I’ve been looking for closed-end fund bargains amidst the recent carnage. Buying cheap assets is great, but finding a double discount is even better. One fund that recently came to my attention is the NexPoint Strategic Opportunities Fund (NYSE:NHF).

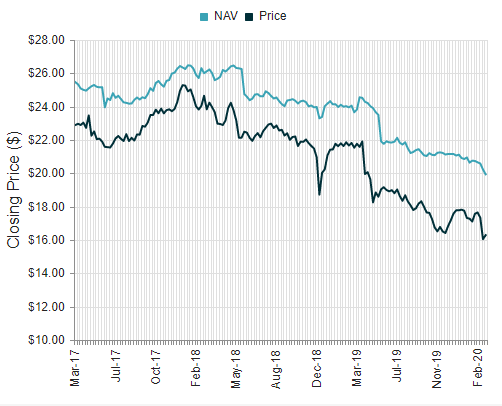

NHF has traded at a chronic discount, and it recently became more severe. The current NAV discount is 22%, nearly double the three-year average of 11.4%. Some discount might be justified in a situation with mediocre performance and/or opaque assets. Is a 22% discount justified for NHF?

This chart shows NHF’s discount over the past three years.

Source: CEF Connect

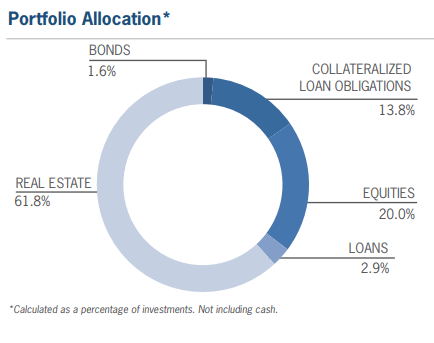

Portfolio

NHF has a broad mandate to equity, derivatives, and high yield credit. Its strategy is more comparable to a hedge fund than a typical closed-end fund.

At first glance, NHF’s portfolio allocation seems straightforward. It includes a large portion of real estate along with a mix of credit and equity. However, upon closer inspection, NHF’s portfolio is more opaque than the typical income CEF. A large portion of NHF investments are in private funds. Three of their top ten holdings are wholly owned subsidiaries, and one is an affiliated publicly-listed REIT.

This chart shows NHF’s portfolio allocation by category:

Source: Fund Fact Sheet

The following table shows NHF’s top ten holdings

|

Collected – Top Holdings |

Weight |

Description |

|

NEXPOINT REAL ESTATE OPPORTUNITIES LLC |

20.10% |

Private REIT (Wholly Owned) |

|

JERNIGAN CAPITAL CUMULATIVE PREF |

9.80% |

Preferred Stock in Publicly traded REIT |

|

NEXPOINT HOSPITALITY TRUST |

5.70% |

Public REIT listed in Canada – NHT.V |

|

FREMF 2018-KC02 |

4.70% |

Freddie Mac Securitization |

|

FREMF 2019-K90 |

5.70% |

Freddie Mac Securitization |

|

SFR WLIF I LLC |

4.17% |

Private Real Estate |

|

TERRESTAR CORP COM |

3.10% |

Equity – Distressed satellite company. Fund also owns credit positions |

|

SPECIALTY FINANCIAL PRODUCTS DAC |

3.00% |

Private Equity (Wholly Owned) |

|

NEXPOINT REAL ESTATE CAPITAL LLC |

2.90% |

Private Mortgage REIT (Wholly Owned Subsidiary) |

|

SFR WLIF II LLC |

2.30% |

Private Real Estate |

Source SEC filings, Author’s calculations

The “Real Estate” category includes mostly private, unlisted investments. In 2019, they conducted a rights offering and invested most of the $240 million in proceeds into real estate. NHF’s largest single holding is NexPoint Real Estate Opportunities REIT, which is a wholly owned subsidiary accounting for approximately 29% of its total assets. This REIT in turn invests directly a variety of real estate, including self storage, office, hospitality and single family homes.

