rising rates dampen FPI’s investment case shark_749/iStock via Getty Images

Investment Thesis

Farmland Partners (NYSE:FPI) is a great way for investors to get exposure to farmland. I explained why farmland is a great diversifying asset to add to a portfolio here. I also explained my reasoning for choosing FPI as my preferred vehicle to get farmland exposure here.

I did however stress in my last article that I thought the biggest risk to my positive stance on FPI would be rising rates.

I consider rising rates as the top risk to my investment thesis.

This view still holds and has been confirmed by results as well as management actions and comments this year. CEO Pittman said this on their Q3 conference call about rates:

That being said, nobody should sugarcoat this. There are great operational things happening in the company but the increase in interest rates is not going to be a positive factor for the company in the 2023 year.

I will first give a quick recap of Q3 results, then focus on what the current rate environment means for FPI and finally give an update on my thinking on FPI as an investment right now.

Farmland Partners Q3 results

FPI reacted very positively to its Q3 results. I will refer to their press release, and their conference call and their Q3 supplemental package when discussing their results.

FPI reported good headline numbers with revenue up over 30%, AFFO more than doubling and raising AFFO guidance by one cent (although consensus is already close to the upper end). Net income even tripled. Furthermore rent increases were over 15% for those up for renewal and FPI also managed to reduce debt.

Looking a bit deeper into results they were still solid but not as great as the headlines might suggest.

Revenue and cost picture more sobering than headlines would suggest

While revenues were up by over 30% this was mostly driven by a nearly tenfold increase of crop sales and more than five times last year’s “other revenue”. Rental income on the other hand has been close to flat not only for Q3 but also for the whole 9 months.

FPI Q3 results table revenues and costs (FPI Q3 press release)

Crop sales should be their direct operations. Crop sales obviously benefit very strongly from the current exceptional pricing environment. I do not believe this kind of level to be sustainable. Furthermore, together with higher crop sales costs of goods sold (COGS) also increased massively as higher fertilizer or gas prices show up there. Therefore, this increase in revenue is mostly negated by associated increases in COGS. Besides the current operational environment they also operated more farms themselves. During the conference call they mentioned that the citrus operations moved from variable income to direct operations and this lead to an $800k reduction in variable income which is 80% of the increase in direct operations profit (revenue less COGS).

impact of variable moving to direct (FPI Q3 supplement)

On the positive side this means that rental income is likely understated by those $800k and therefore showed more encouraging growth than is evident in the tables (about 12% adjusting for this).

“Other revenue” should mostly be Murray Wise Associates (‘MWA’) which they acquired last year. While it is certainly good to see them picking up business they also contribute to the strong increase in “General and administrative expenses” and thus once again a large part of the revenue gain gets canceled out by the increase in associated costs. That said, management were very positive on MWA during the conference call.

In a nutshell: A lot of the revenue growth is driven by segments like direct operations or MWA where higher revenue is also strongly associated with higher costs. The impact on profitability is therefore much less than what one might expect with a 30% increase in revenues. The biggest driver of operating income tripling was the decrease in legal costs after leaving those lawsuits behind.

Continued good NAV progression

During their conference call FPI management made reference to the latest USDA report on land values from August 2022. Land values have continued to increase including the key states of Illinois (+13.3%) and California (+11.2%) in which the majority of FPI’s value is located:

increases in cropland values for 2022 (USDA Land values 2022 Summary)

During their H1 conference call the CEO made a statement that he believes NAV/share is $16 or higher. Now they made a statement that they continue to see further price increases even after the release of the USDA data, albeit at a slower growth rate. Going forward Pittman sees further growth in land values:

We think, in 2023, the rate of appreciation may slow but it will continue to be a strong year for Farmland values.

I think it is therefore fair to assume a current NAV/share somewhere in the range between $16-17 and chances are good we might be seeing a NAV/share of $17-18. This means FPI still trades at a sizeable discount to current and forward NAV.

