dan_prat/iStock via Getty Images

Introduction

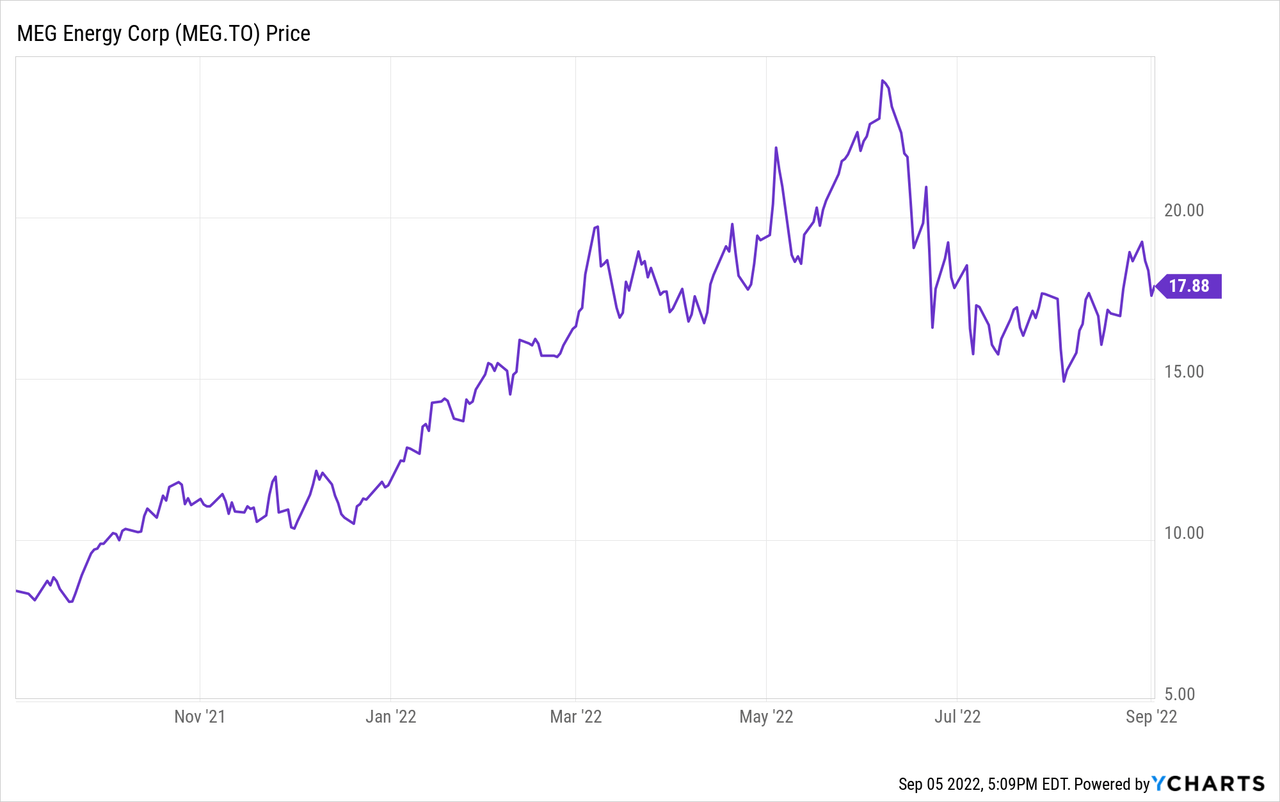

Although MEG Energy’s (TSX:MEG:CA) (OTCPK:MEGEF) share price has lost about 25% of its value since its peak in June, the share price is hanging in there and as MEG should continue to do well in the current price environment I wanted to have another look at this oil sands producer.

Although the company’s US listing is pretty liquid with an average daily volume of in excess of 180,000 shares, the company’s Canadian listing is obviously still the better choice with an average daily volume of in excess of 2.8 million shares. The ticker symbol in Canada is MEG and where applicable I will refer to the company’s primary listing in Canada as the company reports its financial results in Canadian Dollars as well.

The strong oil price was an obvious help in the second quarter

Q2 was widely anticipated to be a weak quarter for MEG Energy as the Christina Lake asset was undergoing a major turnaround which lasted over a month. To add to this issue, the ramp-up after completing the turnaround was slower than anticipated due to an electrical issue.