NHF’s REIT subsidiary owns, SAFSTOR, which in turn owns and develops self-storage properties which are managed by third parties, including Extra Space Storage (NYSE:EXR) and CubeSmart (NYSE:CUBE). SAFSTOR has 8 properties in operation, and 36 projects in planning and construction phase. The projects under development have completion dates ranging from May 2020 to December 2022. When these projects are completed, NHF’s ability to pay distributions will likely increase.

NHF’s REIT subsidiary has made two major investments in the manager’s home market of Dallas. They own CityPlace tower, a 42-story office building in Uptown Dallas. They are redeveloping the property and adding both a hotel and a datacenter. According to management commentary, the prior manager was unwilling to invest the capital needed to remain competitive. They believe they can double the rent on the place once the project is complete in 2022. Additionally, they are in the process of developing a Marriott (NASDAQ:MAR) hotel in uptown Dallas, with an expected completion in the third quarter of 2020.

NHF’s exposure to residential real estate includes both equity and debt. Through the REIT subsidiary, they own a single family private rental REIT that owns 7,000 single-family rental homes across the Midwest. They also invest in Freddie Mac securitizations. Additionally, they have a mortgage REIT subsidiary that owns preferred equity positions in 6 multifamily properties. NHF also owns a 5.4% stake in United Development Funding IV (OTCPK:UDFI), a distressed mortgage REIT whose manager Kyle Bass accused of fraud.

Performance and Distributions

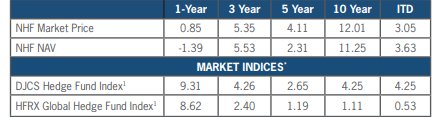

NHF benchmarks itself against the Dow Jones Credit Suisse Hedge Fund and HFRX Global Hedge Fund indices instead of an index of publicly traded securities. NHF has outperformed hedge fund benchmarks over a three and five-year period. Note that, prior to 2013, the fund was run by an affiliate of the current manager.

The following table shows NHF’s performance through December 31, 2019.

Source: Fund Fact Sheet

Given how much discretion NHF management has in valuing its portfolio, we have to take NAV performance with a grain of salt. Ability to distribute cash is another important indicator of performance.

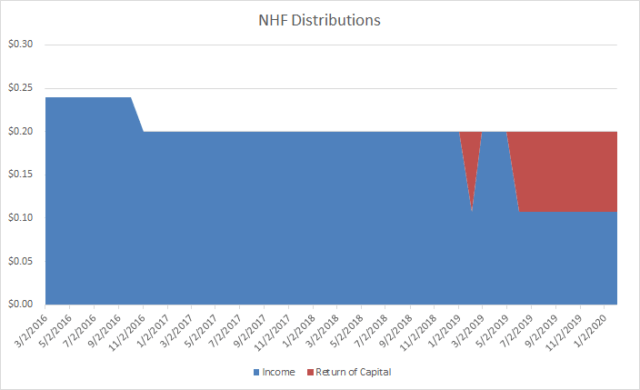

NHF reduced monthly distributions in 2016, but has kept them steady since then. However, in 2019, return of capital started becoming a larger component of NHF’s distributions. Currently, NHF still pays $0.20 per month in distributions, implying a 15% distribution rate.

Source: CEF Connect, Author’s calculations.

The stock price has trended downwards the past three years. This reflects the opaque portfolio and concerns they won’t be able to maintain distributions. Another area of concern is a series of scandals involving affiliates of the NexPoint, the manager of NHF.

Source: CEF Connect

Affiliate Headline Risk

Highland Capital Management LP filed for bankruptcy in October 2019. The bankruptcy stems from pending judgments against Highland for their management of a fund during the 2008 financial crisis. Although this bankruptcy is legally unrelated to NHF, it is at best a distraction for management. Although Highland and NexPoint are separate entities, they are related through common ownership and overlapping executives and are part of the same investment platform.

Conclusion

NHF’s portfolio has several layers of potential value, and the fund is offering a tempting discount and yield. The exposure to unique real estate assets is rare in publicly traded assets. However, the lack of transparency into the performance of subsidiaries and the development progress at some of their assets is cause for concern. I’m not comfortable enough to buy yet, but I will keep monitoring the situation.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment