Elena Bionysheva-Abramova

The final results are in from the Q3 Earnings Season for the Gold Miners Index (GDX), and while it wasn’t a great quarter due to inflationary pressures, the good news is that commentary seems to suggest we may have seen peak unit costs in Q2/Q3 2022. This is reinforced by the fact that oil prices have continued to pull back from extreme levels in Q2, partially offset by the fact that labor tightness has remained sticky. Fortunately, Newcrest (OTCPK:NCMGF) put up solid results with lower costs on a year-over-year basis ($1,098/oz vs. $1,270/oz). However, this was primarily related to easy comps and the addition of a low-cost asset that wasn’t in the portfolio last year.

From a bigger-picture standpoint, the worst looks to be behind most producers from a cost standpoint. Plus, with their strongest quarters of the year ahead in calendar year Q4, one would expect much better sequential results from a margin standpoint if the gold price can remain above $1,725/oz. This should translate to sharp dips being bought into year-end, providing an opportunity to top up the exposure in the highest-quality producers as quarterly results go from ugly to more acceptable. Let’s take a closer look at Newcrest’s Q3 results below and how it’s tracking against its annual guidance.

Newcrest – Red Chris Operations (Company Presentation)

While North American gold producers released their Q3 2022 results, the Australian producers released their fiscal Q1 2023 results, which are the same as calendar year Q3 2022 results, to avoid confusion.

Q1 2023 Results

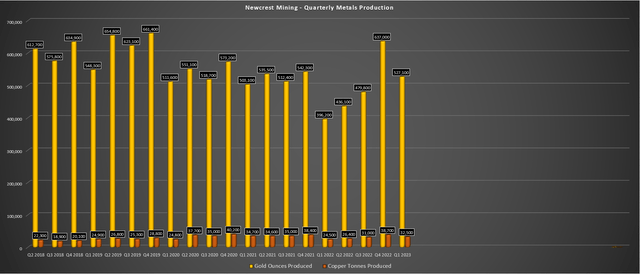

Newcrest Mining released its fiscal Q2 results last month, reporting quarterly production of ~527,100 ounces of gold and ~32,500 tonnes of copper, representing sharp increases from the year-ago period. From a gold production standpoint, production was up 33% from ~396,200 ounces in the year-ago period, helped by better quarters from Cadia and Lihir and a full quarter of contribution from the company’s newest Brucejack Mine. From a copper standpoint, copper tonnes produced were up 32% from ~24,500 tonnes. While these results are phenomenal, the company lapped easy year-over-year comparisons.

Newcrest Mining – Quarterly Gold/Copper Production (Company Filings, Author’s Chart)

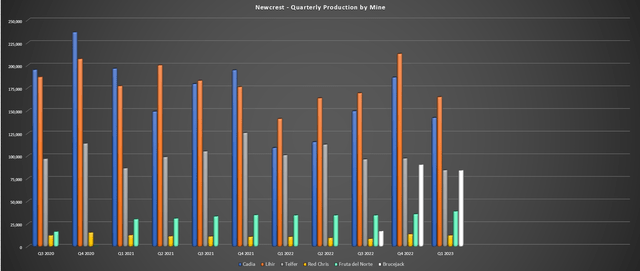

Beginning with Cadia, quarterly production came in at ~142,200 ounces of gold and ~23,400 tonnes of copper, a significant improvement from ~109,000 ounces of gold and ~15,200 tonnes of copper in the year-ago period. The increased production was despite planned maintenance activities for both Concentrator 1 and Concentrator 2, offset by increased throughput and better copper grades. In the previous year’s quarter, mill throughput was impeded by replacing and upgrading the SAG mill motor (July 2021). Overall, this was a solid quarter for the asset, with industry-leading all-in-sustaining costs [AISC] of $107/oz (Q1 2022: $203/oz), and the two-stage plant expansion has been completed, with a ramp-up towards 35 million tonnes per annum expected this quarter.

Newcrest – Quarterly Production by Mine (Company Filings, Author’s Chart)

At the company’s massive Lihir Mine in Papua New Guinea, production was up 17% year-over-year to ~165,200 ounces, and costs improved substantially to $1,436/oz vs. $1,898/oz in the year-ago period. However, this production increase was lapping a 19% decline on a year-over-year basis in Q1 2022 due to major shutdowns related to maintenance for Autoclave 4, Autoclave 2, mills, the oxygen plant, and associated equipment. During fiscal Q2 2023, the operation saw lower grades (2.15 grams per tonne of gold vs. 2.32 grams per tonne of gold), and the lower costs benefited from much higher gold sold vs. produced.