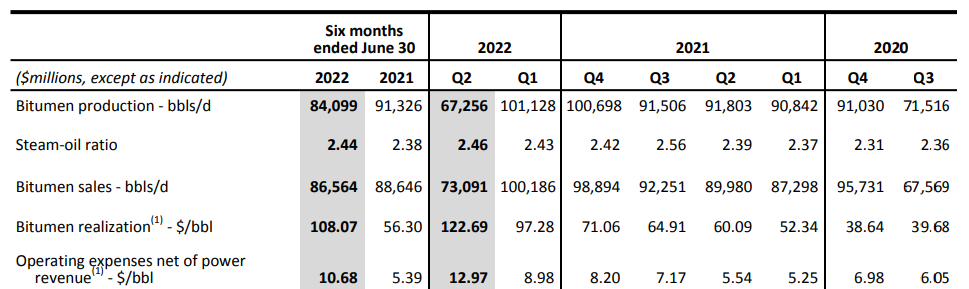

During the second quarter, MEG Energy produced just over 67,000 barrels of bitumen per day and sold just over 73,000 barrels of bitumen. That’s quite a long way off from the record result in the first quarter wherein the company produced in excess of 101,000 barrels of oil equivalent per day, but fortunately, the 25% price increase helped to keep the damage on the financial front relatively limited.

MEG Energy Investor Relations

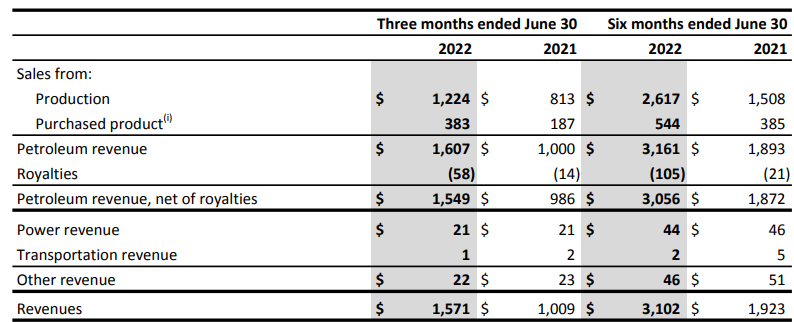

During the second quarter, MEG reported a total revenue of just over C$1.57B which included the C$383M revenue from purchased products (which were acquired for C$376M, so MEG made a small profit on these). That also explains why the reported revenue isn’t much lower than in the first quarter: during Q1, MEG reported an additional revenue from purchased products of just around C$162M, so the revenue from purchased products provided a revenue boost in the second quarter.

MEG Energy Investor Relations

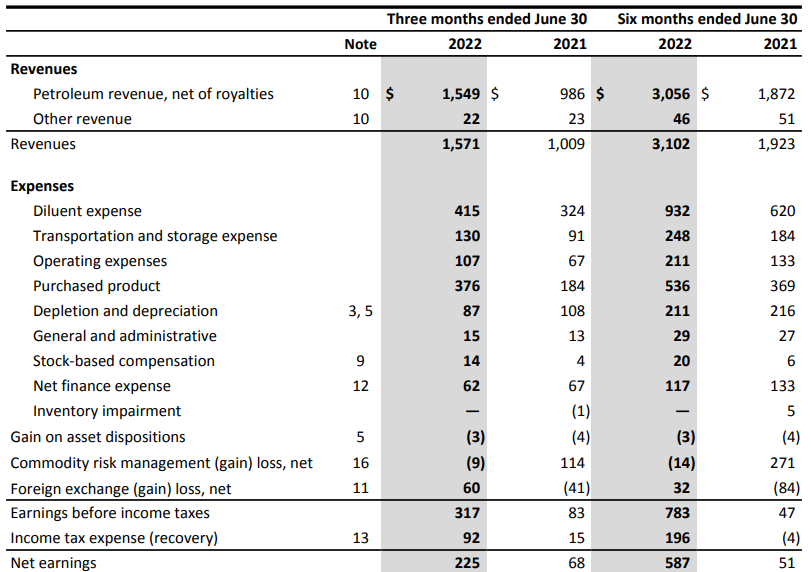

The pre-tax income of C$317M includes a C$60M hedging loss and after taking the taxes into account, the reported net income was C$225M, which works out to be C$0.73 per share.

