NoDerog

Church & Dwight Co., Inc. (NYSE:CHD) has been a top performing consumer products company, outperforming the S&P 500 in the past decade by relying on its acquisition-led business strategy.

However, it is currently valued at 27.6x Fwd P/E with margin contraction headwinds and slowing organic growth. This suggests CHD’s outperformance streak may be coming to an end. Applying the sector median multiple of 19x Fwd P/E to CHD’s 2023 earnings estimates suggest more than 25% downside to current prices.

I would avoid CHD’s shares.

Company Overview

Church & Dwight Co. Inc. is a leading American consumer products company focusing on personal care and household products. CHD owns fifteen ‘Power Brands’, including ARM & HAMMER, TROJAN, OXICLEAN, ORAJEL, SPINBRUSH, WATERPIK, and THERABREATH (Figure 1).

Figure 1 – CHD’s power brands (CHD investor presentation)

Approximately 85% of the company’s revenues and profits are derived from these 15 brands, and each brand is ranked #1 or #2 in its respective category.

CHD’s business is fairly evenly split between household products (45%) and personal care (49%) with specialty products representing 6% of revenues (Figure 2).

Figure 2 – CHD business mix (CHD investor presentation)

CHD Has A Long History Of Growth Through Acquisitions…

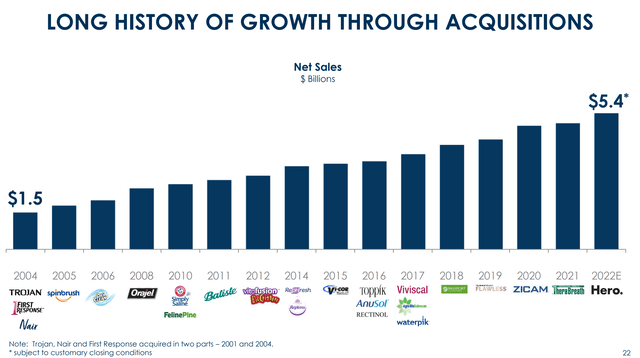

CHD has had a long history of pursuing growth through acquisitions. Starting from the core Arm & Hammer (“A&H”) franchise, CHD has added 14 of its 15 ‘Power Brands’ since 2001, taking net revenues from $1.5 billion in 2004 to ~$5.4 billion in 2022 (Figure 3).

Figure 3 – CHD has grown through acquisitions (CHD investor presentation)

CHD’s acquisition model is to target asset light category leaders with high growth and margins, and apply CHD’s manufacturing, logistics and purchasing expertise (Figure 4).

Figure 4 – CHD’s acquisition strategy (CHD investor presentation)

…Leading To An Excellent Financial Model…

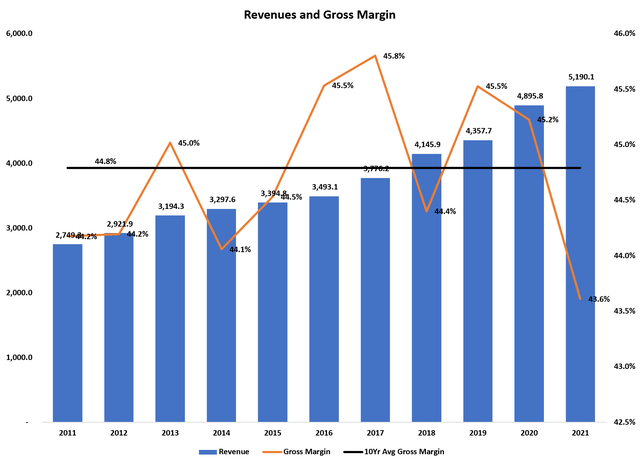

CHD’s acquisition-led business model has underpinned strong financial operating results in the past decade, with revenues increasing almost 90% from 2011 to 2021, and average gross margins of 44.8% over that period (Figure 5).