Lihir Operations (Company Presentation)

That said, there was a ~5,000-ounce impact from water supply limitations that impacted plant throughput (La Nina), which could persist into 2023, according to the company. This isn’t an isolated incident of citing risks from the La Nina weather pattern (in Newcrest’s case, it’s led to rainfall in the catchment area for the mine being patchy and half of the long-term average), with junior producer Minera Alamos (OTCQX:MAIFF) also noting that it is remaining cautious on mine planning activities and may accelerate waste removal activities in Q4 and Q1 which aren’t reliant on water availability at its small-scale Santana Operation in Mexico.

Moving to Telfer in the Paterson Province of Western Australia, gold production was down 16% year-over-year to ~84,400 ounces, while copper production slid nearly 23% to ~2,960 tonnes. This was related to lower gold and copper grades in the period, with lower output significantly impacting costs in the period despite the partial offset of a weaker Australian Dollar. Unlike Cadia, which continues to have industry-leading costs with few peers except Long Canyon in Nevada, Telfer’s costs were among the worst sector-wide for a large-scale operation (~300,000+ ounces), coming in at $1,895/oz vs. $1,358/oz in the year-ago period.

Brucejack Operations (Company Presentation)

Finally, at the company’s newest Brucejack Mine, Newcrest had a solid quarter with ~84,100 ounces produced at AISC of $973/oz, or an annualized production rate of nearly 350,000 ounces. This was overshadowed by the tragic fatality of one of Newcrest’s mining and development contractors that led to the suspension of mining and processing operations late in the quarter. Given the reduced operating days, production was down on a sequential basis (Q4 2022: ~90,400 ounces), with a slight impact from lower head grades (7.59 grams per tonne gold vs. 8.07 grams per tonne gold). However, with lower sustaining capital in the period and a weaker Canadian Dollar, unit costs were lower in Q1 vs. Q4 and came in well below the industry average.

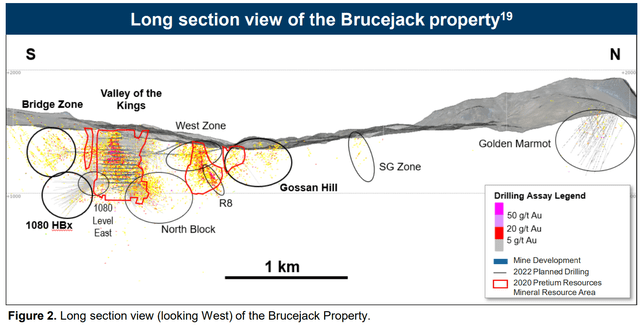

Brucejack Long Section (Company Presentation)

From an exploration and big-picture standpoint, Brucejack continues to be the gift that keeps on giving. While Newcrest certainly paid a premium for the asset, it can be comforted that the drill bit continues to churn out phenomenal results. Some highlight intercepts from the 1080 HBx zone (south of the ultra-high grade North Block and just south of 1080 Level East) were as follows:

- 70.1 meters at 35.0 grams per tonne of gold

- 25.6 meters at 88.0 grams per tonne of gold

- 38.5 meters at 36.0 grams per tonne of gold

- 22.0 meters at 178.0 grams per tonne of gold

Meanwhile, when it comes to brownfield exploration, the new Golden Marmot discovery also continues to yield several bonanza-grade intercepts, with the best holes hitting 46.5 meters at 16.0 grams per tonne of gold and 91.5 meters at 9.1 grams per tonne of gold. These are phenomenal intercepts, and the continued delineation of new zones suggests a very bright future for this asset. The only other company regularly reporting intercepts of this quality from a gram-meter basis is Osisko Mining (OTCPK:OBNNF), a story still in the development stage but hoping to move into production by 2026 in Quebec.

Newcrest has noted that debottlenecking efforts could help push throughput ~20% higher to 4,500 to 5,000 tonnes per day, which is excellent news for a mine looking mill-constrained vs. mine-constrained with a new highly-skilled underground operator and multiple different mining areas outside of the main VOK Zone (Golden Marmot, 1080 HBx, North Block, Gossan Hill, West Zone). An increased throughput rate could easily support a 425,000-ounce plus per annum operation at 8.5 gram per tonne head grades, with a production profile north of 450,000 ounces at the high end of this throughput range (4,500 to 5,000 tonnes per day), potentially lifting Brucejack to near Tier-1 status from a scale standpoint.