Debt reduction achieved by dilutive equity offerings

FPI continued to deleverage their balance sheet funded by dilutive equity issuances but at a lower pace than during the first half. They sold about $100m in the first six months and only a bit more than $20m for Q3 bringing the total to roughly $120m proceeds for the first nine months. This corresponds to them reducing their debt load by over $100m, repaying $10m of preference shares and also reducing their cash position by over $20m. Basically, all of their proceeds from issuing equity have gone into debt reduction instead of financing growth.

These issuance have happened at a discount to NAV as they were sold at an average price of $14.13 for the 9m. Pittman confirmed as much during the conference call at the half year stage:

“… trust me, it pains me every time we issue stock in a $14 or $15 range when I think the NAV is $16 or higher. “

NAV dilution is unfortunate but luckily not overly massive at $14. Given the strongly rising rate environment I believe this a prudent action to be taken by management. That said I am also glad they slowed it down somewhat as the constant drip selling into the market once the shares get in to the $14 range, might very well have put a lid on the stock price.

Overall, I believe those results were solid as expected. They did manage to increase their outlook a little bit. But as consensus was already at the very top end of their old guidance I think everyone expected that and they played it simply conservatively with their guidance.

Why rising rates pose a problem for FPI

When I identified rising rates as the main challenge for FPI in my last article I explained that a minor increase in interest rates could have an outsized impact on cashflows.

I will now update that analysis and look at the recent developments. At the start of the year FPI had $513m of debt outstanding at an average cost of 2.96%. Since then they issued equity to bring the debt load down. This is the current picture:

FPI debt end of Q3 2022 (FPI Q3 supplemental release)

As we can see the weighted average cost of debt has already increased sizably by 63bp. On a balance of $410m this means already a $2.6m increase in annual interest cost. But this is not the end of it. Not only will floating rates on $123m follow rising rates, but in addition $125m of debt will reset during H1/23, followed by another nearly $50m in October 2023 for a total of around $174m to reset next year.

debt to adjust during 2023 (FPI Q3 2022 supplement)

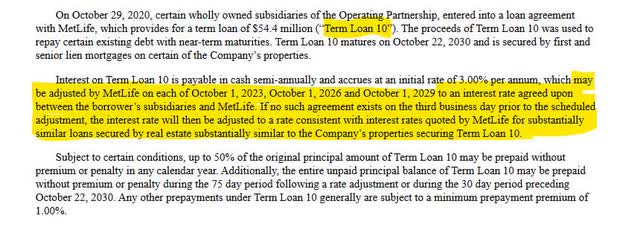

In their Annual Report from 2020 we find the following about how the repricing works for MetLife Term Loan 10 from the table above:

rate reset mechanism (FPI Annual report 2020)

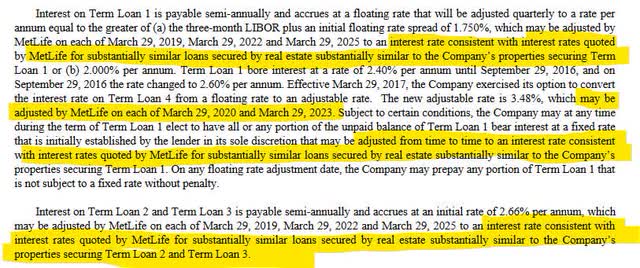

In the 2019 annual report we find the following detail:

MetLife term loan adjustment mechanism (FPI 2019 Annual Report)

To me it reads as if MetLife has the right to adjust the rate to the then prevailing rate for similar loans unless FPI can come to an agreement that says otherwise. Given that 10 year treasuries as a risk-free benchmark currently trade at 4% it seems likely that we will see a sizable uplift on those term loans resetting. If they use a shorter benchmark due to the resetting feature it is even worse as we currently have an inverted yield curve with shorter durations having a higher yield. Even if we enter a recession in 2023 and long rates drop from the current level they will likely still be sizably higher than in recent years as the 10 year treasury mostly traded between 2-3% in the last ten years:

10yr treasury yield (Seeking Alpha)

FPI also commented on it during the conference call:

Some of those debt instruments will be repaid from cash flow probably but we certainly can’t repay them all from cash flow. So as far as the rate resets that occur, most of those are loans with MetLife. The MetLife loan agreements permit us to fully repay those loans at the reset date. So we have quite a bit of negotiating leverage to shift to a different point on the yield curve or to repay with money borrowed from a different lender or negotiate with MetLife. MetLife largely has the authority to set that rate wherever they want, sort of guided by what they’re doing or similarly situated borrowers in the rest of their portfolio.

