bopav

Thesis

The Nuveen Dow 30SM Dynamic Overwrite Fund (NYSE:DIAX) is a buy-write fund geared towards replicating the Dow Jones index. The fund has 36 holdings, and it seeks to replicate the performance of the Dow Jones index with an option overlay:

The Fund is designed to offer regular distributions through a strategy that seeks attractive total return with less volatility than the Dow Jones Industrial Average (DJIA or “Dow 30”) by investing in an equity portfolio that seeks to substantially replicate the price movements of the DJIA, as well as selling call options on 35%-75% of the notional value of the Fund’s equity portfolio (with a 55% long-term target) in an effort to enhance the Fund’s risk-adjusted returns.

Source: Fund Fact Sheet

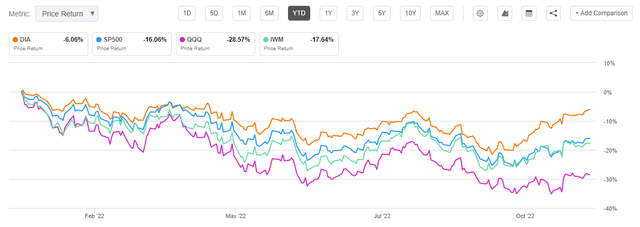

Looking at the U.S. equity markets, the Dow Jones index has been the best performing one so far this year:

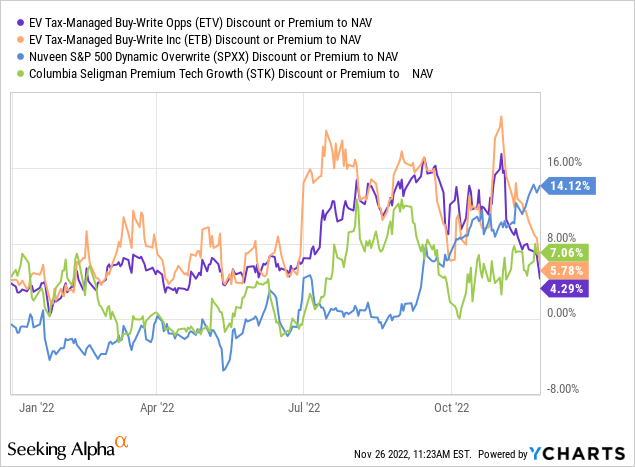

We can see from the above chart that the Dow is down now only -6%, while all the other indices have lost more than -15% so far in 2022. This year has seen a shift in interest from technology to cash generating industries, as rates have risen. Buy-write funds, by their mandate, capture the high volatility associated with option premiums by writing calls. This has been a lucrative business this year, and the market has rewarded it handsomely this year. We are seeing many of the large buy-write funds currently trading at very substantial premiums to NAV:

We can see from the above graph how the premium for buy-write CEFs exploded this year as the market tanked and volatility (as measured by VIX and the option chain implied vol) stayed high.

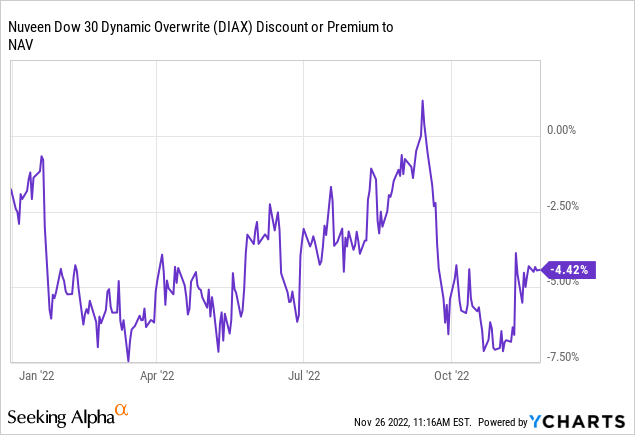

It is surprising to see that DIAX did not follow that trend:

Courtesy of YCharts we can see that not only is DIAX currently trading at a discount to NAV, but it never really traded at a premium. Its performance also never consistently outperformed the underlying index:

We can see that the only time-frame where the CEF had a better performance than the index was the July/August market rally, but the index eventually caught up. From that angle we can only say that DIAX had a shallower drawdown than the index. We are a bit surprised here since we would have expected more.

Options Overlay

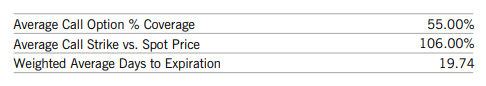

The fund currently writes covered calls on 55% of its portfolio:

Options Coverage (Fund Fact Sheet)

The fund leaves a bit of upside via its structure with a 10% call strike versus spot prices. This means that if the portfolio rallies less than 6%, the options end up expiring without being triggered and the fund pockets the premium.

The more aggressive a CEF gets the larger the written call percentage and the lower the “Average Call Strike vs Spot Price” figure.

Performance

As illustrated in the above graph DIA and DIAX have the exact total return so far in 2022. If we look on a longer time frame DIAX underperforms significantly:

We can see that on a 5-year time-frame the index is up over 67%, while the CEF is up only 22%. In bull markets DIAX will always underperform given its structure which gives up a lot of the upside. We are very surprised though that in a down market like 2022 the CEF is not outperforming the index. Its only attribute is a slightly shallower drawdown this year.

The CEF structure is supposed to give a dynamic manager the structuring form to adapt to market conditions and take advantage of them. We would have expected a larger proportion of written call options and maybe a more aggressive strike profile.

Conclusion

DIAX is an equity buy-write fund. The CEF mimics the Dow Jones index and writes call options on 55% of its portfolio. The fund has not outperformed the index in 2022. Its only attribute so far this year has been a shallower drawdown profile, saving an investor the heartache of being down another -5% at certain points in time. Long term, the CEF substantially underperforms the index by virtue of its capped upside profile. We have seen many of the large buy-write CEFs in the space trade with historic premiums to NAV this year, but DIAX is still at a discount. We are disappointed by this CEF because 2022 has been a year when it could shine. The lack of an active management of its written call coverage in a down market and its strike profile have kept its performance in lockstep with the index. We do not see much value in holding this CEF now versus just buying (DIA) outright. The CEF lags substantially in bull markets and provides for basically the exact total return profile in a bear market, with the only fringe benefit being a slightly better drawdown profile. Not enough is done here to justify the fees and holding the fund. A retail investor is better suited to just holding the index outright.

Be the first to comment