labeling, change in functional connectivity of the nucleus basalis of meynert, and change in neurovascular coupling. These measures do not tell me much, and I expect the company to elaborate on their importance. I have seen INmune Bio read out several functional MRI measures that have been of great importance to my understanding of the potentially disease-modifying characteristics of their drug, such as apparent fiber density, radial diffusivity and white matter free water. So I am curious to see what BioVie will report here.

But I am more curious as to the readout of the additional exploratory endpoints, more specifically readouts on the clinical dementia rating change (QDRS), the Montreal cognitive assessment change (MoCA), the Alzheimer’s Disease Assessment Scale – Cognitive Subscale (Adas-Cog11), and the Mini-Mental State Examination (MMSE).

Alzheimer’s disease being essentially characterized by a constantly declining cognition which ultimately results in loss of function and death, cognition data are important for investors. Cognition data may be indicative of whether a drug candidate stands chances of being successful in a Phase 3 trial. As an example, the possible effect of a readout of a Phase 2 trial on cognition led Casava Sciences’ share price to make a tenfold increase over the course of six months, in between January 2021 and July 2021, almost reaching a $5 billion market cap at its peak. And the essential debate between bulls and bears of Cassava Sciences can be reduced to those who look at cognition data primarily versus those who look at scientific integrity.

What is now clear is that the company will, early fall of 2021 from the latest update shared on Bloomberg TV, report on both its phase 2 Alzheimer’s as its Phase 2 Parkinson’s trial. At the same time, the company’s CEO called the company ‘tremendously undervalued’.

That phase 3 trial is actually midway and should read out some time in 2023. BioVie is indeed in the midst of a Phase 3 trial in Alzheimer’s without having done a proper Phase 2 trial in Alzheimer’s disease. That’s not logical, but it would mean that success would place this company about a year away from a pivotal randomized placebo-controlled trial in Alzheimer’s disease. When enquired about that recently, the company mentioned the following:

This drug was originated a long time ago by a company called Hollis Eden Pharmaceuticals who was developing it for diabetes. And through the long development process eventually they understood that the mechanism of action of the drug is at the central node of inflammation and as a result it plays a bigger role in Alzheimer’s than it would as a diabetic drug. So that’s why the company took a detour and pursued Alzheimer’s instead of just diabetes. […]

The phase 2 data that we have on 3107 essentially came from the diabetes trial where we showed that 3107 did everything that you would expect it to do as a diabetes drug, but in addition it showed signals of essentially restoring what we called lots of dysregulation of other systems. So it helps restore not only glucose control but it helps restore things such as your blood pressure and cholesterol and so forth. So many systems that were dysregulated were now getting back into regulation, and if Alzheimer’s is the poster child for systemic dysregulation. We also saw a signal that it helped reduce the production of APP and so forth. So those were the factors that we basically saw that led us and the FDA to authorize us to go straight to a phase three study for Alzheimer’s from the findings that we have from our phase two in diabetes primarily, because we showed that we can reduce inflammation and reduce insulin resistance, both of which have been shown to be underlying drivers of Alzheimer’s.

Postponement of Phase 2 trial data of NE3107 in Parkinson’s disease until early fall

As mentioned in the previous coverage, BioVie is conducting a Phase 2 study in Parkinson’s disease. This study is a double-blind, placebo-controlled Phase 2a study assessing safety, tolerability and potential pro-motoric impact in 40 Parkinson’s patients on carbidopa/levodopa over 28 days. It started in January 2022 and was supposed to be reported in the second semester of 2022. This date has now been postponed to the early fall.

This trial is essentially based on the same rationale as above in Alzheimer’s, and preclinical results in showing that NE3107 had a similar effect to levodopa in rodent and marmoset models.

The recent SEC filings

As results from the above share price chart over the past months, the sole press release that the company has reported over the past three months had no effect on the share price. I do mention above that, for me, this was the last step in finally de-risking the company’s asset for refractory ascites.

What did make the stock move, and quite considerably even, are recent SEC filings that can be seen to be bullish on the company’s future reportings. I also believe the company’s delays in reporting on the two Phase 2 trials in both Alzheimer’s and Parkinson’s may be related to that. Otherwise I see no reason why there would suddenly be a two-month delay in reporting both.

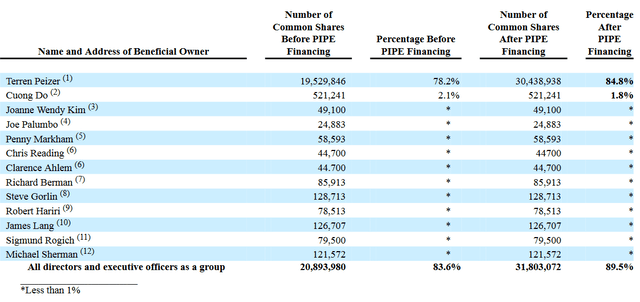

It results from a SEC filing of that same day that on July 15, 2022, BioVie has entered into a securities purchase agreement for the private placement of 3,636,364 shares at $1.65 per share, and a warrant to purchase 7,272,728 shares of common stock at $1.82 over the term of five years, for an aggregate purchase price of $6 million. Acuitas Group Holding is 100% owned by Terren Peizer, the chairman of BioVie’s board of directors. This transaction has led to the following share distribution within the board of directors.

