Editor’s note: Seeking Alpha is proud to welcome NAB Equity Research as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Dr_Microbe

Nurix Therapeutics (NASDAQ:NRIX) is in a strong position to capitalize on four key catalysts arriving over the next two months that will validate the company’s platform, and might reverse the downtrend in the stock. Highlighted by upcoming additional Phase 1a clinical data from its lead asset, Nurix is setting the stage to enter Phase 2 trials, which will provide efficacy data and be the driving factor behind the value creation from the protein degradation technology. I see a 12-month price target of $19 based on the numerous data readouts in the fourth quarter of this year and throughout next year.

Overview

Recently reporting Q3 2022 financial results and reiterating key catalysts that are expected in coming months, Nurix has the potential to reverse course and trend back to the share price levels seen in late 2021. While it might not happen immediately due to upcoming catalysts this year, I anticipate they will lay the foundation for a strong recovery longer term, validating the company’s extensive protein degradation pipeline.

Currently, Nurix sits at around $12, down from its $36 52-week high and 42% lower than its IPO price in July 2020. With a Wall Street consensus price target of $37, my 12-month price target for the company is $19 (the IPO price) and two-plus-year price target of $28. The end of this year will generate small, but numerous data readouts that should create some movement for the stock. Despite this, we are not likely to see large price increases until the overall market begins to recover, anticipated around mid 2023 by many accounts, and NX-2127 demonstrates meaningful efficacy data.

I don’t seem to be the only one thinking that there is meaningful and long-term value to be realized at Nurix. Over the past few weeks, the infamous Cathy Woods has been buying substantial shares of this small oncology company in her ARK Genomic Revolution ETF (ARKG). Despite her innovative ETFs receiving a lot of back lash for investment decisions in recent months, do not let her involvement be a deterrent. I believe that her timing and selection for this company reflects my decision and sentiment in Nurix.

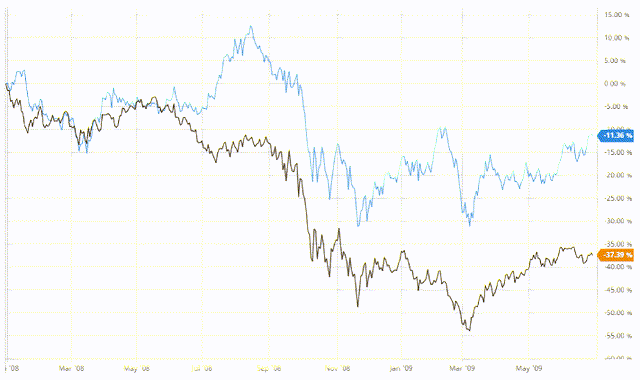

Depending on who you ask, we might or might not be in a recession. It especially feels like it given the bear market that the biotech sector has been facing for the past 14 months. The Biotech Index has experienced roughly a 25% decline since the summer of 2021, following an explosion in premature biotech companies seeking to IPO in the equities markets. The decline in the Biotech Index is outpacing the decline in the S&P 500 (SPY), which is unusual. Traditionally, biotech equities do better in previous recessions than the overall market.

S&P500 vs Biotech Index (Bar Chart)

In the Great Recession of 2008, the Biotech Index fell by around 30% at the peak and leveled out at -11%, while the S&P 500 declined nearly 55% and leveled out at -37%. All that general market talk is to say that pharma and biotech companies tend to be defensive stocks in recessionary periods that recover sooner than the overall market. That’s a key investment thesis to keep in mind when picking stocks in next three to six months. Now, let’s move on to why we should get excited.

Current Position and Key Catalysts

Earlier this month, Nurix reported Q3 2022 financial results and provided an update to the Street. They performed slightly better than consensus, a loss of $0.90 per share compared to estimated loss of $0.95 per share, and ended the quarter with $414M in cash and cash equivalents. Having recently completed two registered direct offering and sitting on a strong cash position, there is little risk that the company will further dilute in the next nine months. Given the company’s current burn rate of about $10.5 million per quarter, I expect their cash position to fund operations through the end of 2024.

Near term, the company is expecting several key catalysts for their pipeline through the end of the year. Specifically, they are:

- NX-2127 – additional Phase 1a clinical data by the end of 2022

- NX-5948 – initial Phase 1a PK/PD clinical data by the end of 2022

- NX-1607 – present initial Phase 1a PK/PD clinical data at SITC in November

- DeTIL-0255 – provide a clinical update from Phase 1 study by the end of 2022

While none of these catalysts are exactly going to cause major movement in the stock, I believe that we will see a nice uptick in share value from the readouts providing a great base for safety data and potentially some efficacy results from their ongoing trials.

The real value will be generated later next year when Phase 2 efficacy data begins to emerge. Dose escalation studies can often take a long time to complete, as you want to slowly titrate drug dosages up and limit any potential safety or toxicity profiles that might emerge. While Nurix navigates these portions of the trials and evaluates PK/PD profiles, do not expect good data here to be a value driver. However, we do have multiple shots on goal to derisk the platform opportunity.

The Science

This emerging biotech is focused on modulating protein degradation to create small molecules that the company believes will improve therapeutic benefits. At a high level, Nurix uses its proprietary DELigase platform of small molecules to deploy E3 ligases that can either increase protein levels or degrade specific proteins.

Nurix has developed DNA-encoded libraries (DEL), a portfolio of small molecules, that it selects from to use with its DELigase platform for Targeted Protein Modulation, or TPM. In May this year, Nurix held an R&D Day that did a large deep dive into the company’s programs and science.

I won’t duplicate efforts by doing a deep dive of their entire platform and the science, but I do want to a highlight overview and really discuss Nurix’s lead asset and Burton’s tyrosine kinase (BTK) degrader, NX-2127.

Burton’s Tyrosine Kinase Degraders

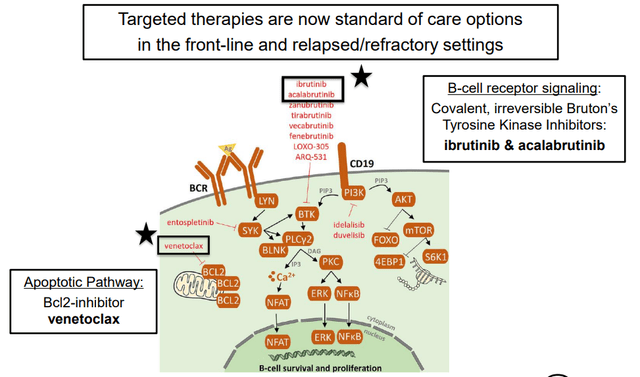

BTK is a key enzyme that has been targeted by big pharma in recent years, namely Imbruvica by AbbVie (ABBV) and Calquence by AstraZeneca (AZN). Nurix’s lead program, NX-2127, is designed to degrade both BTK and immunomodulatory cereblon neosubstrate Aiolos. Nurix believes that removing, not just inhibiting, the BTK protein will yield better treatment outcomes for patients with B-cell malignancies who are failing current first line therapies.

According to Nurix, approximately 85% of non-Hodgkin Lymphoma cases are derived from B-cells. Furthermore, over the past 10 years, BTK inhibitors have been replacing chemotherapy regiments at an increasing rate, especially among the chronic lymphocytic leukemia and mantle cell lymphoma patient populations. Below you will find an overview of B-cell receptor signaling.

B-cell receptor signal pathway (Nurix S1)

There is a growing resistance to noncovalent BTK inhibitors, which presents a growing challenge in the treatment paradigm. Data published in the New England Journal of Medicine suggests that therapeutic outcomes might improve by degrading the scaffolding of BTK, rather than aiming to inhibit BTK kinase activity. Nurix believes that a BTK degrader will solve the issues that are stemming from rising BTK inhibitor resistance in patients.

Immuno-Oncology

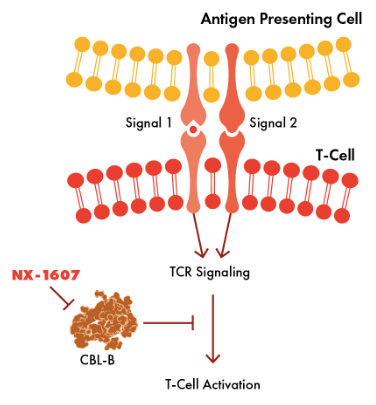

Nurix believes that inhibiting Casitas B-lineage lymphoma proto-oncogene-b (CBL-B), a E3 ligase expressed in immune cells, will activate T-cells and engage a patient’s immune system to fight tumorous cells. CBL-B is “down regulator of T-cell activation, NK cell activity, and immune response through degradation of specific proteins.” Acting on multiple immune cells and addressing multiple resistance mechanisms, Nurix believes that CBL-B inhibitors are the next generation of immune-oncology agents.