We’ve been through this process with MetLife before. They are quite fair in how they do that. They’re looking at the same forward curve we are. That being said, I think we should all expect some level of increase in these interest rates at those reset date. I think that’s just the reality. We are coming off of rates that were set 3 years ago or so and virtually any duration, any instrument of any type. When it resets it would be at a somewhat higher rate. The exact number of the resets is impossible to tell because there is no absolute formula. It’s really sort of discretion of the lender and because we have the right to repay within our discretion…

Overall, it seems likely that we get several millions of additional annual interest costs coming up over the next years as their debt continues to reprice. Mind you, this compares to a 2023 AFFO estimate of roughly $20m and an annual dividend cost of $13.4m.

Besides the additional interest costs rising rates increase their cost of capital sizably. This means it will be harder for them to expand their business as cap rates are very low. Here is what they said about this during their Q3 call:

However, the cost of capital is the major driver right now for us as we think about acquisitions. That’s why I said that we are being seemingly selective and we are going to do acquisitions probably during this period of time in the near future but it’s going to be on a much lesser scale.

and

I mean, we are at a slower acquisitions pace than we were 6 or 12 months ago. And I think that’s appropriate given the cost of capital.

This is in line with statements from Gladstone Land (LAND) management. With high interest rates and low cap rates it will be very hard to make cash accretive acquisitions. FPI mentioned they look at it from a total return perspective which means they will maybe be doing acquisitions even with little cash accretion.

FPI is unfortunately still somewhat sub-scale and it would certainly help their expense ratio and operational efficiency if they could expand their business. Higher rates, however, make that very difficult.

Investment conclusion

My main investment case on FPI rested on this being a vehicle to participate on farmland value increases in a leveraged way. How has this changed?

Underlying operations are progressing very well at FPI with rents repricing at 15%+ for those that come up for renewal. Unfortunately higher rates provide a sizable headwind as expected. Not only will it mean higher interest costs going forward but it will also make it more difficult to add new farms profitably and thereby limits progress in operational efficiency as the sizeable costs of FPI’s administration have to be split over a too small amount of farms leading to a very high cost ratio.

FPI management has acted quickly and decisively on the topic of rising rates and has decided to issue equity at a discount to NAV to pay back debt. This has done three things:

- reduce interest costs going forward

- dilute NAV but the impact should not be high as the discount was not very big

- reduce overall leverage in the structure and also reduce shareholders’ participation on the value gains of the land holdings.