Figure 5 – CHD historical revenues and gross margin (Author created with data from roic.ai)

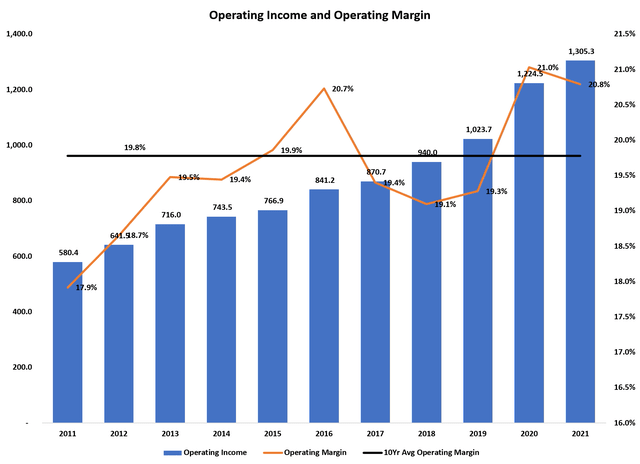

Similarly, operating income more than doubled from $580 million to $1.3 billion in that time frame, with operating margins expanding 290 bps from 17.9% to 20.8% (Figure 6).

Figure 6 – CHD historical operating profits and margin (Author created with data from roic.ai)

…And Strong Stock Outperformance

CHD’s excellent financial results have translated into strong stock performance, with CHD shares returning almost 470% in total returns since the beginning of 2011 vs. only 300% for the S&P 500 (Figure 7).

Figure 7 – CHD has massively outperformed the market (Seeking Alpha)

Sector Multiple At Multi-Decade Highs

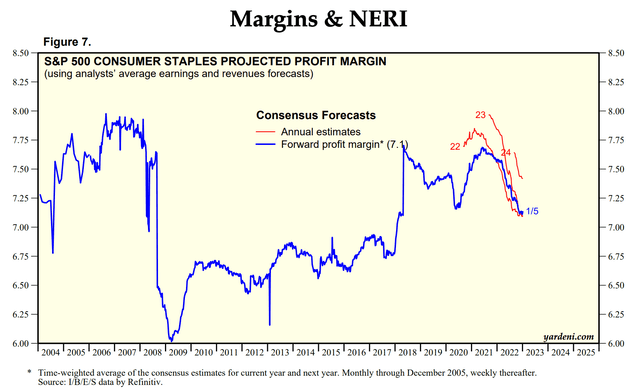

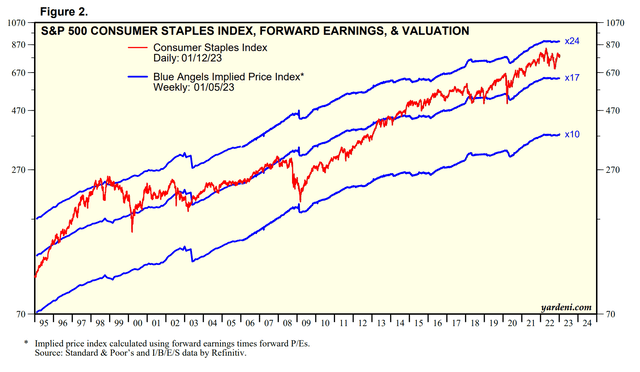

CHD’s strong stock performance in the past decade is partly driven by tailwinds that benefited the consumer staples sector. Consumer staples exited the Great Financial Crisis (“GFC”) at depressed valuations of ~10x Fwd P/E after profit margins collapsed. Over the past decade, as profit margins recovered, valuation multiples expanded to 19x currently (Figure 8).

Figure 8 – Consumer staple sector profit margins are rolling over (yardeni.com)

However, as we enter 2023, we are seeing the profit margin tailwind turn into a headwind for the sector, as analyst consensus expect profit margins to contract significantly in the coming years due to inflation pressures. For consumer staples stocks, it is hard to see how valuation multiples can remain at multi-decade highs (last seen in the late 1990s), with contracting profit margins (Figure 9).

Figure 9 – Consumer staple sector valuations at multi-decade highs (yardeni.com)

Consumers Are Hurting From Inflation

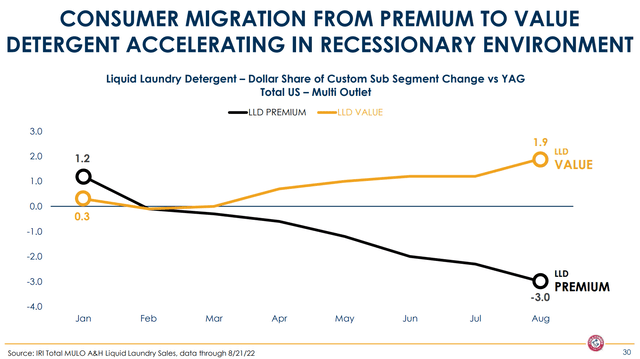

The biggest issue for consumer staples companies like CHD is that the consumer is hurting from the negative effects of multi-decade high inflation. From a recent investor presentation CHD gave at the Barclay’s Global Consumer Staples Conference, the company noted that the consumer has been migrating from premium to value products in a ‘recessionary environment’ (Figure 10).

Figure 10 – Consumers have been trading down (CHD investor presentation)

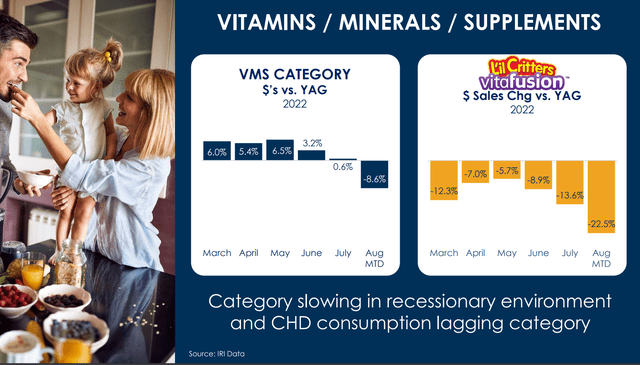

While this has benefited CHD’s ‘value’ A&H detergent, the shift to value has been detrimental to CHD’s ‘premium’ products like vitamins, where dollar sales vs. the prior year have fallen off a cliff, down 22.5% YoY in August (Figure 11).

Figure 11 – CHD’s vitamin business has been hard hit by consumer slowdown (CHD investor presentation)

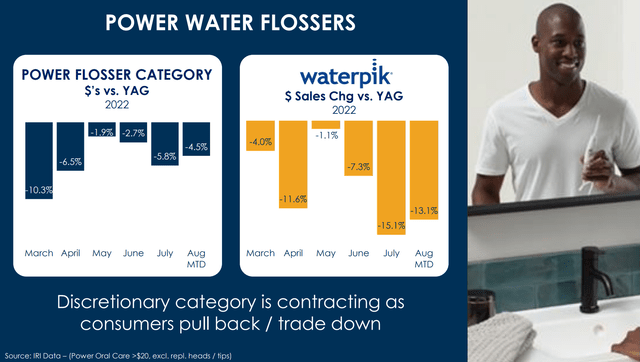

Similarly, CHD’s water floss sales have taken a large hit as ‘consumers pull back / trade down’ (Figure 12).

Figure 12 – CHD’s water floss business has been hit as well (CHD investor presentation)

Organic Sales Contracting As Volume Declines Outpaces Price Increases

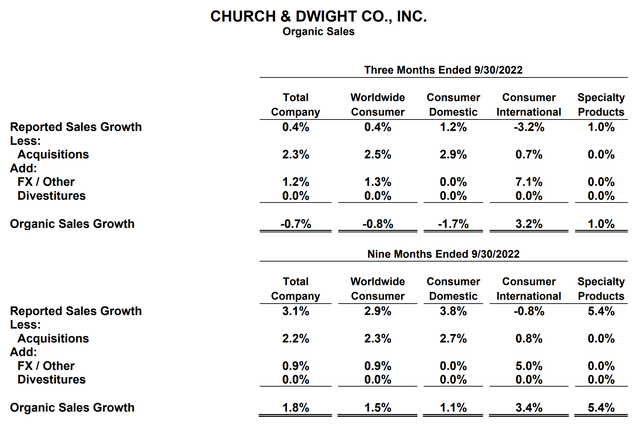

Overall, the company’s organic sales growth fell into negative territory in the recently reported Q3/2022 (Figure 13).