CBL-B pathway (Nurix Website)

Nurix has developed two CBL-B inhibitors, NX-1607 for oral administration and NX-0255 for adoptive cell therapy. Dubbing CBL-B mediated mechanisms the “master orchestrator of the immune system,” Nurix believes that CBL-B inhibition can increase:

- DC and NK infiltration and function

- Cytotoxic T-cells function

- T-cell resistance to tumor immunosuppressive mechanisms

Adoptive Cell Therapy

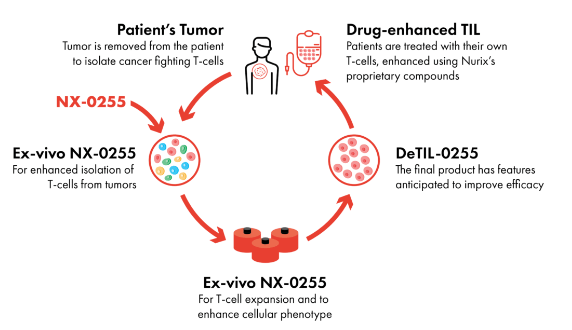

Nurix is also developing drug-enhanced cell therapy that target protein elevation in “adoptive cell therapy.” How it works is Nurix will isolate T-cells from a patient’s extracted tumors and introduce them to a CBL-B inhibitor. This introduction stimulates IL-2 secretion and specific T-cell quantities targeting the tumor to increase. The final product, DeTIL-0255, is then reintroduced to the patient.

Adoptive Cell Therapy Function (Nurix Website)

Lead Program – NX-2127

The company’s lead program is NX-2127, a chimeric targeting molecule that is a potent dual degrader of BTK protein and Aiolos, which protein target of immunomodulatory drugs. NX-2127 uses the E3 ligase cereblon and might be engineered to treat blood related malignancies. The company believes that dual activity will provide improved therapeutic outcomes through combinatory effects.

The BTK inhibitor market is rather sizable. The company estimated that “approximately 77,000 people in the U.S. were diagnosed with non-Hodgkin’s Lymphoma in 2020,” 85% of which were a result of B-cell malignancies. In 2019, global sales of BTK inhibitors were approximately $5.8 billion.

BTK inhibitors have several pitfalls, however, including a growing rate of acquired resistance through mutations as well as off-target toxicity issues with the inhibitors binding to other kinases, leading to adverse side effects. Nurix believes that rather than inhibiting BTK, degrading the BTK protein is a better approach, particularly in the relapsed and refractory patient population.

Preclinical Development of NX-2127

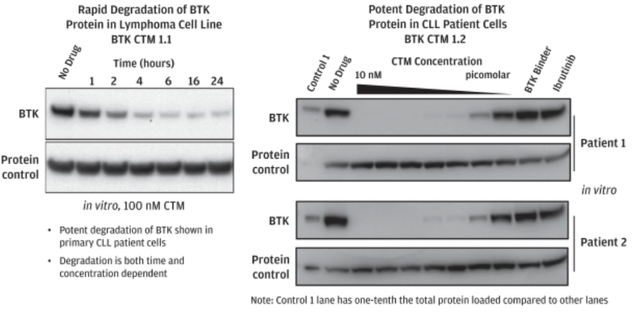

In preclinical settings, NX-2127 was demonstrated to induce rapid BTK degradation over time in lymphoma cell lines when compared to a control, with nearly a complete loss of BTK within hours of administration, as seen on the left hand side of the image below.

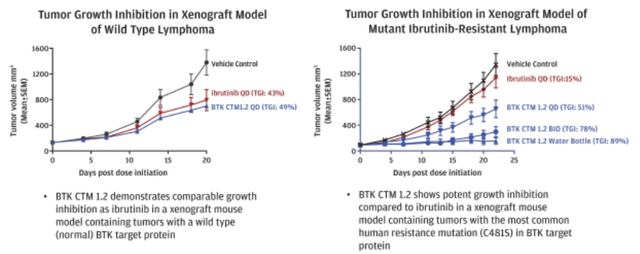

The company has developed NX-2127 to degrade wild type BTK and the C481S variant of BTK, the most prevalent mutation in resistant or refractory patients. Furthermore, in mouse xenograft models with both wild type BTK protein and C481S mutation, NX-2127 demonstrated strong tumor growth inhibition, as shown in the charts below.

Tumor growth inhibition (Nurix S1)

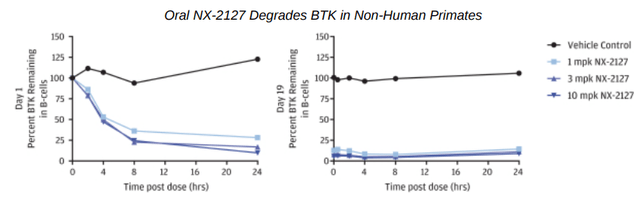

There is a large unmet medical need among the relapsed or refractory B-cell malignancy patient populations. Oral administration of NX-2127 has demonstrated potent BTK degradation and anti-tumor activity against C481S mutations in both xenograft mouse tumor models as well as non-human primate models.

