SolStock

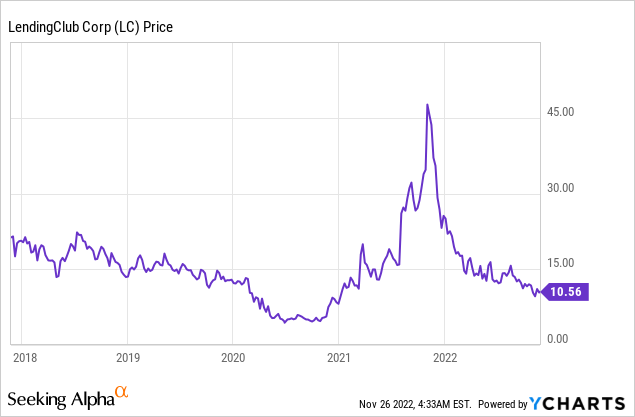

LendingClub (NYSE:LC) is a pioneer of the Peer to Peer lending industry and was the first company to register for this service with the SEC in 2006. Peer to Peer Lending is basically a marketplace place for loans. On one side you have borrowers who want to lend between $1,000 and $40,000. This could be for a variety of reasons from improving business cash flow to buying a house or consolidating credit cards. On the other side of the marketplace, you have individual investors and institutions which want to lend money to these borrowers for a high yield. LendingClub sits in the middle and makes its money by charging a loan origination (setup) fee and a service fee to investors. This type of business opens up liquidity in the loan market and expands capital to those who need it. In this post, I’m going to break down the company’s strong financial results and valuation, let’s dive in.

LendingClub Products (LendingClub Website)

Solid Third Quarter Financials

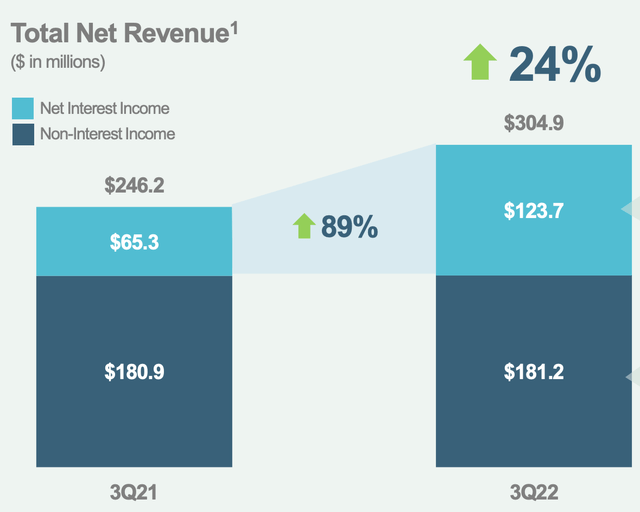

LendingClub reported solid financials for the third quarter of 2022. Revenue was $305 million which increased by a rapid 24% year over year and beat analyst expectations by $10.1 million.

LendingClub Revenue (Q3,22 Report)

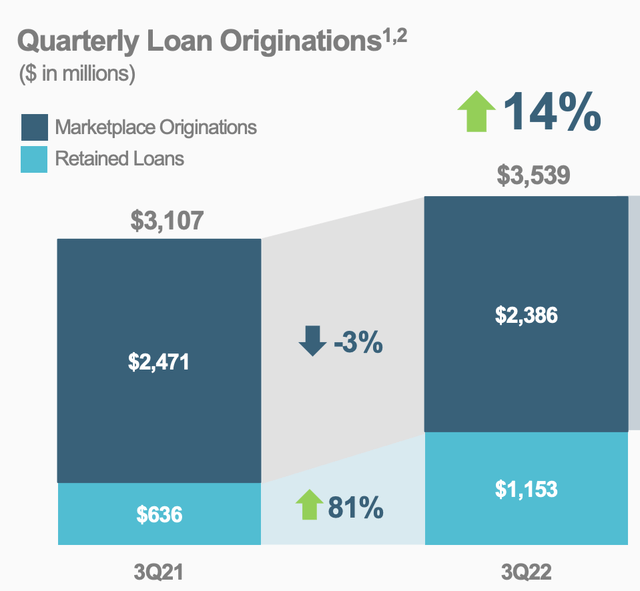

Top-line growth was driven by strong net interest income which increased by a rapid 89% to $123.7 million. This was driven by an interest in Net Interest margin from 6.3% to 8.3% year over year, which was further driven by more personal loans and higher interest rates. Quarterly Loan Originations increased by 14% year over year to $3.539 billion. This was driven by an 81% increase in Retained loans.

Quarterly Loan Originations (Q3,22 )

A negative for the business was its decline in marketplace revenue which decreased by 3% year over year to $2.4 billion. This was due to lower investor demand for its loan portfolio products, which is mainly driven by the macroeconomic environment.