Figure 13 – CHD saw negative organic sales growth in Q3/2022 (CHD Q3/2022 earnings report)

This is especially concerning, as CHD, like many consumer staples companies, has been busy raising prices in order to protect margins. In fact, on the Q3/2022 earnings conference call, Richard Dierker, CHD’s CFO, commented: (author added highlight for emphasis)

Organic sales declined 0.7% as volume was down 8.5%, partially offset by positive pricing of 7.8%. Matt reviewed the top line for the segments, so I will go right to gross margin for the company. Our third quarter gross margin was 41.7%, a 250 basis point decrease from a year ago.

Let me walk you through the Q3 bridge. Gross margin was impacted by 580 basis points of higher manufacturing costs, primarily related to commodity inflation, distribution and labor. These costs were offset by a positive 190 basis point impact, largely from pricing; positive 20 basis points from acquisitions and a positive 120 basis points from productivity.

– CFO Richard Dierker on Q3/2022 earnings call

So CHD’s sales volume declines outpaced its price initiatives, leading to declining organic sales growth. Furthermore, despite raising prices by 7.8% YoY, gross margins actually fell 250 bps.

CHD’s headwinds from inflation have caused the stock to underperform the S&P 500 by 5.7% in the past year (Figure 14).

Figure 14 – CHD has underperformed the S&P in the past year (Seeking Alpha)

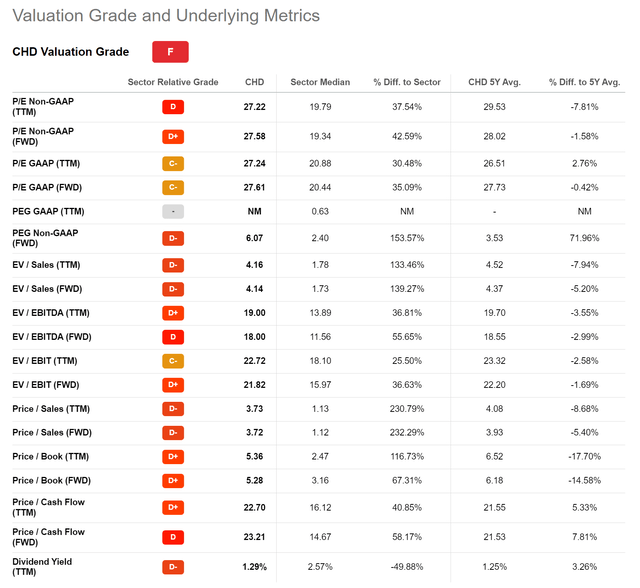

CHD Trading At Premium Valuation With Subpar Growth

Despite declining by ~20% in the past year, CHD’s stock continues to trade at a premium valuation of 27.6x Fwd P/E. This figure is 43% higher than the consumer staples sector median of 19.3x (Figure 15).

Figure 15 – CHD continues to trade at a premium valuation (Seeking Alpha)

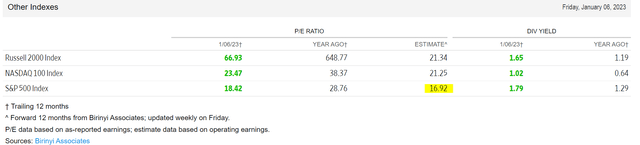

CHD is also trading at a 63% premium to the S&P 500’s Fwd P/E multiple of 16.9x (Figure 16)

Figure 16 – S&P 500 valuation multiple (wsj.com)