MEG Energy Investor Relations

A good result but this obviously came in lower than the reported net income in the first quarter as MEG Energy was able to post a net income of in excess of C$360M due to the higher production rate and a small hedging gain.

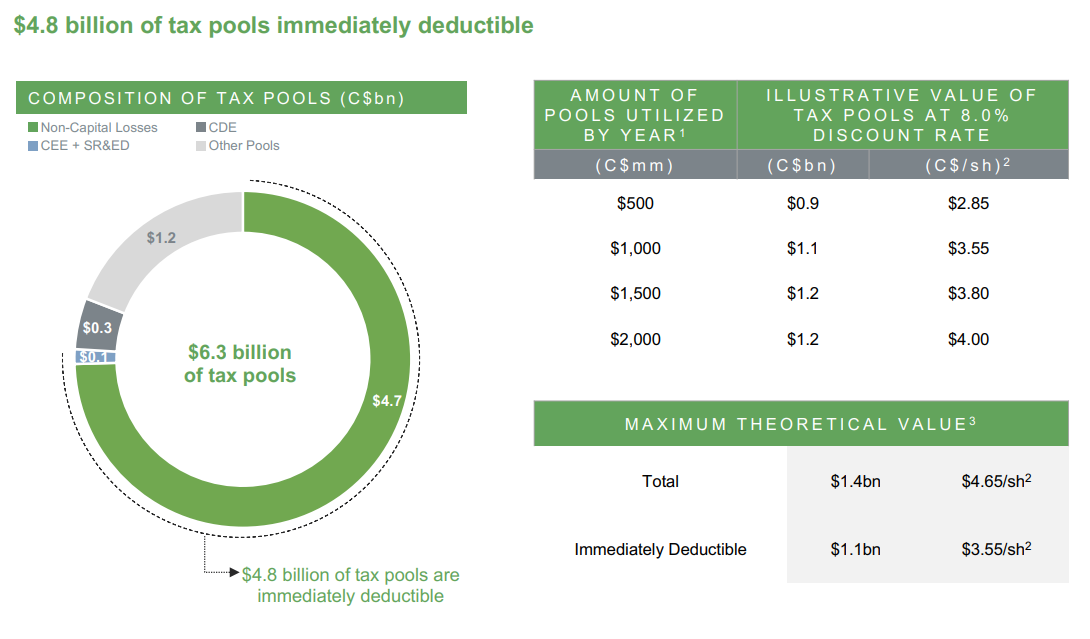

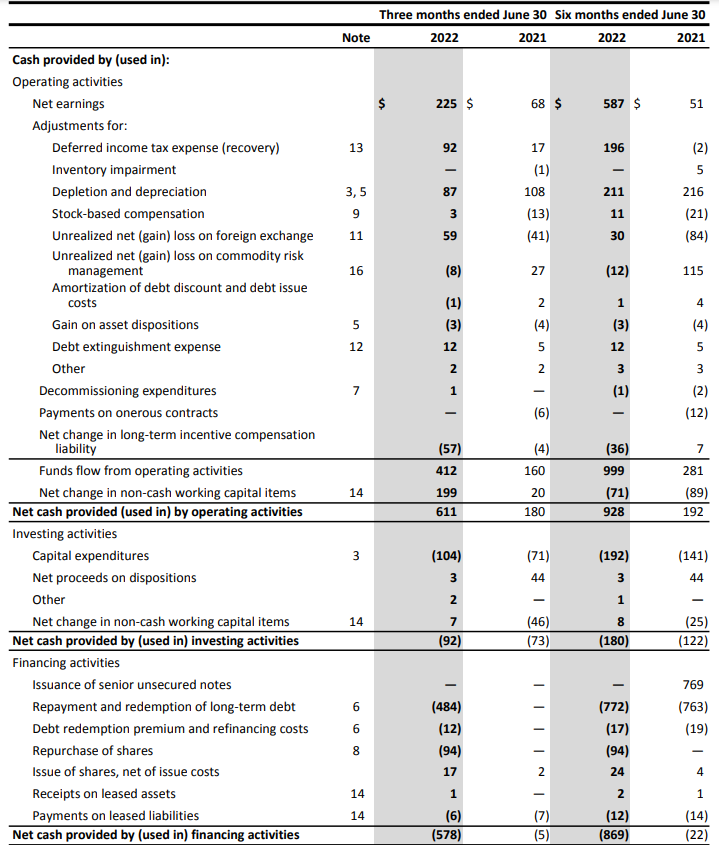

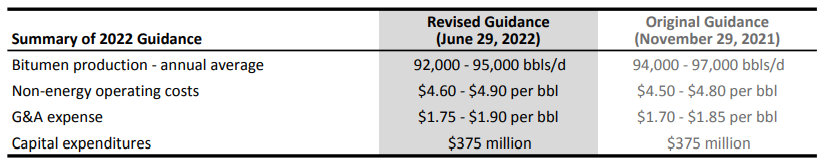

MEG also converted a (relatively) strong earnings result with robust cash flows. The company reported a C$412M operating cash flow excluding changes in the working capital position and as you can see below, that result includes a few interesting elements, including deferring all the corporate taxes due on the result. That’s not a surprise as MEG has been touting its tax pools as one of its main assets.

MEG Energy Investor Relations

So while I usually don’t like to exclude deferred taxes, I think it makes sense in MEG’s case to indeed just take them out of the equation as it looks like the company won’t have to pay taxes in the foreseeable future. We still need to deduct the C$5M in net lease payments and end up with C$407M in adjusted operating cash flow.

MEG Energy Investor Relations

The capex was just C$104M despite the Christina Lake turnaround, which means MEG Energy’s adjusted free cash flow was approximately C$303M. The current share count (as of June 30) was 307.3M shares, which means the underlying free cash flow per share was almost C$1. Not bad for a quarter where the production rate was about 30% lower than what we can expect from MEG in the next few quarters.

MEG Energy Investor Relations

MEG is now back at full production levels

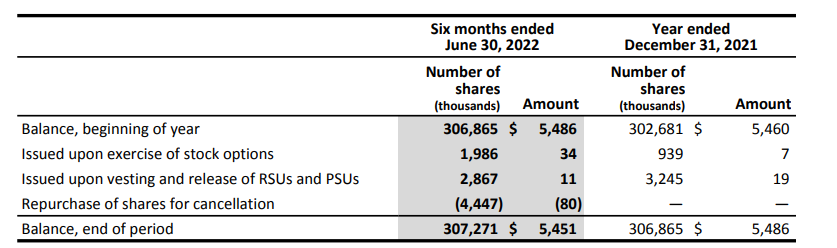

As the Christina Lake facility is now operating at full capacity again after the electrical event, MEG is guiding for a production rate in the second half of the year that will ‘meet or exceed the record production levels the Corporation reached in the first quarter of 2022’. This means we will go back up to about 100,000 barrels of bitumen per day. The reduced full-year guidance now calls for a total production rate of 92,000-95,000 barrels per day.

