Justin Sullivan/Getty Images News

Investment Thesis

Throughout times of recession, when consumer spending weakens, and many stocks get crushed, companies that are trading at low multiples, maintain high dividends, and own strong brand names will do phenomenally well and drastically outperform the market. One stock that is the perfect emulation of these criteria is Walgreens (NASDAQ:WBA).

Walgreens is a global leader in retail pharmacy as they provide accessible high-quality care through medicines. They have numerous retail locations around the globe and a comprehensive digital platform where they offer numerous health and beauty products. Over the past five years, Walgreens has faced significant headwinds such as declining revenue since 2018, increased competition from CVS Health (CVS), and a risk to their fundamental business model as Amazon entered the healthcare industry. These factors have caused Walgreens to significantly underperform over the past 5 years as the stock is down over 44% while the S&P 500 is up 70%.

Although many of the risks I stated are still present today, I believe that Walgreens is significantly undervalued at just $47 a share (market cap of 40 billion) as they are paying a steady 4% dividend, are trading at an extremely low P/E of 6.4, and sell essential products that possess a very strong brand name, thereby making Walgreens resilient during times of recession.

Financial Breakdown

Walgreens’ financials appear robust and reflect the company’s strong fiscal state.

Income Statements

Walgreens is in a phenomenal fiscal state with steady streams of revenue, net income, cash flow, and a significant amount of assets. Over the past decade, they have continuously grown their revenue streams from $71 billion to over $134 billion in the TTM. They are trading at a P/S of just 0.3, which is relatively low compared to CVS health which maintains a P/S of 0.5, while CVS has a significantly lower net margin of just 2.7% compared to Walgreens 4.9%. (To be fair, although CVS does have a lower net margin, their FCF is consistently twice their net income meaning their true margins are quite higher). Walgreens’ net income was $6.4 billion over the TTM, yielding a P/E of just 6.4 while they will continue to grow their EPS at a rate of close to 5% over the next five years, which is excellent for a company trading at a P/E of 6.4. It’s also essential to examine their large dividend yield of 4% and ensure they can maintain it. Their 4% dividend pays out $1.6 billion a year, 25% of their net income; therefore, they can easily sustain it.

Balance Sheets

Additionally, their balance sheet appears very strong as they have over $4 billion in cash on hand, which is equivalent to 10% of their market cap. They also have $63 billion in total liabilities and $33 billion in shareholder equity; therefore, Walgreens has a D/E ratio of 1.9, which is about the industry average of 1.82. Another significant aspect of their balance sheet is that they’ve repurchased over 20% of their shares outstanding over the past 6 years, greatly increasing shareholders’ ownership in the company while also re-instating the managements team’s confidence of the stock.

Cash Flow Statements

Lastly, they have about $4 billion in free cash flow, which is significantly lower than their net income. Over long periods their FCF and net income should converge; therefore, I will primarily be referencing their net income when valuing the company. Overall, Walgreens is in a powerful fiscal state as they are continuously maintaining and expanding their revenue and net income while trading at low multiples.

Growth Strategies

Although Walgreens has had slow and declining growth over the past 5 years, they have outlined large measures to turn the company around and begin growing at a reasonable rate.

Walgreens Health

In October of 2021, they announced the launch of a new healthcare strategy that would be consumer-centric and based around a pharmacy network. The base of this transformation is Walgreens Health, a technology-enabled care model that can be nationally scaled and compete with the likes of Amazon health. Additionally, to further advance this strategy, they announced large investments in Village Practice Management Company and CareCentrix Inc., which will help to reinforce their capabilities. Walgreens believes that they will have flat growth in fiscal 2022 and an acceleration each year afterward, where beyond fiscal 2024 they project to have EPS growth of 11 to 13 percent as Walgreens health achieves scale.

International Business

Although Walgreens’ health is their core strategy to accelerate growth, they are also beginning to scale international operations. For the fiscal year 2021, they had revenue of $112 billion in the United States and international revenue of $20.5 billion. To further increase their international revenues, Walgreens closed a transaction to form a combined pharmaceutical wholesale business in Germany as part of a strategic alliance. These factors should lead Walgreens to accelerate its growth over the next five years.