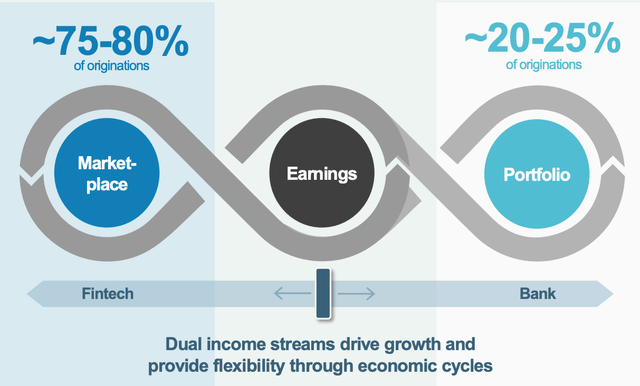

As mentioned prior LendingClub operates a Peer To Peer lending platform which connects investors with borrowers. The company’s marketplace makes up 75 to 80% of loan originations or 52% of revenue and is the capital-light part of the business. In 2021, the company acquired Radius Bancorp which has enabled the business to diversify massively with its Banking business. The company now has its own portfolio of high-quality, high-yielding loans which are funded by low-cost deposits, and make up the remaining 20-25% of loan originations. The beauty of the model is the two parts of the business offer revenue diversification and flexibility through different economic cycles.

LendingClub increased its total assets by a rapid 43% year over year to $6.8 billion. This growth was primarily driven by its growth in personal loans and strong growth in deposits which increased by 80% year over year.

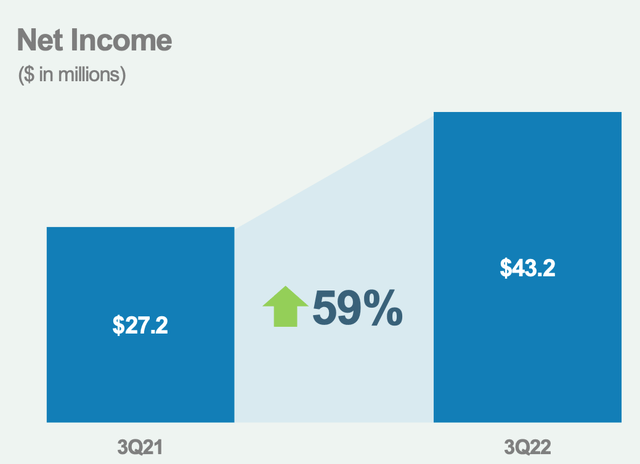

The company reported strong earnings per share of $0.41 which increased by 51% year over year and beat analyst expectations by $0.08. Overall Net Income also popped by a rapid 59% year over year to $43.2 million. This was driven by the strong personal loan demand mentioned prior which is a higher margin part of the business. The majority of customers use LendingClub loans to consolidate their credit card debt. Given the Fed has continued to raise interest interests, this is putting pressure on borrowers with variable rates. Therefore, LendingClub is in a prime position to offer a better alternative with its fixed-rate loans.

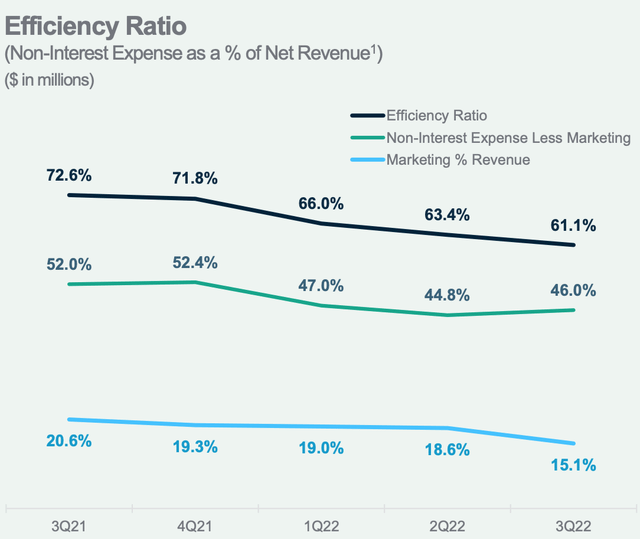

The company has also improved its consolidated efficiency ratio from 73% to 61% in the third quarter of 2022. This was a result of improving marketing efficiencies which have resulted in marketing expenses declining by 9% year over year.

Efficiency Ratio (Q3,22 report)

When analyzing banks and loan portfolios in terms of risk it is a good idea to look at the CET1 (Common Equity Tier 1) ratio. This is the percentage of reserve capital relative to total risk-weighted assets. In this case, CET1 has a capital ratio of 18.3%, which is much higher than the 4.5% regulatory requirement. This strong capital ratio means the company is in a solid position to navigate through any macroeconomic challenges and headwinds.

Moving forward management has “tightened” its guidance with fourth-quarter revenue of between $255 and $265 million expected. In addition to net income of between $15 million and $25 million.