In a 19-day repeat dose study of once daily NX-2127 at various doses in non-human primates, a single oral dose at 1 mg/kg began to degraded BTK only a few hours following administration and achieved over 90% degradation through 24 hours on the very first day. Throughout the study, BTK protein levels remained suppressed.

BTK degradation in primates (Nurix S1)

Clinically, Nurix is evaluating NX-2127 in several potential Phase 1b expansion cohorts in the ongoing Phase 1a/b trial. In May 2022, the company announced positive data from the ongoing Phase 1a dose escalation study and expects to announce additional clinical results from the Phase 1a portion of the trial by the end of the year.

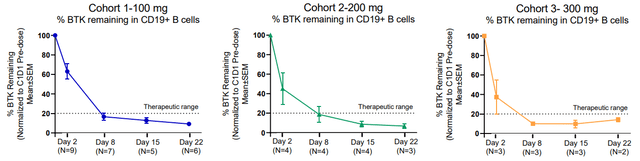

The Phase 1a positive results found that in patients with chronic lymphocytic leukemia NX-2127 demonstrated:

- “Meaningful clinical benefit in confirmed responses in highly pre-treated relapsed or refractory chronic lymphocytic leukemia patients with a median of 6 prior therapies.”

- “Clinical responses in patients with BTK mutations who are resistant to BTK inhibitor therapies.”

- “Robust and durable BTK degradation in all patients.”

- “Immunomodulatory activity generated by the E3 ligase cereblon.”

- “100 mg dose provided overall biologic activity with a favorable safety profile.”

NX-2127 BTK degradation in malignancies (Nurix R&D Day Deck)

As you can see above, NX-2127 enabled BTK degradation across all dose levels and malignancies.

The Phase 1a dose finding study will continue to enroll and dose patients in a range of 50 mg to 300 mg orally once per day. This study has also enabled the Phase 1b study to begin to dose all patients at 100 mg orally once per day.

Market

NX-2127 is likely to have a tremendous future if the data continues to demonstrate positive safety and efficacy results. Historical sales of BTK inhibitors have done well, where Imbruvica was the seventh-largest drug in sales in 2021 reaching $9.8B and Calquence to reach $4.5B in sales by 2031 after reaching $522M in 2020, there is a large market opportunity ahead.

At the current rate of development, I expect NX-2127 to receive FDA approval and hit the market in 2025, with E.U. approval and entry one year following. With a market penetration rate in the US of 25%, I expect peak sales to reach $3B in 2030.

Risks

While I hold a strong sentiment for the company, it is still an early-stage emerging biotech. All four of the company’s drug candidates are in Phase 1 of clinical trials and have not demonstrated full safety or efficacy data.

A single negative data readout, especially in the main asset NX-2127, will lead to a large decline in share price. Investors are looking for a validation for the proof-of-concept for the protein degradation platform. Any negative data will create concerns that there is carry over into the other programs, taking away investor confidence.

Competitors might also generate compelling data to support the case of BTK inhibitors as the leading treatment paradigm, which will downplay Nurix’s stance that BTK degraders may be a more effective therapeutic option.

The CEO of Nurix also happens to be president of the company and a member of the board of directors. This typically creates a conflict, since public companies should keep the board of directors independent from the organization. Having the CEO on the board goes against good corporate governance as they might hold excess influence board decisions on key matters.

Conclusion

With numerous milestones coming in the next two months and a promising outlook on data, Nurix is well positioned to trend back up to previous highs. Following a long biotech bear market, there is little apparent downside left for the stock.

NX-2127 remains a key driver for my outlook, and the additional data readout by the end of the year is likely to make the largest impact on the stock. On the other hand, the additional milestones in the other three programs will likely have little to no impact. I believe that Phase 2 efficacy data for NX-2127, which should initially be generated in 2023, will have the most influence on value creation. On positive data in one or more trials, I can see news potentially moving the stock north of $19 by the end of 2023. Nurix has a strong cash position that can fund operations for the next two years, leaving investors with little worry of dilution.

The data from NX-2127 and the other programs looks promising through initial readouts and preclinical studies. I believe Nurix will continue to generate positive data from its clinical assets, putting an end to the extended downtrend the stock has seen.

Be the first to comment