MEG Energy Investor Relations

Considering the average bitumen production rate was just over 84,000 barrels per day in the first half of the year, MEG needs to produce 100,000 barrels per day to meet the lower end of the guidance and 106,000 barrels per day to meet the higher end of the guidance. I think it’s safer to assume the company will meet the lower end of its guidance for now. That would still be a substantial step-up from the 67,256 barrels in the second quarter. This means the higher production rate should compensate for the lower realized bitumen price over the next few quarters.

Investment thesis

It wouldn’t be too far-fetched to expect MEG to continue to generate a free cash flow result of C$0.90-1.00 per quarter in the foreseeable future at the current oil price. The cash flows should also be protected by MEG’s continuous debt repayment. During the second quarter, the company spent almost C$500M on buying back debt as it retired C$216M of 6.50% debt while it repurchased almost C$400M of the 7.125% debt (including the repurchases subsequent to the end of the quarter). This cumulative debt repayment of in excess of C$600M should reduce the interest bill by about C$40M, providing an additional C$0.13 in free cash flow per share going forward (assuming MEG Energy indeed still doesn’t have to pay corporate taxes).

The net debt has dropped to C$1.8B which is a massive improvement compared to the almost C$2.5B as of the end of last year and I expect MEG to continue to buy back its 7.125% debt as that’s a smart thing to do. With a remaining 1P reserve life index of in excess of 30 years, it looks like MEG Energy could do well in the current energy crisis.

Be the first to comment