Costs & Margins

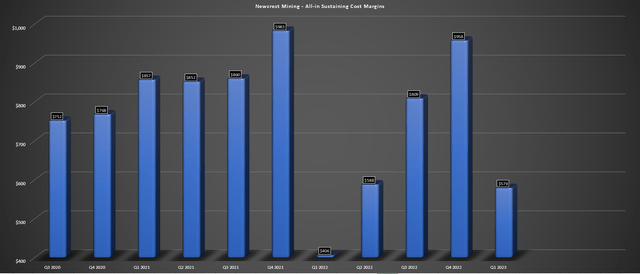

Looking at costs and margins, Newcrest saw a sharp decline in costs on a year-over-year basis ($1,098/oz vs. $1,278/oz), helped by weaker currencies (Australian & Canadian Dollar), higher sales volumes, and the addition of one of the highest grade underground mines globally in Brucejack. That said, the cost improvements year-over-year were mainly due to easy comparisons from the year-ago period, given that costs increased 29% from fiscal Q1 2021 to fiscal Q1 2022 ($980/oz –> $1,270/oz). So, while Newcrest’s costs are below its peer group and it had a solid performance, the year-over-year decline must be put in proper context.

Newcrest Mining – AISC Margins (Company Filings, Author’s Chart)

Moving over to Newcrest’s margins, AISC margins increased to $579/oz in Q1 2023 from $406/oz in the year-ago period. This was related to a weaker average realized gold price ($1,698/oz vs. $1,722/oz) offset by a weaker copper price that impacted by-product credits in the period. However, despite the higher-cost quarter, Newcrest should be in the lower quartile among its peers from a cost standpoint, with AISC likely to come in well below $1,100/oz for the year. These costs would be well ahead of Newmont (NEM) and Barrick (GOLD), which have struggled to keep a lid on costs, not benefiting from significant by-product credits like Newcrest. Given Newcrest’s performance to date, it should have no issue meeting production guidance of 2.1 to 2.4 million ounces of gold.

Valuation & Technical Picture

Based on ~895 million shares and a share price of $13.40, Newcrest trades at a market cap of ~$12.0 billion and an enterprise value of $13.3 billion. If we compare this figure with Newcrest’s estimated net asset value of ~$13.1 billion, Newcrest is back to trading at a slight premium to net asset value, to be expected for a multi-million-ounce producer with the majority of its operations in Tier-1 jurisdictions. Based on what I believe to be a conservative P/NAV multiple of 1.30x, given its attractive margin profile and low jurisdictional risk partially offset by a lower score from a diversification standpoint, I see a fair value for the stock of $17.0 billion or US$19.00 per share – 42% upside from current levels.

While this represents an attractive upside case, Newcrest is much busier than some of its peer group of ~2.5 million-ounce producers from a capital expenditures standpoint, with multiple major projects on the horizon, including the below projects. Although this sets the company up to be a major producer at industry-leading costs later this decade, it could lead to inferior free cash flow generation due to elevated spending over the next few years. So, while I think Newcrest is undervalued, given its long-term potential, the stock could underperform its peers with more relaxed capital expenditures, especially in an environment where even the best operators are seeing capex come in above estimates like Newmont.

- Havieron

- Cadia PC1-2

- Cadia PC2-3

- Red Chris Block Cave

- Lihir Phase 14A

- Lihir Seepage Barrier (depending on timing, possibly FY2026)

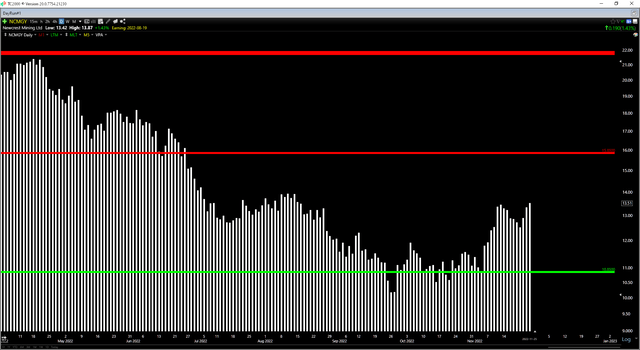

Moving to the technical picture, Newcrest has a new support level at US$10.85 and resistance at US$15.85 after breaking through this critical support level earlier this year. Based on a current share price of US$13.40, the stock trades near the middle of this support/resistance zone, with a current reward/risk ratio of 0.96 to 1.0. Generally, I want a minimum 4.0 to 1.0 reward/risk ratio for large-cap producers, suggesting that this is not a low-risk buying opportunity from a technical standpoint. That said, if the stock were to pull back below US$11.90 before year-end, I would view this as a low-risk area to start a position in the stock.

Newcrest Daily Chart (USD) (TC2000.com)

Summary

Newcrest put up a solid quarter to start the year, and while the temporary suspension of operations due to a tragic fatality at Brucejack will impact the fiscal Q2 results, I would expect a much stronger quarter on a consolidated basis, benefiting from reduced maintenance activities. On a full-year basis, Newcrest is on track for another strong year with increased gold/copper production with the added contribution from Brucejack, a better year at Lihir, and much higher copper tonnes mined at Cadia. So, while I don’t see the stock in a low-risk buy zone yet, any sharp pullbacks below US$11.90 before year-end should present buying opportunities.

Be the first to comment