Advanced Valuation

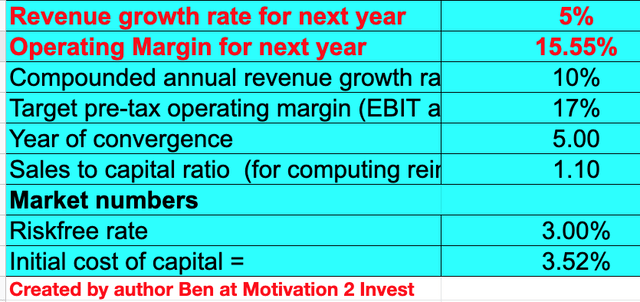

Valuing financial stocks can be fairly challenging, especially for those with a Banking business as customer deposits and regulatory capital can skew the numbers. Despite these challenges, I have plugged the known financials into my discounted cash flow valuation model. I have forecasted a conservative 5% revenue growth for “next year”, which includes Q4 and is based on management’s guidance. In addition, I have forecasted 10% revenue growth for the next 2 to 5 years.

LendingClub stock valuation 1 (Created by Author Ben at Motivation 2 Invest)

I have forecasted the company to continue to improve its business efficiencies as it scales and thus increase its operating margin of 1.45% over the next 5 years.

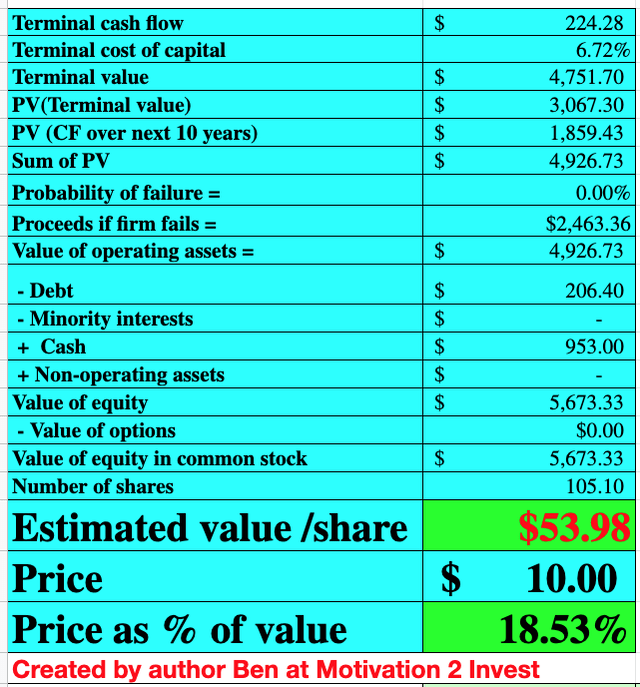

LendingClub stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $54 per share, the stock is trading at just $10 per share at the time of writing and thus is over 80% undervalued.

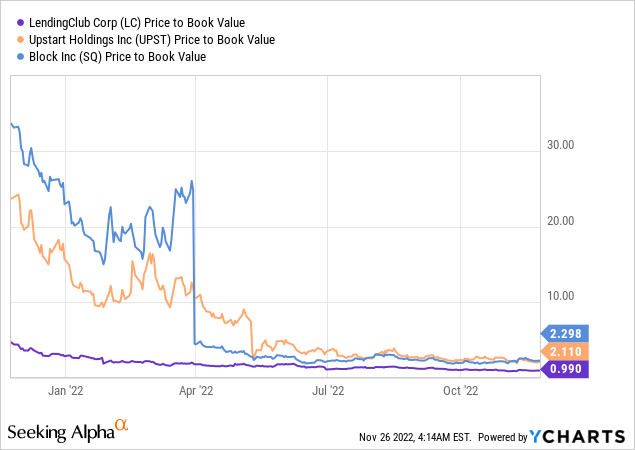

The company has also grown its Tangible book value per common share by 38% year-over-year to $9.78 per share. The business trades at a PE ratio = 4 and a Price to Book value = 0.99 which is 41% cheaper than its 5 year average. As far as I know there is only one other publicly traded Peer to Peer lending platform and that is Upstart (UPST). From the chart below you can see LendingClub trades at a cheaper P/B ratio than that company and Block, a general fintech.

Risks

Recession/loan delinquencies

The high inflation and rising interest rate environment have caused many analysts to forecast a recession. High input costs generally squeeze the consumer and a recessionary environment can cause layoffs. This usually results in higher loan delinquencies for any company in the lending industry. The peer-to-peer lending industry is already under more scrutiny than most financial sectors, therefore getting through tough economic conditions is a challenge. The good news is LendingClub has a strong capital position thus its portfolio looks to be healthy enough to get through any financial hurricane.

Final Thoughts

LendingClub is a tremendous business that is filling a gap in the lending market while also offering investors the chance to earn interest through alternative means. I believe the company’s prior bank acquisition was a strong positive and its diversified portfolio looks to be in a solid position long term.

Be the first to comment