BoD share distribution (SEC filing)

Shares reported for Terren Peizer include the afore-mentioned warrants. Shares reported for Mr. Do, Ms. Kim, Mr. Palumbo, Ms. Markham, Mr. Reading, Mr. Berman, Mr. Gorlin, Mr. Hariri Mr. Lang, Mr. Rogich and Mr. Sherman all include different warrants, and options to purchase a total of 1,011,337 if calculated correctly. Those options are all exercisable within 60 days of July 15, 2022, and hence expire on September 13, 2022.

Then, on August 31, 2022, another SEC filing showed that BioVie had entered into a sales agreement with Cantor Fitzgerald & Co. and B. Riley Securities, allowing BioVie at any time to sell shares of its common stock for an aggregate offering price of to $20,000,000.

In between all those filings, some time before end of August 2022, there was a coverage of BioVie on Bloomberg TV in which the company’s CEO alleged the company to be tremendously undervalued.

My view here is that these filings could be interpreted as the company setting up for success. It strikes me that, at a time when reporting should have been done on the afore-mentioned two Phase 2 trials and while the company’s shares were at an all-time low, the company decided to give out new shares and grant a warrant for not less than 7 million shares at a price close to that all-time low, in a private placement. It is unclear what will happen with all those options that are being held by the company’s directors, and that will soon expire. There may or may not be a link with the recent Cantor Fitzgerald and B.Riley agreement. In any case, latter agreement basically allows the company to pick up future funding. It would be logical when the company would do so at a price substantially higher than the current share price, and I believe that may have been the incentive for both underwriters as well. Of note, Mayank Mamtani of B.Riley also covers BioVie with a price tag of $18. That price target has come down from $47 in January of 2021. At that time, BioVie’s share price was still $27.91.

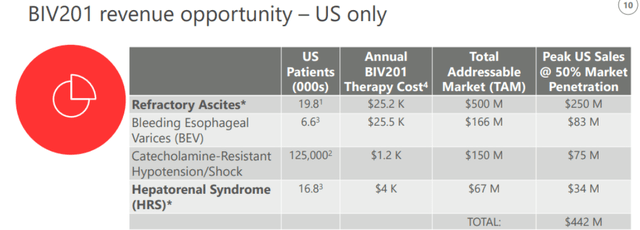

A patent update on Terlipressin or BIV201

BioVie repeatedly stated that its trials with Terlipressin or BIV201 are investment de-risking in that that drug has already been approved in 40 other countries, but not in the US, for refractory ascites. Refractory ascites is a life-threatening complication of advanced liver cirrhosis, has no approved treatment in the US, and there are no other treatment candidates but Terlipressin. At 50% market penetration in the US, BIV201 could lead to annual sales of $250 million.

In a recent interview, BioVie CEO called this ‘the most de-risked asset’ he had ever seen. That may be an overstatement, but with no competitors in sight, I would agree that BIV201 does de-risk investment at the current prices.

BIV201 revenue opportunity (Corporate presentation)

On June 23, 2022, BioVie issued a press release announcing patent issuance for its ascites treatment with BIV201. Although this did not relieve the downward pressure on the share price, this is actually an important event as it finally clears the way for exclusive marketing of BIV201 in the US.

Financials

Apart from the additional funding the company has received from its major stockholder as reported above, there is nothing new to report on the financial side compared to my earlier coverage.

Risks

Here also, there is little new to report compared to my earlier coverage of the company. The recent patent issuance for the company’s drug candidate for refractory ascites de-risks the stock further, certainly at these prices. Admittedly, refractory ascites is the less interesting asset of the company, and the company is most interesting for its Alzheimer’s and Parkinson’s drug candidate. So I would believe that many investors are invested in BioVie for the latter.

I do want to stress again that, at this stage, BioVie’s mechanism of action makes me hopeful, but its results reported so far cannot confirm that at this stage. In my earlier coverage, I had mentioned that for the same reason, I rated the stock as a Buy and not a Strong Buy. Shares of BioVie at this stage belong to the high-risk segment of a biotech portfolio; investors unfortunately do not know what the company knows. My view here has not changed, in spite of actions I believe to be bullish as reported above. But it may change, once the company has done its announced reporting. And I will be watching that reporting closely.

Lastly, with most of the shares being held by the major stockholder, the company’s shares are not very liquid at this stage. This may of course change in case the company reports on any of its studies’ results.

Conclusion

As mentioned above, quite some things have happened since my last coverage of BioVie, including the share price ending its trend downward.

The patent issuance for BIV201, the company’s asset for refractory ascites, has de-risked the stock at these prices.

I believe that the recent SEC filings of the company, starting with a more prominent place and explanation of its investigator-initiated Phase 2 trial, have changed the course of the share price. The results of the investigator-initiated Phase 2 trial, to be reported early in the fall of 2022, will include data on cognition. That knowledge was new to me, and I believe it to be very pertinent to investors. If either biomarker or cognition results here are good, I expect the stock to move higher, as investors may realize this company has a shot at approval with an ongoing Phase 3 trial.

Though very underfollowed, the company is perhaps furthest-advance compared to its peers in its Alzheimer’s trials. It has built on results of previous trials with its drug candidate NE3107, and the FDA apparently agreed that the company could directly proceed to a Phase 3 trial in Alzheimer’s.

The company has also pushed the date of the upcoming results of its phase 2 trial in Parkinson’s disease. That trial also holds potential, as NE3107 has already shown results similar to levodopa in rodent and marmoset models.

Corporate action and financing have been on the foreground of recent SEC filings, which I believe to be bullish.

All of these recent events within BioVie are relevant to any investors’ analysis here, which is why I have wanted to cover them in this follow-up article.

For all of the above, I continue to rate BioVie as a Buy.

Be the first to comment