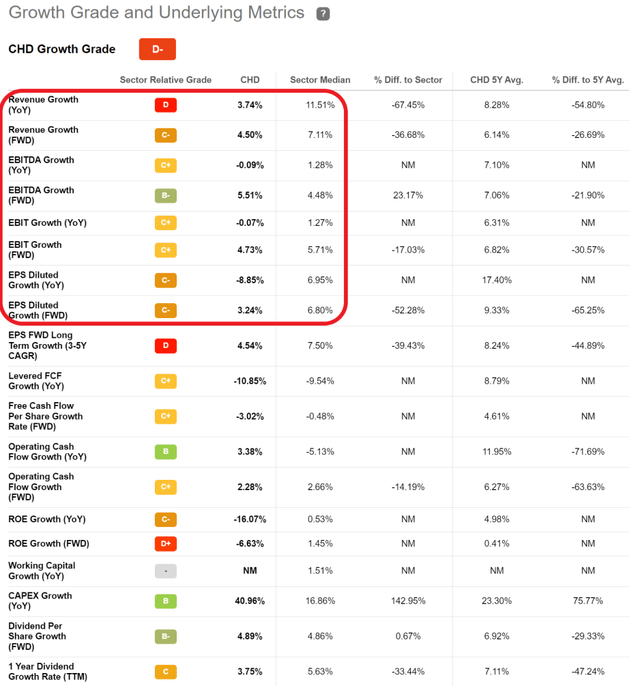

A premium valuation could be justified if CHD is growing at a much faster rate than its peer group and the market. However, if we look at CHD’s growth metrics in Seeking Alpha, we can see that CHD’s revenue and earnings growth have been below its peers both historically and on a forward basis (Figure 17).

Figure 17 – CHD has grown slower than its peers (Seeking Alpha)

With slower than peer growth, it is hard to argue for a premium multiple for CHD. If we were to value CHD using consensus 2023 EPS of $3.11 and consensus Fwd P/E multiple of 19.3x, CHD should be trading at $60 / share, or more than 25% downside from CHD’s current stock price.

Risk To My Call

The most obvious upside risk to my call is a rapid decline in inflation. Falling inflation could alleviate the margin pressures on CHD, allowing the company sufficient time to reprice its products to achieve historical 45% gross margins.

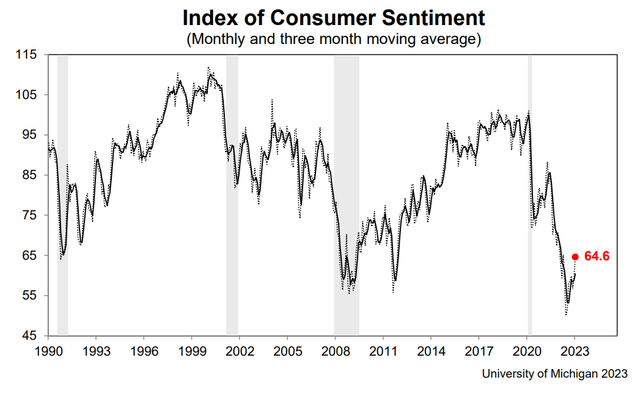

Another risk is if consumer demand proves to be resilient, CHD’s volume declines could reverse in the coming quarters. This risk is certainly possible, as the January University of Michigan Consumer Sentiment survey rebounded sharply to 64.6, far above consensus estimates for 60.5 and December’s 59.7 reading (Figure 18).

Figure 18 – University of Michigan Consumer Sentiment Survey showed sharp rebound in January (University of Michigan)

On the downside, if the economy enters a recession in the coming months, as many economists are predicting, then I would expect CHD’s earnings and valuation to take a further hit.

Conclusion

Church & Dwight Co. Inc. has been a top performing consumer products company, delivering almost 470% in total returns since 2011, far outperforming the S&P 500. However, with its valuation multiple at an elevated 27.6x Fwd P/E and growth slowing to below sector median, I believe CHD is likely to underperform in the coming years. A sector median Fwd P/E multiple of 19x suggests more than 25% downside to current prices.

Be the first to comment