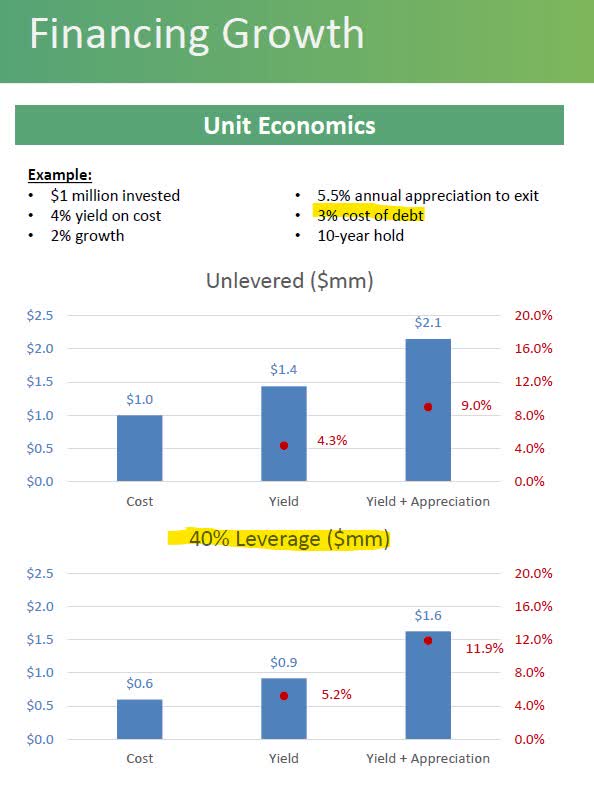

The last point is what will impact my assessment. In my prior piece I calculated NAV progression based on a 40% leverage ratio and a 6% yearly farmland appreciation to be 10% per annum. This leverage assumption was based on their March investor presentation. Here is a slide from back then:

financing growth March 2022 (FPI investor presentation March 2022)

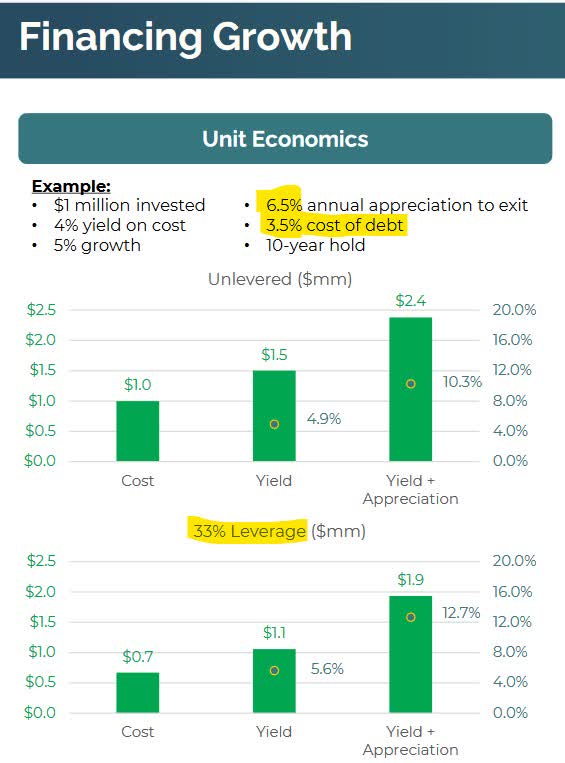

In their most current presentation FPI gives an example with a 33% leverage:

financing growth September 2022 (FPI investor presentation September 2022)

One can see that leverage has come down, interest rates have gone up but overall return expectations have gone up thanks to higher expected growth and land value appreciation. Well, while I don’t see any reason to adjust my long term expectations of land value appreciation I certainly take into account their reduced leverage target. I expect interest savings from reduced leverage to be eaten up by increased rates which leaves me with the reduced multiplier for land value gains. Unfortunately, having a 6% land appreciation with only 33% leverage leaves me with only a 9% annual NAV progression instead of the former 10%. This is obviously a negative. That said, it also means there is lower risk involved plus once the environment changes FPI should have the ability to increase leverage again and therefore finance acquisitions without having to issue new equity. I therefore see no reasons to change my positive stance on FPI for the time being. One can still get into farmland cheaply at a nice discount to NAV. The potential options for higher returns I mentioned in my prior article are also still all possible.

Summary

Overall things progressed as expected. What surprised me, was how quick and decisive management took action to deleverage. I believe this to be prudent. It does however deduct from the attractiveness of the investment as the reduced leverage also reduces expected NAV progression. I do therefore lower my return expectations by 1% annually to 10-11% plus optionality. That said, it is still a great way to be invested in farmland at a discount and to participate in the long term value appreciation of an irreplaceable asset.

I will close with another quote from the Q3 call by Pittman:

… cash flows will suffer a little bit but farmland values will continue to push forward strongly.

Be the first to comment