HJBC

Dear readers/followers,

In this article, we’re going to be taking a look at the New Jersey Resources Corporation (NYSE:NJR). The company is one that a reader introduced me to about a year ago – he works as an employee for the business – and he wanted me to take a look at the company from an investment standpoint.

I’m now ready to give you my first view on this company, and where I view the investment appeal lies.

Let’s get going.

New Jersey Resources – The company and what it does

New Jersey Resources is a holding company for a number of utilities and services throughout various regions in the NJ area. It’s a component of the Fortune 1000.

The company’s focus, again through subsidiaries, is on retail operations, wholesale energy markets, natgas operations and distribution of Natural Gas, various clean energy ventures, storage operations, related services, and HVAC appliance repair. In short, the company focuses on an appealing base business in natural gas and energy, complemented by appealing service business areas.

The company is the first east-coast utility to mix clean hydrogen into its stream, and it’s one of the most-liked utilities in the area, with high customer satisfaction levels. It’s also one of the largest owner-operators of solar assets in all of New Jersey.

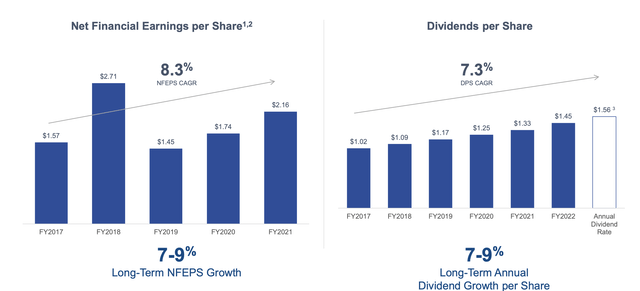

The company, as I said early on, has an excellent history of growing earnings, but also has an appealing dividend stability which really makes this utility a solid and practicable sort of income investment.

The company pays Fitch for credit ratings, and Fitch gives the company a corporate credit rating of A-, implying a high degree of safety for this company and its cash flows. Over the past 20 years, the company has been able to grow its EPS by around 6.2% on an adjusted basis every year, and investment in NJR would have generated annual rates of return of 9.5% including dividends every year, turning a $10,000 investment into $62,618. An impressive track record, all things considered.

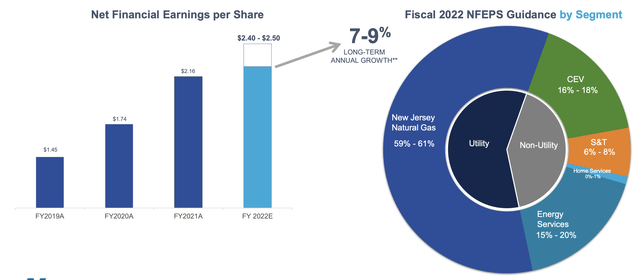

From a segment or industry split, the company’s EPS comes to 60% from Natgas, and 20% from energy services, with the remaining services being a bit mixed from 6-18%. This means that NJR’s EPS split is around 61% utility and 39% non-utility income – an interesting and appealing split, as I see it because it allows for the safe cushioning of regulated businesses with the growth potential of service-oriented business areas.

The company expects its 7-9% annual long-term growth to continue, and even recently bumped expectations for its net earnings.

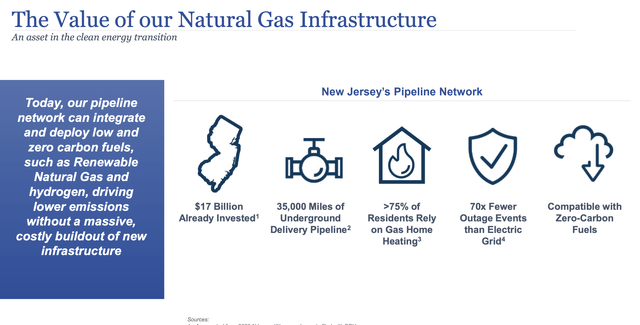

From a high level, the company operates and maintains around 7,500 miles of natgas transportation and distribution infrastructure which serves around 568,000 customers in appealing geographic areas. The company has a stable and conservative regulatory framework, and is in the midst of a CapEx investment plan that calls for transition to RNG and hydrogen.