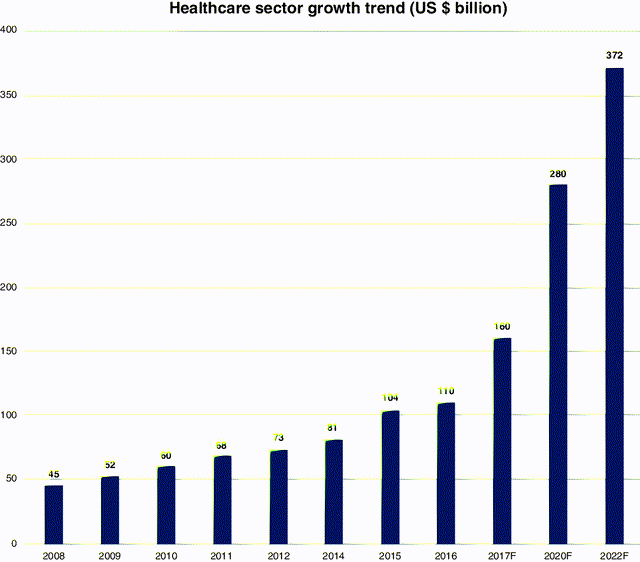

Past and Forward Growth of the Health Industry (Research Gate)

Valuation

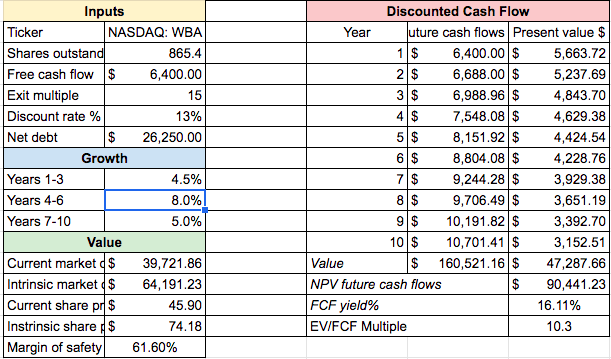

To value Walgreens, I will be utilizing a DCF model that estimates their FCF for the next ten years and discounts them back to today, which would derive a fair value that investors should pay to receive a 13% return. Now, I believe that Walgreens will easily be able to grow 4-5% over the next 4 years as they open new stores, expand into new consumer segments, increase their product lines, and continue to run their business efficiently. From there, I believe that revenue will accelerate due to the expansion of Walgreens health during 2024, and their growth will slowly teeter. These estimates are pretty conservative as the overall health industry is growing at a 7.5% CAGR from 2014-to 2018, and Walgreens has a variety of other strategies to continue growing. Additionally, regarding the debt levels of Walgreens, for the DCF model, I brought down their debt from US$35 billion to US$26.25 billion as retailers tend to have much higher debt. This is simply the nature of their business models. Therefore, it would be unfair to drag down Walgreens’ valuation sheerly due to their debt. Lastly, I’m going to give Walgreens a P/E of 15 as their business has an enormous moat around it as it’s pretty tricky for competitors to enter the space and possess a considerable brand name, thereby fetching them a higher multiple.

DCF model of Walgreens (Hossin Rasoli: Seeking Alpha Financials)

As we can observe, Walgreens is phenomenally undervalued with an over 57% margin of safety to consistently receive a 13% return over the next ten years.

Risk Factors

Even though Walgreens appears to be significantly undervalued at these levels, there are still many significant risks throughout the industry and on a macroeconomic level that could derail the bull case for this stock.

Competitive Environment

The most significant threat facing Walgreens is the emerging competition within the healthcare and pharmacy industry. CVS has been a growing threat within the healthcare industry as they were able to pivot towards an online business model at a more rapid pace, thereby denting into their past revenue and continuing to be an enormous threat going into the future. The most significant emerging danger to Walgreens is Amazon’s healthcare business, but this doesn’t directly compete with their main pharmacy consumer segment.

Slow Growth

The other significant risk that Walgreens faces is slowing/stagnant growth. An important reason why the stock has suffered over the past five years has primarily been the threat of companies such as Amazon entering the space and stagnant if not declining growth. If the expansion of Walgreens health fails or Amazon and CVS successfully steal large portions of market share, their revenue growth could be largely jeopardized.

Final Thoughts

Walgreens Boots Alliance appears significantly undervalued with a large margin of safety which I have concluded from my thorough analysis. The primary concerns I had with the company, being their slow growth and high competition, appear to be turning into tailwinds with the Walgreens health integrated platform launching that will accelerate growth and dwarf the competition. Additionally, for such a large company that sustains a phenomenal business model paired with a strong brand, a 57% margin of safety is frankly substantial considering that conservative growth estimates were also utilized. Lastly, Walgreens’ large share buybacks paired with a significant dividend will return considerable amounts of value to investors even if their growth rates begin to taper off.

Be the first to comment