The value of the state’s natural gas infrastructure here is not to be underestimated in the least. Take a look at some of these basic stats.

The company is also in the midst of working on its Howell Green Hydrogen Project – the first east-coast project to deliver green hydrogen through utility distribution infrastructure, with commercial operation achieved around a year ago. The company has a customer base spread across the counties that amount to around 569,000, with an addition of 5,274 in fiscal 2022 alone. The company’s service area is attractive, and it’s growing.

The rate case results, which are something you want to be looking very closely at in an investment like this, are very stable. The company is allowed an RoE of close to 10% at an equity layer of 54%, with full recoveries of plant investments currently in the books. NJR has almost never litigated against regulators, implying a very good and constructive relationship between regulators and the private sector – an excellent sign.

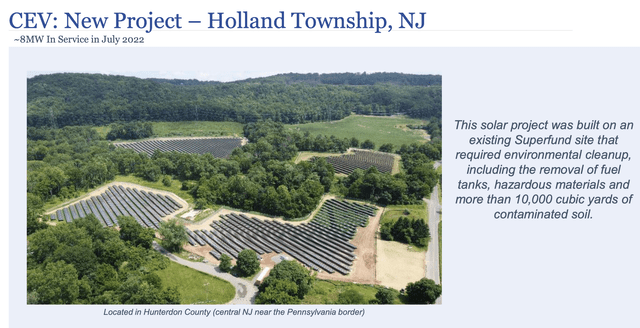

The company’s ambition in solar is equally attractive. The company has significant assets in operation, with more coming online in the coming years, with the company slowly adding and diversifying operations.

The company’s capital plan is well in hand, and the company projects increasing and growing cash flows, which will allow the business to grow its dividends.

The company markets itself as NJ’s clean energy operator, with a solid 7-9% NFEPS growth based on diversified, appealing energy infrastructure investments, coming with a yield of between 3-4% with a growth rate of along the lines of its EPS growth, targeting a TSR of 10-12% per year.

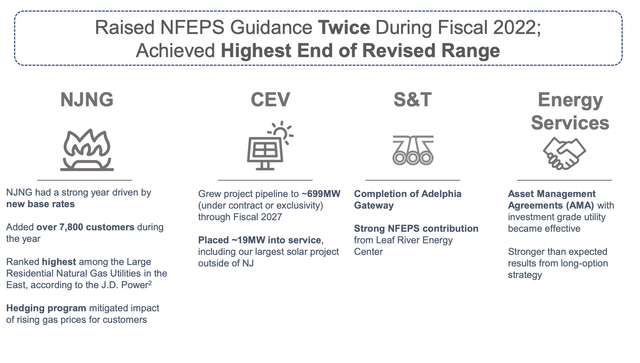

The most recent results for the company confirm the fundamental appeal of this business. The company closed the books on its 2022 fiscal with a $2.50 NFEPS, which is up 16% YoY, and comes to a $2.86 in EPS. All of the company’s segments had very solid results for the year, with nothing of the troubles or issues trickling through clearly to negative bottom-line results.

The company even introduced 2023E guidance, coming to $2.52 for the high end, and targeting an annual dividend of $1.56/share here.

Some impacts were of course to be mentioned by the company during this year. One of them was the impact of significantly increased gas prices, which is a natural pass-through to customers – but NJR has hedged nearly 90% of its winter sales, which goes some way to protecting customers here, and stabilizing overall revenues. However, as higher prices persist, only so much hedging will be able to offset this. For the time being, up to 89% of pricing until year-end 2025 is hedged – but only 29% of 2026 is hedged, and it seems doubtful at this point that the company will be able to attractively hedge most of its positions here.

In the end, NJR is a company I view as being extremely attractive as an investment. It has great fundamentals, and superb “bones” if you will. It has a good yield and an attractive upside.

The only thing that remains is to make sure that you buy the company at a great price.

New Jersey Resources – The Valuation

Here is unfortunately where we start running into issues. While the company is a superb investment – no doubt about that – and the company has massive potential for safety and dividend income, again no doubt about that – we also have a valuation that I view as prohibitively high at this point.

NJR is just out of a slump, trading at a valuation of just over 20x P/E. That’s not really workable when we have utilities – great utilities, trading at a third of that valuation or even half, at substantially higher yields.

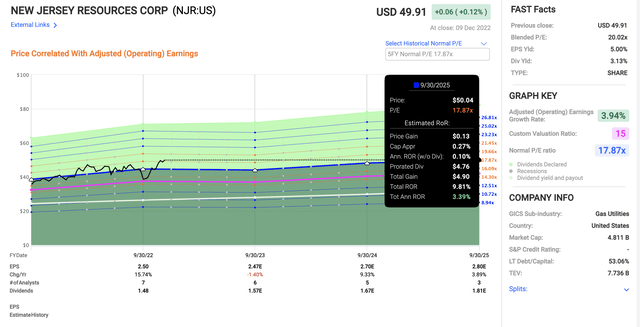

The company’s typical premium comes to around 16.65x over 20 years, which I would actually view as decent and attractive given the company’s fundamentals. However, I won’t buy it at 20x P/E, and neither should you. At any time you bought the company at around 20x, barring a few frothy years, your returns would have been negative for the long term.

The time to buy the company is when it goes under 16-17x P/E again – there’s a reason why we have normalized valuations and look at averages over time.

The company’s upside even based on a premium 17x to 18x P/E here is no more than 3.4% annually, or less than 10% in 2-3 years at this point.

NJR Valuation (F.A.S.T graphs)

I don’t view NJR as an especially complex or difficult investment to evaluate or go for. It’s incredibly stable, attractive, and operates with some of the best metrics and fundamentals I’ve seen in an American company in this sector – and its relationship with regulators is superb. I’m prepared for these fundamentals to overlook a sub-par yield of 3-4% for the sector, and even assign it its 15-17x P/E premium range.

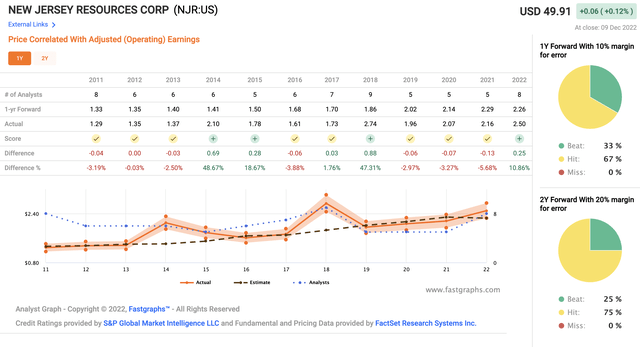

This inherent stability is further confirmed by analysts that follow the company. Here are some of the analyst targets and how successful they have been in forecasting this company’s earnings and income.

NJR Analyst accuracy (NJR Analyst accuracy)

So, as you can see, the company not only hits its targets, but it has an established history well beyond the margins of error of doing better than expected. All of these things that come together are what make it such an attractive investment here.

People that follow the company would tend to agree here. S&P Global has 9 analysts that cover the company – but these analysts also see what I see, in that this company isn’t worth this multiple. Their average range goes from $40 on the low side to $59 on the high side, and they settle on an analyst average of $46.6, which implies a downside of around 6.5% at this time.

For those reasons and those reasons alone, in terms of valuation, this investment is unfortunately a no-go here.

I’ve been through the options chains currently available, and there are no attractive options plays available for this investment either that would allow you to enter through a cash-covered PUT or similar approaches – an approach I would have been interested in here if I could have sold attractively-priced $40 strike PUT options.

For the time being, I am unfortunately forced to call this investment an absolute “no-go” due to overvaluation.

Here is my current thesis, and my initial coverage of NJR.

Thesis

My current thesis for NJR is as follows:

- This is an above-average quality utility with a very attractive set of fundamentals and overall qualities. The yield is growing and well-covered, the stability and the relationships with regulators are solid, and the company operates a very attractive mix of assets in a very attractive geography.

- At any appealing price below 16x P/E, this becomes a “BUY” to me. But that is not where we currently are.

- For that reason, I am giving NJR a price target of a conservative normalized $42/share, which would be where I would become interested in the stock.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

Because the company does not fulfill my valuation criteria – any of them – at this time, I’m forced to go with a “HOLD” here.

Be the first to comment